What is the maximum unemployment benefit in Arizona?

You are eligible for FPUC if you receive any of the following benefits:

- Unemployment Insurance (UI)

- Unemployment Compensation for Federal Employees (UCFE)

- Unemployment Compensation for Ex-Servicemembers (UCX)

- Pandemic Emergency Unemployment Compensation (PEUC)

- Pandemic Unemployment Assistance (PUA)

- Extended Benefits (EB)

- Shared Work (SW)

- Trade Readjustment Allowances (TRA)

- Disaster Unemployment Assistance (DUA)

How do I apply for unemployment benefits in Arizona?

To apply for Arizona benefits online, you'll need the following information:

- Your Social Security number or Alien Registration Number

- Your Arizona driver's license number or state-issued ID

- Your mailing address

- Your employment history for the past 18 months, including employer names, addresses, phone numbers, and your last day of work

- Bank account information for direct deposit

How long can you receive unemployment in Arizona?

If you feel you have been wrongfully discharged or terminated from employment, you may:

- Contact your State Labor Office for more information on wrongful termination laws in your state.

- Seek legal counsel if your employer terminated you for any reason not covered under state or federal law.

- You may also be eligible for unemployment compensation and extension of your health care benefits.

How to apply for unemployment in AZ at unemployment benefits?

How to File a Claim for Unemployment Benefits in Arizona. You may file your unemployment claim online at the DES website. If you don't have Internet access, you can apply by phone by calling 1-899-600-2722. How to Appeal a Denial of Unemployment Benefits in Arizona. If your unemployment claim is denied, you have 15 days to appeal the decision ...

What happens if you misrepresent your unemployment claim in Arizona?

When will the unemployment search be reinstated?

How long does Extended Benefits last?

What happens if you make a false statement on unemployment?

What is MEUC in unemployment?

See more

About this website

How much is Arizona unemployment a week?

If you are eligible to receive unemployment, your weekly benefit in Arizona will be 4% of the wages you earned in the highest paid quarter of the base period. The most you can receive per week is currently $240; the least you can receive is $122.

How much is unemployment in AZ due to coronavirus?

Federal Pandemic Unemployment Assistance (FPUC) FPUC is a $300 weekly supplement for all individuals receiving unemployment benefit payments. In Arizona, eligible claimants will receive FPUC through benefit week ending July 10, 2021.

Is Arizona still paying unemployment benefits?

The PUA program has been extended through benefit week ending September 4, 2021. Weekly certifications will continue to be required. Per federal law, individuals who have exhausted benefits will not be eligible for weeks of benefits prior to benefit week ending March 20, 2021.

Is unemployment paying an extra $600 in Arizona?

This emergency benefit provides most individuals receiving unemployment Insurance (UI), as well as those eligible for Pandemic Unemployment Assistance (PUA), an emergency increase in traditional unemployment benefits with an additional $600 per week through July 25, 2020.

Is pandemic unemployment still available?

The COVID-19 Pandemic Unemployment Payment (PUP) was a social welfare payment for employees and self-employed people who lost all their employment due to the COVID-19 public health emergency. The PUP scheme is closed.

What is the maximum unemployment benefit in Arizona 2021?

$240Your weekly Unemployment Insurance Benefit Amount (WBA) is calculated on wages you earned from employers who paid Unemployment Tax to the State of Arizona. The WBA is 4% of the wages paid in the highest quarter of your base period. The current maximum WBA is $240.

Is AZ unemployment extended?

PEUC has been extended by 29 weeks, and now provides a maximum of 53 weeks of unemployment insurance benefits to eligible individuals. Claimants may continue to receive PEUC through benefit week ending September 4, 2021, or until their benefits are exhausted, whichever comes first.

Who qualifies for Pua in Arizona?

Pandemic Unemployment Assistance (PUA) provides up to 79 weeks of benefits to qualifying individuals who are otherwise able to work and available for work within the meaning of applicable state law, except that they are unemployed, partially unemployed, or unable or unavailable to work due to COVID-19 related reasons, ...

