Does my current health insurance affect SSDI or SSI?

Your current health insurance plan should not affect your application for Social Security Disability (SSD) programs, including Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI).

Does life insurance affect Social Security benefits?

You can rest easy, life insurance does not affect social security benefits since they are not based on your net worth. They are based on lifetime payments into SSI, and even billionaires are entitled to their SSI benefit. You have SS and SSI confused.

Can SSI recipients buy or have life insurance?

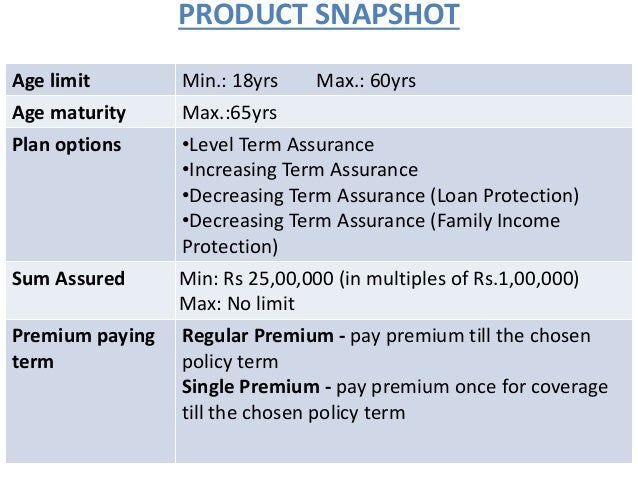

SSI recipients can still get great life insurance coverage. Life insurance for SSI recipients can be based on a number of different factors. Most importantly, you need to decide if you want term or permanent life insurance. Term policies won't affect your SSI benefits, but permanent policies could reduce your benefits.

Does credit score affect life insurance?

Your credit-based insurance score is not used to determine life insurance rates, however. And while your regular old credit score also is not directly documented during the life insurance underwriting process, it is used in the calculations of other reports and records that life insurance underwriters do use. So, in an indirect way, your life insurance premiums can be affected by your credit score.

Does life insurance payout affect Social Security benefits?

Does life insurance affect social security benefits? Retirement benefits through the Social Security Administration, which you can receive beginning at age 62, aren't impacted by your life insurance or most other assets.

Can you have life insurance and receive SSI?

The short answer is yes1, because the Social Security Administration doesn't have the right to interfere with your ability to purchase life insurance. Supplemental Security Income (SSI) is a program offered by the federal government through the Social Security Administration (SSA).

Does a life insurance payout count as income?

Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them. However, any interest you receive is taxable and you should report it as interest received. See Topic 403 for more information about interest.

How much life insurance can you have on SSI?

$1,500Life insurance that has a cash surrender value and is owned by you (or your spouse) is excluded from countable resources if the total face value of all policies you own on any one person is not more than $1,500.

Will I lose my SSI if I get a settlement?

Unfortunately, a settlement amount in a personal injury case will reduce or terminate Supplemental Security Income (SSI) once you received the settlement payout.

Can the IRS take life insurance proceeds from a beneficiary?

If the insured failed to name a beneficiary or named a minor as beneficiary, the IRS can seize the life insurance proceeds to pay the insured's tax debts. The same is true for other creditors. The IRS can also seize life insurance proceeds if the named beneficiary is no longer living.

Do beneficiaries have to pay taxes on inheritance?

This is done by the person dealing with the estate (called the 'executor', if there's a will). Your beneficiaries (the people who inherit your estate) do not normally pay tax on things they inherit. They may have related taxes to pay, for example if they get rental income from a house left to them in a will.

Is beneficiary money taxable?

Beneficiaries generally don't have to pay income tax on money or other property they inherit, with the common exception of money withdrawn from an inherited retirement account (IRA or 401(k) plan). The good news for people who inherit money or other property is that they usually don't have to pay income tax on it.

What income is not counted for SSI?

A couple can get SSI if they have unearned income of less than $1,281 a month in 2022. Because a larger portion of earned income isn't counted, a person who gets SSI can earn up to $1,767 a month ($2,607 for a couple) and still get SSI.

How do I hide money from SSI?

