Is SSI considered unearned income?

Supplemental Security Income (SSI) benefits are only provided to claimants who have very limited income and resources. Both earned and unearned income is considered in the resource and income calculations, which means if a claimant has too much unearned income they will not qualify for SSI benefits.

How much money can you make and still get SSI?

- You were eligible for SSI monthly payments for at least one month.

- You are disabled.

- You meet all non-disability eligibility guidelines for SSI.

- You must have Medicaid coverage to continue working.

- Your gross earnings are insufficient to replace SSI, Medicaid, and publicly-funded care services.

Does working past age 70 affect your Social Security benefits?

While working past age 70 could mean higher Social Security benefits, it could also mean higher taxes and more.

Is unearned income subject to Medicare tax?

Medicare taxes: • The Net Investment Income Tax. A 3.8% surtax on unearned income • The Additional Medicare Tax. An additional 0.9% Medicare tax that will be levied on wages Net Investment Income Tax First, let’s review the new 3.8% surtax on unearned income that took effect on January 1, 2013. The tax will be applied against the lesser ...

Do I have to report unearned income to Social Security?

Do I have to report my earnings to Social Security? Yes. If you work and get SSI, then you must report your earnings. If you have a representative payee, then your representative payee must report your earnings.

What type of income will reduces Social Security benefits?

If you are younger than full retirement age and earn more than the yearly earnings limit, we may reduce your benefit amount. If you are under full retirement age for the entire year, we deduct $1 from your benefit payments for every $2 you earn above the annual limit. For 2022, that limit is $19,560.

What income does not count against Social Security?

People can earn $50,520 before reaching full retirement age without affecting their benefits. And the amount of reduction is also just $1 for every $3 earned over the cap. In addition, income only counts against the cap until the month before full retirement age is reached.

What is considered unearned income for Social Security?

Unearned Income is all income that is not earned such as Social Security benefits, pensions, State disability payments, unemployment benefits, interest income, dividends and cash from friends and relatives.

Does passive income affect Social Security benefits?

Having a stream of passive income should not affect your claim for, or receipt of, Social Security disability benefits, as long as the income is truly passive. That means that you must be prepared to show that the income you receive is not the result of work activity.

What income is Social Security based on?

Social Security replaces a percentage of your pre-retirement income based on their lifetime earnings. The portion of your pre-retirement wages that Social Security replaces is based on your highest 35 years of earnings and varies depending on how much you earn and when you choose to start benefits.

Is unearned income taxable?

While unearned income is frequently subject to taxes, it is typically not subject to payroll taxes. For example, earned interest is not subject to payroll taxes, but is frequently subject to a capital gains tax. Unearned income also is not subject to employment taxes, like Social Security and Medicare taxes.

What is unearned income?

Unearned Income. Unearned income includes investment-type income such as taxable interest, ordinary dividends, and capital gain distributions. It also includes unemployment compensation, taxable social security benefits, pensions, annuities, cancellation of debt, and distributions of unearned income from a trust.

How much unearned income do I have to file taxes?

Criteria for Filing Taxes as a Dependent in 2019 If you're a single or married dependent under age 65, you need to file taxes if any of these are true: Unearned income more than $1,100. Earned income more than $12,200.

Does unearned income count?

Unearned income works differently than earned income. You don't have to pay any payroll taxes, including Social Security and Medicare, on the various forms of unearned income. However, your unearned income (line 37 of your Form 1040) will count toward your adjusted gross income on your state and federal tax returns.

What is the maximum amount you can earn while collecting Social Security in 2021?

How Much Can I Earn and Still Collect Social Security? If you start collecting benefits before reaching full retirement age, you can earn a maximum of $18,960 in 2021 ($19,560 for 2022) and still get your full benefits. Once you earn more, Social Security deducts $1 from your benefits for every $2 earned.

How much money can you have in bank on SSI?

$2,000WHAT IS THE RESOURCE LIMIT? The limit for countable resources is $2,000 for an individual and $3,000 for a couple.

Why Is Income Important in The SSI Program?

Generally, the more countable income you have, the less your SSI benefit will be. If your countable income is over the allowable limit, you cannot...

What Income Does Not Count For Ssi?

Examples of payments or services we do not count as income for the SSI program include but are not limited to:the first $20 of most income received...