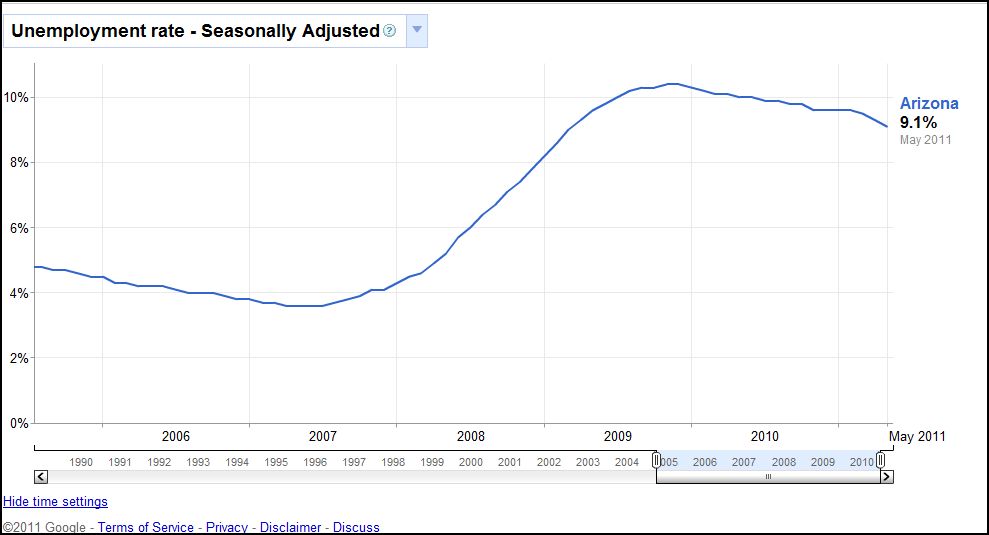

Why is unemployment so low in Arizona?

“Now on the negative side, one of the reasons that the unemployment rate is so low is that we've been experiencing labor shortages in a lot of different areas,” Rounds said. “When you have labor shortages, it tends to push wages up which adds to inflation, but it's not the good kind of upward pressure on wages.”

How long do you have to work to get unemployment in AZ?

To be eligible for this benefit program, you must a resident of Arizona and meet all of the following: Unemployed, and. Worked in Arizona during the past 12 months (this period may be longer in some cases), and. Earned a minimum amount of wages determined by Arizona guidelines, and.

Can you work part time and collect unemployment AZ?

If you are returning to part-time work, you may continue to file weekly certifications and report your earnings for each week. If you earn less than your weekly benefit amount, you may still be entitled to partial unemployment benefits.

Unemployment Insurance | az.gov

Search the Official Website of the State of Arizona. Search . Half Staff

AZ Continued Claims: Enter SSN

AZ UI Benefits Weekly Claim. New! The Pandemic Emergency Unemployment Compensation (PEUC) program expired on September 6, 2021.

Arizona's Pandemic Unemployment Assistance Portal

Pandemic Unemployment Assistance (PUA) Pandemic Unemployment Assistance (PUA) provides up to 79 weeks of benefits to qualifying individuals who are otherwise able to work and available for work within the meaning of applicable state law, except that they are unemployed, partially unemployed, or unable or unavailable to work due to COVID-19 related reasons, as defined in the CARES Act.

How do I qualify for unemployment in Arizona?

To qualify for UI benefits, you must be out of work through no fault of your own. Workers who are laid off for economic reasons due to a plant closing , a reduction-in-force , or because of lack of work , for example -- are considered to be unemployed through no fault of their own. If your reason for separation from your last job is due to some reason, a determination will be made about whether or not you are eligible for benefits. All determinations of whether or not a person is eligible for benefits are made by the appropriate Arizona Revised Statute, Administrative Code or applicable federal laws.

What is the maximum WBA in Arizona?

The WBA is 4% of the wages paid in the highest quarter of your base period. The current maximum WBA is $240.

What are the requirements to qualify for unemployment?

You must meet specific requirements for wages earned or time worked during an established period of time, be determined to be unemployed through no fault of your own (determined under state law) and meet other eligibility requirements to qualify for Unemployment Insurance benefits.

What happens if you are denied unemployment benefits?

If you are disqualified/denied benefits, you have the right to file an appeal. You must file your appeal within an established time frame. Your employer may also appeal a determination if he/she does not agree with the determination regarding your eligibility.

Can you combine Arizona wages?

If you have Arizona wages and also worked in another state, or currently reside in Arizona and have earnings from employers in two or more other states (within the base period), you may choose to combine these wages to establish monetary eligibility. If you were employed in more than one state at any time during the current base period, ...

Can you file a claim against any state in which you were employed?

Filing a claim against any state in which you were employed, using the wages from all states in which you earned wages.

When will the unemployment benefit end in Arizona?

On March 11, 2021, President Biden signed into law a $1.9 trillion COVID-19 relief bill known as the American Rescue Plan (ARP). The law extended a $300 per week federal unemployment supplement (on top of state-provided benefits) until September 6, 2021. However, the state of Arizona decided to end this supplement early on July 10, 2021, citing labor shortages. That means the unemployment supplement is no longer available in Arizona.

