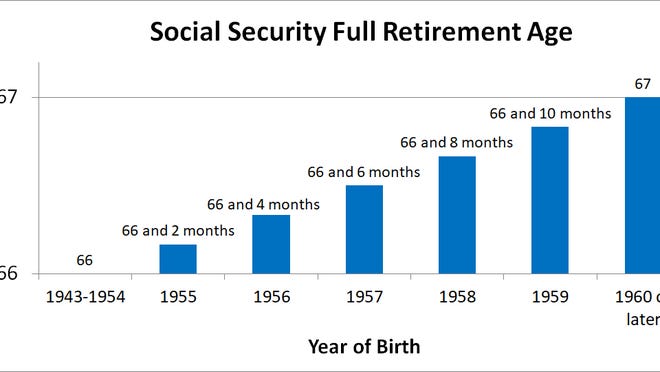

Contrary to what many people think, your payment will not automatically increase to 100 percent of your full retirement benefit when you reach full retirement age, which is 66 and 2 months for people born in 1955, 66 and 4 months for people born in 1956, and will incrementally rise to 67 over the next few years.

How much can I earn at 66 on social security?

You turned 66 in June 2021 and began your Social Security benefits at that time. You earned $44,000 from January through May of 2021. Your benefits will not be reduced, because you earned less than $50,520 during the months before you attained full retirement age.

Is it better to take Social Security at 62 or 67?

For many people, starting at age 62 makes the most sense. Do your own math, though -- waiting until age 70 is better for some. You can start collecting your Social Security benefits as early as age 62 and as late as age 70 -- though you have a full retirement age (FRA) somewhere in between, which is 66 or 67 for most of us.

Do I pay taxes on social security after 66?

Social Security benefits can be taxable on a federal tax return if you have other taxable income to report. There is no age limit on the benefits received being taxable. Up to 85% of Social Security becomes taxable when all your other income plus 1/2 your social security reaches:

What is the maximum Social Security benefit at age 66?

For someone retiring in 2020 at full retirement age (66 or 67 years old for most modern retirees depending on the year of birth), the maximum Social Security benefit is $3,011 per month. However, actual income is a function of what age you retire .

How much does Social Security increase each year after 62?

Key takeaways. If you claim Social Security at age 62, rather than wait until your full retirement age (FRA), you can expect up to a 30% reduction in monthly benefits. For every year you delay claiming Social Security past your FRA up to age 70, you get an 8% increase in your benefit.

Is Social Security prorated between 62 and 66?

Your benefit is reduced a fraction of a percent for each month before FRA that you filed, and the reduction is permanent. So, if you retire at, say, age 62 and 6 months, your benefit is, in effect, prorated — you are credited for waiting six months after becoming eligible.

Is it better to take Social Security at 62 or 67?

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.

Do my Social Security benefits increase each month after 62?

Social Security retirement benefits are increased by a certain percentage for each month you delay starting your benefits beyond full retirement age.

Do you get more Social Security at 65 than 62?

Social Security benefits are reduced by 20% for a person who retires at 62 whose full retirement age is 65 (born 1937 or earlier). Social Security benefits will be reduced by 205/6% for a person whose full retirement age is 65 and 2 months (retires at 62 in 2000).

How much more is Social Security at 63 than 62?

Monthly Social Security payments are reduced if you sign up at age 63, but by less than if you claim payments at age 62. A worker eligible for $1,000 monthly at age 66 would get $800 per month at age 63, a 20% pay cut. If your full retirement age is 67, you will get 25% less by signing up at age 63.

What is the best age to draw Social Security?

When it comes to calculating the best age for starting to collect your Social Security benefits, there's no one-size-fits all answer. As a rule, it's best to delay if you can. If you're in good health and don't need supplemental income, wait until age 70.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

What is the average Social Security benefit at age 62 in 2021?

$2,364At age 62: $2,364. At age 65: $2,993. At age 66: $3,240. At age 70: $4,194.

Does your Social Security benefit increase each month?

We increase your Social Security benefits incrementally each month that you delay receiving benefits after your full retirement age until you reach age 70.

How do I increase my Social Security benefits?

How to increase your Social Security payments:Work for at least 35 years.Earn more.Work until your full retirement age.Delay claiming until age 70.Claim spousal payments.Include family.Don't earn too much in retirement.Minimize Social Security taxes.More items...•

Does Social Security increase 8 each year you wait?

You'll get an extra 2/3 of 1% for each month you delay after your birthday month, adding up to 8% for each full year you wait until age 70. The clock starts ticking the month you reach full retirement age. For example, if you were born on April 24, you'd reach your full retirement age on April 1.

