How much does social security increase each year?

This is an:

- 8% increase in benefits if you delay one year

- 16% increase in benefits if you delay two years

- 24% increase in benefits if you delay three years

- 32% increase in benefits if you delay four years

How much does SS increase per year?

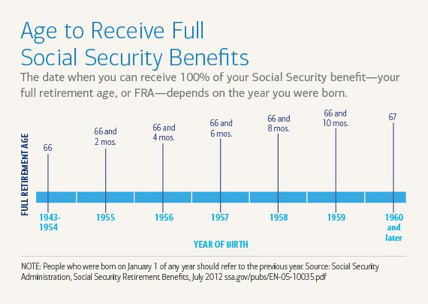

Under current law, the retirement age for Social Security purposes is set to increase by two months each year until it hits 67. If you turned 62 in 2021, then your full retirement age is 66 and 10 ...

How much does SS increase after 62?

If you claim Social Security at age 62, rather than waiting until your full retirement age (FRA), you can expect up to a 30% reduction in monthly benefits. For every year you delay past your FRA up to age 70, you get an 8% increase in your benefit.

Does my social security increase every month?

Social Security retirement benefits are increased by a certain percentage for each month you delay starting your benefits beyond full retirement age. The benefit increase stops when you reach age 70. Increase for Delayed Retirement

How much does Social Security increase each year?

5.9 percentThe latest COLA is 5.9 percent for Social Security benefits and SSI payments. Social Security benefits will increase by 5.9 percent beginning with the December 2021 benefits, which are payable in January 2022. Federal SSI payment levels will also increase by 5.9 percent effective for payments made for January 2022.

Does your Social Security check increase every year?

Your benefits may increase when you work: However, we will check your record every year to see whether the additional earnings you had will increase your monthly benefit. If there is an increase, we will send you a letter telling you of your new benefit amount.

How often do they increase Social Security benefits?

Apart from any earnings-based calculations, Social Security makes an annual cost-of-living adjustment (COLA) to your benefit based on inflation, if any.

Does Social Security go up 8 every year?

You'll get an extra 2/3 of 1% for each month you delay after your birthday month, adding up to 8% for each full year you wait until age 70. The clock starts ticking the month you reach full retirement age.

What percentage does Social Security increase each year after 62?

8%Key takeaways. If you claim Social Security at age 62, rather than wait until your full retirement age (FRA), you can expect up to a 30% reduction in monthly benefits. For every year you delay claiming Social Security past your FRA up to age 70, you get an 8% increase in your benefit.

Is it better to take Social Security at 62 or 67?

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.

How can I increase my Social Security benefits?

How to increase your Social Security payments:Work for at least 35 years.Earn more.Work until your full retirement age.Delay claiming until age 70.Claim spousal payments.Include family.Don't earn too much in retirement.Minimize Social Security taxes.More items...

Is Social Security getting a $200 raise in 2022?

Cost-of-Living Adjustment (COLA) Information for 2022 Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase 5.9 percent in 2022. Read more about the Social Security Cost-of-Living adjustment for 2022.

What is the max Social Security benefit?

The maximum benefit depends on the age you retire. For example, if you retire at full retirement age in 2022, your maximum benefit would be $3,345. However, if you retire at age 62 in 2022, your maximum benefit would be $2,364. If you retire at age 70 in 2022, your maximum benefit would be $4,194.

How much Social Security will I get if I make $75000 a year?

about $28,300 annuallyIf you earn $75,000 per year, you can expect to receive $2,358 per month -- or about $28,300 annually -- from Social Security.

Is Social Security based on the last 5 years of work?

A: Your Social Security payment is based on your best 35 years of work. And, whether we like it or not, if you don't have 35 years of work, the Social Security Administration (SSA) still uses 35 years and posts zeros for the missing years, says Andy Landis, author of Social Security: The Inside Story, 2016 Edition.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

How to increase SSA payments?

To increase your SSA payments, aim to build 35 years of work history. Try to have few or no long stretches where you don't earn an income. Find and correct periods of low or no income as early in your career as you're able to increase your average monthly earnings and get the highest amount you can to retire on.

Why was Social Security created?

