No. The GPO affects your dependent/survivor benefit only. The Windfall Elimination Provision

Windfall Elimination Provision

The Windfall Elimination Provision is a statutory provision in United States law which affects benefits paid by the Social Security Administration under Title II of the Social Security Act. It reduces the Primary Insurance Amount of a person's Retirement Insurance Benefits or Disability Insurance Benefits when that person is eligible or entitled to a pension based on a job which did not contribute to th…

What is the GPO and how does it affect your benefits?

The GPO can inadvertently punish public service workers like teachers and firefighters, which is why it’s extremely important for anyone with a history of government service to familiarize themselves with the GPO and how it could impact their benefits. What If a Retiree Inherits a Spouse’s Non-Covered Pension?

How does the GPO affect Social Security survivor and spousal benefits?

GPO can severely affect recipients of Social Security survivor and spousal benefits if they themselves worked for a state or government agency at any point in their career. The GPO will affect them if, during their employment, they became eligible to receive a government pension and did not contribute to Social Security.

When does the GPO apply to dependent/survivor benefits?

The GPO applies if you are entitled to a dependent/survivor benefit based on your spouse's disability. Is it possible that my dependent/survivor benefit may be reduced to zero?

Will I be affected by the government pension override (GPO)?

You will only be affected by the GPO if you are due to receive a government pension that is based on earnings that are not covered under the Social Security system. This group may include teachers, police and law enforcement workers, postal workers, firefighters, nurses and healthcare workers, state DMV workers, and many other government employees.

Does the Government Pension Offset apply to survivor benefits?

The Government Pension Offset affects only your Social Security spousal or survivor benefit. If you are collecting Social Security retirement benefits and a non-covered government pension, you may be subject to the Windfall Elimination Provision. The GPO applies only to your government pension.

Does WEP or GPO affect survivor benefits?

Survivor benefits are not adjusted for the WEP . The GPO adjustment is calculated by subtracting two-thirds of the value of the noncovered-work pension from the pensioner's spouse or survivor benefit.

Does GPO affect my Social Security?

Your Government Pension May Affect Social Security Benefits (En español) The Government Pension Offset, or GPO, affects spouses, widows, and widowers with pensions from a federal, state, or local government job. It reduces their Social Security benefits in some cases.

Does WEP affect survivor benefits?

WEP does not affect benefits for your survivors. You can learn more about non-covered pensions and WEP on our Information for Government Employees page.

Will WEP be eliminated 2021?

January 4, 2021, Congressman Rodney Davis (R-IL-13) introduced H.R. 82 to repeal the WEP and GPO. It is important that CalRTA continues to push our California Representatives to sign on as co-sponsors. Check the list of co-sponsors to see if your representative is listed.

Will WEP be repealed in 2021?

H.R. 82, titled the “Social Security Fairness Act,” was introduced in the House of Representatives in January 2021. It aims to eliminate both the WEP and GPO.

What happens to my Social Security if I take a government job?

We'll reduce your Social Security benefits by two-thirds of your government pension. In other words, if you get a monthly civil service pension of $600, two-thirds of that, or $400, must be deducted from your Social Security benefits.

What income reduces Social Security benefits?

If you are younger than full retirement age and earn more than the yearly earnings limit, we may reduce your benefit amount. If you are under full retirement age for the entire year, we deduct $1 from your benefit payments for every $2 you earn above the annual limit. For 2022, that limit is $19,560.

Can you have a government pension and Social Security?

Yes. There is nothing that precludes you from getting both a pension and Social Security benefits.

What is the difference between WEP and GPO?

WEP is short for the Windfall Elimination Provision and GPO is short for the Government Pension Offset. Both could adversely affect how much money you'll receive in retirement — and your Social Security checks may be a lot smaller because of them.

Who is exempt from Windfall Elimination Provision?

Workers who have 30 years of coverage (YOCs) are fully exempt from the Windfall Elimination Provision (WEP). Workers with 21 to 29 YOCs are eligible for a partial exemption.

Does Windfall Elimination apply to spousal benefits?

