Which states don't tax Social Security benefits?

37 States That Don’t Tax Social Security Benefits

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

How are Social Security benefits taxed in Oregon?

- You were age 62 or older on December 31, 2015, and receiving retirement income, and

- Your household income is less than $22,500 ($45,000 if Married Filing Jointly ), and

- Your Social Security benefits and/or tier 1 Railroad Retirement Board benefits are less than $7,500 ($15,000 if Married Filing Jointly ), and

What state does not tax Social Security?

What states do not tax Social Security benefits? Quick Facts. Alaska and New Hampshire are the only states with no sales, income or Social Security tax. Alaska also pay a dividend each year from the Alaska Permanent Fund (PFD) and in 2019 it was $1,606 per resident. What is the highest paying state for disability?

Is Social Security retirement income taxed in Oregon?

Oregon is moderately tax-friendly for retirees. As is mentioned above, it exempts Social Security retirement benefits from the state income tax. It also has no sales tax, along with property taxes that are a bit lower than the national average. Those are both positives for retirees in Oregon, but there are also a few negatives.

Is Oregon a tax friendly state for retirees?

Does Oregon tax retirement income? Oregon is moderately tax friendly. While the state does not tax Social Security benefits, it does tax other retirement income, like withdrawals from retirement accounts. Additionally, public and private pension income are partially taxed.

What retirement income is taxable in Oregon?

Oregon exempts Social Security retirement benefits from the state income tax. Oregon taxes income from retirement accounts like a 401(k) or an IRA, though, at the full state income tax rates. The state has no sales tax, along with property taxes that are slightly below average.

Can Oregon tax my pension if I move out of state?

While he remains an Oregon resident, all of his retirement distributions are subject to Oregon tax under ORS 316.048. If he later moves out of Oregon, none of the distributions received after his change of residence are subject to Oregon tax.

What states do not tax retirees Social Security?

Nine of those states that don't tax retirement plan income simply because distributions from retirement plans are considered income, and these nine states have no state income taxes at all: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

Is it better to retire in Oregon or Washington?

We recommend Oregon if you're looking for a laid-back society with rich green scenery for outdoor activities such as golfing, hiking, and biking. Washington might be for you if you prefer big cities' fast-paced life but still want some room for physical activities.

What are the pros and cons of living in Oregon?

Pros And Cons Of Living In OregonAn outdoor lover's paradise.Environmentally friendly.Pleasant weather conditions.Good local things to eat and drink.No sales tax.High cost of living.Heavy tax burden.High cost of gasoline.More items...

What is the Oregon retirement income credit?

The credit is equal to nine (9) percent of the lesser of $10,000 or $8,000 (the total of their retirement income).

Can I retire in one state and live in another?

When you retire, you may consider moving to another state — say, for the weather or to be closer to your loved ones. Don't forget to factor state and local taxes into the equation. Establishing residency for state tax purposes may be more complicated than it initially appears to be.

Does Oregon tax out of state income?

The state of Oregon requires you to pay taxes if you're a resident or nonresident that receives income from an Oregon source. Oregon assesses income taxes up to 9.9%, and doesn't have a general sales tax rate.

What are the 13 states that tax Social Security?

Of the 50 states, 13 states tax Social Security benefits. Those states are: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia.

How can I avoid paying taxes on Social Security?

How to minimize taxes on your Social SecurityMove income-generating assets into an IRA. ... Reduce business income. ... Minimize withdrawals from your retirement plans. ... Donate your required minimum distribution. ... Make sure you're taking your maximum capital loss.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

How much estate tax is there in Oregon?

Unlike most other states, Oregon has its own estate tax. The exemption amount on that tax is $1 million, which means many estates that are not subject to the federal tax may be taxed in Oregon. The federal exemption is $11.58 million for 2020 and $11.7 million for 2021.

What can a financial advisor do in Oregon?

