How do you calculate gross adjusted income?

This typically includes:

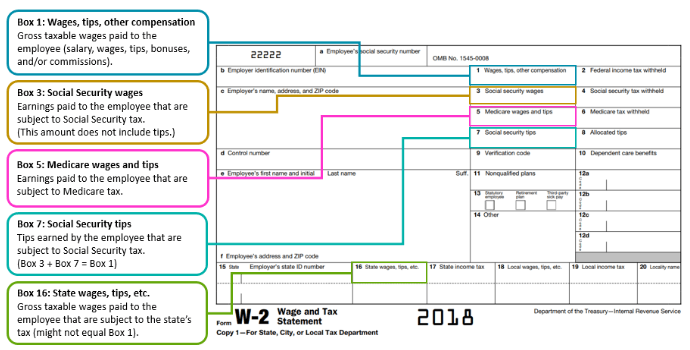

- Your wages from work reported on a Form W-2

- Income from self-employment, which is usually calculated on Schedule C

- Taxable interest and dividends

- Taxable alimony payments you receive from a former spouse

- Capital gains

- Rental income

- Any other payment you receive that isn’t specifically exempted from the income tax

Do Social Security benefits count as gross income?

While Social Security benefits are not counted as part of gross income, they are included in combined income, which the IRS uses to determine if benefits are taxable. Social Security benefits do not count as gross income. However, the IRS does count them in your combined income for the purpose of determining if you must pay taxes on your benefits.

How to calculate your adjusted gross income (AGI)?

- student loan interest deduction,

- foreign earned income and housing exclusions,

- foreign housing deduction,

- excluded savings bond interest,

- excluded employer adoption benefits, and,

- for 2017 and earlier, the domestic production activities deduction and the tuition and fees deduction paid before 2021.

How to calculate adjusted gross income (AGI) for tax purposes?

- Money rolled over from one retirement account to another, executed using a trustee-to-trustee transfer

- Foster care payments

- Scholarships or fellowship grants

- Canceled debts intended as a gift

- Certain inherited assets of money received as a gift

- Capital gains on the sale of your primary residence

- Disability payments

- Life insurance proceeds

Gross Income vs. Combined Income

To calculate income taxes, most taxpayers must calculate their adjusted gross income, which includes all income from wages, investments and other s...

Calculating Combined Income For Individuals

To calculate your combined income, add together your adjusted gross income, the value of nontaxable interest income, plus half of your total Social...

Combined Income Limits For Married Couples Filing Jointly

The combined income limits are slightly different for married couples who file jointly. Those who have less than $32,000 in combined income general...

Combined Income Limits For Married Couples Filing Separately

Married couples who file separate tax returns and live together for any part of the year should expect to pay taxes on their Social Security benefi...

How much of your AGI can you deduct for medical expenses?

For example, on your 2020 taxes, which are due on Tax Day 2021, it’s possible to deduct medical expenses that exceed 7.5% of your AGI.

How does AGI work on state taxes?

Most states start with your federal AGI and then allow some state-specific adjustments.

What is the difference between AGI and MAGI?

The difference is that MAGI adds back some of the deductions you’re allowed to make when calculating AGI. AGI and MAGI are the same or very similar for most people. Deductions you can take for your AGI but not your MAGI include the following: Half of the self-employment tax. Tuition and fees deduction.

What is AGI on state tax returns?

AGI on state tax returns. Editorial disclosure. Your adjusted gross income (AGI) is your gross income minus certain deductions, also known as adjustments. Your AGI isn’t the same as your taxable income, but finding your AGI is a necessary intermediate step for determining your taxable income. Once you know your AGI, you can determine whether ...

What can I take after I calculate my AGI?

After you calculate AGI, you can take either the standard deduction or you can take the total of your itemized deductions, whichever is worth more . What’s left after you deduct that amount is your taxable income. So finding your AGI is necessary for getting your taxable income.

What deductions can I take for AGI?

For the 2019 tax year, which you file in early 2020, these are the main deductions you can make to find your AGI: Individual retirement account (IRA) contributions. Health savings account (HSA) contributions. SEP IRA and SIMPLE IRA plan contributions.

Is AGI subject to federal tax?

Some income is not subject to federal income tax, so you subtract (deduct) it from your gross income. After you account for those deductions, you have your AGI. There are more than a dozen potential deductions. One common example is for contributions you make to a health savings account (HSA).

What is adjusted gross income?

Adjusted Gross Income (AGI) is defined as gross income minus adjustments to income. Gross income includes your wages, dividends, capital gains, business income, retirement distributions as well as other income.

How much is the AGI for married filing jointly?

If you are filing using the Married Filing Jointly filing status, the $72,000 AGI limitation applies to the AGI for both of you combined. To e-file your federal tax return, you must verify your identity with your AGI or your self-select PIN from your 2019 tax return.

How much of your Social Security income is taxable?

Taxes on Social Security Income. Up to 85 percent of your Social Security benefits can count as part of your gross income for income tax purposes, depending on what other income you have and your tax filing status. Each filing status has different threshold levels that determine what percentage of your Social Security benefits are taxable income.