What you may have read is that the Windfall Elimination Provision (WEP) does not directly apply to spousal benefits. WEP can only apply to Social Security retirement or disability benefits payable based on a person's own work record.

What is the amount in #3 of "Calculate Your Benefits"?

The amount in #3 of "Calculate Your Benefits" is your estimated spouse's, widow's, or widower's benefit after GPO is applied. Add that figure to the estimated amount of your retirement benefit to find your total estimated monthly benefit.

What is gross monthly pension?

The estimated "gross" monthly amount of your pension from your government job not covered by Social Security. The estimated monthly amount of your Social Security benefit as a spouse, widow, or widower before the effect of GPO.

Why is my retirement benefit reduced?

Your retirement benefit based on your own earnings may be reduced due to another provision of the law, the Windfall Elimination Provision .

How to plan for retirement?

Choosing when to retire is an important and personal decision. The best way to start planning for your future is by creating a my Social Security account. With my Social Security, you can verify your earnings, get your Social Security Statement, and much more – all from the comfort of your home or office.

Will my spouse's unemployment benefit be reduced?

Your benefit amount as a spouse will be reduced. (The reduction will vary based on your date of birth.)

Is the government pension based on earnings?

Your government pension is not based on your earnings. Your government pension is from a federal, Civil Service Offset, state, or local government job where you paid Social Security taxes; and at least one of the following applies: You filed for and were entitled to spouse, widow, or widower benefits before April 1, 2004.

Does a government job reduce Social Security?

It reduces their Social Security benefits in some cases. If you receive a pension from a government job but did not pay Social Security taxes while you had the job, we’ll reduce your Social Security spouse, widow, or widower benefits by two-thirds of the amount of your government pension. This offset is known as the GPO.

What is the impact of the GPO on Social Security?

Essentially, the GPO rule reduces the amount of Social Security survivors’ or spousal benefits for beneficiaries who also receive non-covered government pension benefits from their own work (i.e., they did not pay Social Security taxes through ...

How many people are affected by the GPO?

Today, the GPO affects more than 695,000 Social Security beneficiaries.

Why Does The Government Pension Offset (GPO) Rule Exist?

In 1977, the Social Security Administration introduced an amendment implementing the Government Pension Offset (GPO) to address policymakers’ concerns that workers who received a pension from a Federal, state, or local government job, not covered by Social Security, were 'double-dipping' by also receiving spousal or survivor benefits that were nominally intended for beneficiaries who hadn’t worked and were financially dependent on a working spouse for benefits. After all, had the individual worked in a job covered by Social Security, they typically would not have received Social Security spousal or survivor benefits, because their own individual Social Security benefit would be higher (which they would have received in lieu of any spousal benefit).

