What are taxable benefits?

Thanks to the Tax Cuts and Jobs Act’s higher standard deduction, fewer taxpayers are itemizing on their returns. This may have simplified tax preparation for many, but those who use the standard deduction now miss out on several popular tax breaks, including claiming a deduction for gifts they make to a charity.

What are employee benefits taxable?

The taxable amount to the employee is the difference between the fair market value and the amount the employee paid for it. For example, if the employee paid you $100 for something, and the FMV is $200, you gave the employee a $100 benefit, so that's taxable.

How much of my social security benefit may be taxed?

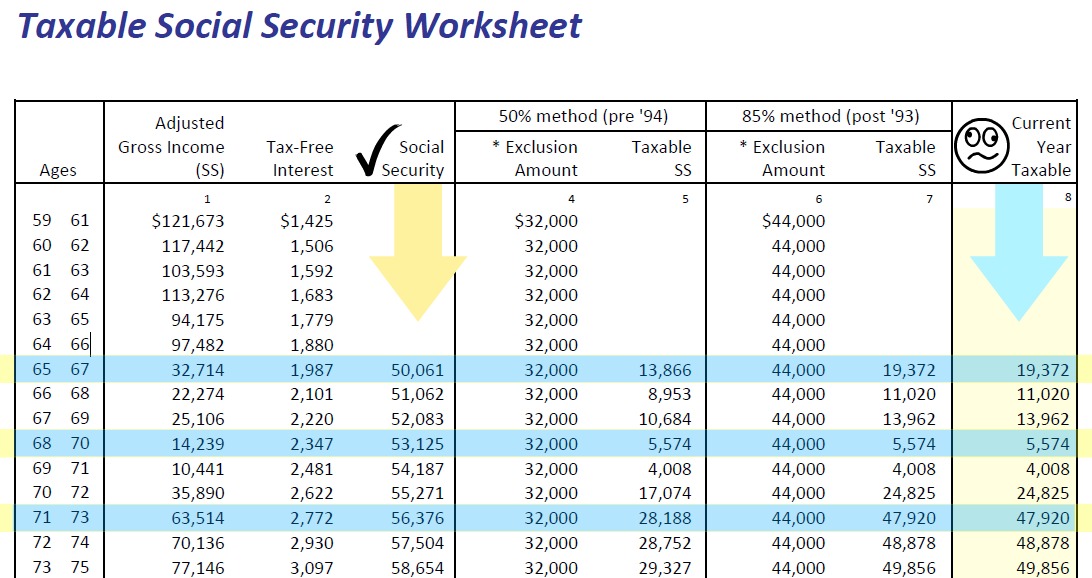

If your income is above that but is below $34,000, up to half of your benefits may be taxable. For incomes of over $34,000, up to 85% of your retirement benefits may be taxed. For the purposes of taxation, your combined income is defined as the total of your adjusted gross income plus half of your Social Security benefits plus nontaxable interest.

Are Social Security benefits taxable?

Supplemental Security Income payments, however, are not taxable. You could have to pay taxes on 50% of your Social Security benefits if the total income for an individual, including pensions, wages, dividends and capital gains plus Social Security benefits total between $25,000 and $34,000.

How much are benefits taxed?

between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

Do benefits get taxed UK?

As an employee, you pay tax on company benefits like cars, accommodation and loans. Your employer takes the tax you owe from your wages through Pay As You Earn ( PAYE ). The amount you pay depends on what kind of benefits you get and their value, which your employer works out.

What type of benefits are taxable?

Bonuses, company-provided vehicles, and group term life insurance (with coverage that exceeds $50,000) are considered taxable fringe benefits. Nontaxable fringe benefits can include adoption assistance, on-premises meals and athletic facilities, disability insurance, health insurance, and educational assistance.

Do you pay tax on Universal Credit?

Does Universal Credit Income get reported in the 2020-2021 Self Assessment Tax Return. Universal Credit is non taxable and should not be reported on the tax return.

How much tax do I pay on health insurance UK?

12%Healthcare cover is subject to IPT at the standard rate, which from June 1st 2017 is 12%.

Do benefits count as income?

Do I include benefits? Most, but not all, taxable state benefits should be included as social security income. However, income-based Jobseekers Allowance although taxable is not counted as income for tax credit purposes.

What benefits are not taxable in payroll?

