Which fringe benefits are taxable?

Fringe benefits that do not meet any statutory requirements for exclusion are fully taxable. Although there are special rules and elections for certain benefits, in general, employers report taxable fringe benefits as wages on Form W-2 for the year in which the employee received

What are some examples of taxable fringe benefits?

Which fringe benefits are taxable?

- Taxable fringe benefits

- Fully exempt fringe benefits. Life, health and accident plans: Life, health and accident insurance benefits are exempt from FUTA. ...

- Partially exempt fringe benefits. Dependent care assistance is exempt up to certain limits. ...

Are fringe benefits taxable income?

Under the Internal Revenue Code, all income is taxable unless an exclusion applies. Some examples of excludable fringe benefits are health insurance, certain travel expenses, and certain educational assistance. For example, it’s a fringe benefit if a company lets an employee drive a business vehicle to commute to and from work.

What is taxable fringe benefit?

An employee "fringe benefit" is a form of pay other than money for the performance of services by employees. Any fringe benefit provided to an employee is taxable income for that person unless the tax law specifically excludes it from taxation. Taxable fringe benefits must be included as income on the employee's W-2 and are subject to withholding.

What's included in fringe benefits?

Fringe benefits are allowances and services provided by employers to their employees as compensation in addition to regular salaries and wages. Fringe benefits include, but are not limited to, the costs of leave (vacation, family-related, sick or military), employee insurance, pensions, and unemployment benefit plans.

Which fringe benefits are excluded from taxation?

The IRS allows several fringe benefits to be excluded from taxes. Some of these benefits include adoption expenses, group-term life insurance, retirement planning services, and de minimis benefits (e.g., certain meals and employee parties).

What fringe benefits are taxable to the employee?

Any fringe benefit provided to an employee is taxable income for that person unless the tax law specifically excludes it from taxation. Taxable fringe benefits must be included as income on the employee's W-2 and are subject to withholding.

How do you calculate fringe benefits tax?

To calculate an employee's fringe benefit rate, add up the cost of an employee's fringe benefits for the year (including payroll taxes paid) and divide it by the employee's annual wages or salary. Then, multiply the total by 100 to get the fringe benefit rate percentage.

Which benefits are tax free?

The most common state benefits you do not have to pay Income Tax on are: Attendance Allowance. Bereavement support payment. Child Benefit (income-based - use the Child Benefit tax calculator to see if you'll have to pay tax)

Which benefits are not taxable?

State Benefits that are not taxable: Child Tax Credit. Disability Living Allowance. Employment and Support Allowance – this is also income related. Free TV license for over-75s.

What are the fringe benefits not subject to fringe benefit tax?

Fringe benefits which are authorized and exempted from tax under special laws; Contributions of the employer for the benefit of the employee to retirement, insurance and hospitalization benefit plans; Benefits given to the rank and file employees, whether granted under a collective bargaining agreement or not; and.

How do I avoid fringe benefits tax?

You can reduce the amount of FBT you pay by:replacing fringe benefits with cash salary.providing benefits that your employees would be entitled to claim as an income tax deduction if they had paid for the benefits themselves (the 'otherwise deductible' rule)providing benefits that are exempt from FBT.More items...•

Why do we tax fringe benefits?

FBT is a tax that employers pay on benefits paid to an employee (or their associate, such as a family member) in addition to their salary or wages. FBT is calculated on the taxable value of the benefits you provide. This is separate to income tax.

What is the supplemental rate for fringe benefits?

The employer may elect to add taxable fringe benefits to employee regular wages and withhold on the total or may withhold on the benefit at the supplemental wage flat rate of 22% (for tax years beginning after 2017 and before 2026). Treas. Regs. 31.3402(g)-1 and 31.3501(a)-1T

What is de minimis fringe benefit?

De minimis fringe benefits include any property or service, provided by an employer for an employee, the value of which is so small in relation to the frequency with which it is provided, that accounting for it is unreasonable or administratively impracticable. The value of the benefit is determined by the frequency it’s provided to each employee, or, if this is not administratively practical, by the frequency provided by the employer to the workforce as a whole. IRC Section 132(e); Treas. Reg. Section 1.132-6(b)

What is wage recharacterization?