A financial advisor in Oregon can help you plan for retirement and other financial goals. Financial advisors can also help with investing and financial plans, including taxes, homeownership, insurance and estate planning, to make sure you are preparing for the future.

Does Oregon tax 401(k)?

Most notably, Oregon taxes income from retirement accounts like a 401 (k) or an IRA at the full rates, which range from 4.75% to 9.9%. That being said, there are a number of other retirement tax policies in ...

Is Oregon tax friendly?

Oregon is moderately tax-friendly for retirees. As is mentioned above, it exempts Social Security retirement benefits from the state income tax. It also has no sales tax, along with property taxes that are a bit lower than the national average. Those are both positives for retirees in Oregon, but there are also a few negatives.

Is 401(k) income taxable in Oregon?

Income from a 401 (k), IRA or any other retirement account is taxable at rates ranging from 4.75% to 9.9%. Check out the full Oregon income tax rate tables below. Pension income is also taxable, but some seniors may be able to claim a credit on that income.

Does Oregon tax pensions?

Unlike many other states, Oregon does not exempt or allow deductions on income from retirement accounts. The state also taxes pension income, although seniors with income below a certain threshold can claim a 9% credit on that income.

Does Oregon pay property taxes?

If you do qualify, the state of Oregon will pay all county property taxes for your house. You will still have to pay any school district and municipal taxes. Additionally, the taxes you defer will accrue interest, which you will have to pay back at the time you sell your home.

Potential Option for Those Living Mostly on Social Security Income

If you were age 62 or older as of Dec. 31, 2015, were receiving retirement income and your household income is less than $22,500 as an individual ($45,000 for joint filers), you could take off additional thousands of dollars of federal income taxes paid on your state return.

Additional Retirement Tax Considerations

Oregon does tax income from retirement accounts like an IRA or 401 (k) at full state income tax rates. If you’re collecting income from a private or public pension, those earnings are also partially taxed.

What are the best places to retire in Oregon?

Retirees in Oregon can take advantage of a breathtaking and diverse landscape with the Painted Hills, Mount Hood, the Wallowas, South Rock, and Crater Lake. Sandboard at the dunes or hike through an evergreen forest. The choice is yours.

Is there sales tax in Oregon?

Wages are taxed at standard rate and the marginal state tax rate is 9%. There is no sales tax in the state, adding to Oregon’s tax friendliness ranking. 2. Do I need a car to retire in Oregon? While it’s always convenient to have a car, retiring in Oregon may mean eliminating the expense of car ownership.

Is Oregon a public beach?

Oregon not only has an abundance of beaches, thanks to a pioneering beach bill, all 363 miles of Oregon’s coastline are free and public. From sandy beaches to majestic cliffs, the Oregon coast is nothing less than magical. The famous Highway 101 will take you down the entire coastline offering unforgettable views.

Does Oregon tax Social Security?

While the state does not tax Social Security benefits, it does tax other retirement income, like withdrawals from retirement accounts. Additionally, public and private pension income are partially taxed. Wages are taxed at standard rate and the marginal state tax rate is 9%. There is no sales tax in the state, adding to Oregon’s tax friendliness ...

Is Oregon a good retirement state?

The state is tax-friendly for retirees, boasts hundreds of farmers markets, is environmentally and health conscious and may be your retirement destination. Learn more about an Oregon retirement.

Is Portland a good place to retire?

Portland is quickly becoming a popular retirement destination because of its abundance of outdoor recreational activities and luxurious city lifestyle. Choose a city, a small town, or something in between and soak it all in with an Oregon retirement.

Is Oregon a veggie paradise?

Aside from its abundance of outdoor activities, Oregon is a veggie lover’s paradise. Oregon’s temperate climate and nutrient-rich soil make it a farmer’s paradise. During the warmer months, produce stands and roadside farmer’s markets pop up everywhere, making it easy for retirees to eat local, fresh produce in season.

