Do Social Security Survivors Benefits count as income?

Social Security survivors benefits only count toward MAGI of tax filers. So is a tax dependent does not have to file then MAGI income for social security isn't counted. This is true for most nontaxable Social Security income. In the case above she would need to file taxes to have her Social Security Survivors benefits count as income.

Should survivor benefits be counted as household income for food stamps?

He is currently receiving survivor benefits because he is still in high school. Should his benefits be counted as household income when qualifying for food stamps? It seems that all sources of income from social security count towards household income for the SNAP program.

Do survivor benefits count as income for health insurance tax credits?

Health insurance tax credits are based on Modified Adjusted Gross Income . Social Security survivors benefits only count toward MAGI of tax filers. So is a tax dependent does not have to file then MAGI income for social security isn't counted. This is true for most nontaxable Social Security income.

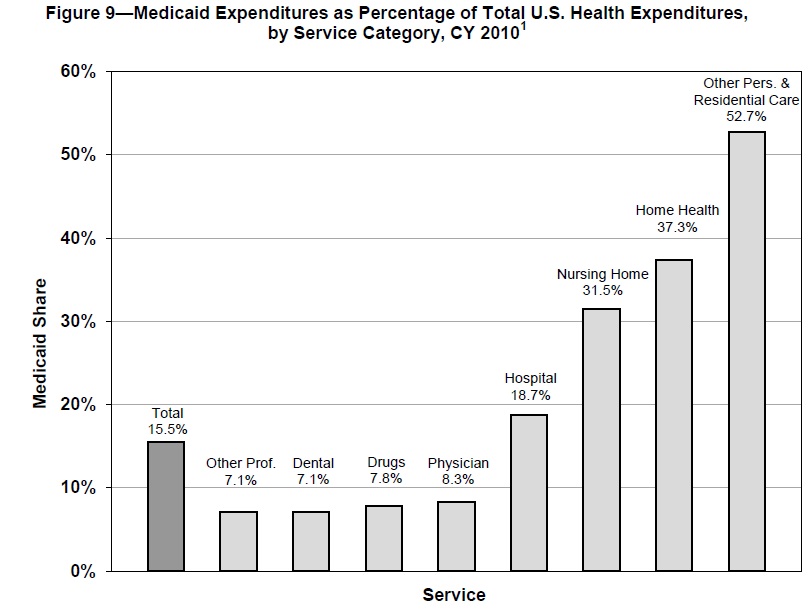

Does SSI count as income for Medicaid?

In all cases, SSI benefits are not included in a household’s income when evaluating eligibility for Medicaid services. Otherwise, taxable and non-taxable Social Security income received by the primary beneficiary may be counted as part of the household’s income for Medicaid eligibility.

Are survivor benefits considered income?

The IRS requires Social Security beneficiaries to report their survivors benefit income. The agency does not discriminate based on the type of benefit -- retirement, disability, survivors or spouse benefits are all considered taxable income.

Are Social Security benefits considered earned income?

Earned income does not include amounts such as pensions and annuities, welfare benefits, unemployment compensation, worker's compensation benefits, or social security benefits.

Do survivor benefits count as income for ACA?

Answer: Yes. Consumers should report Social Security income on their Marketplace application. This includes Social Security Disability Insurance (SSDI), retirement income, and survivor's benefits. Consumers should not include Supplemental Security Income (SSI).

Do you get Medicare with survivors benefits?

You become eligible for Part A Medicare benefit when you reach age 65 and have qualified for Social Security retirement benefits. You must be a citizen or permanent resident of the United States.

What is not earned income?

Examples of items that aren't earned income include interest and dividends, pensions and annuities, social security and railroad retirement benefits (including disability benefits), alimony and child support, welfare benefits, workers' compensation benefits, unemployment compensation (insurance), nontaxable foster care ...

What qualifies as earned income?

Earned income is money received as pay for work performed, such as wages, salaries, bonuses, commissions, tips, and net earnings from self-employment. It can also include long-term disability, union strike benefits, and, in some cases, payments from certain deferred retirement compensation arrangements.

Are widow survivor benefits taxable?

If your combined taxable income is less than $32,000, you won't have to pay taxes on your spousal benefits. If your income is between $32,000 and $44,000, you would have to pay taxes on up to 50% of your benefits. If your household income is greater than $44,000, up to 85% of your benefits may be taxed.