Generally, wage recharacterization occurs when the employer structures compensation so that the employee receives the same or a substantially similar amount whether or not the employee has incurred deductible business expenses related to the employer’s business. If an employer reduces wages by a designated amount for expenses, but all employees receive the same amount as reimbursement, regardless of whether expenses are incurred or are expected to be incurred, this is wage recharacterization. If wage recharacterization is present, the accountable plan rules have not been met, even if the actual expenses are later substantiated. In this case, all amounts paid are taxable as wages. For more information, see Revenue Ruling 2012-25.

How to prevent financial hardship to employees traveling away from home on business?

To prevent a financial hardship to employees traveling away from home on business, employers often provide advance payments to cover the costs incurred while traveling. Travel advances may be excludable from employee wages if they are paid under an accountable plan. (Allowable travel expenses are discussed in Transportation Expenses) There must be a reasonable timing relationship between when the advance is given to the employee, when the travel occurs and when it is substantiated. The advance must also be reasonably calculated not to exceed the estimated expenses the employee will incur. Treas. Reg. Section 1.62-2(f)(1)

Why are items listed in IRC 280F considered listed property?

Items listed in IRC Section 280F are considered “listed property” because the property by its nature lends itself to personal use. Strict substantiation requirements apply to property in this category. Employees are required to account for business and personal use. IRC Sections 274(d), 280F(d)(4) and 132(d)

When to use per diem rate?

If the employee is traveling to more than one location in one day, use the per diem rate for the area where the employee stops for rest or sleep. Rev. Proc. 2011-47

When will bicycle reimbursements be exempt from taxes?

The Tax Cuts and Jobs Act, Section 11047, suspends the exclusion of qualified bicycle commuting reimbursements from your employee’s income for any tax year beginning after December 31, 2017, and before January 1, 2026.

What is fringe benefit?

The Taxable Fringe Benefits Guide was created by the Internal Revenue Service office of Federal, State and Local Governments (FSLG) to provide governmental entities with a basic understanding of the Federal tax rules relating to employee fringe benefits and reporting.

What is the supplemental wage rate for fringe benefits?

The employer may elect to add taxable fringe benefits to employee regular wages and withhold on the total, or may withhold on the benefit at the supplemental wage rate of 25% .

What is considered timely if an arrangement does not meet one of the safe harbor methods?

If an arrangement does not meet one of the safe-harbor methods, it may still be considered timely, if it is reasonable based on the facts and circumstances. Reg. §1.62-2(g)(1)

Is fringe benefit taxable on W-2?

In general, taxable fringe benefits are reported as wages on Form W-2 for the year in which the employee received them. However, there are many special rules and elections for different benefits. IRC 451(a); IRS Ann. 85-113, 1985-31

What Are Fringe Benefits?

Fringe benefits are any type of pay or perks an employee receives in addition to their salary. Examples of fringe benefits include:

What is de minimis fringe benefit?

De minimis fringe benefits are property and services the employer provides to the employee that have so little value that it would be unreasonable or impracticable for the employer to account for them. That includes occasional use of the company’s copier, flowers, coffee and doughnuts, or occasional theater or sporting event tickets. There is no specific dollar amount that automatically makes a benefit more than de minimis. However, the IRS usually considers benefits that cost $75 or less to be de minimis. The exclusion doesn’t apply to any cash, gift cards, or gift certificates, no matter how small the amount.

How long does it take for an employer to reimburse an employee for a nonaccountable plan?

If the employer reimburses the employee for more than the employee actually spent, the employee has to return the excess to the employer within a reasonable timeframe (usually 120 days). Expense reimbursements under a nonaccountable plan are income, and employers must include them in the employee’s wages.

What is the amount of property an employer can give to an employee for service?

Achievement Awards. Employers can give employees property worth up to $1,600 as an award for length of service or safety achievement. The exclusion doesn’t apply to awards of cash, gift cards, or gift certificates.

How much can an employer exclude from an employee's wages?

Employers can generally exclude up to $50,000 of group term life insurance coverage from an employee’s wages. Employers must include the cost of coverage over that limit in the employee’s taxable income. Health Savings Account (HSA).

How much can you exclude from dependent care?

These programs help employees pay for the cost of the care of a child or other dependent, allowing the employee to work. Employers can exclude up to $5,000 of dependent care benefits from the employee’s wages.

Do fringe benefits affect taxable income?

Many employers and employees think of fringe benefits as freebies that don’t impact the employee’s taxable income. But that’s not always the case.

What is the federal tax rate for fringe benefits?

