Can freelance income be deducted from unemployment benefits?

Each state has its own threshold of how much freelance income you can earn before your benefits are reduced. Freelance income earned above that threshold can be deducted from your unemployment check. What is freelance work? If you read through all the questions, you now have a pretty good idea!

What does freelance work mean?

Freelance professionals can work in a variety of fields, such as writing, editing, web development, design, photography, acting, and more. Many freelancers work online. If their work is something that can be done remotely, they may also work from home.

Can I freelance without giving up my day job?

Luckily, it’s possible to start freelancing without giving up on your day job, so you can ease your transition and grow your income over time. If you need help getting started with freelancing, consider signing up for either of my courses or reaching out to me through email with questions.

Is freelancing a good career choice for You?

Freelancing is a great career choice with lots of benefits that you can only realize if you give it a try. Luckily, it’s possible to start freelancing without giving up on your day job, so you can ease your transition and grow your income over time.

Does freelance work count as employment?

Yes, any work you do on a freelance basis certainly counts toward your professional experience and should be included on your resume.

Are freelancers considered unemployed?

Self-employed workers, independent contractors, and freelance workers who lose their income are traditionally not eligible for unemployment benefits.

Do you get benefits as a freelancer?

– Lack of Benefits Whereas an employee is (for the most part) eligible for benefits, freelancers rarely receive benefits. Since freelancers are self-employed, they are typically responsible for finding and funding their own insurance.

How much money can you make and still collect unemployment in California?

If your weekly earnings are $100 or less, the first $25 do not apply. Any amount over $25 is subtracted from your weekly benefit amount and you are paid the difference, if any. For example: Your weekly benefit amount is $145.

Is freelancing considered a business?

Many freelancers have a name for the business and a current account meant for business purposes; they are treated as small businesses from a taxation perspective.

Is freelancing a business?

In a nutshell, an online freelancing business is a service-based business where the freelancer offers a certain skill that can be accomplished remotely like SEO, graphic design, video editing, content creation, etc. However, the freelancer will not be tied to an employment contract with a client.

Is freelance considered full-time?

There's much more to freelancing than flexible hours and being your own boss. One of the biggest pluses of full-time employment (and drawbacks of doing gigs) are employer-provided benefits, such as health insurance, 401(k) plans, sick days and paid vacation time.

What are the disadvantages of freelancing?

The Disadvantages of FreelancingLack of Benefits. ... Variable Workloads and Income. ... Unique Ethical Considerations. ... Accountability. ... Initial Cash Investment. ... Lack of Job Security. ... Administrative Responsibilities. ... Client Development.More items...•

What are the negative side of freelancing?

One of the drawbacks to working freelance is the lack of benefits you would otherwise receive when working for a company. However, when you become your own boss you are much less likely to need time off.

How many hours can you work and still get unemployment in California?

Earnings equal to or over the benefit amount will result in no benefits for that week. You may work part-time and earn up to 30 percent of your weekly benefit rate in each claim week before your earnings affect your weekly benefit payment.

Can I work while receiving unemployment benefits in California?

If you work part-time during the course of the week, you may still be eligible for partial benefits. The first 25 percent of your earnings do not count against your unemployment; subtract the rest of your earnings from your unemployment benefit for that week to determine the partial benefits.

Can you work part-time while on unemployment in California?

Even if you are still working part-time, you may be eligible for unemployment benefits, depending on your earnings and your situation. California has several programs that offer "partial" unemployment benefits: A portion of the benefit you would receive if you were fully unemployed, reduced to take into account your ...

Can Freelancers Get Unemployment Benefits?

If you are a pro or a beginner at the early stage of your gig career, you might be worried that your unemployment benefits will stop. But will it? Can freelancers get unemployment benefits?

Does Freelance Work Count As Employment?

We know that’s the first question on your mind. And you were right to ask.

Why Do Freelancers Qualify For Unemployment Benefits?

By definition, freelancing means an individual is gainfully engaged and won’t qualify for unemployment benefits. Freelancers won’t even think about applying. But COVID19 changed the narrative.

5 Tips To Help Freelancers Get Unemployment Benefits

It can be frustrating applying for state unemployment systems. The entire process is confusing, starting from the guidance, through delayed responses, to broken communication.

Verdict

Freelancers can get unemployment benefits like other out-of-jobs individuals. Indeed, freelancing in itself is self-employment. Regardless, it qualifies for relief plans through the Pandemic Unemployment Assistance (PUA).

Do I need to report income earned from odd jobs?

Yes. If you earn money from odd jobs and don’t report it, you could endanger your eligibility for jobless benefits in the future. The income should be reported as it is earned, not as it is paid.

How does freelance work affect my unemployment benefits?

I wish I had a simple answer, but every state handles things a bit differently. There are a few different ways that income from odd jobs (such as freelance work) can affect your benefits:

Should I bother with freelance work?

Definitely! And many of the folks who run online businesses will attest to this.

What else can you expect out of self-employment?

I’m glad you asked. First of all, you’re going to be paying more in taxes. If you have self-employment income, you pay both the employee and employer’s share of FICA (Social Security and Medicare).

Should You Accept a Contract Gig?

When you are unemployed, your focus is often on finding that next role, and you may be afraid to look at contract roles for fear that employers will look at that kind of work as less than desirable.

Reasons Employers Hire Contract Workers

Today, employers are increasingly turning to freelancers and contractors.

How Contract Work Impacts Your Income and Unemployment Status

You have bills to pay, and contract work can pay those bills. This is an obvious plus even when you are collecting unemployment compensation.