What is considered income for Medicare?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Can I claim my mother as a dependent if she receives Social Security?

Yes, most likely. Social security does not count as income for the dependent income test (#2 below), but there are other dependent tests to meet.

How long can a widow receive survivor benefits?

Widows and widowers Generally, spouses and ex-spouses become eligible for survivor benefits at age 60 — 50 if they are disabled — provided they do not remarry before that age. These benefits are payable for life unless the spouse begins collecting a retirement benefit that is greater than the survivor benefit.

What is the difference between survivor benefits and widow benefits?

It is important to note a key difference between survivor benefits and spousal benefits. Spousal retirement benefits provide a maximum 50% of the other spouse's primary insurance amount (PIA). Alternatively, survivors' benefits are a maximum 100% of the deceased spouse's retirement benefit.

How much can you earn and still collect survivor benefits?

$19,560If you have reached full retirement age, there is no annual limit on the amount of money you can earn from working. If you are not going to reach full retirement age within the year, you can only earn up to $19,560 (in 2022) before it starts to affect your survivors benefits.

What is the difference between SSDI and Supplemental Security?

Two programs provide disability benefits through the SSA. Social Security Disability Insurance (SSDI) is paid to disabled adults who have earned enough work credits through Social Security taxes to qualify, while Supplemental Security Insurance is available to low-income households for disabled children and adults who do not have enough work credits to qualify for SSDI.

What is adjusted gross income?

Adjusted gross income (AGI) is the total taxable amount of earned and unearned income for a tax-filing individual or group, minus qualifying deductions.

What is the SSA?

The Social Security Administration (SSA) manages various benefits programs that pay cash allotments to beneficiaries and, in some cases, their dependents. Although these programs are all managed by the SSA, it’s important to understand how they differ and under which circumstances they might overlap.

Does Medicaid use the same standards as the ACA Marketplace?

Medicaid uses many of the same standards as the ACA Marketplace when it comes to establishing what types of income are included in a household’s MAGI. However, in households that receive Social Security income, whether it’s related to retirement, disability or survivor and dependent benefits, there may be special rules that impact how Medicaid determines income eligibility.

Is Social Security income included in household income?

In all cases, SSI benefits are not included in a household’s income when evaluating eligibility for Medicaid services. Otherwise, taxable and non-taxable Social Security income received by the primary beneficiary may be counted as part of the household’s income for Medicaid eligibility.

Does Medicaid change throughout the year?

Applicants should be aware that the policies that regulate MAGI inclusions and exemptions, as well as how Medicaid determines eligibility, can change throughout the year or differ between states. Call the agency that manages Medicaid in your state for the most current information about income limits and eligibility requirements.

Can a beneficiary receive more than one Social Security?

In some circumstances, a beneficiary may receive more than one type of Social Security income. For example, if a retiree is disabled, they may receive their retirement income in addition to SSDI or SSI payments.

What is Medicaid magi?

Medicaid uses your modified adjusted gross income (MAGI) as the measure of your income for eligibility standards. Modified adjusted gross income that Medicaid will generally count towards your income limit includes:

What is the FPL for medicaid?

Medicaid uses the Federal Poverty Level (FPL) as a benchmark to determine one’s eligibility. In most states that grant Medicaid to low-income adults, individuals are eligible for Medicaid if they have an income that is at or below 150% of the FPL. The state in which you live and the type of Medicaid you are applying for may dictate a different income amount.

Does Medicaid count Social Security?

In most cases, yes, Medicaid will count your Social Security check as part of your income toward those eligibility limits. That includes Social Security retirement payments, Social Security disability income (SSDI) and Social Security survivor’s benefits. Supplemental Social Security income (SSI) is not counted by Medicaid however.

Does medicaid count toward income limits?

And there are certain things that Medicaid will count or not count toward those limits.

Can you deduct medicaid from Social Security?

Your Medicaid benefits are not deducted from your Social Security check. Some things that may be deducted from your Social Security benefits include:

Is Medicaid income counted?

For individual applicants, the income count is very straightforward. All of the individual’s countable income is added up, and if the total is below the Medicaid limit, the person is eligible.

Do survivor benefits count toward MAGI?

As a rule of thumb, if the benefits are taxable, they count toward MAGI for the marketplace and Medicaid, and if they aren't they do not . However, there are some exceptions and those exceptions can differ between the Marketplace and Medicaid (see details ).

Is Medicaid based on household income?