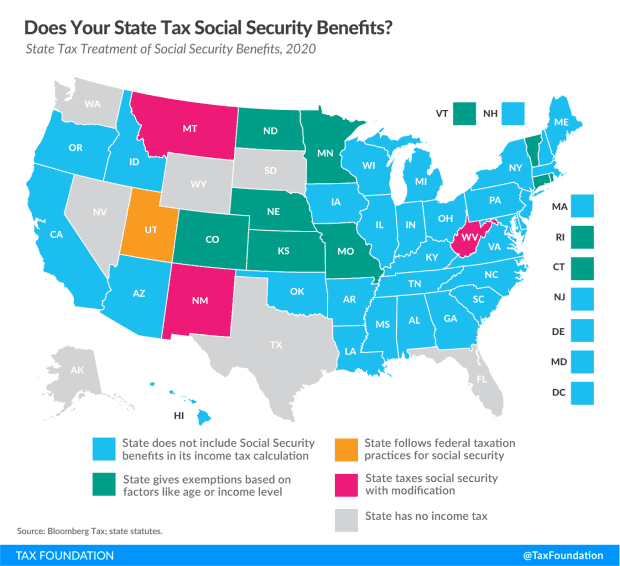

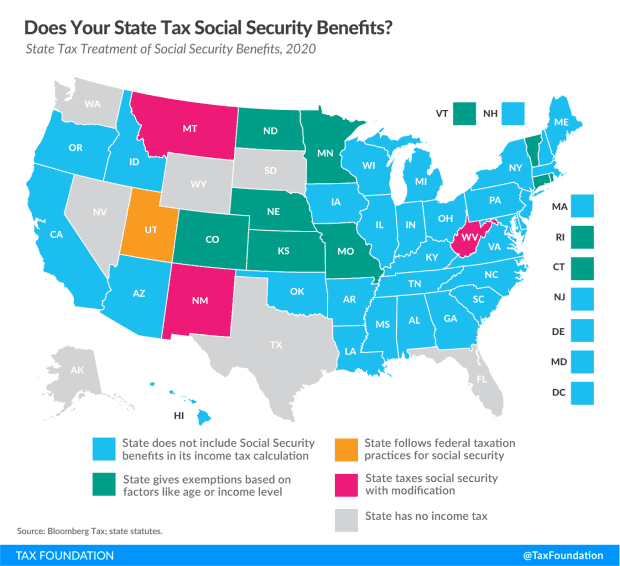

How many states tax Social Security?

Thirteen states tax Social Security benefits, a matter of significant interest to retirees. Each of these states has its own approach to determining what share of benefits is subject to tax, though these provisions can be grouped together into a few broad categories. Today’s map illustrates these approaches.

How much can I deduct from my Social Security in North Dakota?

North Dakota allows taxpayers to deduct taxable Social Security benefits if their AGI is less than $50,000 (single filer) or $100,000 (filing jointly).

What is the exemption for Social Security in Missouri?

Missouri allows a 100 percent Social Security exemption as long as the taxpayer is 62 or older and has less than $85,000 (single filer) or $100,000 (filing jointly) in annual income. Nebraska allows single filers with $43,000 in AGI or less ($58,000 married filing jointly) to subtract their Social Security income.

Which states have a Social Security exemption?

Kansas provides an exemption for such benefits for any taxpayer whose AGI is $75,000, regardless of filing status. Minnesota provides a graduated system of Social Security subtractions which kick in if someone’s provisional income is below $81,180 (single filer) or $103,930 (filing jointly). Missouri allows a 100 percent Social Security exemption ...

When will West Virginia stop paying Social Security taxes?

West Virginia passed a law in 2019 to begin phasing out taxes on Social Security for those with incomes not exceeding $50,000 (single filers) or $100,000 (married filing jointly). Beginning in tax year 2020, the state exempted 35 percent of benefits for qualifying taxpayers. As of 2021, that amount increased to 65 percent, and in 2022, ...