Here are some suggestions for what an individual could buy to spend down a lump sum:Buying a home or paying off a mortgage, if the SSI recipient is on the title or has a lifetime agreement to be a tenant of the home. ... Buying a car or paying off a car, if the SSI recipient is on the title.More items...•

What counts as assets for SSI?

The assets or resources that are counted by SSI include money in the bank, investments of any kind, real estate other than a primary residence, and personal property and household goods over certain limits. SSI also counts any money or property in which you have an interest, even if you are not the sole owner.

When does Social Security reduce your benefits?

Furthermore, reductions apply only if you earn wages after you access your benefits and before you reach full retirement age.

How does the WEP affect Social Security?

The WEP primarily affects you if you were a government employee who did not pay Social Security taxes and later worked in a job where you did pay into the system, and worked long enough to qualify for benefits. If you turn 62 during the year of publication, the formula takes the first $749 of your average monthly earnings and multiplies by 90 percent; then multiplies the next $3,768 by 32 percent; and then multiplies the remaining average income by 15 percent. The SSA than adds the resulting amounts together to determine you total monthly benefit amount.

Does investment affect Social Security?

Investment accounts that supply pension-type income do not affect your Social Security benefit either. Pension income from employment where you paid into the Social Security system will not negatively affect your benefit amount.

Does an annuity reduce Social Security?

Insurance policies that provide annual annuity payments during retirement do not qualify as a source of earned income; therefore, income from these annual payments does not reduce your Social Security check. Investment accounts that supply pension-type income do not affect your Social Security benefit either.

Does a government pension offset affect Social Security?

Government Pension Offset. If you receive a government pension based on noncovered employment, the Government Pension Offset can have a negative impact on your spouse’s Social Security benefit if the pension your spouse receives is also based on noncovered employment.

Can you have a limit on SSI?

1 Answer. For those who are qualified for SSI, there is a limit to how much income you are allowed to have. Income sources can be anything from a part time job to investments, including some types of life insurance policies. Term life and final expense insurance will not count against you, but most permanent life insurance policies will.

Do you declare cash value as income on SSI?

Since the cash value of those types of policies can be accessed by the person receiving SSI, the amount of the cash value must be declared as savings or income, depending on whether you receive dividends.

Does term life insurance count against SSI?

Term life and final expense insurance will not count against you, but most permanent life insurance policies will. The key to whether your life insurance policy will affect your SSI is whether or not the policy has a cash value. Term life policies do not carry a cash value and are not counted as income because you cannot withdraw ...

Is term life insurance considered income?

Term life policies do not carry a cash value and are not counted as income because you cannot withdraw or borrow against any portion of the policy. Final expense insurance is a type of permanent coverage, but it does not have a cash value or pay out to your named beneficiaries, making it exempt as well.

Does Life Insurance Affect SSDI?

Can I qualify for life insurance if I am currently receiving SSA Disability Benefits? Yes, individuals who are currently receiving SSDI or SSI may be able to qualify for a traditional term or whole life insurance policy. In fact, some may even be able to qualify for a Standard or better rate!

Does claiming disability affect Social Security benefits?

If you’re getting Social Security survivors’ benefits , disability income from private or public source won’t affect your payments . Eligibility is based on your assets and resources, including unearned income such as disability benefits . Disability income exceeding the program’s guidelines reduces your SSI benefits .

What income reduces Social Security disability benefits?

Each month, we reduce your SSI benefits 50 cents for every dollar that you earn over $85. Example: You work and earn $1,000 in a month; and your only income comes from your earnings and your SSI .

How much money can you have in the bank with SSDI?

Because SSDI is this type of benefit, a person’s assets have nothing to do with their potential eligibility to draw and collect SSDI. In other words, whether you have $50 or $50,000 in the bank makes no difference to the SSA.

Does life insurance affect Medicaid?

If a Medicaid applicant has term life insurance , it doesn’t count as an asset and won’t affect Medicaid eligibility because this form of life insurance does not have an accumulated cash value. On the other hand, whole life insurance accumulates a cash value that the owner can access, so it can be counted as an asset.