When you apply for the Marketplace or Medicaid your eligibility is based on total household income, this Includes income from survivor's benefits. With that said, the rules are a bit complex and whether or not income is included depends on other taxable income.

Does Social Security count toward MAGI?

Second, as a rule of thumb, Social Security income specifically is counted toward MAGI for ObamaCare and thus affects tax credits and Medicaid eligibility if a person has to file taxes. Social Security Income includes disability payments (SSD and SSDI), pension, retirement benefits, and survivor benefits, but does not include supplemental security ...

How to determine taxability of benefits?

The taxability of benefits must be determined using the income of the person entitled to receive the benefits. If you and your child both receive benefits, you should calculate the taxability of your benefits separately from the taxability of your child's benefits. The amount of income tax that your child must pay on that part ...

How much is a child's Social Security filing?

If the child is single, the base amount for the child's filing status is $25,000. If the child is married, see Publication 915, Social Security and Equivalent Railroad Retirement Benefits for the applicable base amount and the other rules that apply to married individuals receiving social security benefits.

How to find out if a child is taxable?

To find out whether any of the child's benefits may be taxable, compare the base amount for the child’s filing status with the total of: All of the child's other income, including tax-exempt interest. If the child is single, the base amount for the child's filing status is $25,000.

Is a child's Social Security payment taxable?

If the total of (1) one half of the child's social security benefits and (2) all the child's other income is greater than the base amount that applies to the child's filing status, part of the child's social security benefits may be taxable.

What to do if you are not getting survivors benefits?

If you are not getting benefits. If you are not getting benefits, you should apply for survivors benefits promptly because, in some cases, benefits may not be retroactive.

How old do you have to be to get a mother's or father's benefit?

Mother's or Father's Benefits (You must have a child under age 16 or disabled in your care.)

Can you get survivors benefits if you die?

The Basics About Survivors Benefits. Your family members may receive survivors benefits if you die. If you are working and paying into Social Security, some of those taxes you pay are for survivors benefits. Your spouse, children, and parents could be eligible for benefits based on your earnings.

Can you collect survivors benefits if a family member dies?

You may receive survivors benefits when a family member dies. You and your family could be eligible for benefits based on the earnings of a worker who died. The deceased person must have worked long enough to qualify for benefits.

What is the income limit for Medicaid in 2021?

In 2021, the income limit for long-term care (nursing home Medicaid and home and community-based services Medicaid waivers) in most, but not all states, for a single applicant is $2,382 / month, which equates to $28,584 per year . For regular Medicaid, often called Aged, Blind and Disabled (ABD) Medicaid ...

How is income counted for senior married applicants?

The way income is counted varies based on the program for which one is applying and the state in which one resides. In many states, married applicants applying for nursing home Medicaid or a Medicaid waiver are considered as single applicants. This means each spouse is able to have income up to the income limit. In this case, the “name on the check” rule is followed. This means that whichever spouse’s name is on the check is considered to own the income, and it will be counted towards that spouse’s income eligibility.

What documents do you need to apply for medicaid?

Medicaid applicants generally have to provide documentation of their monthly income (earned and unearned) with their Medicaid application. Examples include copies of dividend checks, social security check or award letter, pay stubs, alimony checks, and VA benefits check or award letter.

How much is the Medicaid limit for nursing homes in 2021?

As of 2021, the individual income limit for nursing home Medicaid and Medicaid waivers in most states is $2,382 / month, which equates to $28,854 per year.

How much is the poverty level in 2021?

As mentioned previously, this income limit varies based on the state in which one lives. Generally, most states use 100% of the Federal Poverty Level for a household of two (as of 2021, $1,452 / month) or the SSI Federal Benefit Rate for couples (as of 2021, $1,191 / month). Married applicants over the income limit can still qualify for Medicaid.

How much is the SSI income limit for 2021?

The income limit varies by state, but in most states, either 100% of the SSI Federal Benefit Rate for couples ($1,191 / month in 2021) or 100% of the Federal Poverty Level for a household of two ($1,452 / month in 2021) is used. In order to protect the community spouse from having little to no income, and hence, becoming impoverished, ...

Is Medicaid income counted as income?

For single elderly applicants, it is very straightforward as to how income is counted. All of the monthly income the individual receives is added up and counted towards the income limit (with the exception of VA Pension with Aid & Attendance in some states). If an applicant’s total monthly income is under the Medicaid limit, they are income eligible. If their monthly income is over the income limit, they are not income eligible.

