What is the maximum unemployment benefits in Arizona?

- You must be unemployed through no fault of your own, as defined by Arizona law.

- You must have earned at least a minimum amount in wages during a certain period of time before you were unemployed.

- You must be able and available to work, and you must be actively seeking employment.

Does Arizona tax unemployment benefits?

Use the Internet Unemployment Tax and Wage System (TWS) to:

- File a Quarterly Wage Report.

- Make a payment.

- View and print a copy of documents previously filed via the Internet.

What is the Arizona unemployment tax rate?

The Arizona 2021state unemployment insurance (SUI) tax rates range from 0.08% to 20.6%, significantly up from 0.05% to 12.85% for 2020. The 2021 new employer rate continues at 2.0%. 2021 taxable wage base. The SUI taxable wage base continues at $7,000 for 2021.

What is my state unemployment tax rate?

UI Tax Rates

- Variable Taxable Wage Base. Tennessee’s unemployment insurance taxable wage base varies based on the balance in the Unemployment Trust Fund.

- Factors Affecting Your Premium Rate. Tennessee is one of 31 states that use the reserve-ratio formula to determine employer premium rates.

- Determination of Rate Table in Effect. ...

Is unemployment taxable in 2021 in Arizona?

Arizona later conformed to the tax provisions in the American Rescue Plan Act of 2021, resulting in the same $10,200 of unemployment benefits being excluded from Arizona income tax.

Is Arizona pandemic unemployment assistance taxable?

Claimants who received PUA benefits will have a separate 1099-G tax form than those claimants who received Unemployment Insurance (UI), Pandemic Emergency Unemployment Compensation (PEUC), and Extended Benefits (EB). If you received PUA and UI, PEUC, or EB benefits, you will receive two 1099-G forms.

Does Arizona tax unemployment from another state?

Although unemployment insurance income may come from another state, it is only taxable to the state you were living in at the time you received it. If you had MN taxes taken out, you would want to file a MN nonresident return with zero income to have those taxes returned. Otherwise, you wil only file Arizona.

Will Arizona refund unemployment taxes?

Arizona will give refunds for taxes on unemployment benefits, but you'll have to work for it. The Arizona Department of Revenue will issue refunds to state residents for certain unemployment benefits received in 2020, the department announced.

Do I have to claim my unemployment on my taxes this year?

Yes, you need to pay taxes on unemployment benefits. Like wages, unemployment benefits are counted as part of your income and must be reported on your federal tax return. Unemployment benefits may or may not be taxed on your state tax return depending on where you live.

Is the pandemic unemployment assistance taxable income?

Overview. PUP is available to employees and the self-employed who lost their job on or after 13 March 2020 due to the COVID-19 pandemic. The PUP is paid by the Department of Social Protection (DSP). Payments from the DSP are taxable sources of income unless they are specifically exempt from tax.

What is the Arizona unemployment tax rate?

The Arizona 2022 state unemployment insurance (SUI) tax rates range from 0.08% to 20.93%, up from 0.08% to 20.6% for 2021. The 2022 new employer rate continues at 2.0%. This minimal increase is due to the deposit of federal American Rescue Plan Act (ARPA) stimulus funds to the state's SUI trust fund.

What happens if you don't withhold taxes on unemployment?

If you don't have taxes withheld from your unemployment benefits and you fail to make estimated payments, you'll have to pay any lump sums and penalties by tax day (usually April 15), when your tax return is due.

Who pays for unemployment in Arizona?

employerAs an employer, your Arizona unemployment taxes pay the entire cost of unemployment benefits paid. By law, unemployment taxes cannot be withheld from the wages you pay workers.

How do I get my AZ Pua back pay?

Retroactive claims can be filed by calling 877-600-2722 or by completing a Weekly Claim form for each week.

When should I receive 1099 G?

January 31You should receive your Form 1099-G by January 31 of the year following the tax year. You may also access the form online if you received unemployment compensation by visiting your state's unemployment benefits website.

What is a 1099 G?

Form 1099G is a record of the total taxable income the California Employment Development Department (EDD) issued you in a calendar year, and is reported to the IRS. You will receive a Form 1099G if you collected unemployment compensation from us and must report it on your federal tax return as income.

How will bankruptcy affect my credit?

There is no single answer to this question. Under the current federal law, a bankruptcy can remain on a person’s credit history for up to 10 years....

Will bankruptcy stop wage garnishments?

Yes, filing for bankruptcy will stop most wage garnishments. However, bankruptcy will not stop wage garnishments based on a domestic support obliga...

What debts can be discharged (eliminated) in bankruptcy?

Most unsecured debts can be discharged in bankruptcy. This includes credit card balances, medical bills, and personal loans. In addition, some secu...

Who reports unemployment in Arizona?