Tax-free employee fringe benefits include:Health benefits. ... Long-term care insurance. ... Group term life insurance. ... Disability insurance. ... Educational assistance. ... Dependent care assistance. ... Transportation benefits. ... Working condition fringe benefits.More items...

What kind of income is not taxable?

The following items are deemed nontaxable by the IRS: Inheritances, gifts and bequests. Cash rebates on items you purchase from a retailer, manufacturer or dealer. Alimony payments (for divorce decrees finalized after 2018)

What percentage of Social Security recipients owe income tax?

The Social Security Administration estimates that about 56 percent of Social Security recipients owe income taxes on their benefits. For purposes of determining how the Internal Revenue Service treats your Social Security payments, “income” means your adjusted gross income plus nontaxable interest income plus half of your Social Security benefits.

How many states tax Social Security?

All of the above concerns federal taxes; 13 states also tax Social Security to varying degrees. If you live in Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, North Dakota, Vermont, Utah or West Virginia, contact your state tax agency for details on how benefits are taxed.

Do Social Security payments count toward income?

If your child receives Social Security dependent or survivor benefits, those payments do not count toward your taxable income. That money is taxable if the child has sufficient income (from Social Security and other sources) to have to file a return in his or her own name.

Is Social Security income taxable?

Supplemental Security Income (SSI) is never taxable. If you do have to pay taxes on your benefits, you have a choice as to how: You can file quarterly estimated tax returns with the IRS or ask Social Security to withhold federal taxes from your benefit payment. Updated June 30, 2021.

How much of a person's income is taxable?

Fifty percent of a taxpayer's benefits may be taxable if they are: Filing single, single, head of household or qualifying widow or widower with $25,000 to $34,000 income. Married filing separately and lived apart from their spouse for all of 2019 with $25,000 to $34,000 income.

How much income do you need to be married to be eligible for a widow?

Filing single, head of household or qualifying widow or widower with more than $34,000 income. Married filing jointly with more than $44,000 income. Married filing separately and lived apart from their spouse for all of 2019 with more than $34,000 income.

When is the IRS filing 2020 taxes?

The tax filing deadline has been postponed to Wednesday, July 15, 2020. The IRS is processing tax returns, issuing refunds and accepting payments. Taxpayers who mailed a tax return will experience a longer wait. There is no need to mail a second tax return or call the IRS. Social Security Income.

Is Social Security taxable if married filing jointly?

If they are married filing jointly, they should take half of their Social Security, plus half of their spouse's Social Security, and add that to all their combined income. If that total is more than $32,000, then part of their Social Security may be taxable .

Do you pay taxes on Social Security?

Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. Social Security benefits include monthly retirement, survivor and disability benefits. They don't include supplemental security income payments, which aren't taxable. The portion of benefits that are taxable depends on ...

What is a de minimis benefit?

De minimis benefits are those that hold such a minimal amount of value that employers would have a difficult time accounting for them. For instance, a gift card given to an employee for a holiday or birthday is considered a de minimis benefit, as are refreshments or snacks provided during a business meeting. Typically, meals are not considered ...

Is fringe benefit taxable?

Any fringe benefit offered as a bonus to an employee from an employer is considered taxable income, unless it falls under a specific list of excluded benefits as determined by the IRS. Taxable fringe benefits must be included on an employee’s W-2 each year, and the fair market value of the bonus is subject to withholding.

What is the federal unemployment tax?

The Federal Unemployment Tax Act (FUTA), with state unemplo yment systems , provides for payments of the unemployment compensation to workers who have lost their jobs. Most employers pay both a federal and a state unemployment tax. Only the employer pays FUTA tax; it is not withheld from the employee’s wages.

What is the most important benefit provided by an employer?

A health plan can be one of the most important benefits provided by an employer. The Department of Labor's Health Benefits Under the Consolidated Omnibus Budget Reconciliation Act (COBRA) provides information on the rights and protections that are afforded to workers under COBRA.

What is unemployment benefit?

Unemployment insurance payments (benefits) are intended to provide temporary financial assistance to unemployed workers who meet the requirements of state law. Each state administers a separate unemployment insurance program within guidelines established by federal law.

Is fringe income taxed?

Fringe benefits are generally included in an employee’s gross income (there are some exceptions). The benefits are subject to income tax withholding and employment taxes. Fringe benefits include cars and flights on aircraft that the employer provides, free or discounted commercial flights, vacations, discounts on property or services, memberships in country clubs or other social clubs, and tickets to entertainment or sporting events.