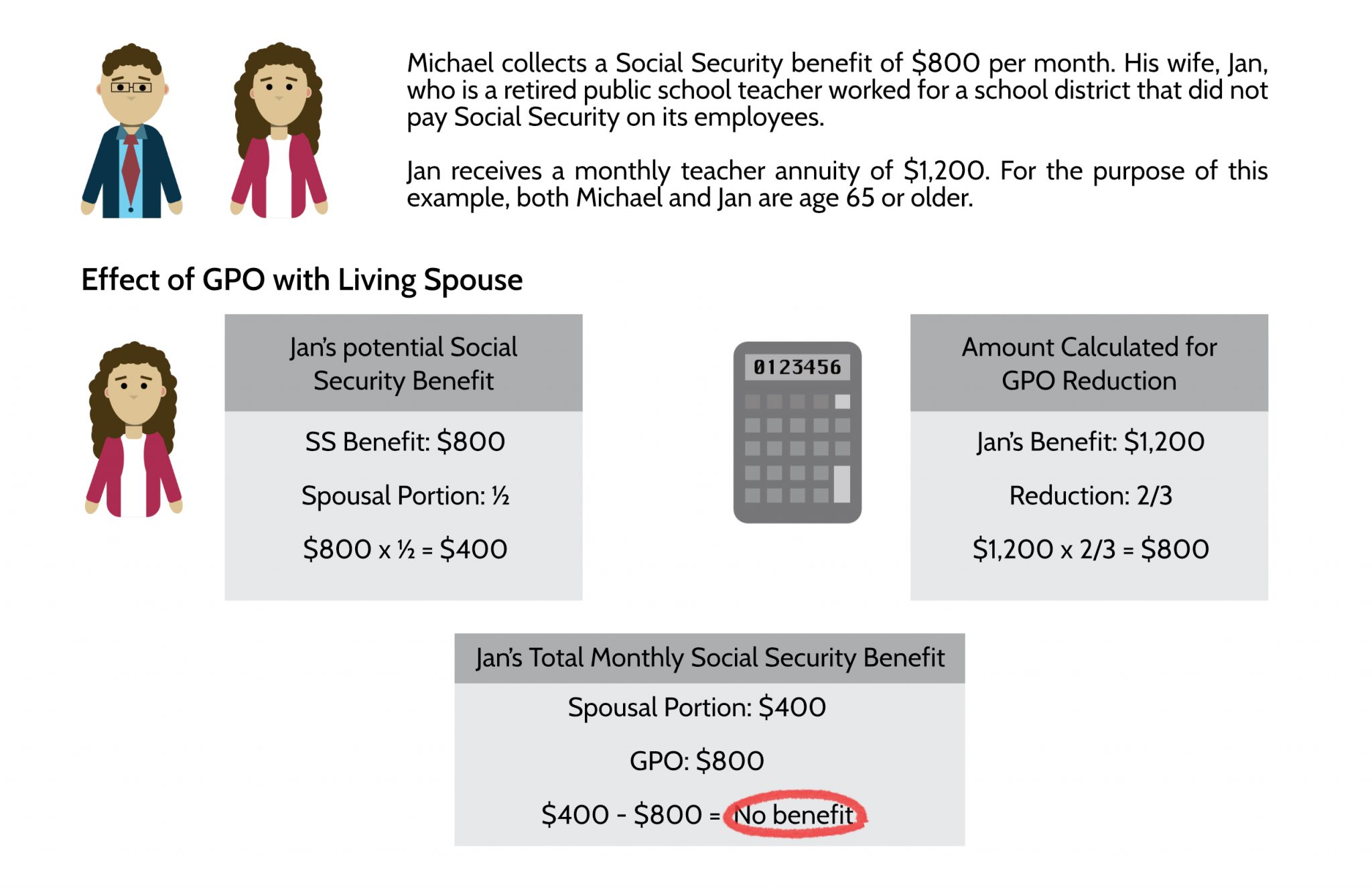

How to figure out how much GPO reduces Social Security?

To figure out how much the GPO may reduce a retiree’s Social Security benefits, first figure out how much of a regular, normal spousal or survivors’ benefit they could receive. Then, take the gross amount of their pension from non-covered employment, and subtract two-thirds of that from the spousal or survivors’ benefit amount.

What is the difference between a WEP and a GPO?

One notable difference between the WEP and the GPO is that while the WEP is triggered by a pension from any non-covered job, the GPO is only triggered if the pension is a “government pension” as defined by the Social Security Administration.

What happens if 2/3 of a pension exceeds spousal benefit?

And if 2/3 of the retiree’s pension exceeded their spousal or survivor benefit altogether, the net result is that they will receive none of that Social Security benefit at all! Importantly, though, this rule applies only to the person who actually owns (i.e., originally earned) the non-covered pension.

What is spousal and survivor benefits?

Social Security spousal and survivor benefits were created to provide some level of Social Security benefits to households that relied primarily on a single worker, as a means to both financially support households with stay-at-home spouses, and to ensure that an earner’s widow was not left in poverty after the primary worker passed away. The caveat, however, is that in the early years of Social Security, some government workers had the opportunity to participate in jobs that did not pay into Social Security (so-called “non-covered” jobs), and instead directly received a private pension… with the end result that, in addition to their pensions, they also ended out receiving Social Security spousal and survivor benefits as though they were a stay-at-home spouse, when in reality they were simply a working spouse in a non-covered job.

How does GPO work?

