Which states don't tax Social Security benefits?

37 States That Don’t Tax Social Security Benefits

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

What is exempt from New Jersey income taxes?

The New Jersey Gross Income Tax rate increased to 10.75% on income over $1 million. For Tax Year 2020, you may be eligible to exclude a maximum amount of pension and/or other retirement income of $100,000. See Income Exclusions for more information. Three lines have been added to the NJ-1040 for the 2020 return:

Does NJ tax federal pensions?

“New Jersey does not tax U.S. military pensions or survivorship benefits.” But that exemption does not apply to civil service pensions or annuities, even if it’s based on military service ...

What state does not tax Social Security?

What states do not tax Social Security benefits? Quick Facts. Alaska and New Hampshire are the only states with no sales, income or Social Security tax. Alaska also pay a dividend each year from the Alaska Permanent Fund (PFD) and in 2019 it was $1,606 per resident. What is the highest paying state for disability?

Does New Jersey tax pensions and Social Security?

Overview of New Jersey Retirement Tax Friendliness Social Security is not taxed at the state level in New Jersey. State income taxes will also be low for any retirees with income from retirement accounts and pensions below $75,000 for single filers or $100,000 for joint filers.

What is the tax rate on pensions in NJ?

Total Income of $100,001 - $150,000Total Income% of Taxable PensionFiling Status$100,001 - $125,00037.5 %Single/head of household/qualifying widow(er)$125,001 - $150,00025 %Married filing jointly12.5 %Married filing separately18.75 %Single/head of household/qualifying widow(er)3 more rows

When did NJ stop taxing Social Security?

New Jersey does not tax Social Security benefits or military pensions. Since 2000, New Jersey has provided taxpayers a pension and retirement income exclusion.

At what age do you stop paying property taxes in NJ?

age 65 or olderEligibility Requirements and Income Guidelines You must be age 65 or older, or disabled (with a Physician's Certificate or Social Security document) as of December 31 of the pretax year.

Is New Jersey a good state to retire in?

NEW JERSEY -- New Jersey was ranked as the country's worst state to retire in, according to personal finance website WalletHub's annual list of Best States to Retire....New Jersey Is 2022's Worst State to Retire – WalletHub Study.Overall Rank50StateNew JerseyTotal Score40.27Affordability49Quality of Life344 more columns•Jan 29, 2022

Is Social Security taxed after age 70?

Bottom Line. Yes, Social Security is taxed federally after the age of 70. If you get a Social Security check, it will always be part of your taxable income, regardless of your age.

Is NJ tax friendly for retirees?

For example, married seniors filing a joint return can exclude up to $100,000 of income from a pension, annuity, IRA, or other retirement plan if their New Jersey income is $100,000 or less. Single taxpayers and married taxpayers filing a separate return can exclude up to $75,000 and $50,000, respectively.

Why is Social Security taxed twice?

The rationalization for taxing Social Security benefits was based on how the program was funded. Employees paid in half of the payroll tax from after-tax dollars and employers paid in the other half (but could deduct that as a business expense).

Do seniors pay taxes on Social Security income?

Many seniors are surprised to learn Social security (SS) benefits are subject to taxes. For retirees who are still working, a part of their benefit is subject to taxation. The IRS adds these earnings to half of your social security benefits; if the amount exceeds the set income limit, then the benefits are taxed.

Is NJ Senior Freeze taxable?

This property tax relief program does not actually freeze your taxes, but will reimburse you for any property tax increases you have once you're in the program.

What age is considered senior citizen in New Jersey?

Among those eligible for consideration are persons 65 and older, or blind, or disabled as defined by the Social Security Administration.

What is the income limit for senior freeze in NJ?

Income Limit Your total annual income (combined if you were married or in a civil union and lived in the same home) was: 2020 – $92,969 or less; and. 2021 – $94,178 or less.

How much of your Social Security is taxable?

Under federal rules, a portion of your Social Security benefits may be taxable up to a maximum of 85 percent , said Cynthia Fusillo, a certified public accountant with Lassus Wherley in New Providence.

Is Social Security taxed in New Jersey?

Social Security benefits are exempt from income tax in New Jersey. In fact, the benefits aren't even reported anywhere on the state return. But the federal rules for Social Security taxability are quite different. Let's review the rules.

