Which states do not have Social Security taxes?

- Colorado

- Connecticut

- Kansas

- Minnesota

- Missouri

- Montana

- Nebraska

- North Dakota

- Rhode Island

- Vermont

What states have no SS tax?

I'd like to retire in a no (or low ... unfortunately isn't that tax-friendly. But before I make any suggestions, let's talk more about taxes. Please look beyond whether a state has an income tax. Far more don't tax Social Security payments, for example.

What states charge tax on social security?

- Colorado: Social Security income received in Colorado will be taxed at the state’s flat rate of 4.55%. ...

- Connecticut: Connecticut’s Social Security income tax rate ranges from 3% to 6.99%. ...

- Kansas: In Kansas, Social Security benefits are taxed at the same rate as all other forms of income, with the tax rate ranging from 3.1% to 5.7%. ...

How many states tax Social Security?

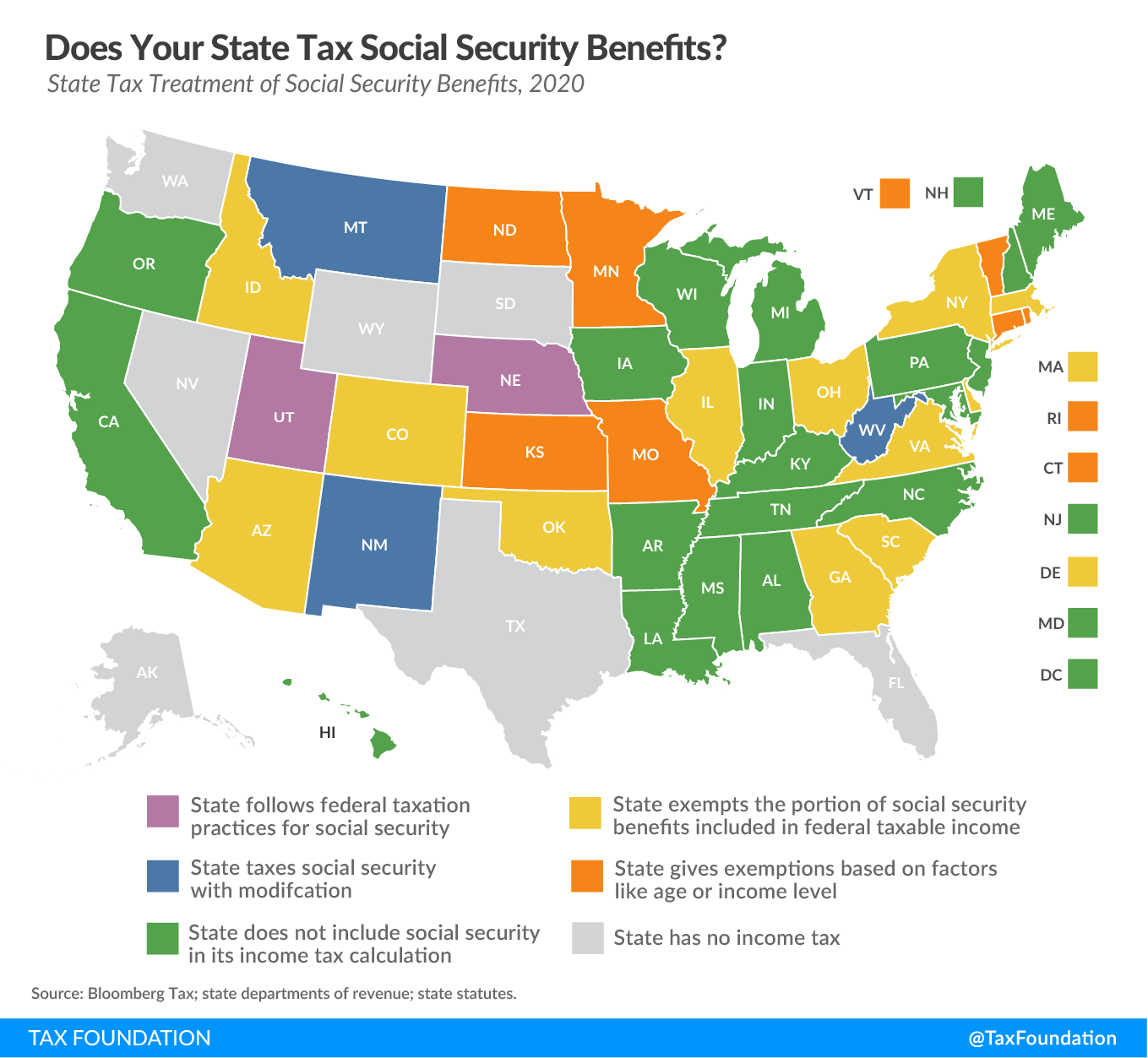

States that tax Social Security. There are currently 13 states that tax Social Security income to varying degrees: Colorado. Connecticut. Kansas. Minnesota. Missouri. Montana. Nebraska.

News about Do States Tax Social Security Benefitsbing.com/news

Videos of Do States tax Social Security benefitsbing.com/videos

Which states do not tax Social Security payments?

States That Don't Tax Social SecurityAlaska.Florida.Nevada.New Hampshire.South Dakota.Tennessee.Texas.Washington.More items...•

Do most states tax Social Security benefits?

Most states, however, exempt Social Security from state taxes. The list of 37 states, plus the District of Columbia, that don't tax Social Security includes the nine states with no state income tax, as well as some other states that rank as the most tax-friendly states for retirees, such as Delaware and South Carolina.

Do states tax your Social Security?

While California does have a reputation as a high-tax state, surprisingly, it does not tax your Social Security benefits.

How many states tax Social Security benefits?

Twelve statesTwelve states in the U.S. impose income taxes on Social Security benefits, as of tax year 2021. The other 38 states and Washington, D.C. don't tax Social Security benefits.

Which are the 12 states that tax Social Security benefits?

Twelve states also tax some or all of their residents' Social Security benefits: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, Utah, Vermont and West Virginia.

What are the 13 states that tax Social Security?

Of the 50 states, 13 states tax Social Security benefits. Those states are: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

What are the 3 states that don't tax retirement income?

Nine of those states that don't tax retirement plan income simply because distributions from retirement plans are considered income, and these nine states have no state income taxes at all: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

How can I avoid paying taxes on Social Security?

How to minimize taxes on your Social SecurityMove income-generating assets into an IRA. ... Reduce business income. ... Minimize withdrawals from your retirement plans. ... Donate your required minimum distribution. ... Make sure you're taking your maximum capital loss.

Does Social Security change from state to state?

No matter where in the United States you live, your Social Security retirement, disability, family or survivor benefits do not change. Along with the 50 states, that includes the District of Columbia, Puerto Rico, Guam, the U.S. Virgin Islands, American Samoa and the Northern Mariana Islands.

What is the most tax friendly state to retire in?

Delaware1. Delaware. Congratulations, Delaware – you're the most tax-friendly state for retirees! With no sales tax, low property taxes, and no death taxes, it's easy to see why Delaware is a tax haven for retirees.

What state pays the most in Social Security?

There are five states that on average pay more for SSI benefits than others. The highest paying states for SSI benefits as of 2022 are New Jersey, Connecticut, Delaware, New Hampshire and Maryland.