HOW THE GPO WORKS: The GPO reduces the spousal or widow (er) benefit by two-thirds of the monthly non-covered pension and can partially, or fully, offset an individual's spousal/ widow (er) benefit, depending on the amount of the non-covered pension.

What is a GPO?

BACKGROUND: The Government Pension Offset ( GPO) adjusts Social Security spousal or widow (er) benefits for people who receive “non-covered pensions.” A non-covered pension is a pension paid by an employer that does not withhold Social Security taxes from your salary, typically, state and local governments or non- U.S. employers.

When was the GPO created?

Congress created the GPO in 1977 to help ensure that spousal and widow (er) benefits of those with covered or non-covered lifetime earnings would be roughly equal. a Under Social Security's dual-entitlement rule, spouses with their own covered earnings have their spousal benefits offset dollar-for-dollar by their own earned benefit.

What does GPO mean for Social Security?

The GPO reduces your Social Security survivor or dependent benefits. It affects individuals who worked as federal, state, or local government employees. This includes educators, police officers and firefighters, if the job was not covered by Social Security. See Less.

What is the purpose of the GPO?

When it enacted the GPO, Congress forgot that the original purpose of the dependent/survivor benefit was to help a husband or wife who depends financially on his/her breadwinner spouse. The benefit provides additional income to help the financially dependent husband or wife once the breadwinner retires or is disabled (in which case the dependent benefit applies) or once the breadwinner dies (in which case the survivor benefit applies).

How much does the SSA reduce dependents?

In other words, the GPO lowers the dependent/survivor benefit by $2 for every $3 you receive from your government pension.

Why is the government pension payable?

The government pension is payable because you qualify for either 1) a retirement benefit based on age and length of service; or 2) a permanent disability, that is, a condition which is expected to continue throughout your lifetime and preclude your return to work. A government pension does not include such payment as:

What happens to Tony's Social Security?

Tony reaches the age at which she can draw a Social Security benefit. She goes to the local SSA office to apply for her benefits. Because of the WEP, Tony's own Social Security benefit is reduced unless she had 30 or more years of Social Security coverage. Because of the GPO, Tony's dependent benefit from her husband is either reduced or eliminated. If Tony had not worked in the non-SS-position for the school district, the reductions would not have applied.

What is a government pension?

Government pension: A retirement benefit from non-Social Security-covered employment for a state or local government. Non-SS-covered employment: Work you perform for a state or local government that is not covered by Social Security. SSA: The Social Security Administration.

Who is entitled to dependent benefit?

A dependent benefit is paid to the spouse and minor children of a retired or disabled worker.

What is a GPO on Social Security?

The Social Security Administration addresses this issue in its manual. According to the SSA: The Government Pension Offset (GPO) applies to a spouse’s Social Security benefit for any month the spouse receives a pension based upon his or her own government employment not covered under Social Security.

When does a spousal benefit apply to a GPO?

If at any time during the last 60 months of government service, the individual worked in non-covered employment under the retirement system that provides the pension, the individual’s spousal benefit will be subject to GPO. GPO will apply, with regard to that pension, even if the individual concurrently worked in another position with the same or a different employer covered by Social Security.

Do I Need to Tell the Social Security Administration About My Pension’s Cost of Living Adjustment??

Yes, you do need to report cost of living adjustments to the Social Security Administration if your pension includes this feature.

How Do 401 (k) and 403 (b) Plans, 457 Accounts, and ORPs Factor into the GPO Rule?

Specifically, there are workers in certain community colleges and universities who are given a choice between their state’s Teachers Retirement System (TRS) or an Optional Retirement Plan (ORP).

Does the GPO Apply to Foreign Pensions?

A foreign pension will not trigger the application of the GPO. What it does trigger, however, is another Social Security rule that can impact how much you receive in benefits: the Windfall Elimination Provision (WEP).

Why does GPO exist?

Why Does the GPO Exist? In the past, many people felt that workers who received a pension from a Federal, state, or local government job, and did not pay into Social Security via Social Security taxes, were taking advantage of the system .

How much is the Social Security pension offset?