How many states tax Social Security?

Thirteen states tax Social Security benefits, a matter of significant interest to retirees. Each of these states has its own approach to determining what share of benefits is subject to tax, though these provisions can be grouped together into a few broad categories. Today’s map illustrates these approaches.

Which states have a Social Security exemption?

Kansas provides an exemption for such benefits for any taxpayer whose AGI is $75,000, regardless of filing status. Minnesota provides a graduated system of Social Security subtractions which kick in if someone’s provisional income is below $81,180 (single filer) or $103,930 (filing jointly). Missouri allows a 100 percent Social Security exemption ...

What is the exemption for Social Security in Missouri?

Missouri allows a 100 percent Social Security exemption as long as the taxpayer is 62 or older and has less than $85,000 (single filer) or $100,000 (filing jointly) in annual income. Nebraska allows single filers with $43,000 in AGI or less ($58,000 married filing jointly) to subtract their Social Security income.

What is taxable income?

Taxable income is the amount of income subject to tax, after deductions and exemptions.

How much can I deduct from my Social Security in North Dakota?

North Dakota allows taxpayers to deduct taxable Social Security benefits if their AGI is less than $50,000 (single filer) or $100,000 (filing jointly).

When will West Virginia stop paying Social Security taxes?

West Virginia passed a law in 2019 to begin phasing out taxes on Social Security for those with incomes not exceeding $50,000 (single filers) or $100,000 (married filing jointly). Beginning in tax year 2020, the state exempted 35 percent of benefits for qualifying taxpayers. As of 2021, that amount increased to 65 percent, and in 2022, ...

Does Utah tax Social Security?

Utah taxes Social Security benefits but uses tax credits to eliminate liability for beneficiaries with less than $30,000 (single filers) or $50,000 (joint filers), with credits phasing out at 2.5 cents for each dollar above these thresholds. Until this year, Utah’s credits mirrored the federal tax code, where the taxable portion ...

Is an IRA withdrawal taxable in New Jersey?

An IRA withdrawal is not taxable if the distribution you receive was derived entirely from New Jersey municipal, county, or State debt (bonds) that is exempt from New Jersey Income Tax. For more information, see Exempt Obligations.

Does New Jersey tax military pensions?

New Jersey does not tax U.S. military pensions or survivor’s benefits, regardless of your age or disability status. Do not include such payments on your New Jersey return.

Does New Jersey have a property tax relief program?

Many retirees live on a fixed income. New Jersey offers two property tax relief programs to help them remain in their New Jersey homes. You must apply annually for both programs maintain eligibility.

Is pension income taxable?

In general, pension and annuity income received by a survivor or beneficiary, whether in the form of periodic payments or in a lump sum, are taxable if they exceed the decedent’s previously taxed contributions.

What age do you have to be to receive Social Security?

Social Security and Railroad Retirement benefits; Pension payments received because of permanent and total disability before age 65. However, the year you reach age 65, your disability pension is treated as ordinary pension income and must be reported; Military pensions and survivor’s benefit payments, regardless of your age or disability status.

What is considered taxable retirement income?

Taxable pensions include all state and local government, teachers', and federal pensions, as well as employee pensions and annuities from the private sector and Keogh plans.

Is GIT 2 taxable?

GIT-2. If you were not required to contribute to your retirement plan while you were working, it is a noncontributory plan. All the amounts you receive from that plan are fully taxable. If you were required to contribute to your retirement plan, it is a contributory plan.

Is military pension taxable?

Military pensions are those resulting from service in the Army, Navy, Air Force, Marine Corps, or Coast Guard. However, civil service pensions and annuities are taxable, even if they are based on credit for military service.

Can you use retirement exclusions if you are 62?

However, if you (and/or your spouse/civil union partner if filing jointly) were 62 or older or disabled , you may be able to use the retirement exclusions to reduce your taxable income. Retirement plans are either noncontributory or contributory. The amounts you report depend on the type of plan you have.

Is NJ income tax taxable?

NJ Income Tax – Retirement Income. If you are a New Jersey resident, your pensions, annuities, and certain IRA withdrawals are taxable and must be reported on your New Jersey tax return. However, the taxable amount you report for federal tax purposes may not be the same as the amount you report for New Jersey purposes.

