Employees do not pay into the unemployment insurance plan but most full time workers are eligible to receive it. To be eligible, the worker must be a permanent, full-time employee and not considered self-employed or a contractor. If the employee is fired due to incompetence or poor work performance, he is generally not eligible.

How much federal tax do you pay on unemployment?

- Taxable social security benefits (Instructions for Form 1040 or 1040-SR, Social Security Benefits Worksheet)

- IRA deduction (Instructions for Form 1040 or 1040-SR, IRA Deduction Worksheet)

- Student loan interest deduction (Instructions for Form 1040 or 1040-SR, Student Loan Interest Deduction Worksheet)

Does the employer pay for unemployment benefits?

Your employer pays for unemployment insurance benefits, not the employees. In fact, businesses in the United States contribute money to the fund on a state and federal level, and a company’s payroll determines how much money they contribute. Learn more about who pays for unemployment insurance in our guide below.

What does an unemployment claim cost an employer?

- Keeping adequate documentation. Documentation is a vital part of the unemployment claims process. ...

- Establishing and following sound employee policies and procedures. Sound HR policies and procedures set a precedent for employees as to what the company’s expected standards of work and behavior are. ...

- Conducting workplace investigations. ...

Do companies pay unemployment insurance?

Unemployment insurance is funded by employers (not by all tax payers like some people think) through federal and state payroll taxes. Under the Wisconsin Unemployment Insurance law, employer payroll taxes are collected exclusively to fund the Unemployment Insurance Fund pursuant to a tax formula.

Who pays unemployment in California?

employersThe UI benefits are funded entirely by employers. In California, there are three methods of paying for UI: the tax-rated method, the reimbursable method, and the School Employees Fund method. Private sector employers are required to use this method and, therefore, most employers use it.

Who pays for unemployment in NY?

EmployersEmployers must pay taxes to provide unemployment insurance in New York State. Unemployment insurance is temporary income for workers who become unemployed through no fault of their own. Only certain workers are eligible.

How much does an employer pay for unemployment in Texas?

The RTR for 2022 is 0.20 percent.

How do unemployment benefits work in Texas?

Weekly Benefit Amount Your WBA will be between $71 and $549 (minimum and maximum weekly benefit amounts in Texas) depending on your past wages. To calculate your WBA , we divide your base period quarter with the highest wages by 25 and round to the nearest dollar.

Do employees contribute to unemployment in NY?

Most employers pay quarterly contributions into the fund. Contributions cannot be funded through deductions from employee wages. If you have not done so already, you must register for Unemployment Insurance, withholding and wage reporting.

Do employees pay unemployment tax in New York?

If your small business has employees working in New York, you'll need to pay New York unemployment insurance (UI) tax. The UI tax funds unemployment compensation programs for eligible employees. In New York, state UI tax is just one of several taxes that employers must pay.

Which employer is responsible for unemployment benefits?

Employer responsibility for unemployment benefits: Taxes When you hire new employees, report them to your state. You must pay federal and state unemployment taxes for each employee you have. These taxes fund your state's unemployment insurance program. Federal Unemployment Tax Act (FUTA) tax is an employer-only tax.

Do you have to pay back unemployment in Texas?

State law requires that you repay your overpayment before we can pay further unemployment benefits. TWC cannot dismiss or forgive an overpayment, and there is no exception in the law for hardship cases.

What taxes do employers pay in Texas?

The main taxes employers have to pay in Texas. Employers must pay 6.2 percent of taxable wages on the first $132,900. In some places, you might see this referred to as “FICA” or the “Federal Insurance Contributions Act,” and that refers to the combination of Social Security and Medicare.

What can disqualify you from unemployment benefits?

Unemployment Benefit DisqualificationsInsufficient earnings or length of employment. ... Self-employed, or a contract or freelance worker. ... Fired for justifiable cause. ... Quit without good cause. ... Providing false information. ... Illness or emergency. ... Abusive or unbearable working conditions. ... A safety concern.More items...•

How much is unemployment in Texas during Covid?