When a husband dies does the wife get his Social Security?

When a retired worker dies , the surviving spouse gets an amount equal to the worker’s full retirement benefit. Example: John Smith has a $1,200-a-month retirement benefit. His wife Jane gets $600 as a 50 percent spousal benefit. Total family income from Social Security is $1,800 a month.

Can two wives collect Social Security?

As a spouse, you have the option of claiming a Social Security retirement benefit based on your own earnings record or collecting a spousal benefit equal to half of your spouse’s Social Security benefit.

Does life insurance affect social security benefits?

Retirement benefits through the Social Security Administration, which you can receive beginning at age 62, aren’t impacted by your life insurance or most other assets. Since you put a portion of your paycheck toward Social Security benefits while you’re working, you’re entitled to them later, regardless of your overall financial resources.

SSI and disability benefits

However, Supplemental Security Income, another program from the Social Security Administration, has different rules. Supplemental Security Income provides monthly payments to Americans who are 65 or older, blind, or have a disability.

How to qualify for SSI

To qualify for Supplemental Security Income, you need to prove that you have limited income and resources. Income includes:

How do my life insurance benefits affect Supplemental Security Income?

The effect of your life insurance on your Supplemental Security Income depends on the type of life insurance you own. If you own a term life insurance policy, you don’t need to worry about the impact on Supplemental Security Income. Term life insurance only has value after your death, so it’s not considered an asset.

How does Supplemental Security Income affect buying a life insurance policy?

What about SSI and a life insurance policy? Receiving Supplemental Security Income doesn’t prevent you from buying a life insurance policy. It’s your right to spend your benefits on coverage to protect your family and loved ones.

Bottom Line: Life insurance and social security benefits

Benefits from the Social Security Administration won’t be affected by your life insurance. However, if you qualify for Supplemental Security Income, these benefits may be affected by your life insurance, depending on the type of policy you have.

EDITORIAL DISCLOSURE

At Fidelity Life, our goal is to make life insurance simple, affordable, and understandable for everyday families. This content is intended for educational purposes only. Each post is carefully fact-checked, reviewed and updated regularly to ensure the information is as relevant as possible.

What happens if you stop receiving workers compensation?

For example, if you stop receiving workers compensation or other insurance benefits, you disability benefits will likely increase. However, if you receive more benefits from other sources, the disability amount can be decreased as well.

Why do unemployment benefits conflict?

Because unemployment benefits are paid while the claimant is able to work and actively seeking employment, disability benefits pose a conflict. As a condition of receiving disability benefits, the claimant has to prove that he cannot work, and these two unique programs will cancel each other out.

Can you get disability if you collect other benefits?

However, for those collecting other benefits can possibly have their disability payment amounts reduced if the total of both exceeds a certain threshold. Keep in mind that having other benefits paid to you in addition to Social Security Disability benefits will not disqualify you from receiving disability. However, the more you receive ...

Can you receive Social Security without a penalty?

The Social Security Administration allows claimants to receive benefits from things like workers compensation or Medicare as well as some others without incurring a penalty. However, the amount of money received from these sources can impact how much the Social Security Disability payments will be.

What happens if you inherit SSI?

If you are on SSI, the inheritance will likely cause your benefits to stop or decrease. My sister is on SSI and is about to receive a $60,000 life insurance benefit from her brother who has passed away. She 71 years old will this affect her SSI benefits.

Why is 30k needed for SSIS?

The 30k is to supplement the ssi because shes only receiving 1400 a month (will go down to 700 when my brother graduates) and she can not work due to medical reasons. Theres no way she can survive on 700/month, but everywhere I look says she'll lose it. Help!!!

Does it matter if SSI puts money in the bank?

For SSI, it doesn't matter if she puts the money in the bank or keeps it in a lock box in her house or puts in your safe deposit box. She has the money. It belongs to her. She is required to report it or she is committing fraud. And SSI will find out.

Can SSI be cancelled?

SSI will not cancel since a one time payment is not the same as an income change. It would only be paused until the money is used if you can use it within a month or two then she will not be out much SSI , only a few thousand and the Medicaid or Medicare will not end at all during this time.