The Arizona Department of Economic Security reports unemployment compensation to the Internal Revenue Service, and the information is also transferred to the Arizona Department of Revenue.

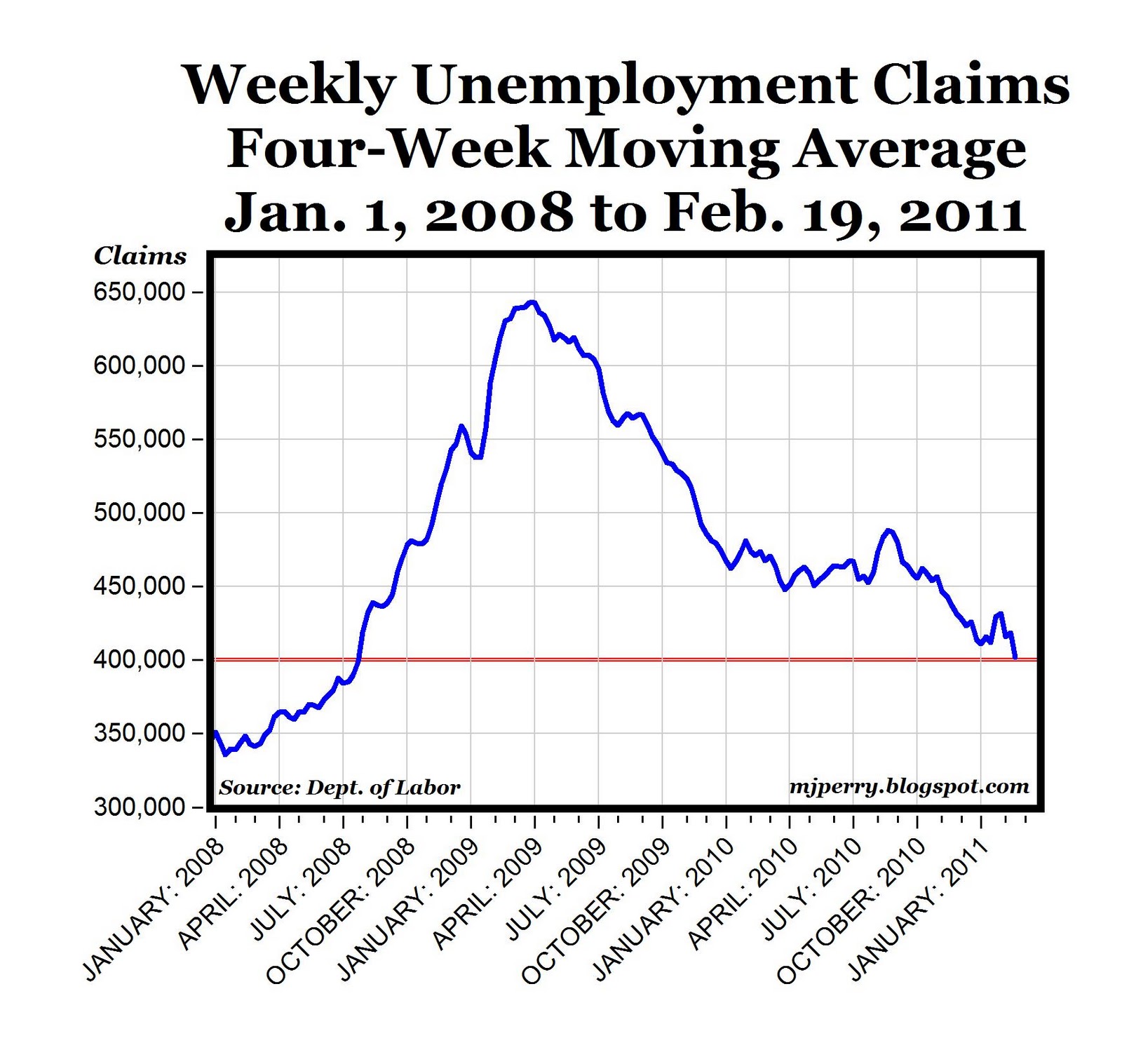

How much unemployment will Arizona get in 2021?

But with the increase in unemployment benefits due to the pandemic, Arizona residents could receive over $800 per week, and as of 2021 are still eligible to receive over $500 per week. All of a sudden, the potential taxes owed on unemployment benefits became a real concern.

How long can you pay taxes in bankruptcy?

However, if you are unable to pay your taxes, and are unable to reach an acceptable agreement with the IRS or the state taxing entity, Chapter 13 bankruptcy can allow you to pay your taxes over a period of up to five years.

Is unemployment compensation taxable?

It was a surprise to many recipients of unemployment benefits to find out that unemployment compensation is taxable. In other words, unemployment compensation is considered income, and is taxed the same way as other income, both by the federal government and by the state.

Does Arizona have a tax break for unemployment?