FPUC provided an additional $600 per week to claimants who lost work as a result of the COVID-19 pandemic. Texans will continue to receive state unemployment benefits for the remainder of their claim.

How many hours can you work and still get unemployment in Texas?

If you work part time, you can earn up to 25 percent of your weekly benefit amount (WBA) before TWC reduces your benefit payment. For example, if your WBA is $160, you may earn $40 without a reduction. If you earn $50, we reduce your WBA for the week to $150.

What is the purpose of unemployment insurance?

Unemployment insurance programs are intended to ensure that employees have some income coming in while they search for a new job if they lose a job through no fault of their own. Thus, the employer pays for the insurance rather than the employee. Having the employer pay for unemployment insurance also discourages ...

What is the federal tax act for unemployment?

The Federal Unemployment Tax Act ensures that all employees are covered by unemployment insurance so that employees who are involuntarily terminated without cause will have a source of income while they search for a new job.

Does the federal government take payroll taxes?

Payroll Taxes. The federal and state government take payroll taxes to fund unemployment insurance for workers. However, these payroll taxes are not taken out of the employee's paycheck. The employer funds unemployment insurance out of his share of the payroll taxes; employees' paychecks are not affected by the need to pay for unemployment.

Is unemployment taxable income?

Unemployment benefits are taxable income at the federal level as well as in most states. Taxation of these benefits may not be equal to the taxes employers pay to cover unemployment insurance costs; however, the employee who takes advantage of unemployment benefits helps pay for them by paying taxes on the benefits she receives throughout the year.

What is the liability of an employer for unemployment?

In order to fund unemployment compensation benefit programs, employers are subject to federal and state unemployment taxes depending on several factors. These factors include the sums employers pay their employees, the unemployment claims filed against the business, and the type & age of the business.

Why is unemployment tax so high?

When you first open your UI account, your tax rate will be fairly high because you have no track record. If you work for several years without laying off an employee, your tax rate will go down. If you continually lay off employees, your tax rate will increase.

How much do you pay in a quarter for a FUTA?

You pay wages totaling at least $1,500 to your employees in any calendar quarter; or. You have at least one employee on any given day in each of 20 different calendar weeks. Once you fulfill either of the tests, you become liable for the FUTA tax for the whole calendar year and for the next calendar year as well.

How does each state limit the tax you have to pay with respect to any one employee?

However, each state confine the tax you have to pay with respect to any one employee by detailing a maximum wage amount to which the tax applies. Once an employee’s wages for the calendar year surpass that maximum amount, your state tax liability with respect to that employee ends.

What is the premium rate for new non-governmental employers?

All other new employers are allotted a 2.7% new employer premium rate. In the past, mining and construction are the only industries with new employer rates higher than 2.7%.

Can you claim a credit against your federal unemployment tax?

You can usually claim credits against your gross FUTA tax to reflect the state unemployment taxes you pay. If you paid all your state unemployment taxes on time , and prior to the due date of your FUTA tax return, you will be permitted to claim a credit equal to 5.4% of your federally taxable wages. This will in effect reduce the FUTA tax to 0.6%.

Does a business have to pay unemployment tax?

The Federal Unemployment Tax Act (FUTA) imposes a payroll tax on employers, depending on the wages they pay to their employees. Unlike some other payroll taxes, the business itself has to pay the FUTA tax. You do not hold back the FUTA tax from an employee’s wages.

What is unemployment claim?

This claim is basically a notification to the state, the federal government, and the previous employer that they are seeking unemployment insurance benefits.

How long does it take to get unemployment benefits?

In most states, laid-off workers can receive 26 weeks of unemployment benefits and will receive a set percentage of their average annual pay. Programs to provide unemployment payments are managed at both the federal and state levels, and businesses fund these programs by paying state and federal taxes. In some states, employees also pay ...

What happens if you lose your unemployment claim?