When does Arizona unemployment expire?

ARP increases the maximum duration of PEUC benefits from 24 to 53 weeks, with an expiry date of September 4, 2021. For up-to-date information on Arizona's rules on unemployment eligibility and amounts during the COVID-19 pandemic, visit the state's Unemployment Insurance Benefits page.

What is the job of the Arizona Department of Economic Security?

The Arizona Department of Economic Security (DES) handles unemployment compensation and decides whether claimants are eligible for benefits. Under the state's normal eligibility rules, you must meet the following three requirements to collect unemployment benefits: You must be unemployed through no fault of your own, as defined by Arizona law.

How long does unemployment last?

Benefits will continue until you've received the equivalent of 26 weeks of your weekly benefit amount or one-third of your total base-period wages, whichever is less. (In times of very high unemployment, federal and state programs may make additional weeks of benefits available.)

How to keep collecting unemployment?

To keep collecting unemployment benefits, you must be able to work, available to work, and looking for employment. If you're offered a suitable position, you must accept it. Whether a position is suitable depends on how similar the job is to your previous employment, how much you will be paid, the working conditions, and the skills, experience, ...

When is the base period for Arizona unemployment?

The base period is the first four of the five complete calendar quarters before you filed your benefits claim . For example, if you file your claim in May 2020, the base period would be from January 1 through December 31, 2019. To qualify for benefits in Arizona, you must meet either of the following criteria:

Can you get unemployment if you are out of work in Arizona?

You must be out of work through no fault of your own to qualify for unemployment benefits in Arizona.

How long does it take to get unemployment benefits?

If there are no issues established on your claim, you can expect your first benefit payment** (normally after you've filed your second weekly claim) within approximately 10 business days.

How long do you have to collect unemployment?

You may have up to 26 weeks of UI benefit payments, depending on how much you earned in your base period. If you return to work or if you have deductible income for any week, you may collect more or less than 26 weeks.

How to contact Way2Go for unemployment?

If you checked your Unemployment Insurance benefit status (as outlined above) and it shows benefits were paid, but the balance on your Electronic Payment Card (EPC) is zero, please contact the Way2Go card® call center toll-free at 1-833-915-4041, TTY: 877-427-4172, or by Direct International at 1-214-210-2249.

How to check if I received my unemployment payment?

To check by phone: Call the Telephone Information and Payment System, and select Option 2 for the latest payment made to you, or information about the last week you filed if you did not receive a payment, and the balance remaining on your current claim. View more information about the telephone options available for other various UI claim inquiries.

What is UB-107 in unemployment?

Your Wage Statement (UB-107) will show a weekly benefit amount and total award if you've earned enough wages to qualify.

What happens if you miss a benefit week?

Note: If you skip or miss filing more than two consecutive benefit weeks, your claim becomes inactive. View information about filing weekly claims.

How will Arizona unemployment benefit change in 2023?

These benefit changes will be funded by expanding the taxable wage base upon which employers are assessed a tax that funds Arizona’s unemployment insurance trust fund. This change will take effect in Calendar Year 2023. The wage base will increase from the first $7000 earned by an employee in a year to $8000 — the first time it has been adjusted in almost 40 years and still one of the lowest in the nation. Covid relief funds and a planned transfer from the General Fund have helped to bolster Arizona’s trust fund which was significantly depleted due to the pandemic but never reached a zero balance.

How many unemployment claims are there in Arizona in 2020?

In July 2020, almost 3 million unemployment claims were filed at the peak of the crisis. In August 2020, the Grand Canyon Institute estimated that Arizona had lost more than $1 billion in economic activity due to the low benefit amounts paid by the state and those excluded from assistance who also missed out on federal supplemental assistance that has varied between $300 and $600 per week.

How many people will receive unemployment benefits in the first year?

An estimated 70,000 people will benefit from the increased benefit amount in the first year after taking effect. Of those, an estimated additional 14,000 people will remain eligible for assistance while accepting partial employment. Under the previous law, the unemployed were penalized after earning more than $30 a week and lost all assistance after earning no more than $240 per week. The new law will provide more people with the opportunity to remain connected to the workforce while they look for full employment.

How long does unemployment last?

Weeks of unemployment assistance will remain at 26 weeks while unemployment is above 5%. Once the rate drops below 5%, weeks of assistance decline to 24 weeks. Twenty-six weeks is the norm across the United States.

Arizona Unemployment Assistance

If you live in Arizona and you've lost your job, help is available. Arizona unemployment benefits are available through the state via an unemployment insurance fund, which is paid into by employers doing business in Arizona. Benefits vary based on your past salary and eligibility is determined by an examiner at a local Arizona unemployment office.

