Can your employer refuse you unemployment?

Your employer may reduce the workforce by offering separation packages to employees who quit. But even in this case, you may be eligible for unemployment benefits, depending on how the package is paid out and if refusing to take the package would still result in being left without a job.

Does unemployment have to be paid back?

While paying back unemployment benefits usually is not required, you may have to pay back unemployment benefits if your state’s unemployment commission determines that you received some benefits in...

Can You cash out your unemployment?

If you’re old enough to access your 401 (k) funds without penalty, you may decide to just cash out your old plan upon leaving your job. Once you turn 59 1/2, any money in a tax-advantaged...

Can I receive back pay from unemployment?

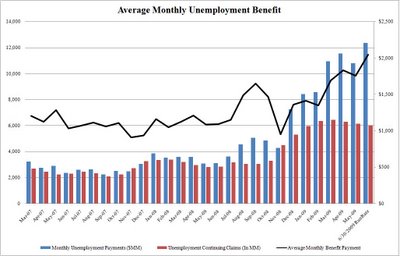

Translation: If you’re approved for unemployment benefits after July 31, you can collect back pay, which includes the $600 weekly boost for each eligible week between March 28 and July 31. The FPUC time frame includes 17 payment periods for an estimated $10,200 in federal benefits. Are you an independent contractor or freelancer who’s out of work?

How much do employers pay for unemployment?

What to do if you overpaid unemployment?

What is the base for unemployment taxes in 2020?

What are the causes of unemployment overpayment?

When will the 600 unemployment be extended?

Can you get a waiver for unemployment if you overpaid?

Do you have to pay back unemployment?

See more

About this website

What are the negatives of unemployment?

Common disadvantages of unemployment for individuals include:Reduced income. ... Health problems. ... Negative familial effects. ... Mental health challenges. ... Don't deny your feelings. ... Think of unemployment as a temporary setback. ... Reach out to friends and family. ... Start networking.More items...•

Do you have to pay back EDD unemployment?

If you do not repay your overpayment, the EDD will take the overpayment from your future unemployment, disability, or PFL benefits. This is called a benefit offset. For non-fraud overpayments, the EDD will offset 25 percent of your weekly benefit payments.

How much is EDD paying now 2021?

$167 plus $600 per week for each week you are unemployed due to COVID-19.

Can you go to jail for EDD?

What are the Penalties for EDD Fraud? A violation of Unemployment Insurance Code 2101 is a “wobbler” that can be charged as either a misdemeanor or felony crime. A misdemeanor conviction carries up to one year in the county jail and a $1,000 fine.

Unemployment Benefits Are, For The Most Part, Yours To Keep

Unemployment insurance benefits (UI benefits) are benefits that belong to you. The unemployment insurance program is a state-run program with oversight from the U.S. Department of Labor. Employers fund the program by paying a federal unemployment tax. Employers also pay a state unemployment tax.

Paying Back Unemployment

As noted above, if you receive UI benefits, that money is typically yours to spend on living expenses while you’re unemployed. It’s important to be aware of how taxes and overpayments work with these benefits and how to repay benefits if necessary.

Keeping Track Of Your Unemployment Benefits

It’s a good idea to keep track of all the paperwork associated with your unemployment benefits. Take screenshots of online documentation. Keep receipts for the unemployment you receive. Make sure you know how much you are entitled to receive. If you are receiving more than you are supposed to receive, you will be required to return the overpayment.

How much do employers pay for unemployment?

In accordance with the Federal Unemployment Tax Act (FUTA), employers pay the federal government up to 6% of each employee’s first $7,000 of annual income. This helps maintain UI trust funds. There is an exception to the FUTA payments though.

What to do if you overpaid unemployment?

If you were overpaid unemployment benefits, you should receive a letter notifying you of the issue and the amount you owe. The letter will present the option to pay the debt in full immediately or set up a payment plan.

What is the base for unemployment taxes in 2020?

The 2020 wage bases for SUI taxes vary by state and range from the first $7,000 of an employee’s wages in Tennessee, California, Arkansas and Arizona to the first $52,700 in Washington. If a state exhausts its unemployment funds, it can borrow from the federal government.

