Do tax refunds count as income for snap?

If you receive a refund through the Earned Income Tax Credit, that doesn't count as income for SNAP or any other federal welfare benefits. However some states may count the amount refunded among your assets once you deposit it. In Massachusetts, for instance, an EITC refund counts as an asset two months after you receive it.

How do I report changes to my SNAP benefits?

You may report changes by calling the SNAP office. However, it is better to write down the change and mail it to the office. If you are eligible for SNAP benefits, you will be told what information to report and when to report. It is extremely important that you report changes, so that your household gets the right amount of SNAP benefits.

Can I get SNAP benefits?

You may be able to get SNAP benefits if you are: Receiving welfare or other public assistance payments; Homeless. State public assistance agencies run the program through their local offices. The following basic rules apply in most states, but a few states have different rules.

How do I report fraud and abuse of SNAP benefits?

If you wish to report any misuse, fraud, waste, or abuse of SNAP benefits, you can use this toll-free number: 1-800-424-9121. If you are in the Washington, DC, metropolitan area, the number is 202-690-1622.

Does snap get reported to IRS?

Food Stamps and Taxable Income The IRS says if you receive SNAP benefits, they do not count as taxable income. Receiving food stamps won't affect your return, increase your tax bill or reduce your refund.

Do I report CalFresh on taxes?

You do not need to report CalFresh on your tax return. You can get CalFresh even if you get money from a job, disability, unemployment, Social Security, CalWORKs, General Assistance or retirement. People who get SSI are not eligible for CalFresh.

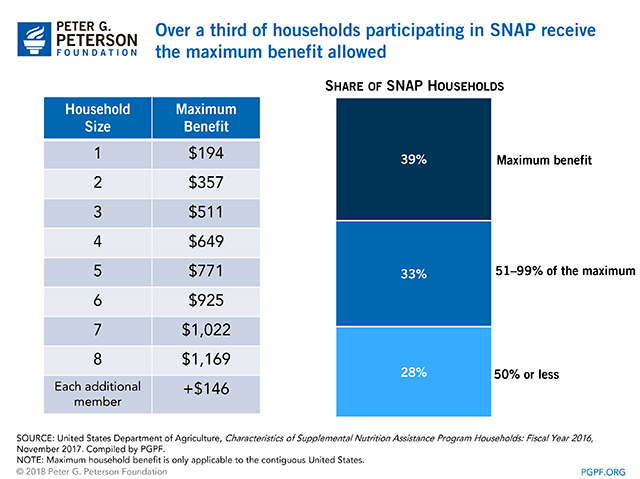

What is the highest income for food stamps?

SNAP/Food Stamps Gross Income and Maximum Benefits for Individuals and Families*Gross Monthly Income Limit If not Elderly or Disabled*Max Monthly F.S. Benefit for Everyone1 person: $2,265$2502 people: $3,052$4593 people: $3,839$6584 people: $4,625$8355 more rows

What's included in taxable income?

Taxable income is more than just wages and salary. It includes bonuses, tips, unearned income, and investment income. Unearned income can be government benefits, spousal support payments, cancelled debts, disability payments, strike benefits, and lottery and gambling winnings.

Is CalFresh considered income?

Typical payments treated as income are the “Family Self-Sufficiency Allowance” (FSSA), and the basic housing allowance for off-base housing. [See ACIN I-79-03EII for California state policy based on 7 CFR § 273.9(vii).] IHSS wages are considered income for purposes of CalFresh. [ACIN I-34-17.]

What is the income limit for food stamps 2021?

$1,500 earned income + $550 social security = $2,050 gross income. If gross monthly income is less than the limit for household size, determine net income. $2,050 is less than the $2,871 allowed for a 4-person household, so determine net income.

What disqualifies you from getting food stamps?

Some categories of people are not eligible for SNAP regardless of their income or assets, such as individuals who are on strike, all people without a documented immigration status, some students attending college more than half time, and certain immigrants who are lawfully present.

How can I increase my food stamp benefits?

You need to contact your caseworker immediately! Start by calling or visiting your local government agency that administers food stamps. You can ask to have your food stamps amount recalculated at any time, so you could start getting more food stamps right away!

How many hours do you have to work to get food stamps?

80 hoursYou can meet the ABAWD work requirement by doing any one of these things: Work at least 80 hours a month. Work can be for pay, for goods or services (for something other than money), unpaid, or as a volunteer; Participate in a work program at least 80 hours a month.

What benefits are not taxable?

HS207 Non taxable payments or benefits for employees (2019)Accommodation, supplies and services on your employer's business premises.Supplies and services provided to you other than on your employer's premises.Free or subsidised meals.Meal vouchers.Expenses of providing a pension.Medical treatment abroad.More items...•

What kind of income is not taxable?