Once the claim has been contested, both you and the claimant will receive a “Notice of Determination” that will show whether the unemployment claim has been accepted or not by the state. Even if the employee loses the determination, they may still be able to appeal the decision, so keep that in mind.

How much do you have to pay for a FUTA?

No matter what state you are located in, you’ll need to pay set FUTA taxes, which amount to 6% of the first $7,000 each employee earns per calendar year. This means the maximum you’ll pay per employee is $420. In some states, you’ll be eligible to receive a tax credit later where you’ll get some of these payments back.

Why did the worker leave?

Why the worker left, including whether they were laid off (lack of work), voluntarily quit, were fired or left because of a trade/strike dispute. Whether they refused employment. Is legally able to work in the U.S. Is receiving any form of compensation, such as a pension or severance pay.

Is letting employees go a normal job?

While letting employees go is a normal function of a business, it can sometimes be challenging to understand exactly how the process is supposed to work, what responsibilities employers have, what taxes are owed and more. Here are questions and answers to help employers better understand what happens when former (or furloughed) ...

Can you collect unemployment if you were laid off?

Generally speaking, unemployment is only available for employees who have been laid off through no fault of their own. If an employee was fired for misconduct or company policy violations, they are likely ineligible to collect benefits.

How is unemployment insurance funded?

Department of Labor’s Unemployment Insurance program is funded through unemployment insurance taxes paid by employers and collected by the state and federal government. The taxes are part of the often-discussed payroll taxes all employers pay.

How long can you get unemployment benefits?

This usually comes in the form of extending the time individuals can receive benefits over the 26 week maximum offered in most states. The loan fund is reserved for bridging gaps for states that run out of unemployment insurance money during times of heightened unemployment.

How much do employers pay in taxes?

Employers pay federal taxes of 6 percent on the first $7,000 in annual income earned by every employee. Employers who pay on time get a tax break at 5.4 percent. The amount collected by each state varies as does the amount of income it is collected on—the first $7,000 to $34,000 an employee earns each year, depending on the state.

Which states require employees to contribute to unemployment insurance?

There are only three states—Arkansas, New Jersey and Pennsylvania —that ask employees to contribute and only in specific situations. Similar to varying car insurance rates, state unemployment insurance rates vary for employers based on their history.

What are the pots of unemployment tax money?

The unemployment insurance tax money is placed into three pots: state programs, extended benefits program and the loan fund. The U.S. Department of Labor oversees all of the funds, which are administered through the states.

How to keep unemployment costs low?

This starts with smart and prudent hiring—hiring only workers who are needed and qualified. This helps prevent layoffs and situations where an employee is simply not a good fit.

What is the federal unemployment tax rate?

The Federal Unemployment Tax Act (FUTA) tax is imposed at a flat rate on the first $7,000 paid to each employee. The current FUTA tax rate is 6%, but most states receive a 5.4% “credit” reducing that to 0.6%. There is no action an employer can take to affect this rate. Some of this federal money is used for loans to states ...

Why do employers have to prevent UI?

However, employers must prevent UI benefit charges in order to keep their unemployment tax rate low. This is done by contesting and winning claims when employees should be judged ineligible for benefits, such as employees who quit (in most cases) or are fired for misconduct. Many employers use an outsourced UI claims management/cost control ...

How long does unemployment affect tax rates?

Each awarded unemployment claim can affect three years of UI tax rates. Employers often don’t realize the real cost of a claim since it’s spread out over a long period. The average claim can increase an employer’s state tax premium $4,000 to $7,000 over the course of three years.

How do state governments get money to pay claims?

State governments get the money to pay claims by debiting the employer’s UI account (in states that require an account balance) or by raising the employer’s UI taxes. A deduction in the account balance may also cause a rate increase, as the ratio between taxable payroll and the account balance changes. Each claim assessed to an employer’s account ...

Which states have unemployment taxes?

Only three states—Alaska, New Jersey and Pennsylvania —assess unemployment taxes on employees, and it’s a small portion of the overall cost. Unemployment is funded, and taxed, at both the federal and state level: The Federal Unemployment Tax Act (FUTA) tax is imposed at a flat rate on the first $7,000 paid to each employee.