The tax break applies only to federal taxation. As of the end of March 2021, Arizona has not yet followed the federal government in eliminating state income taxes on unemployment benefits. Furthermore, the tax break only applies to 2020 unemployment benefits. It may be possible, however, that Congress will eventually pass a law providing ...

Is the first $10,200 of unemployment tax free?

Specifically, the first $10,200 of 2020 unemplo yment compensation is now tax free . If your spouse also received unemployment and you file a joint tax return, each of you can exclude from taxable income up to $10,200 received in unemployment benefits. This benefit applies only to households with a modified adjusted gross income under $150,000.

Is unemployment taxed in Arizona?

Unemployment Compensation Is Taxable in Arizona (with One Exception) One of the effects of the COVID pandemic has been that many more people became reliant on unemployment compensation and benefits. At the same time, the unemployment benefits significantly increased due to the passage of the CARES Act and other similar laws.

What is the UI tax in Arizona?

In Arizona, the Unemployment Insurance (UI) Program is administered through a federal-state partnership between the U.S. Department of Labor (DOL) and the Department of Economic Security (DES). Arizona employers are required to pay both a federal and a state unemployment excise tax. The federal unemployment tax, called FUTA, is collected by IRS and provides the administrative funding which is appropriated by Congress back to the states through DOL for the administrative costs. The state unemployment insurance tax, called SUTA, is collected by the DES UI Tax Section. SUTA payments are used for the payment of unemployment insurance benefits. These contributions allow eligible individuals to receive Unemployment Insurance Benefits while they seek new employment. Employers are given a tax credit against their federal liability when they are in compliance with and certified by the state’s program. The DES UI Tax section processes over 110 thousand reports and payments quarterly from Arizona employers. The money deposited into the state’s UI Trust Fund is used for the payment of unemployment insurance benefits and the quarterly wage information for each of the employers’ workers is used to establish the wage credits necessary for calculating the amount to which a claimant may be entitled. The DES UI Tax section is also responsible for the integrity of the state’s UI Trust Fund through audit, collections and other monitoring activities.#N#The information contained within our website has been prepared to provide basic information about the unemployment tax, benefit and appeal provisions of the law, as administered by DES. It includes summary information on other services provided to employers by DES as well as information about withholding taxes as administered by the Department of Revenue. It does not have the force of law, rule or regulation and may be subject to change at any time. If you have questions concerning your rights and responsibilities or general UI Tax questions, contact us for assistance.

What is SUTA payment?

SUTA payments are used for the payment of unemployment insurance benefits. These contributions allow eligible individuals to receive Unemployment Insurance Benefits while they seek new employment. Employers are given a tax credit against their federal liability when they are in compliance with and certified by the state’s program.

Does Arizona have unemployment tax?

Arizona employers are required to pay both a federal and a state unemployment excise tax. The federal unemployment tax, called FUTA, is collected by IRS and provides the administrative funding which is appropriated by Congress back to the states through DOL for the administrative costs.

What is the UI system in Arizona?

In order to use Arizona’s Internet Unemployment Tax and Wage System, your business must be registered with the Arizona Department of Economic Security (DES); be determined by DES to be liable for Unemployment Insurance (UI) coverage; and have an active UI account as a rated or reimbursable employer.

What does "active" mean in unemployment?

Active: the current status of the employer’s UI account is “active,” i.e., not temporarily suspended or permanently closed. If you have a UI account that is not in “active” status, contact the Employer Registration Unit.

What happens if you resume your employment?

When employment resumes, simply resume indicating the wages you paid on your reports. If you submit Unemployment Tax and Wage Reports indicating that no wages are being paid for 12 consecutive calendar quarters, your unemployment tax account will be suspended automatically.

Can I apply for voluntary unemployment in Arizona?

If you have not met any of the statutorily defined conditions (also refer to Arizona Revised Statutes, Section 23-613) that require you to provide unemployment insurance (UI) coverage, but you want to get UI coverage for your workers, you may apply for voluntary coverage.

Do you report wages to Arizona?

If an employee works only in Arizona, report the wages and pay taxes to Arizona, whether or not you are located in Arizona. If an employee works only in another state, report the wages and pay taxes to that other state, even if you are located in Arizona. If an employee works primarily in Arizona and only occasionally in another state, ...

Is unemployment included in quarterly wage report?

Employees are included under the unemployment insurance law, unless their services are specifically excluded. If a service is excluded, it is not counted in determining your liability for taxes, and payments for those services should not be included on your quarterly wage reports.

How much is Florida unemployment tax?

State Taxes on Unemployment Benefits: There are no taxes on unemployment benefits in Florida. State Income Tax Range: There is no state income tax. Sales Tax: 6% state levy. Localities can add as much as 2.5%, and the average combined rate is 7.08%, according to the Tax Foundation.