Nontaxable income won't be taxed, whether or not you enter it on your tax return. The following items are deemed nontaxable by the IRS: Inheritances, gifts and bequests. Cash rebates on items you purchase from a retailer, manufacturer or dealer.

What amount of income is not taxable?

In 2021, for example, the minimum for single filing status if under age 65 is $12,550. If your income is below that threshold, you generally do not need to file a federal tax return.

What is the food stamp program?

Supplemental Nutrition Assistance Program or SNAP, more commonly known as food stamps, is a program of federal benefits provided by the United States Department of Agriculture that assists low-income families and the under-employed in affording nutritious food and basic household necessities.

When did food stamps start?

The program has been in operation since the 1960s, and currently serves more households than any other state or federal public-assistance program. However, anyone receiving food stamps should be aware of the tax treatment of these benefits by the Internal Revenue Service.

Do you have to pay tax on food stamps?

In addition to not having to pay federal taxes on your benefits amount, retailers that accept food stamps also cannot charge sales tax on the purchases of items paid for with SNAP. This is a federal law, and still holds true, even if the state normally charges tax on food items.

Do you have to declare food stamps on your taxes?

Neither the IRS nor state or local taxing authorities may tax food-stamp benefits, according to federal law. If you receive food stamps, you do not need to declare their value on your annual tax return as part of your income.

Can you claim food stamps as child support?

Nor may you count the food stamps as support provided to children, in the matter of apportioning that support for a claim for the child tax credit. This is because any money or benefits you receive from public assistance programs is not income you earned, therefore, it cannot earn you any tax breaks or credits. References.

Do you report unemployment on your taxes?

Unemployment benefits paid out of your state's unemployment insurance system are the only exception — you do report them on your return and pay taxes on the money you receive. Advertisement.

Is the Supplemental Nutrition Assistance Program taxable?

Under any name, SNAP helps low-income individuals and families purchase food. The benefits are not taxable income. Advertisement.

Does SNAP affect your tax refund?

SNAP benefits don't affect your tax refund, but your tax refund might affect your SNAP benefits. The program can disqualify you based on your income or the value of your assets. The income limits aren't the problem, here. If say, you receive a $1,200 refund, that doesn't affect benefits as SNAP doesn't count refund income.

Do food stamps count as income?

Food Stamps and Taxable Income. The IRS says if you receive SNAP benefits, they do not count as taxable income. Receiving food stamps won't affect your return, increase your tax bill or reduce your refund. That's because food stamps are a type of welfare benefit, and welfare benefits don't count as taxable income as long as they're based on need.

Do you pay sales tax on snap cards?

You also don't pay sales tax when you buy food with SNAP debit cards, even if you live in one of the states that charges sales tax on food. If you use SNAP to buy seeds or plants for growing food at home — the only legitimate non-food purchase — there's no sales tax on the plants, either.

Does SNAP refund count as income?

If say, you receive a $1,200 refund, that doesn't affect benefits as SNAP doesn't count refund income. If you receive a refund through the Earned Income Tax Credit, that doesn't count as income for SNAP or any other federal welfare benefits. However some states may count the amount refunded among your assets once you deposit it.

How often do you have to report changes to snap?

Still other households report changes once a quarter or semi-annually. You may report changes by calling the SNAP office. However, it is better to write down the change and mail it to the office. If you are eligible for SNAP benefits, you will be told what information to report and when to report.

What is Snap benefits?

SNAP benefits help supplement an individual’s or a family’s income to help buy nutritious food. Most households must spend some of their own cash along with their SNAP benefits to buy the food they need. To apply for benefits or for more information about SNAP, contact your local SNAP office.

What happens after a snap interview?

After your interview, the SNAP office will send you a notice. If you do not qualify for SNAP benefits, the notice will explain why. If you do qualify, the notice will explain how much your SNAP benefit will be. It will also tell you how many months you can get SNAP benefits before you must reapply.

What is a single parent on food stamps?

An employment and training program under the Food Stamp Act; or. An employment and training program operated by a state or local government. Also, a single parent enrolled full time in college and taking care of a dependent household member under the age of 12 can get SNAP benefits if otherwise eligible.

How to get a paper snap application?

How to get a paper application - You may ask for an application in person from the SNAP office, over the phone, or by mail. You can also ask someone else to get one for you. The SNAP office will give you an application form on the same day you ask for one. You can also download a state application at: SNAP state applications or directly from your state's website. States should have their applications in every language in which they make a printed application available. This will enable you to print the application, fill it out, and send it to your local SNAP office right away.

How long can you get snap benefits?

Generally, able-bodied adults aged 18 to 50 who do not have children and are not pregnant can only get SNAP benefits for 3 months in a 3-year period unless they are working or participating in a work or workfare program. There are a few exceptions.

What does a snap worker do?

A SNAP worker will explain the program rules and help you complete any parts of the application that you have not filled out. The worker will also ask you for proof of certain information you have given. Ask the worker to explain anything you don’t understand. It’s important that you understand the rules.