Does each claim increase tax rate?

Each claim assessed to an employer’s account can result in a tax rate increase in future years. So the real story isn’t the cost of an individual claim (though it can be significant). It’s the higher tax rate that will have a long-term impact. The state formulas generally use a three-year moving period to assign a tax rate.

How to stop claiming unemployment benefits?

The way to stop your claim is simple: just stop filing your weekly claims. You may stop claiming at any time during your benefit year and resume claiming the balance of your benefits until your benefit year ends if you meet all eligibility requirements.

What is unemployment insurance?

Q. What are unemployment-insurance benefits?#N#A. Unemplo yment benefits partially replace your regular earnings and help you meet expenses while you look for another job. They are not based on financial need. While receiving benefits, it’s your responsibility to get back to work as quickly as you can.

What to do if you can't find a description of your unemployment?

If you cannot locate a description that best describes your situation, you might want to call the claims center to apply for unemployment benefits.

How to contact unemployment in Washington state?

By calling 800-318-6022. For current claims center contact information and hours go to: https://esd.wa.gov/unemployment/unemployed-workers-contact. Continue to file your weekly claims as you do now. Although you are living in a different state, Washington state will continue to pay you benefits.

How long is a Washington state unemployment claim good for?

Your claim is good for a “benefit year,” which is 52 weeks, beginning with the week you file your application. You cannot file a new claim in Washington until your benefit year is over, even though you may have received all of your benefits. Most claims receive between 13 to 26 weeks of benefits. Q.

Can I collect unemployment if I work part time?

Q. Can I collect unemployment benefits if I work part-time?#N#A. Yes. If you work part-time, we reduce your benefits using the earnings deduction chart (gross earnings minus $5 times 75 percent).

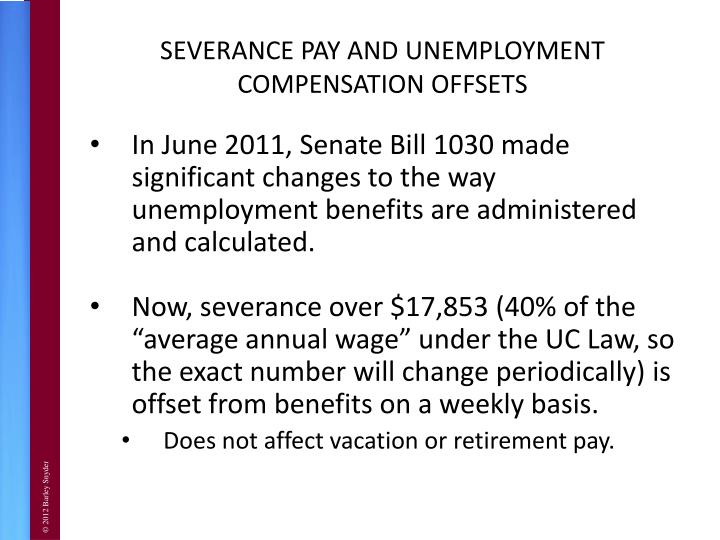

Does a severance payment affect unemployment?

A. Severance payments do not usually affect your unemployment benefits. However, pay in lieu of notice or continuation pay with full benefits that are guaranteed can affect your benefits. Report any separation-related payment you receive or are entitled to receive to the claims center.

How to know if your employer is paying unemployment?

How to Determine if Your Employer Is Paying Unemployment. When you lose your job through no fault of your own, such as if your company is experiencing downsizing or layoffs, you might qualify for unemployment benefits. A joint federal and state financed program, unemployment benefits provide temporary income while you search for a new job. ...

Who can help you verify your employer's unemployment?

The proper regional office of the U.S. Department of Labor can help you verify if your employer qualifies to be paying unemployment insurance premiums, and if it has complied accordingly. The U.S. Department of Labor can also help you with any questions you might have regarding your employer’s eligibility. av-override.