:max_bytes(150000):strip_icc()/GettyImages-184127461-e960f1b3d8964e9ca317e4640e208ab2.jpg)

The short answer is yes, but there is more to take into consideration. Because the IRS considers SSDI

Social Security Death Index

The Social Security Death Index is a database of death records created from the United States Social Security Administration's Death Master File Extract. Most persons who have died since 1936 who had a Social Security Number and whose death has been reported to the Social Security Administration are listed in the SSDI. For most years since 1973, the SSDI includes 93 percent to 96 percent of deaths of i…

How much taxes on Social Security disability?

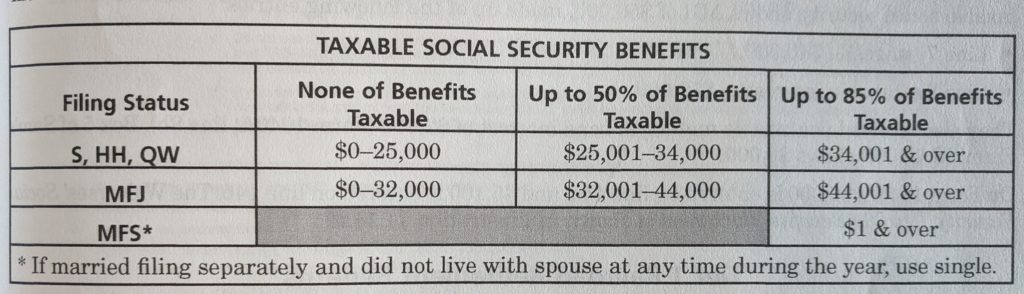

The base amount for your filing status is:

- $25,000 if you're single, head of household, or qualifying widow (er),

- $25,000 if you're married filing separately and lived apart from your spouse for the entire year,

- $32,000 if you're married filing jointly,

- $0 if you're married filing separately and lived with your spouse at any time during the tax year.

When does SSDI become taxable?

The IRS states that your Social Security Disability Insurance benefits may become taxable when one-half of your benefits, plus all other income, exceeds an income threshold based on your tax filing status:

Is my Social Security disability benefits taxable?

The rest do have an income tax, but they exclude Social Security benefits from taxable income. Here are the 13 states that do tax benefits: Fortunately, things may not be as bad as you fear -- because many of these states do not have a heavy hand when it comes to taxing your benefits.

How much SSD is taxable?

There is no maximum dollar amount for how much Social Security income is taxable. Instead, there is a maximum percentage of Social Security income that is taxable. If you make more than $34,000 if you’re a single filer or $44,000 if you’re married filing jointly, you may pay taxes on up to 85% of your Social Security benefits.

How much of my Social Security disability is taxable?

between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

Does Social Security Disability count as income?

Federal SSI payments in 2022 max out at $841 a month for an individual and $1,261 for a married couple when both spouses are eligible. Those benefits are not subject to income tax. However, SSDI is potentially taxable, coming under the same set of tax rules as Social Security retirement, family and survivor benefits.

Do Social Security Disability have to file taxes?

But the good news is that you will never have to pay tax on all of your disability benefits. In fact, no matter how much you make, you will never have to pay taxes on more than 85 percent of your Social Security Disability income.

Do you have to report disability income to IRS?

Taxing Social Security disability income SSI payments are not taxable. SSDI benefits, like other Social Security income, must be reported on your tax return. Whether you pay tax on those benefits depends on your total income and benefits for the year.

What is the disability tax credit for 2021?

$8,662The federal DTC portion is 15% of the disability amount for that tax year. The “Base Amount” maximum for 2021 is $8,662, according to CRA's Indexation Chart....YearMaximum Disability AmountMaximum Supplement For Persons Under 182021$8,662$5,0532020$8,576$5,0032019$8,416$4,9092018$8,235$4,8049 more rows•Mar 7, 2022

How long can you be on Social Security disability?

To put it in the simplest terms, Social Security Disability benefits can remain in effect for as long as you are disabled or until you reach the age of 65. Once you reach the age of 65, Social Security Disability benefits stop and retirement benefits kick in.

How much of my Social Security is taxable in 2021?

For the 2021 tax year (which you will file in 2022), single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

What line do you report Social Security benefits on?

You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040-SR. Your benefits may be taxable if the total of (1) ...