Applying for Benefits

A specific formula is used by the Arizona unemployment office to determine the amount of weekly benefits that approved applicants will receive.

How much unemployment will Arizona get in 2021?

But with the increase in unemployment benefits due to the pandemic, Arizona residents could receive over $800 per week, and as of 2021 are still eligible to receive over $500 per week. All of a sudden, the potential taxes owed on unemployment benefits became a real concern.

What Types of Unemployment Benefits Are Taxable?

These include regular unemployment insurance, Arizona Extended Benefits (EB), Federal Pandemic Unemployment Compensation (FPUC), Pandemic Emergency Unemployment Compensation (PEUC), Pandemic Unemployment Assistance (PUA), Lost Wages Assistance (LWA), CARES Act benefits, and Trade Adjustment Assistance (TAA).

Can Taxes on Unemployment Compensation Be Spread Out to Avoid a Large Tax Bill at the End of the Year?

The answer is yes . In order to avoid a large tax bill at the end of the year, you can have income taxes deducted from each of your unemployment checks. You may choose to have federal income taxes withheld from unemployment compensation at the rate of 10% of the gross weekly unemployment benefit. To do so in Arizona, you will need to fill out Voluntary Election for Federal/State Income Tax Withholding form (Form UB-433). By using the same form, you can also have state income taxes withheld from you unemployment compensation. State income taxes are withheld at the rate of 1% of the gross weekly unemployment benefit.

Can you take state income tax out of unemployment?

It should be noted that state income taxes cannot be withheld from the supplemental unemployment compensation you may receive under the Lost Wage Assistance or the Federal Pandemic Unemployment Compensation. However, because state income taxes are much lower than federal taxes, they should not create a significant liability even if they have to be paid at the end of the year.

Is unemployment taxed in Arizona?

Unemployment Compensation Is Taxable in Arizona (with One Exception) One of the effects of the COVID pandemic has been that many more people became reliant on unemployment compensation and benefits. At the same time, the unemployment benefits significantly increased due to the passage of the CARES Act and other similar laws.

Is unemployment compensation taxable?

It was a surprise to many recipients of unemployment benefits to find out that unemployment compensation is taxable. In other words, unemployment compensation is considered income, and is taxed the same way as other income, both by the federal government and by the state.

Does Arizona have a tax break for unemployment?

The tax break applies only to federal taxation. As of the end of March 2021, Arizona has not yet followed the federal government in eliminating state income taxes on unemployment benefits. Furthermore, the tax break only applies to 2020 unemployment benefits. It may be possible, however, that Congress will eventually pass a law providing ...

What happens if you misrepresent your unemployment claim in Arizona?

It is a felony to misrepresent or fail to disclose facts or to make false statements in order to obtain or increase benefits. If you knowingly make a false statement or withhold information in order to collect unemployment insurance benefits to which you are not entitled, the Arizona Department of Economic Security may take civil or criminal action against you. Criminal action may result in a fine and/or imprisonment. In addition, you will be required to repay the amount you received illegally as well as penalty amounts which are added to each week that was fraudulently claimed. As part of our fraud prevention efforts, the Department regularly conducts several types of audits to detect improper benefit payments. View more information about Unemployment Insurance Fraud.

When will the unemployment search be reinstated?

New! On May 3, 2021, Governor Ducey rescinded Executive Order 2020-11 and reinstated the requirement for unemployment claimants to search for work. In order to be eligible for unemployment benefits, claimants receiving benefits from any unemployment program must complete work-search activities during the week that begins May 23, 2021, and log those work search activities when they file their weekly claims on May 30, 2021. To learn more, visit our Work Search web page.

How long does Extended Benefits last?

Extended Benefits (EB) provides up to an additional 13 weeks of benefits to eligible claimants who have exhausted both their regular Unemployment Insurance (UI) benefits and Pandemic Emergency Unemployment Compensation (PEUC) assistance.

What happens if you make a false statement on unemployment?

If you knowingly make a false statement or withhold information in order to collect unemployment insurance benefits to which you are not entitled, the Arizona Department of Economic Security may take civil or criminal action against you. Criminal action may result in a fine and/or imprisonment.

What is MEUC in unemployment?

The MEUC program was created as part of the federal Continued Assistance Act (CAA) and provides an additional $100 per week in supplemental unemployment benefits to individuals who receive regular unemployment benefits ( UI), Pandemic Emergency Unemployment Compensation (PEUC) or Extended Benefits (EB) who also have at least $5,000 in net income from self-employment during the most recent tax year that ended prior to their application for Unemployment Insurance (UI).