Does Utah tax Social Security?

Utah taxes Social Security benefits but uses tax credits to eliminate liability for beneficiaries with less than $30,000 (single filers) or $50,000 (joint filers), with credits phasing out at 2.5 cents for each dollar above these thresholds. Until this year, Utah’s credits mirrored the federal tax code, where the taxable portion ...

How much is Social Security income in Peach State?

The Peach State's low-tax climate may have something to do with it. Social Security income is exempt from state taxes, and so is up to $65,000 of most types of retirement income for those age 65 or older ($130,000 per couple). (For those age 62 to 64, the maximum exemption is $35,000.)

Which state has the highest income tax rate?

California can be a difficult state to figure out when it comes to taxes on retirees. For instance, at 13.3%, the Golden State has the highest income tax rate in the country — but that rate is for millionaires. For middle- and lower-income folks, the rates are much lower.

What is the tax rate for Idaho?

Idaho taxes are no small potatoes: the state taxes all income, except Social Security and Railroad Retirement benefits, and its top tax rate of 6.5% kicks in at a relatively low level. While there is a generous retirement-benefits deduction, it's only available to retirees with qualifying public pensions.

Does Utah tax Social Security?

The Beehive State's income tax system is rough on retirees — especially wealthier ones. Utah is one of only a handful of states that taxes Social Security benefits. Most other retirement income is exposed to the state's flat 4.95% income tax, too.

Is California a good state for retirees?

Sales taxes are relatively high, but the state's median property tax rate is not. In the end, when you balance out all the pros and cons, California is actually a good state for most retirees when it comes to taxes, thanks mainly to the reasonable income tax rates for ordinary seniors.

Is military retirement income tax free in Arizona?

Military retirement income is tax-free in Arizona, too. While plenty of other states have more generous exemptions, Arizona's low income tax rates for most people keep the net burden down. Sales taxes are above average in the state—the average combined (state and local) rate is 8.4% (11th-highest in the nation).

Is Social Security taxed in Arkansas?

For instance, Arkansas exempts Social Security benefits and up to $6,000 of retirement income from its state income tax. And, as a plus for veterans, all military pension income is tax-exempt. Beginning in 2021, the top rate for taxpayers with net income over $79,300 also went from 6.6% to 5.9%.

How many states have Social Security taxes?

There are 13 states that collect taxes on at least some Social Security income. Four of those states (Minnesota, North Dakota, Vermont or West Virginia) follow the same taxation rules as the federal government.

How much of your Social Security income is taxable?

If your Social Security income is taxable, the amount you pay in tax will depend on your total combined retirement income. However, you will never pay taxes on more than 85% of your Social Security income. If you file as an individual with a total income that’s less than $25,000, you won’t have to pay taxes on your social security benefits in 2020, ...

How much to withhold from Social Security?

The only withholding options are 7%, 10%, 12% or 22% of your monthly benefit . After you fill out the form, mail it to your closest Social Security Administration (SSA) office or drop it off in person.

How to find out if you will pay taxes on Social Security?

According to the IRS, the quick way to see if you will pay taxes on your Social Social Security income is to take one half of your Social Security benefits and add that amount to all your other income , including tax-exempt interest. This number is known as your combined income (combined income = adjusted gross income + nontaxable interest + half of your Social Security benefits).

How much tax do you pay on your income if you live in one of the states?

So if you live in one of those four states then you will pay the state’s regular income tax rates on all of your taxable benefits (that is, up to 85% of your benefits). The other nine states also follow the federal rules but offer deductionsor exemptions based on your age or income.

How to file Social Security income on federal taxes?

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this part is easy. First, find the total amount of your benefits. This will be in box 3 of your Form SSA-1099.

Do you pay taxes on Roth IRA?

With a Roth IRA, you save after-tax dollars. Because you pay taxes on the money before contributing it to your Roth IRA, you will not pay any taxes when you withdraw your contributions.