Is an employer's health insurance taxable?

If an employer pays the cost of an accident or health insurance plan for his/her employees, including an employee’s spouse and dependents, the employer’s payments are not wages and are not subject to Social Security, Medicare, and FUTA taxes, or federal income tax withholding.

Does the employer pay FUTA tax?

Only the employer pays FUTA tax; it is not withheld from the employee’s wages. The Department of Labor provides information and links on what unemployment insurance is, how it is funded, and how employees are eligible for it. In general, the Federal-State Unemployment Insurance Program provides unemployment benefits to eligible workers who are ...

How many states tax Social Security?

As for state taxes, only 13 states tax Social Security benefits: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia. If you live in one of them, you'll also need to learn your state's rules for when and how your benefits will be taxed.

Why are state taxes so complicated?

Things get even more complicated when it comes to state taxes, because there are big differences from one state to another. Here's what you need to know about how the federal government and the state you live in may tax different benefits.

How is Social Security income determined?

Your income is determined by adding half your Social Security benefits to all your other taxable income from other sources. Some tax-free income, such as municipal bond interest, is also added to determine your total income.

Does pension income have to be taxed in Alaska?

As far as state taxes go, if you live in Alaska, Florida, Illinois, Mississippi, Nevada, New Hampshire, Pennsylvania, South Dakota, Tennessee, Texas, Washington, or Wyoming, your pension income won't be taxed. If you live in any other state, you'll need to find out your local rules.

Is pension income taxable?

Pension income. If you're lucky enough to get a pension from your employer, the entire amount you receive is probably taxable income federally. This is the rule if you didn't contribute any of your own money to your employer's pension plan.

Do you pay taxes on 401(k) withdrawals?

That means you'll pay taxes based on whatever your tax rate is . If you have Roth accounts, on the other hand, you aren't subject to any federal taxes on withdrawals as long as you've complied with requirements related to your age and how long you've had your accounts open.

Is all my retirement income subject to taxes?

The good news is, not all of your retirement income is necessarily subject to taxation. It's important to understand how tax rules apply to different sources of funds in retirement so you can plan accordingly ...

How often are non cash awards taxable?

are not eligible for such an award more often than every five years. However, your taxable income includes incentive awards and performance bonuses.

Is non group insurance taxable?

Are non-group insurance plans a taxable benefit? Employer contributions to a non-group insurance plan* are a taxable benefit even if the plan is for sickness, accident or disability insurance. (*A non-group insurance plan is a plan for an individual employee.) For example, an executive may negotiate individual paid participation in ...

Is a flat rate deduction taxable in 2020?

Before the COVID-19 pandemic forced most people to work from home, equipment and supplies provided by your employer were not taxable benefits. However, for the 2020 tax year, the Canada Revenue Agency (CRA) issued a temporary flat rate deduction.

Is group life insurance taxable in Quebec?

group life insurance, dependant life insurance, accident insurance and. critical illness insurance. What's more, your taxable income includes the amounts paid on your behalf. Outside of Quebec, employer-paid premiums for health insurance benefits like prescription drug coverage, eye and dental care, and the like are not taxable.

Is short term disability taxable?

Employer-paid short-term disability or long-term disability premiums are not taxable benefits. But any short- or long-term disability benefits you receive in the future from your employer will be taxable. Conversely, if all employees pay their own short or long-term disability premiums, any benefits they receive are tax-free.

Is tuition paid by your employer taxable?

Tuition paid by your employer isn't a taxable benefit if you need the training to progress in your job. For example, let's say you're employed by a bank and are working towards becoming a Certified Financial Planner. In this case, any tuition reimbursed by the bank for this program would not be taxable.

Is a $500 gift taxable?

Employers sometimes give non-cash gifts or awards, worth under $500, for things like: outstanding service, or. milestones (such as a wedding or the birth of a child). In these cases, the value of the award is not a taxable benefit. Similarly, non-cash awards worth less than $500 aren't taxable benefits if you: ...

What are the benefits that are taxable?

The most common benefits that you pay Income Tax on are: Bereavement Allowance (previously Widow’s pension) Carer’s Allowance. contribution-based Employment and Support Allowance (ESA) Incapacity Benefit (from the 29th week you get it) Jobseeker’s Allowance (JSA)

What state benefits do not have to be paid income tax?

