Your child support won’t reduce your FTB below the base rate of FTB Part A. However, other factors like your family’s adjustable taxable income may also affect how much FTB you can get. Example of child support affecting FTB Part A Sally has a 3 year old child from a previous relationship. Sally’s child support assessment is $5,000 for this year.

Full Answer

What happens to my family tax benefit when my child turns 16?

When your child turns 16 or stops studying after they turn 16, your Family Tax Benefit (FTB) may change. As part of a care assessment, we consider how often each parent or non-parent carer, cares for a child. This is the percentage of care.

Can your kids help you save money on your taxes?

You give your kids shelter; the least they can do is act as a tax shelter. In other words, play your cards right, and your kids may help you reduce your tax bill. Not so long ago, the Tax Cuts and Jobs Act of 2017 brought a lot of changes to the tax code.

How much Family Tax Benefit will I get?

The amount of Family Tax Benefit you get will depend on your family income and circumstances. We have a range of other services, tools and information to help you manage your payment or get extra support.

Will my child support reduce my taxable income?

Your child support won’t reduce your FTB below the base rate of FTB Part A. However, other factors like your family’s adjustable taxable income may also affect how much FTB you can get. Sally has a 3 year old child from a previous relationship.

Does my child's income affect my benefits?

No, they are still classed as a dependant so any income they have won't affect your benefits.

At what age does family tax benefit stop?

If your child is 16 or older and stops studying, your FTB for that child will stop. If they don't complete year 12 or an equivalent qualification, your FTB will stop from the date they stop studying. You need to update their study end date to reflect the date they ceased studying.

What is the threshold for family Tax Benefit Part A?

FTB Part A supplement income test To be eligible for the supplement, your family's adjusted taxable income must be $80,000 or less. The income test applies to everyone, even if you are getting an income support payment. If you're eligible for the supplement, we'll pay it to you after we balance your payments.

Does Canada child benefit depend on income?

For the benefit periods from July 2022 to June 2023, your benefits will be increased. But keep in mind, your benefits are still based on your income.

What affects family tax benefit?

Your FTB could change depending on the amount of time the child is in your care, or when your child turns 16 or stops studying. There are rules about how long you can get FTB when you, or a dependent child, travel outside Australia. Read more about how your percentage of care affects your FTB payments.

Does family tax benefit go up when your child turns 13?

When your child turns 13, the maximum rate of FTB Part A increases.

How is family Tax Benefit Part A calculated?

The base rate for FTB Part A is $61.46 for each child per fortnight. The base rate isn't the minimum rate of FTB Part A. We may pay you less than the base rate. For example, you may get less due to your income.

Does everyone get family Tax Benefit?

We pay Family Tax Benefit (FTB) Part A per child. The amount we pay you depends on your family's circumstances. We may pay you FTB Part B if you're a single parent or non-parent carer, a grandparent carer, or if you're a member of a couple with 1 main income.

Does family tax benefit include income estimate?

We use your family income estimate to work out how much family assistance to pay you. This includes Family Tax Benefit (FTB) and Child Care Subsidy (CCS).

What is the income cut off for Canada Child Tax Benefit?

You may be entitled to a benefit of up to $122.83 per month for each child under 18 years of age. If your adjusted family net income is over $22,504, you may get part of the benefit.

What is the maximum income to qualify for Canada Child Benefit?

Maximum Canada child benefit If your adjusted family net income (AFNI) is under $32,028, you get the maximum payment for each child. It will not be reduced. For each child: under 6 years of age: $6,833 per year ($569.41 per month)

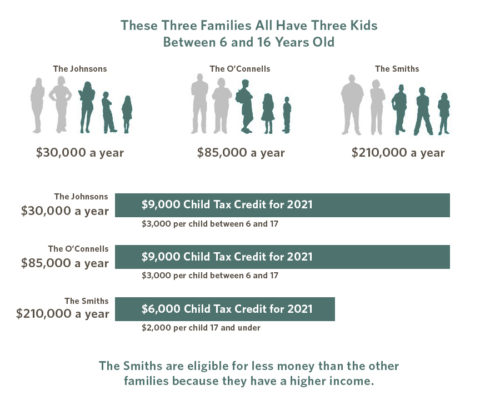

What is the max income for Child Tax Credit?

Who qualifies for the child tax credit? For the 2021 tax year, you can take full advantage of the expanded credit if your modified adjusted gross income is under $75,000 for single filers, $112,500 for heads of household, and $150,000 for those married filing jointly.