Is my first Social Security check prorated?

Schedule of SS payments Social Security benefits are not prorated. They start the month following the birthday. The schedule, according to AARP, follows this rule: When the birth date falls between the 1st and 10th of the month, the payment is issued on the second Wednesday of the month following the birthday month.

Is Social Security retroactive at 62?

All of which brings us to retroactive benefits. Here are the rules: If you first claim Social Security after reaching full retirement age, you can backdate your application and receive benefits for the months after reaching your full retirement age, not to exceed six months.

Is Social Security based on the last 5 years of work?

A: Your Social Security payment is based on your best 35 years of work. And, whether we like it or not, if you don't have 35 years of work, the Social Security Administration (SSA) still uses 35 years and posts zeros for the missing years, says Andy Landis, author of Social Security: The Inside Story, 2016 Edition.

Do Social Security benefits accrue monthly?

We increase your Social Security benefits incrementally each month that you delay receiving benefits after your full retirement age until you reach age 70.

What are the advantages and disadvantages of taking your retirement benefits before your full retirement age?

The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

What happens if you delay your retirement?

If you delay your benefits until after full retirement age, you will be eligible for delayed retirement credits that would increase your monthly benefit. That there are other things to consider when making the decision about when to begin receiving your retirement benefits.

Is it better to collect your retirement benefits before retirement?

There are advantages and disadvantages to taking your benefit before your full retirement age. The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different.

How much will Social Security increase if you wait to claim?

Waiting to claim your Social Security benefit will result in a higher benefit. For every year you delay your claim past your FRA, you get an 8% increase in your benefit. That could be at least a 24% higher monthly benefit if you delay claiming until age 70. But, make sure to evaluate your decision based on how much you've saved for retirement, ...

What are the factors that affect Social Security?

Plus, guaranteed monthly income is nice to have. Health status, longevity, and retirement lifestyle are 3 key factors that can play a role in your decision when to claim your Social Security benefits.

What is the downside of claiming early?

The downside of claiming early: Reduced benefits. Consider the following hypothetical example. Colleen is 62 as of 2022. If Colleen waits until age 67 (her FRA) to collect, she will receive approximately $2,000 a month. However, if she begins taking benefits at age 62, she'll receive only $1,400 a month.

What is the reduction for claiming your own FRA?

If claiming spousal benefits provides more, claiming before your FRA on a spouse's record means you'll lose even more than claiming on your own record—the benefit reduction for a spouse is up to 35% while the reduction for claiming your own benefit is up to 30% .

How much will Social Security increase if you wait until 62?

If you claim Social Security at age 62, rather than waiting until your full retirement age (FRA), you can expect up to a 30% reduction in monthly benefits. For every year you delay past your FRA up to age 70, you get an 8% increase in your benefit.

What is the retirement age for 2020?

For 2020 that number is $137,700 . “If you choose to retire at 62 your full retirement age benefit will be based upon the highest 35 years of earnings at that point,” he notes. Your full retirement age benefit would not dramatically change from that point on; it would essentially be frozen.

Do you get Social Security if you are born after 1943?

You are absolutely correct, says Rich Allridge, CFP, with Allridge Wealth Management. “The longer you wait after your full retirement age or FRA to take Social Security the more you will receive despite being retired,” he says. “In fact, for those born after 1943, the annual increase in benefits is 8% for each year you delay until age 70.”.

What is the penalty for taking Social Security benefits early?

Taking benefits early does come with a monetary monthly penalty of up to 30% for those enrolling in benefits at 62 versus their full retirement age of 67. The Social Security Administration has done a pretty good job of explaining the transition from the previous full retirement age of 65 to the new (everyone born in 1960 or later) ...

What happens if you don't make it to 81?

If you don't make it to 81, at least your spouse or heirs will benefit from the additional benefits paid early and invested. Source: Author. As you would expect, the break-even age for both early and late options compared to taking SS benefits at 67 continues to move to the right.

Is there a penalty for taking Social Security earlier than retirement age?

Summary. It is pretty well-known that there is a benefit penalty for taking Social Security earlier than your full retirement age. There are dozens if not hundreds of articles about the penalty for taking SS earlier than your full retirement age. There is little written explaining the full set of pros and cons for taking SS benefits ...

Will the SS be redeemed in 2035?

In or around 2035, the Special Obligation Bonds will all be redeemed and the SS Program will not be able to cover all of the then current benefit payments due to retirees. The most credible estimates indicate roughly a 30% shortfall in SS tax receipts versus benefit payments in 2035.