The most common state benefits you do not have to pay Income Tax on are: Attendance Allowance. Bereavement support payment. Child Benefit (income-based - use the Child Benefit tax calculator to see if you’ll have to pay tax) Child Tax Credit. Disability Living Allowance (DLA)

How much medical expenses can be deducted from your income?

Medical expenses can be deducted to the extent they exceed 7.5 percent of your adjusted gross income for the 2018 tax year, and this threshold rises to 10 percent for 2019.

Is medical reimbursement taxable?

Personal Medical Expense Reimbursement. If your benefits do nothing but pay for doctor bills, prescriptions and hospital stays, then don't worry – those payments are not taxable. Even though your health insurance is essentially paying for these critical services, this will in no way be considered part of your annual income.

Is health insurance considered income?

Are Health Insurance Benefits Considered Income by the IRS? Health insurance is not taxable income, even if your employer pays for it. Under the Affordable Care Act, the amount your employer spends on your premiums appears on your W-2s, but it should in no way be classified as income.

Is insurance tax free?

The primary factor decided who the tax burden falls on at this point is who is currently paying your premiums. When you pay for the insurance policy, your benefits are tax-free. When your employer pays, the benefits are taxable.

Is 60 percent of your health insurance premiums taxable?

If it's a split – your employer pays 60 percent of the premiums, for example – then 60 percent of the benefits are taxable. Your employer should factor that into your withholding.

Can you claim a high tech exam as a deduction?

If your insurance pays for a $2,000 high-tech exam, for example, you can't claim that as a deduction. However, if you paid a $40 co-payment, you can write that off if you have enough other deductions to make itemizing a better deal than taking the standard deduction.

Is adult child coverage taxable?

In that case, your coverage is a fringe benefit and part of your taxable income. One effect of the Affordable Care Act is that if you cover an adult child younger than 27, the coverage isn't subject to tax.

What Are Some Taxable Fringe Benefits?

- Any fringe benefit offered as a bonus to an employee from an employer is considered taxable incomeunless it falls under a specific list of excluded benefits as determined by the IRS. Taxable fringe benefits must be included on an employee’s W-2 each year, and the fair market value of the bonus is subject to withholding. The most common fringe benef...

Which Fringe Benefits Are Excluded from Taxation?

- Although some fringe benefits are considered a part of taxable income for employees, there is a lengthy list of common fringe benefits that are excluded from an employee’s taxable compensation. For example, awards given for achievements are exempt from tax withholding, as well are accommodations provided so an employee can perform their job. Fringe benefits that fa…

Special Considerations

- Other important benefits offered to U.S. employees are unemployment insurance, governed by individual states, and worker's compensation. Unemployment insurance temporarily provides unemployment benefits to certain workers who have lost their jobs. To qualify, the worker must not have caused the loss of employment, must have worked for a specific period and earned a c…

The Bottom Line

- Employers offer a wide range of fringe benefits as a recruitment or retention strategy, and these benefits can make up a substantial portion of an employee’s total compensation. To fully compare benefits packages between employers, it is important to understand how common fringe benefits are taxed.

Fringe Benefits

- Fringe benefits are generally included in an employee's gross income (there are some exceptions). The benefits are subject to income tax withholding and employment taxes. Fringe benefits include cars and flights on aircraft that the employer provides, free or discounted commercial flights, vacations, discounts on property or services, memberships i...

Unemployment Insurance

- The Federal Unemployment Tax Act (FUTA), with state unemployment systems, provides for payments of the unemployment compensation to workers who have lost their jobs. Most employers pay both a federal and a state unemployment tax. Only the employer pays FUTA tax; it is not withheld from the employee's wages. The Department of Labor provides information and li…

Workers' Compensation

- The Department of Labor's Office of Workers' Compensation Programs (OWCP)administers four major disability compensation programs that provide wage replacement benefits, medical treatment, vocational rehabilitation and other benefits to federal workers or their dependents who are injured at work or who acquire an occupational disease. Individuals injured on the job while e…

Health Plans

- If an employer pays the cost of an accident or health insurance plan for his/her employees (including an employee's spouse and dependents), then the employer's payments are not wages and are not subject to social security, Medicare, and FUTA taxes, or federal income tax withholding. Generally, this exclusion also applies to qualified long-term care insurance contract…