For federal income tax withholding, you can either add the value of the fringe benefits to the employee’s regular wages, or you can withhold at the fringe benefit tax rate of 22% (the same rate for supplemental pay ). Withhold FICA tax (Social Security and Medicare taxes) on the fringe benefits added to the employee’s wages.

What are fringe benefits?

Fringe benefits are benefits in addition to an employee’s wages. So, any monetary benefit an employer offers in exchange for an employee’s services that does not include their salary is a fringe benefit.

What is the purpose of annual fringe benefit statement?

You can provide your employees with an annual fringe benefit statement to show them their total compensation ( regular wages + fringe benefits).

Can you use a Section 125 cafeteria plan for a non-taxable employee?

When you establish a Section 125 cafeteria plan, you must let your employees choose between taxable and nontaxable benefits . The qualifying benefit comes from the list of excludable (from taxes) fringe benefits as well as flexible spending accounts (FSAs). Some of the non taxable fringe benefits are not allowed in a cafeteria plan.

Do you have to pay taxes on fringe benefits?

As with wages, most fringe benefits are subject to federal income taxes: FICA and FUTA. Unless the IRS explicitly says a fringe benefit is nontaxable, you will need to withhold taxes from fringe benefits in order to correctly deposit and report taxes.

Does Patriot Software calculate fringe benefits?

Need help withholding taxes from employee fringe benefits? Patriot Software’s online payroll services will calculate deductions on your behalf. And, we offer free setup and support to get you started. Try it for free today!

Do cafeteria plans include taxable benefits?

To ensure cafeteria plans don’t favor highly compensated or key employees, you need to include the value of taxable benefits in their wages and conduct discrimination testing. For more information on cafeteria plans, consult the IRS.

Why is it important to distinguish between taxable fringe benefits and nontaxable fringe benefits?

It’s important for employers to distinguish between taxable fringe benefits and nontaxable fringe benefits so they can understand how they are valued and report them properly.

What are Fringe Benefits?

Fringe benefits are a form of pay, often from employers to employees, and are considered compensation for services beyond the employee's normal rate of pay. They can be made in the form of property, services, cash, or cash equivalents. Cash equivalents are things that can be turned into cash fairly quickly, such as savings bonds. Generally, fringe benefits are taxable to the employee, must be included as supplemental income on the employee's W-2, and are subject to withholding and employment taxes. The IRS provides guidance on fringe benefits in a publication titled Employer's Tax Guide to Fringe Benefits For Use in 2021.

What form do you report fringe benefits on?

For example, taxable fringe benefits paid by the employer to an employee are included in the employee's annual W-2 statement, but taxable fringe benefits paid to independent contractors are reported on the Form 1099 miscellaneous.

What is considered a de minimis fringe benefit?

De minimis fringe benefits such as employee use of office equipment, holiday gifts, parties or picnics, and entertainment events. In this category the value of the property should be considered minimal. Athletic facilities primarily used by employees, if located at the place of employment. Retirement planning services.

Is the cost of an item the same as the fair market value?

In many cases, the fair market value and the cost of the item are the same. The fair market value is typically what a willing buyer would pay for the item and may be higher than the cost if the employer was able to purchase the item for a price lower than the fair market value.

What are taxable fringe benefits?

Unless otherwise stated by the Internal Revenue Code, an employee fringe benefit is likely taxable to some extent.

What is fringe benefit?

A fringe benefit, sometimes referred to as an employee benefit or perk, is the additional compensation or benefit an employer offers an employee on top of their regular salary or wages. The IRS considers most fringe benefits to be taxable compensation that must be reported on tax forms (e.g., Form W-2, Wage and Tax Statement, and Form 1099-MISC, ...

Why should you offer fringe benefits?

Offering employees superb benefits packages, in addition to competitive salaries, can bolster your recruitment process and help you attract and retain top talent. However, before you ramp up your employee benefits, you should understand how each benefit is taxed. Having a good understanding of what fringe benefits are and how each is taxed (or not taxed) can save you and your employees from unpleasant surprises during tax season.

What are the benefits of Section 132?

Transportation benefits in excess of employer/employee pretax deferrals under a Section 132 Plan. Housing allowance. Moving expenses. Meals and lodging (distinct from business travel) Reimbursement for classes or development unrelated to work (e.g., foreign language classes, if those classes are not work-related)

What to do when creating an employee benefits package?