The Government Pension Offset’s mechanics are really simple: Your survivors’ or spousal benefits from Social Security will be reduced by an amount equal to two-thirds of your gross pension.

IMPACT

The WEP reduces the Social Security retirement, disability, spousal, or survivor benefits of people who work in jobs in which they pay Social Security taxes and jobs in which they do NOT pay Social Security taxes—for example, educators who take part-time or summer jobs to make ends meet.

NEA-SUPPORTED BILLS

Jump to updates, opportunities, and resources for NEA state and local affiliates.

Learn more about NEA-Retired

Now more than ever the commitment continues. Learn how NEA-Retired works to meet the needs of retired education employees (like Sam Evelyn Rock from the Chattanooga Hamilton County Retired Teachers Assn in Tennessee at right) and how to join.

Stay Informed We'll come to you

From education news to action alerts to member benefits-we're here to help you succeed in your career, advocate for your students, and support public education. Sign up to stay informed.

How many people will be affected by the GPO in 2020?

The reach of the GPO is relatively small. As of December 2020, it affected about 717,000 people, or 1 percent of all Social Security beneficiaries, according to the Congressional Research Service (CRS). More than 70 percent of state and local government employees are covered by Social Security and thus not subject to the offset, the CRS reports.

Do federal employees pay Social Security?

Federal employees hired since 1984 pay Social Security taxes (previously they did not ). Some state and local government employees are covered by Social Security, some only by public-sector pension plans and some by both.

Can I collect my own pension and Social Security?

Can I collect my own government pension and Social Security on my spouse’s record? En español | Yes, although a Social Security rule called the Government Pension Offset (GPO) will reduce your spousal benefits if your pension is from a “non-covered” government job in which you did not have Social Security taxes withheld from your paycheck .

Does GPO affect Social Security?

The GPO applies only to your government pension. If you are collecting a deceased spouse’s government pension, it does not affect your Social Security payments. Published October 10, 2018.

Does the government pension offset affect Social Security?

The Government Pension Offset affects only your Social Security spousal or survivor benefit. If you are collecting Social Security retirement benefits and a non-covered government pension, you may be subject to the Windfall Elimination Provision.

How does GPO affect Social Security?

The GPO will affect them if, during their employment, they became eligible to receive a government pension and did not contribute to Social Security.

What is the difference between WEP and GPO?

WEP is short for the Windfall Elimination Provision and GPO is short for the Government Pension Offset. Both could adversely affect how much money you’ll receive in retirement — and your Social Security checks may be a lot smaller because of them. Why Social Security WEP Or GPO Could Ruin Your Retirement - Photo by Getty.

What was the purpose of the 1981 Social Security Windfall Elimination Provision?

The bi-partisan commission introduced the Social Security Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) as solutions to the government paying too much in Social Security benefits to people who have not paid into the system but are not really lower-income workers because they receive other government benefits.

How to see estimated benefits for Social Security?

By creating a My Account, users can click “My Home” and then click “Estimated Benefits” where the Social Security Administration gives both the good and bad news . The good news is under the Retirement section, toward the top, is where Social Security recipients will see the estimated Social Security payouts that they’ll start receiving at ages 62, 67 or 70, depending on the age they declare retirement. The bad news is just above the Retirement section where it points out that you might be subject to a reduction because of WEP and GPO offsets.

When did WEP and GPO start?

The history of WEP and GPO. Prior to 1983 if you worked in a government job and did not pay FICA (Federal Insurance Contribution Act) taxes, the Social Security Department did not know you had a government job. By design, the Social Security System on a percentage basis pays lower-income people a higher percentage benefit than higher-income people.

Is Social Security spousal and survivor benefits same sex?

The Social Security spousal and survivor benefits are two of the benefits same-sex couples gained when the Supreme Court approved marriage equality in all 50 states in 2015. WEP and GPO now affect the Social Security spousal and survivor benefits that we discussed on this Queer Money ™ episode with Freitag. Both the Social Security WEP and GPO ...

What is the green line on Social Security?

In the past, people who paid into Social Security likely received a “green line” form from the Social Security Department that listed their contribution into Social Security to date and their expected Social Security retirement payment based on those contributions.