What is the taxable portion of Social Security?

Under the federal tax code, the taxable portion of Social Security income depends on two factors: a taxpayer’s filing status and the size of his “combined income” (adjusted gross income + nontaxable interest + half of Social Security benefits). In general, if a taxpayer has other sources of income and a combined income of at least $25,000 ...

Which states have a Social Security exemption?

Kansas provides an exemption for such benefits for any taxpayer whose AGI is $75,000, regardless of filing status. Minnesota provides a graduated system of Social Security subtractions which kick in if someone’s provisional income is below $81,180 (single filer) or $103,930 (filing jointly). Missouri allows a 100 percent Social Security exemption ...

How much can I deduct from my Social Security in North Dakota?

North Dakota allows taxpayers to deduct taxable Social Security benefits if their AGI is less than $50,000 (single filer) or $100,000 (filing jointly).

When will West Virginia start phasing out Social Security?

West Virginia passed a law in 2019 to begin phasing out taxes on Social Security for those with incomes not exceeding $50,000 (single filers) or $100,000 (married filing jointly). Beginning in tax year 2020, the state exempts 35 percent of benefits for qualifying taxpayers.

Does New Mexico have a Social Security tax credit?

It should be noted that the state also provides a nonrefundable retirement tax credit (this does not apply to survivor or disability Social Security benefits). New Mexico includes social security benefits in its definition of income. Several states reduce the level of taxation applied to Social Security benefits depending on things like age ...

Only 12 states actually levy a tax on Social Security benefits

Ward Williams is an Associate Editor with over four years of professional editing, proofreading, and writing experience. Ward is also an expert on government and policy as well as company profiles. He received his B.A. in English from North Carolina State University and his M.S. in publishing from New York University.

Understanding Taxes on Social Security Benefits

Since 1983, Social Security payments have been subject to taxation by the federal government. 5 How much of a person’s benefits are taxed will vary, depending on their combined income (defined as the total of their adjusted gross income (AGI), nontaxable interest, and half of their Social Security benefits) and filing status.

Social Security Benefit Taxation by State

Out of all 50 states in the U.S., 38 states and the District of Columbia do not levy a tax on Social Security benefits. 2 Of this number, nine states—Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming—do not collect state income tax, including on Social Security income. 8

Are States That Tax Social Security Benefits Worse for Retirees?

Including Social Security benefits in taxable income doesn’t make a state a more expensive place to retire.

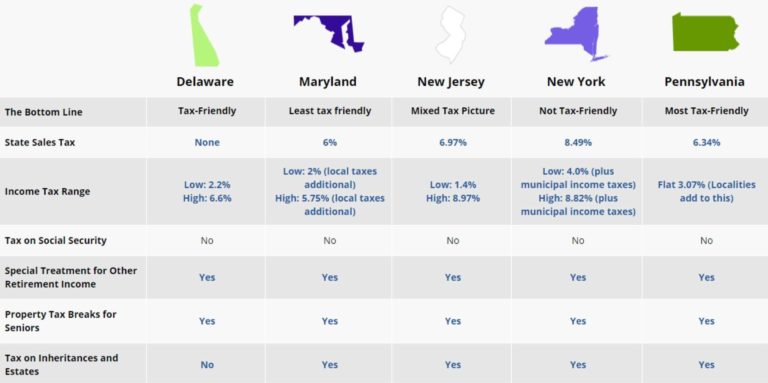

Which state is the most tax-friendly for retirees?

Although there’s no official measure of tax friendliness, Delaware is a strong contender for the best state for retirees when it comes to taxes. The First State levies neither state or local sales tax, nor estate or inheritance tax. 40 41 Delaware’s median property tax rate is also one of the lowest in the U.S.

At what age is Social Security no longer taxable?

Whether or not a person’s Social Security benefits are taxable is determined not by their age but by their income—the amount that’s subject to taxation is referred to as “combined income” by the Social Security Administration. 1

The Bottom Line

Although low taxes shouldn’t be the sole motivating factor when deciding on a long-term residence, you still should be aware of which taxes the local government levies so as not to be caught unprepared when your next tax bill rolls in. State taxes on Social Security income can take a significant bite out of your retirement income.