How much does a pension count towards Medicaid?

In the states that count the basic pension benefit towards Medicaid’s income limit, the approximate $1,146 / month would count towards Medicaid’s income limit. The approximate $766 / month for the A&A portion of the benefit amount would not count towards Medicaid’s income limit.

How much does a veteran with no dependents get in a month?

As an example, let’s say a veteran with no dependents receives the maximum A&A pension amount, which is approximately $1,912 / month. If that same veteran were not eligible for A&A and only received the maximum amount for the basic pension, he / she would receive approximately $1,146 / month.

What is Aid and Attendance Benefit?

The Aid & Attendance benefit is a monthly cash benefit for veterans and surviving spouses who require assistance with their activities of daily living and receive the basic veterans pension or the basic survivors pension. (To see eligibility requirements for the basic pension and A&A, click here ). Since A&A is considered an “add on” benefit to ...

Do single veterans get A&A?

Please note; single veterans (and surviving spouses) who receive the A&A pension and reside in a Medicaid-funded nursing home will have their A&A benefit reduced to $90 / month, of which they can keep. In addition, the individual will still receive his / her personal needs allowance from Medicaid. Medicaid beneficiaries who reside in nursing home facilities must pay all of their income to Medicaid to go towards their cost of nursing home care except for a monthly personal needs allowance and a monthly spousal monthly maintenance needs allowance, if applicable. To be clear, if a veteran is married or has a dependent child, his / her A&A benefit amount will not be reduced. Furthermore, benefits will not be reduced if the individual resides in a VA state veterans home.

Does VA Aid and Attendance count as income?

While in most cases, one’s VA Aid & Attendance (A&A) monetary benefit does not count as income for Medicaid eligibility purposes, this is not always the case. The is because the way a state views one’s A&A monthly payment varies based on the state in which one resides. The Aid & Attendance benefit is a monthly cash benefit for veterans ...

Can a veteran's A&A be reduced?

To be clear, if a veteran is married or has a dependent child, his / her A&A benefit amount will not be reduced. Furthermore, benefits will not be reduced if the individual resides in a VA state veterans home. Calculating one’s income for Medicaid qualification purposes can be confusing, particularly when it comes to considering one’s VA pension ...

Do you have to pay Medicaid for nursing home?

Medicaid beneficiaries who reside in nursing home facilities must pay all of their income to Medicaid to go towards their cost of nursing home care except for a monthly personal needs allowance and a monthly spousal monthly maintenance needs allowance, if applicable.

Do non-taxed Social Security benefits count as household income?

The rule of thumb is that if you file nontaxable Social Security benefits count as household income, if you don't file they don't.

Does MAGI count as income?

So is a tax dependent does not have to file then MAGI income for social security isn't counted. This is true for most nontaxable Social Security income. In the case above she would need to file taxes to have her Social Security Survivors benefits count as income.

Does Social Security count toward MAGI?

Health insurance tax credits are based on Modified Adjusted Gross Income . Social Security survivors benefits only count toward MAGI of tax filers. So is a tax dependent does not have to file then MAGI income for social security isn't counted. This is true for most nontaxable Social Security income.

How to get a valid answer for Social Security?

The best way to get a valid answer is to contact the Social Security office near you. This is a page about Social Security surviver benefits and food stamps.

What happens if you get turned down for food stamps?

If you have applied for food stamps and you were turned down or given lower benefits then you can appeal that decision.

What do social workers look for in a case?

That would be up to your social/case worker to decide. They will look at assets, income and number of vehicles of everyone living in the home. Also, are you listed jointly on any banking records or vehicles.

Do you have to tell your dependents?

You have to tell them (in my state and I assume all--but I hate to assume) all of your dependents and if your dependents have things like the Social Security survivor benefits.

Is food stamp budgeting complicated?

Food Stamp budgeting is complicated. Many things are considered, such as the age of household members, the source, earned or unearned, of the income, shelter costs relative to income, medical expenses of the elderly or disabled members. It's too complicated to explain here entirely.

Does Social Security count as household income?

It seems that all sources of income from social security count towards household income for the SNAP program. I would double-check if I were you.

Is Survivor Benefits counted as income?

Survivor benefits are counted by social security as income. Here is the number to contact, if you have any questions about what income is counted. Advertisement. Social Security Customer Service. 1 (800) 772-1213. Have a blessed day! ---Robyn.