What are the causes of unemployment overpayment?

Errors that can result in an overpayment may include: A mistake on your application. A mistake making a weekly UI benefits claim. Failure to meet eligibility requirements. A clerical issue at your state’s unemployment office. The unemployment insurance office will notify you of any overpayment via a letter.

When will the 600 unemployment be extended?

This act extended unemployment benefit payments by 13 weeks, added $600 to the weekly benefit amount through July 31, 2020, and extended UI benefits to part-time employees, gig workers and freelancers. The federal government funded 100% of the CARES Act.

Can you get a waiver for unemployment if you overpaid?

Failure to address the issue can result in stiff fines or even jail time. If the overpayment wasn’t due to unemployment insurance fraud, you may qualify for an overpayment waiver. These waivers are generally granted on a case-by-case basis.

Do you have to pay back unemployment?

In most cases, the short answer is no: You don’t have to pay back unemployment insurance (UI) benefits directly. These benefits are backed by the trust funds employers pay into. In most states, only employers pay into the unemployment insurance trust funds. But in Alaska, New Jersey and Pennsylvania, employees pay a small percentage ...

What happens if you overpay unemployment?

If the overpayment is due to fraud on your part, you will have to pay back the money, plus you may have to pay a penalty and interest. Examples of fraud, according to the New York State Department of Labor, include not reporting money you received for working while you collected unemployment benefits, lying on your unemployment application, helping someone else prepare a false claim or lying about your availability for work while you’re collecting unemployment checks. Fraud is a crime, and in addition to monetary penalties, you could be charged, prosecuted and sentenced to time in jail.

How long does unemployment last?

And the benefits are designed to last only a limited time - usually 26 weeks - but less in some states.

What happens if you get a notice of overpayment?

If you receive a Notice of Overpayment, you can appeal the repayment requirement. The court will consider the reason for the overpayment, as well as your ability to repay the money. If you don’t win your appeal, you will still have to repay the money, but also have the option of negotiating a repayment schedule.

What is unemployment insurance?

Unemployment insurance (UI) is a federal program that’s administered by each state. In most states, employers pay UI premiums for each employee on the business payroll. In a few states, employees also chip in for part of the costs. The federal government supplies some money, too.

How long did the Cares Act extend unemployment?

An extension of the CARES Act in December 2020 expanded UI benefits for another 24 weeks. None of these additional UI benefits had to be repaid.

Can you ask for an overpayment waiver for unemployment?

Asking for an Unemployment Overpayment Waiver. If you were paid more unemployment benefits than you were due through no fault of your own, or the fraud alleged was not committed by you, you can ask the unemployment commission for an u nemployment overpayment waiver , which means you don't have to repay the benefits.

When do you have to pay back PUA?

If you do not submit your documentation on time, or are deemed ineligible to continue receiving PUA benefits, you could have to pay back any benefits you’ve received since Dec. 27, 2020.

What are the methods of collecting repayment?

Possible methods of collecting that repayment include offset of future benefits, reduction in tax returns, or other repayment plans. There is also uncertainty about the states’ ability to comply with these heightened requirements, and their ability to process an onslaught of new documentation.

Do gig workers have to pay back unemployment?

A GrubHub delivery person exits a restaurant last month in New York City. Gig workers and independent contractors could have to pay back unemployment benefits if they fail to meet new requirements.

How do unemployment benefit payments work?

Unemployment benefits (also known as unemployment insurance or UI) are funded by unemployment taxes under the Federal Unemployment Tax Act. Most employers pay both federal and state unemployment tax, and if you’re an employee, it’s not deducted from your wages in most states.

When do you have to pay back unemployment benefits?

Overpayments received as the result of fraud on the part of the individual have serious repercussions. Unemployment insurance fraud occurs when you're overpaid because you've made false statements, provided false information, or withheld information to receive benefits.

How to pay back overpaid unemployment benefits

Suppose the state determines you've been overpaid, and it decides to collect. In that event, you'll receive a notice of overpayment that will include the reason you were overpaid and the number of weeks involved.

Is there a downside to collecting unemployment?