Do you have to add spouse's income to joint tax return?

If you're married and file a joint return, you and your spouse must combine your incomes and social security benefits when figuring the taxable portion of your benefits. Even if your spouse didn't receive any benefits, you must add your spouse's income to yours when figuring on a joint return if any of your benefits are taxable.

Is Social Security income taxable?

Social security benefits include monthly retirement, survivor and disability benefits. They don't include supplemental security income (SSI) payments, which aren't taxable. The net amount of social security benefits that you receive from the Social Security Administration is reported in Box 5 of Form SSA-1099, Social Security Benefit Statement, and you report that amount on line 6a of Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors. The taxable portion of the benefits that's included in your income and used to calculate your income tax liability depends on the total amount of your income and benefits for the taxable year. You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040-SR.

How much disability income can I avoid?

If you are single, the threshold amount is currently $25,000.

How does SSDI work?

How SSDI Works. When SSDI Benefits Are Taxed. State Taxes on SSDI. Social Security disability benefits may be taxable if you have other income that puts you over a certain threshold. However, the majority of recipients do not have to pay taxes on their benefits because most people who meet the strict criteria to qualify for ...

How many states will have tax benefits in 2020?

As of 2020, however, a total of 13 states tax benefits to some degree. Those states are Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia. Most of these states set similar income criteria to the ones used by the IRS to determine how much, if any, ...

How long does a disabled person have to be disabled to work?

First, the SSA says, "Your condition must significantly limit your ability to do basic work such as lifting, standing, walking, sitting, and remembering—for at least 12 months.".

Why did Roosevelt include Social Security in the New Deal?

The purpose of the New Deal was to lift the country out of the Great Depression and restore its economy.

Is SSDI income taxed?

Key Takeaways. Many Americans rely on Social Security Disability Income (SSDI) benefits for financial support. If your total income, including SSDI benefits, is higher than IRS thresholds, the amount that is over the limit is subject to federal income tax.

How to find out if child benefits are taxable?

To find out whether any of the child's benefits may be taxable, compare the base amount for the child’s filing status with the total of: One-half of the child's benefits; plus. All of the child's other income, including tax-exempt interest. If the child is single, the base amount for the child's filing status is $25,000.

What line do you report Social Security benefits on?

You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040-SR. Your benefits may be taxable if the total of (1) ...

How much is the federal income tax for married filing separately?

The base amount for your filing status is: $25,000 if you're single, head of household, or qualifying widow (er), $25,000 if you're married filing separately and lived apart from your spouse for the entire year, $32,000 if you're married filing jointly,

Do you have to add spouse's income to joint tax return?

If you're married and file a joint return, you and your spouse must combine your incomes and social security benefits when figuring the taxable portion of your benefits. Even if your spouse didn't receive any benefits, you must add your spouse's income to yours when figuring on a joint return if any of your benefits are taxable.

Is a child's Social Security payment taxable?

If the total of (1) one half of the child's social security benefits and (2) all the child's other income is greater than the base amount that applies to the child's filing status, part of the child's social security benefits may be taxable. You can figure the taxable amount of the benefits on a worksheet in the Instructions for Form 1040 ...

Is Social Security taxable for children?

Yes, under certain circumstances, although a child generally won't receive enough additional income to make the child's social security benefits taxable. The taxability of benefits must be determined using the income of the person entitled to receive the benefits. If you and your child both receive benefits, you should calculate the taxability ...

Is Social Security income taxable?

Social security benefits include monthly retirement, survivor and disability benefits. They don't include supplemental security income (SSI) payments, which aren't taxable. The net amount of social security benefits that you receive from the Social Security Administration is reported in Box 5 of Form SSA-1099, Social Security Benefit Statement, and you report that amount on line 6a of Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors. The taxable portion of the benefits that's included in your income and used to calculate your income tax liability depends on the total amount of your income and benefits for the taxable year. You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040-SR.

How to prove a child's disability?

To prove your child's disability, get a letter from their doctor, healthcare provider or any social service program or agency that can verify their disability.

How long does EITC refund count as income?

It can’t be counted as income for at least 12 months after you get it. To find out if this rule applies to your benefits, check with your benefit coordinator.

Can a child with disability claim EITC?