How much is unemployment taxed in Massachusetts?

State Taxes on Unemployment Benefits: Massachusetts generally taxes unemployment benefits. However, for the 2020 and 2021 tax years, up to $10,200 of unemployment compensation that's included in a taxpayer's federal adjusted gross income is exempt for Massachusetts tax purposes if the taxpayer’s household income is not more than 200% of the federal poverty level. Up to $10,200 can be claimed by each eligible spouse on a joint return for unemployment compensation received by that spouse. Note that, since the Massachusetts income threshold is different from the federal income threshold (AGI of less than $150,000), some taxpayers may be eligible for a deduction on their federal tax return but not on their Massachusetts tax return.

What is the Colorado income tax rate?

Income Tax Range: Colorado has a flat income tax rate of 4.55% (the approval of Proposition 116, which appeared on the November 2020 ballot, reduced the rate from 4.6 3% to 4.55% ). The state also limits how much its revenue can grow from year-to-year by lowering the tax rate if revenue growth is too high.

Is Iowa unemployment taxed?

State Taxes on Unemployment Benefits: Unemployment benefits are generally fully taxable in Iowa. However, the state adopts the federal $10,200 exemption for unemployment compensation received in 2020. The Iowa Department of Revenue will make automatic adjustments for people who already filed a 2020 Iowa income tax return. As a result, taxpayers won't need to file an amended Iowa tax return if their only adjustment pertains to unemployment compensation. People filing an original 2020 Iowa tax return should report the unemployment compensation exclusion amount on Form IA 1040, Line 14, using a code of M.

Does Connecticut tax unemployment?

State Taxes on Unemployment Benefits: Connecticut taxes unemployment compensation to the same extent as it is taxed under federal law. As a result, any unemployment compensation received in 2020 (up to $10,200) exempt from federal income tax is not subject Connecticut income tax.

Does Arizona tax unemployment?

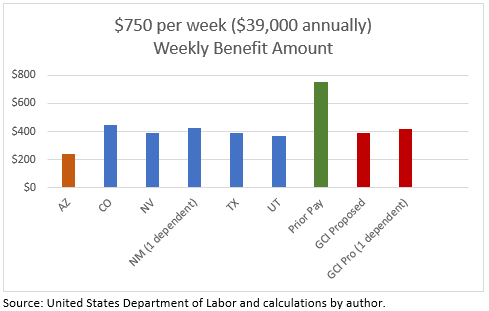

State Taxes on Unemployment Benefits: Arizona generally taxes unemployment compensation to the same extent as it is taxed under federal law. The state also adopted the federal exemption for up to $10,200 of unemployment compensation received in 2020. Taxpayers who filed their original 2020 federal return claiming the exemption should file their Arizona return starting with federal adjusted gross income from their federal return. Taxpayers who didn't claim the exemption on their original federal return and are waiting for the IRS to adjust their return to account for the exemption should wait to amend their Arizona return. The Arizona Department of Revenue is analyzing this situation and will announce additional guidance later.

Is a 50000 severance pay taxed?

The first $50,000 received from an employer as severance pay, unemployment compensation, and the like as a result of "administrative downsizing" is also not taxed. State Income Tax Range: Low: 2% (on up to $1,000 of taxable income for married joint filers and up to $500 for all others).

What happens if you are denied unemployment benefits?

If you are disqualified/denied benefits, you have the right to file an appeal. You must file your appeal within an established time frame. Your employer may also appeal a determination if he/she does not agree with the determination regarding your eligibility.

Can you combine Arizona wages?

If you have Arizona wages and also worked in another state, or currently reside in Arizona and have earnings from employers in two or more other states (within the base period), you may choose to combine these wages to establish monetary eligibility. If you were employed in more than one state at any time during the current base period, ...

Can you be unemployed through no fault of your own?

You must meet specific requirements for wages earned or time worked during an established period of time, be determined to be unemployed through no fault of your own (determined under state law) and meet other eligibility requirements to qualify for Unemployment Insurance benefits.

Do you have to file weekly claims if your wage statement is incorrect?

Remember-even if the wages on your Wage Statement are missing or incorrect, you must file (and continue to file) weekly claims while the wage investigation is in progress after you file your Wage Protest. If your Wage Statement is accurate (all of the wages are correct) and you do not qualify for benefits; meaning, ...

When is the unemployment tax deadline in Arizona?

The bill succeeded as many are preparing their taxes. Arizona moved its tax filing deadline to May 17 to match the federal deadline.

Does Arizona have a state tax code?

The Arizona Senate and House unanimously have approved of Senate Bill 1752, which fully conforms state tax code with the federal code. Doing so means, with limits on income, an Arizonan who received unemployment aid at the state or federal level will not be responsible for paying state income taxes on it. The measure also means business owners who ...