The Basics of Freelancing

A freelancer is a self-employed person who doesn’t call anyone or any business their boss. They usually work on pre-defined projects with multiple clients, often simultaneously. They have full control over where and when they work and set their own rates.

Becoming a Freelancer

There are lots of freelance work categories that are always in high demand, such as:

Managing Your Freelance Income

Freelancers can be paid in a number of ways: bank transfer, PayPal, Stripe, or other payment solutions of their choice. Freelancers who work through a freelancer platform like Upwork get paid directly through the platform.

Wrapping Up

What is freelance work? If you read through all the questions, you now have a pretty good idea! Freelancing is a great career choice with lots of benefits that you can only realize if you give it a try. Luckily, it’s possible to start freelancing without giving up on your day job, so you can ease your transition and grow your income over time.

DEFINITION OF UNEMPLOYMENT

The Bureau of Labor Statistics defines unemployment as when individuals – do not have a job, have actively looked for work in the last four weeks. Individuals who have been temporarily laid off and are waiting to be called back to that job are also included in the unemployment statistics.

HOW DOES THIS WORK FOR FREELANCERS?

Independent contractors may be found in all industries, from entertainment to construction and engineering.

GOVERNMENT TO SUPPORT ALL AMIDST COVID-19 PANIC

In the United States of America, the government has declared 2.2 trillion dollars as aid for all Americans. According to an article by Forbes, self-employed individuals are included in the stimulus package even though they technically cannot be termed “unemployed.”

What happens if you reject a job on unemployment?

Another thing to note is that if you’re offered a job in your field while currently on unemployment benefits and you reject the job, you’ll be taken off of unemployment benefits. Again, this is something that must be reported to the unemployment office immediately.

How does part time unemployment affect unemployment?

How does a part-time job affect unemployment benefits? In most states, if you’re receiving benefits and accept a part-time position, your unemployment benefits will not be canceled. Like side hustle, the amount you earn will reduce your weekly benefit payment, but it won’t eliminate it altogether.

How much unemployment do you get if you get a part time job in Maryland?

In Maryland, if you get a part-time job while on unemployment, you will simply subtract what your part-time position pays weekly from what you’re currently getting from unemployment. So, if you start earning $550 a week from your part-time position and getting $600 in unemployment benefits, you will still get $50 in unemployment.

What happens if you don't report your side hustle to unemployment?

Take note that if you don’t report your side hustle income to your unemployment office, you will be charged with fraud. So be sure to report it as soon as you can.

How much do you have to make to get unemployment in Maryland?

For example, in Maryland, you must have earned at least $1,176 in your highest paying quarter (a 2–3 month period). If you meet both of these requirements, you are eligible to begin receiving unemployment benefits.

What is the unemployment rate in 2021?

As of May 2021, the unemployment rate is now only 6.1%, less than half what it was a year ago. With millions of people coming off unemployment benefits for the first time in a while, some people may be unsure what that means for their benefits. This guide details what unemployment benefits are, how you qualify them, and how part-time jobs, ...

Can I file for unemployment if I get a full time job?

If you get a full-time job, you will become ineligible for unemployment benefits. You must report this to your unemployment office at your earliest availability. Failure to do so will lead to charges against you for fraud.

How many people have filed for unemployment?

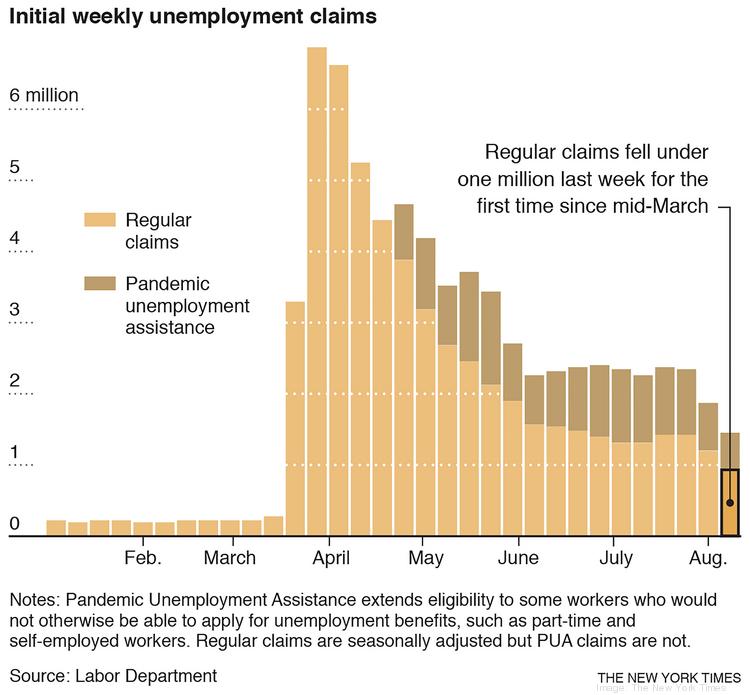

Nearly 36.5 million Americans have filed for unemployment since mid-March, and for many, the process of filing for benefits has been fraught with confusion, system crashes and delays.

Can you get unemployment if you are laid off?

If your working hours are reduced in any way, including if you hold several jobs and you’re laid off from one, you may qualify for partial unemployment, says Michele Evermore, senior policy analyst at the National Employment Law Project.

Can you get unemployment if you lose rental income?

That also means if you lose rental income because your tenant can’t make rent that month, you won’t be able to recover some of those funds through unemployment assistance.

Can you get unemployment based on hours worked?

Many states award partial unemployment benefits based on your hours worked . However, some, like New York, base your benefit amount on the number of days worked during the week. This could impact how you schedule shifts at your remaining job, such as choosing to work longer shifts on fewer days versus spreading hours throughout the week.