How to calculate Social Security combined income?

To calculate your combined income, add your adjusted gross income plus any nontaxable interest income plus one-half of your Social Security benefits. For example, say your adjusted gross income is $12,000, you have $3,000 in nontaxable interest from state or local bonds and you receive $28,000 in Social Security benefits each year. Add the $3,000 in nontaxable interest income to your adjusted gross income to get $15,000. Then, add $14,000 – half of your Social Security benefits – to get $29,000 as your combined income.

What percentage of Social Security is taxable?

But, if you’re over the highest threshold, up to 85 percent can be subject to federal income tax.

Is Social Security indexed for inflation?

The thresholds for calculating the percentage of your Social Security benefits aren’t indexed for inflation, so the same amounts apply for the 2017 tax year. However, the individual income tax rates are higher in 2017 than they will be for the 2018 tax year due to the tax cuts, so it’s possible that your taxes will decrease from 2017 ...

Do you have to pay taxes after 70?

However, you’ll still have at least a few responsibilities, including potentially paying income tax after age 70. Retirees often have taxable income from a variety of sources, including pensions, annuities, retirement plan distributions like 401 (k)s and IRAs, as well as potentially taxable Social Security benefits.

What is the purpose of Social Security?

The Social Security Administration (SSA) keeps a record of your earned income from year to year, and the portion of your income that is subject to Social Security taxes is used to calculate your benefits in retirement. The more you earned while working (and the more you paid into the Social Security system through tax withholding), ...

How many years do you have to pay Social Security?

If you paid into the system for more than 35 years, then the Social Security Administration uses only your 35 highest-earning years and does not include any others in its formula. If you did not pay into the system for at least 35 years, then a value of $0 is substituted for any missing years. 3. After you apply for benefits, these earnings are ...

What is the full retirement age for a person born in 1943?

4 The full retirement age for anyone born from 1943 to 1954 is 66. For people born after 1954, the age rises by two months annually until it hits 67 for anyone born in 1960 or later. 5.

Is Social Security income taxable?

Is Social Security Taxable? Your income from Social Security can be partially taxable if your combined income exceeds a certain amount. “Combined income” is defined as your gross income plus any nontaxable interest that you earned during the year, plus half of your Social Security benefits. For example, if you’re married, file a joint tax return ...

What is gross income?

Gross income includes all of your income before any deductions are taken. For example, if you are working in a job in which you're paid an hourly wage, your gross income is the hourly rate you're paid multiplied by the number of hours you've worked during a pay period.

What does SGA mean on Social Security?

Social Security looks at gross income to determine whether you're meeting or exceeding substantial gainful activity (SGA). If you receive SSDI and are still in your Trial Work Period (TWP), Social Security looks at your gross earnings to determine if you've used one of your TWP months.

What should be on a paystub?

Your paystub should include an indication of what deductions have been taken and how much that deduction is. It's a good idea to review this information — whether it's by yourself or with someone else – to make sure your paycheck is accurate.

Why is net income important?

This means that when you create your budget for living expenses, such as food, lodging, or transportation, you will base it on your net income.

Do you report gross income to Social Security?

When reporting your wages, Social Security requires that you report your gross income — the amount you've earned before any deductions were taken from your paycheck.

Is the final amount of your paycheck considered income?

However, you may notice that this is not the final amount of your paycheck. That's because your paycheck will reflect your net income, or the amount of money once deductions — like taxes, employee benefits, or retirement plan contributions — have been considered.

How much Social Security do you get if you make more than $17,640?

If you make more than $17,640, the Social Security Administration will withhold $1 in benefits for every $2 in income that exceeds that amount. The one exception is during the calendar year you attain full retirement age. During that period, the earnings limit nearly triples and the withholding amount is not as steep.

What does it mean when Social Security sends you an overpayment letter?

They’ll send you an overpayment letter that says something along the lines of, “Because you received this payment you should not have received your benefit.

What is the retirement age for a person born in 1960?

For those born in 1960 or later, the full retirement age is set at age 67 . Obviously, the current full retirement age if you were born after 1960 is subject to change with the proposals floating around to fix Social Security — but this is where we are right now.

Can you receive Social Security if you have capital gains?

Capital gains. As the law is currently written, you can receive an unlimited amount of income from the sources above and receive your full Social Security benefit. The income that does count in the earnings limit is employment income. That means gross employment wages if you’re an employee and/or your net earnings from self-employment.

Do you count income when you work for wages?

For previous employees, the Administration’s article, How Work Affects Your Benefits, says if you work for wages, income counts when its earned, not when its paid.

Is there an income limit for retirement?

At your full retirement age, there is no income limit. The $17,640 amount is the number for 2019, but the dollar amount of on the income limit will increase on an annual basis going forward. You need to keep up with the year-to-year changes to stay informed.

Can you get Social Security if you were still working?

Additionally, the Social Security Administration will often want clarification on the timing of your earnings. In some cases, you may have earned money while you were still working, but didn’t receive it until after you stopped working and filed for Social Security.