When you create an employee benefits package, identify each benefit's "taxability," and clearly outline what you are offering in your employee handbook. It is often helpful to work with an experienced benefits administrator to create your benefits package.

What is qualified transportation benefit?

Qualified transportation benefits, also known as commuter benefits (up to certain limits) No additional cost services. Employers can also take advantage of an affordable, nontaxable fringe benefit option: de minimis benefit.

How much is dependent care assistance taxable?

Most benefits an employee receives under the policy are taxable) Dependent care assistance (up to $5,000 per year, as long as it doesn't exceed the earned income of the employee or employee's spouse) Educational assistance (up to $5,250 annually) Employee stock options (These may be subject to taxes)

What are fringe benefits?

Health and accident insurance, along with life insurance, are common fringe benefits that many employers offer their employees. These benefits might be fully paid by your employer or partially paid by you both. Employers also offer fringe benefits such as tuition reimbursement, fitness memberships, company vehicles, paid flights, vacation trips and entertainment perks, such as concerts and sports events.

Does fringe benefit count as federal income tax?

Other fringe benefit options depend entirely on the largesse of your employer. Any of these categories of fringe benefits can result in more federal income tax. However, the fair market value of the benefit determines what your employer can exclude from your federal income tax withholding.

Is an employer's stock option exempt from FICA?

Some employer-provided benefits will not be eligible for exclusion from FICA taxes. Adoption expense benefits that your employer reimburses you for are not included in the FICA exclusion provisions. The IRS does not treat employer-provided stock options as wages. At the time you exercise your stock option, your employer’s valuation of your stock options determines whether you are eligible for the exclusion from FICA taxes.

Do fringe benefits get taxed?

Fringe benefits that are excluded from payroll taxes don’t always receive exemptions from federal income taxes. In addition to profit from stock options, your employer might provide you with a leased vehicle for company business. The IRS regulations require your employer to use specific rules to assign a monetary value to your personal use of an employer-provided vehicle. If the value exceeds any available exclusion, your employer must report it as wages on your W-2 form, and it becomes taxable income.

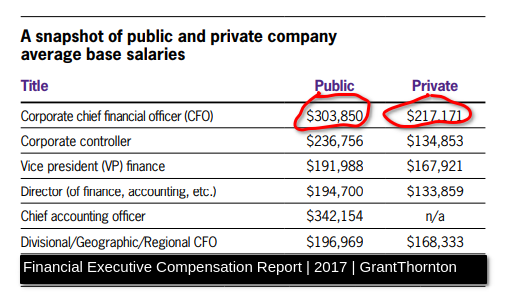

Is a fitness center subject to FICA?

Use of a fitness center on your employer’s premises and employer-provided business cell phone are not subject to FICA taxes. Your employer can also exclude 20 percent of employee discounts, and this exclusion applies to company products and to employer arrangements with retailers.

Does FICA exclude tuition assistance?

Your employer can exclude reimbursements to you for $5,000 of your expenses for the care of your dependents, if you needed the care in order to work. Employer tuition assistance, up to $5,250 per year, is another fringe benefit that the IRS excludes from FICA payroll taxes. Life insurance policies with a value of $50,000 or less are excluded too. Amounts greater than the limit are added to your wages and subject to FICA payroll taxes.

Is no additional cost taxable?

Employees also benefit from so-called no-additional-cost services, which include a benefit or service that is typically provided to customers at no additional cost or lost revenue. The value of such services is not taxable to the employee.

Is fringe benefit tax deductible?

In fact, many fringe benefits are tax-advantageous to both the employer and the employee. There are limits to this, and some fringe benefits do not provide a tax deduction, or they have a set limit on the amount that may be used for tax-savings purposes.

Is fringe benefit limitless?

Deductions are not limitless; for instance, educational assistance programs have a maximum deduction set by the Internal Revenue Service, or IRS. 1 . Fringe benefits do not necessarily have to be offered to a direct employee; independent contractors, partners, or directors may all be recipients. The tax treatment of benefits ...

What Are Fringe Benefits?

- Although some fringe benefits are considered a part of taxable income for employees, there is a lengthy list of common fringe benefits that are excluded from an employee’s taxable compensation. For example, awards given for achievements are exempt from tax withholding, a…

Taxable vs. Nontaxable Fringe Benefits

Taxable Fringe Benefits

Final Word