Social security was created as a safety net for workers and their survivors. Social security provides income that increases with inflation. Even a small increase in your initial benefit will result in a larger payment each year after you retire. Taking certain actions now and later will allow you to increase the amount of Social Security benefits ...

What age does the PIA increase?

It is age 67 for anyone born in 1960 or later. It is reduced by two months for every year before that. The FRA drops no lower than age 65 for those born in or before 1937. For each year after your FRA that you delay taking payments, you will receive an increase in the PIA of 5.5% to 8% per year.

What age can you collect survivor benefits?

Most of the time, widows and widowers are eligible for reduced payments at age 60. By waiting until you reach full retirement age to begin survivor benefits, you can get a higher payment each month.

How much is the PIA increase for 1943?

For instance, someone born in 1943 or later gets an 8% annual increase in PIA, which amounts to a payout increase of two-thirds of 1% each month. There is no point in waiting past age 70 to file, as these increases are not given past that point. 4.

How much tax do you pay on SSA?

Under IRS rules, some people will have to pay federal income tax on up to 50% of their benefits. Some may even have to pay 85% tax on their SSA payments if they make a large amount of combined income.

How many credits do you need to get unemployment in 2021?

People born in or after 1929 need 40 credits in total to get benefits. In 2021, you earn one credit for every $1,470 you earn. You can earn up to four credits in a year. That means you can get the most number of credits in a year by earning only $5,880. 2.

When did the Social Security Cola start?

The annual rate of inflation doubled to more than 12 percent between 1969 and 1974. Congress enacted the COLA provision as part of the 1972 Social Security Amendments and automatic annual COLAs began in 1975. The first automatic Social Security COLA was 8 percent in 1975.

What is the average COLA increase for 2021?

Thus, the COLA increase for 2021 was 1.3 percent. As a result, the average monthly benefit for all retired workers rose by 1.3 percent to $1,543 from $1,523. The average monthly benefit for all disabled workers rose to $1,277, from $1,261. The COLA amount is typically announced by SSA in October.

How much has COLA increased in the 21st century?

The 21st century has seen modest COLA increases, ranging from 5.8 percent in 2008 to zero for 2010, 2011 and 2016. There's no COLA increase if prices remain flat (or fall) year over year.

When will the AARP COLA take effect?

The COLA that will take effect in January 2022, is estimated to be about 5 percent. Save 25% when you join AARP and enroll in Automatic Renewal for first year. Get instant access to discounts, programs, services, and the information you need to benefit every area of your life. Getty Images.

Do retired workers get a Cola increase?

Retired workers receive the annual COLA from the Social Security Administration (SSA), as do survivors, those getting Social Security Disability Income (SSDI) and recipients of Supplemental Security Income (SSI) payments. Yet, while these beneficiaries are, indeed, eligible for COLA increases annually, the amount of the increase can vary greatly ...

Do Cola benefits increase annually?

Yet, while these beneficiaries are, indeed, eligible for COLA increases annually, the amount of the increase can vary greatly from year to year — and there's no guarantee of an increase in any given year.

What happens if you don't sign up for Medicare at age 65?

If you do not sign up at age 65, in some circumstances your Medicare coverage may be delayed and cost more. If you retire before age 70, some of your delayed retirement credits will not be applied until the January after you start receiving benefits.

When do you get your delayed retirement?

If you retire before age 70, some of your delayed retirement credits will not be applied until the January after you start receiving benefits. For example, if you reach your full retirement age (67) in June, you may plan to wait until your 69th birthday to start your retirement benefits. Your initial benefit amount will reflect delayed retirement ...

Can you get retroactive unemployment benefits if you are already retired?

However, we cannot pay retroactive benefits for any month before you reached full retirement age or more than six months in the past.

What is the PIA for Social Security?

PIA equals the amount of money you will receive in social security benefits per month if you choose to wait until full retirement (which I guess is 66 for you) to receive benefits. Your FRA is determined by your birth year and it is between 66 and 67 for most people.

Does Social Security increase if you stop working?

Do Social Security benefits increase if you stop working? Your PIA amount will not increase. However, the longer you delay the start of benefits, the higher your monthly benefit amount will be. Without continued work, your Social Security benefit amount will be based on your existing work history.