If you’re worried that you won’t have enough money to cover your expenses, including things that can affect your credit like utility and credit card payments, collecting unemployment is probably a good idea. Unemployment insurance is one form of assistance you can use to protect your finances and credit in difficult times.

The bottom line

For the most part, unemployment benefits are going to help people more than they hurt financially. They've also been a good resource during the pandemic for people who haven't been eligible before.

Sources

NextAdvisor in partnership with TIME. “Millions Could Have to Pay Back Unemployment Benefits If They Miss This Deadline,” https://time.com/nextadvisor/in-the-news/pay-back-unemployment-benefits/. Accessed August 9, 2021.

What happens if you lose your unemployment benefits?

NOTE: If you lose benefits because you made a false statement or held back important information, you will have to repay the benefits you received and pay penalties that could double the amount you owe. You could also be charged with a crime. You cannot apply for a waiver.

How long do you have to appeal unemployment?

If you win your appeal, you will keep getting benefits and you will not have to repay anything. Make sure you appeal before the deadline. You have 15 days to appeal a decision of the ...

What happens if you get overpaid for a false statement?

If the Department of Labor decides you received an overpayment because of "a false statement or representation" or "knowingly failed to disclose a material fact," you will have to repay up to double the benefits you received, plus interest.

How to apply for a waiver for unemployment in Augusta?

You apply for a waiver by sending a letter to: Unemployment Insurance Commission. 57 State House Station. Augusta, ME 04333-0057. The Commission will not accept phone calls requesting a waiver. Your letter to the Commission should include all the reasons why you are unable to repay the overpayment.

How much interest do you have to pay if you overpay?

If the overpayment was a mistake, you will have to pay interest at 1% per month, starting one year after the overpayment is established. If you do not repay in one lump sum or make a payment plan, the Department of Labor can issue a civil warrant to collect the debt.

How long does it take to appeal an unemployment decision?

You have 15 days to appeal a decision of the Administrative Hearing Officer. You must appeal in writing. Fill out the form that came with your decision. Then fax, mail, or hand-deliver it to the Unemployment Insurance Commission before the deadline.

Can you pay unemployment in one lump sum?

You may have to pay in one lump sum. Or the money can be withheld from your paycheck, lottery winnings, and tax refunds due to you or your spouse. And 100% of any unemployment benefits you get after the 1 year ineligibility ends can be withheld until the amount you owe is paid in full. Updated September 2017.

How much do employers pay for unemployment?

In accordance with the Federal Unemployment Tax Act (FUTA), employers pay the federal government up to 6% of each employee’s first $7,000 of annual income. This helps maintain UI trust funds. There is an exception to the FUTA payments though.

What to do if you overpaid unemployment?

If you were overpaid unemployment benefits, you should receive a letter notifying you of the issue and the amount you owe. The letter will present the option to pay the debt in full immediately or set up a payment plan.

What is the base for unemployment taxes in 2020?

The 2020 wage bases for SUI taxes vary by state and range from the first $7,000 of an employee’s wages in Tennessee, California, Arkansas and Arizona to the first $52,700 in Washington. If a state exhausts its unemployment funds, it can borrow from the federal government.

What are the causes of unemployment overpayment?

Errors that can result in an overpayment may include: A mistake on your application. A mistake making a weekly UI benefits claim. Failure to meet eligibility requirements. A clerical issue at your state’s unemployment office. The unemployment insurance office will notify you of any overpayment via a letter.

When will the 600 unemployment be extended?

This act extended unemployment benefit payments by 13 weeks, added $600 to the weekly benefit amount through July 31, 2020, and extended UI benefits to part-time employees, gig workers and freelancers. The federal government funded 100% of the CARES Act.

Can you get a waiver for unemployment if you overpaid?

Failure to address the issue can result in stiff fines or even jail time. If the overpayment wasn’t due to unemployment insurance fraud, you may qualify for an overpayment waiver. These waivers are generally granted on a case-by-case basis.

Do you have to pay back unemployment?

In most cases, the short answer is no: You don’t have to pay back unemployment insurance (UI) benefits directly. These benefits are backed by the trust funds employers pay into. In most states, only employers pay into the unemployment insurance trust funds. But in Alaska, New Jersey and Pennsylvania, employees pay a small percentage ...