What is a snap household?

This is a SNAP household where all adult members are aged 60+ or have a verified disability. There may be children under 18 in the household. These households do not have any earnings from work.

When do you report a household member's income to the DTA?

if a household member gets a job and starts earning wages. You must report this change to us by the 10th day of the month following the month of the change. Example: Edward, age 65, starts a new job in November and receives his first paycheck on November 28. He needs to report the earnings to DTA by December 10th.

How many different types of certifications are there for Snap?

There are 4 different certification types, however most SNAP households are on Simplified Reporting. Your certification type can change. When this happens, DTA will send you a notice to let you know.

When do you need to fill out a simplified report?

Simplified Reporting households have two check-ins. You must fill out an Interim Report form at month 6 and a Recertification form at month 12. You must report: when your household’s gross monthly income goes over the limit for your household size.

How many checks in Bay State CAP?

These households may or may not have other sources of unearned income. Bay State CAP households have one check-in. You must fill out a Recertification form at month 36. You should report changes in your income or household circumstances to the Social Security Administration (SSA) at (800) 772-1213.

Got a Tax Question?

Get your questions answered from the comfort of your home! Our friends at JustAnswer are standing by to help. Chat now!

Assistance Programs That Pay Out to EBT Accounts

It’s difficult to say whether or not all of the funds that land in your EBT account will be taxed. This is because numerous assistance programs can deliver benefits to your EBT card so that you can make purchases.

The Bottom Line

The switch from traditional food stamps and welfare checks to the Electronic Benefits Transfer (EBT) system has helped save a lot of time and money. It has also ensured that those in need of assistance can receive and use their benefits as quickly as possible.

Get More Freebies & Money-Saving Tips!

Subscribe to Low Income Freebies & Tips (LIFT) now so you never miss another money-saving update!

Does Applying for Food Stamps Affect Your Credit?

No, applying for food stamps doesn’t affect your credit because it’s not something that gets reported to the credit bureaus. This means it doesn’t appear on your credit report and doesn’t affect your credit score in any way.

What You Need to Know About SNAP

Before you apply for SNAP benefits, it’s important to understand what they are, who qualifies, and how it may or may not affect other areas of your life.

Helpful Resources

Whether you’re already receiving SNAP benefits or just starting the process of determining if you’re eligible, it’s likely there may be some other programs that could be of benefit. Here are some helpful resources to get you started:

What is considered TANF support?

Under proposed Treasury regulations, if you received Temporary Assistance to Needy Families (TANF) payments or other similar payments and used the payment to support another person, those payments are considered support you provided for that person, rather than support provided by the government or other third party.

Can a non-custodial parent claim a child as a dependent?

The IRS goes by physical custody, not legal custody. The non-custodial parent can only claim the child as a dependent if the custodial parent gives permission (on form 8332) or if it's spelled out in a pre 2009 divorce decree.

What happens if you don't report your tax refund?

If you do not report a tax refund or EITC/EIC, you may have problems with DTA. The Department of Revenue (DOR) shares tax information with DTA. In most cases, your tax refund or EITC/EIC will not hurt your SNAP and TAFDC benefits. 2. I filed my taxes and got money back.

How much does Beverly get on Snap?

She gets SNAP benefits because her rent is very high. Because Beverly is a senior and her income is above $2,082/month, her assets count for SNAP. Her asset limit is $3,500.

How much is Lilly's tax refund?

Lilly and her children get TAFDC. Lilly gets a tax refund that is not EITC money. Lilly’s tax refund is $5,000. Lilly already has $600 in savings when she gets the refund. Once she gets the refund, she has $5,600. This is more than the $5,000 asset limit for TAFDC, so Lilly’s TAFDC benefits stop.

How to tell if your tax refund is EIC?

You can tell how much of your refund is EITC/EIC by looking at your federal and state tax returns. The EITC/EIC is on a separate line from the rest of your tax refund. You may get a tax refund and EITC from the federal government, the Internal Revenue Service (IRS).

Does EIC money affect Snap?

EITC/EIC money will not impact SNAP benefits for most people. EITC/EIC money may impact your SNAP benefits if: If someone in your household cannot get SNAP benefits because they broke a SNAP work rule or a SNAP or TAFDC reporting rule, your asset limit is $2,250.

Do Julie and Samantha get the same SNAP?

Julie and her sister Samantha live together and get SNAP on the same grant. They do not fall into either of the 2 groups that have an asset limit. Julie gets a $3,000 tax refund and Samantha gets a $2,000 tax refund. The refunds are not EITC payments. The refunds count as assets right away.

Does Tim get a tax refund?

Tim and his family get TAFDC. Tim gets a $2,500 tax refund that is not an EITC payment. The $2,500 counts as an asset right away. Tim does not have any other assets. He is not over the $5,000 asset limit, so the tax refund does not change his TAFDC.