Claim a Qualifying Child with a Disability. The qualifying child you claim for the EITC can be any age if they: Have a permanent and total disability and. Have a valid Social Security number. If the child gets disability benefits, they may still be your qualifying child for the EITC.

Is disability considered earned income?

Disability payments qualify as earned income depending on: The type of disability payments you get: Disability retirement benefits. Disability insurance payments. Other disability benefits. Your age when you start to get the disability payments.

Is sheltered employment considered gainful?

We do not consider sheltered employment “substantial gainful activity.”. Sheltered employment is when a child with a physical or mental disability works for minimal pay under a special program. If people with physical or mental disabilities work for minimal pay, it must be done at a qualified location.

Do disability payments qualify as earned income?

Disability Insurance Payments. If you get disability insurance payments, your payments do not qualify as earned income when you claim the EITC if you paid the premiums for the insurance policy. If you got the policy through your employer, your Form W-2 may show the amount you paid in box 12 with code J. For more information about disability ...

How much income is subject to tax on SSDI?

Here's how it works. If you are married and you file jointly, and you and your spouse have more than $32,000 per year in income (including half of your SSDI benefits), a portion of your SSDI benefits are subject to tax. If you are single, and you have more than $25,000 in income per year (including half of your SSDI benefits), a portion of your SSDI benefits will be subject to tax.

What is the tax rate for disability?

85%. Keep in mind that if your disability benefits are subject to taxation, they will be taxed at your marginal income tax rate. In other words, your tax rate would not be 50% or 85% of your benefits; your tax rate would probably be more like 15-25% of your benefits. Those with higher incomes (where 85% of your benefits would be taxed) ...

Do you pay taxes on Social Security Disability?

Social Security disability is subject to tax, but most recipients don't end up paying taxes on it. Social Security disability benefits (SSDI) can be subject to tax, but most disability recipients don't end up paying taxes on them because they don't have much other income.

Do you have to pay taxes on SSDI?

Most states do not tax Social Security disability benefits. The following states, however, do tax benefits in some situations. Some of these states use the same income brackets as the federal government (above) to tax SSDI benefits, but others have their own systems.

Can SSDI payments bump up your income?

Large lump-sum payments of back payments of SSDI (payments of benefits for the months you were disabled but not yet approved for benefits) can bump your income up for the year in which you receive them, which can cause you to pay a bigger chunk of your backpay in taxes than you should have to.

Which states impose full income tax on Social Security?

You can click on the state to be directed to its tax authority. Montana. Montana imposes full income taxes on Social Security benefits. Utah. Although Utah imposes taxes, there are some tax credits available to residents depending on their age, filing status, and household income. New Mexico.

What states tax Social Security?

States That Fully Tax Social Security Benefits 1 Montana. Montana imposes full income taxes on Social Security benefits. 2 Utah. Although Utah imposes taxes, there are some tax credits available to residents depending on their age, filing status, and household income. 3 New Mexico. New Mexico doesn't exempt Social Security benefits, but does provide a small exemption for people who have low income or are over 65.

How much is a married person exempt from a state tax?

Married taxpayers who file jointly are exempt from paying state taxes on their Social Security benefits if their federal AGI is below $60,000. Colorado. People under 65 who receive Social Security benefits can exclude up to $20,000 of benefits from their state taxable income. Recipients 65 and older can exclude up to $24,000 ...

Is SSDI income taxed?

In the following states, SSDI income is taxed according to the taxpayer's federally adjusted gross income ( AGI ). However, some states exempt recipients whose income falls under certain thresholds. For more information, you can click on the state to be directed to its tax authority.

Is Social Security taxable?

Social Security payment s from Social Security Disability Insurance (SSDI) may be taxable in your state. The majority of states, however, exempt disability benefits from state taxation. (Also, read about when you have to pay federal taxes on your disability benefits .)

Does New Mexico have a Social Security exemption?

New Mexico. New Mexico doesn't exempt Social Security benefits, but does provide a small exemption for people who have low income or are over 65. You may be eligible for other disability-related income deductions or credits in these states. For more information, contact your tax professional.

Is Social Security income taxed?

Social Security benefits are not taxed for disability recipients who have a federal AGI of less than $85,000 ($100,000 for married couples). In all the instances above, any taxable Social Security benefits are taxed at that state's income tax rate. You may be eligible for other income deductions or credits in your state.