How Does Your Income Affect Your SSI Benefit?

Step 1: We subtract any income that we do not count from your total gross income. The remaining amount is your "countable income".Step 2: We subtra...

Example A – SSI Federal Benefit With only Unearned Income

Total monthly income = $300 (Social Security benefit)1) $300 (Social Security benefit) -20 (Not counted) =$280 (Countable income)2) $750 (SSI Feder...

Example B – SSI Federal Benefit With only Earned Income

Total monthly income = $317 (Gross wages)1) $317 (Gross wages) -20 (Not counted) $297 -65 (Not counted) =$232 divided by 1/2 =$116 (Countable income)

Example C – SSI Federal Benefit and State Supplement With only Unearned Income

The facts are the same as example A, but with federally administered State supplementation.1) $300 (Social Security benefit) -20 (Not counted) =$28...

Example D – SSI Federal Benefit and State Supplement With only Earned Income

Total monthly income = $317 (Gross wages)1) $317 (Gross wages) -20 (Not counted) $297 -65 (Not counted) $232 divided by 1/2 =$116 (Countable income...

How Will Windfall Offset Affect My Benefit?

Windfall offset occurs when we reduce your retroactive Social Security benefits if you are eligible for Social Security and SSI benefits for the sa...

When Does Deemed Income Apply?

When a person who is eligible for SSI benefits lives with a spouse who is not eligible for SSI benefits, we may count some of the spouse's income i...

When Does Deemed Income Not Apply?

When you no longer live with a spouse or parent.When a disabled or blind child attains age 18. When an alien's sponsorship ends.

What is the purpose of Social Security?

The Social Security Administration (SSA) keeps a record of your earned income from year to year, and the portion of your income that is subject to Social Security taxes is used to calculate your benefits in retirement. The more you earned while working (and the more you paid into the Social Security system through tax withholding), ...

How many years do you have to pay Social Security?

If you paid into the system for more than 35 years, then the Social Security Administration uses only your 35 highest-earning years and does not include any others in its formula. If you did not pay into the system for at least 35 years, then a value of $0 is substituted for any missing years. 3. After you apply for benefits, these earnings are ...

What is the full retirement age for a person born in 1943?

4 The full retirement age for anyone born from 1943 to 1954 is 66. For people born after 1954, the age rises by two months annually until it hits 67 for anyone born in 1960 or later. 5.

Is Social Security income taxable?

Is Social Security Taxable? Your income from Social Security can be partially taxable if your combined income exceeds a certain amount. “Combined income” is defined as your gross income plus any nontaxable interest that you earned during the year, plus half of your Social Security benefits. For example, if you’re married, file a joint tax return ...

What happens if you start collecting Social Security benefits earlier?

However, once you reach full retirement age, Social Security will recalculate your benefit to make up for the money it withheld earlier.

What happens to Social Security after you reach full retirement age?

After you reach full retirement age, Social Security will recalculate your benefit and increase it to account for the benefits that it withheld earlier. 7 .

How much can I deduct from my Social Security if I earn more than $50,520?

If you earn more than $50,520, it deducts $1 for every $3 you earn—but only during the months before you reach full retirement age. Once you reach full retirement age, you can earn any amount of money, and it won't reduce your monthly benefits. 3 . Note, however, that this money is not permanently lost. After you reach full retirement age, Social ...

How much can I deduct from my Social Security?

If you haven't reached full retirement age, Social Security will deduct $1 from your benefits for every $2 or $3 you earn above a certain amount. After you reach full retirement age, Social Security will increase your benefits to account ...

What is the full retirement age?

What Is Full Retirement Age? For Social Security purposes, your full or "normal" retirement age is between age 65 and 67, depending on the year you were born. If, for example, your full retirement age is 67, you can start taking benefits as early as age 62, but your benefit will be 30% less than if you wait until age 67. 4 . ...

How many Social Security credits will I get in 2021?

In 2021, you get one credit for each $1,470 of earnings, up to a maximum of four credits per year. That amount goes up slightly each year as average earnings increase. 3 . Social Security calculates your benefit amount based on your earnings over the years, whether you were self-employed or worked for another employer.

How many hours can I work to reduce my Social Security?

If you are younger than full retirement age, Social Security will reduce your benefits for every month you work more than 45 hours in a job (or self-employment) that's not subject to U.S. Social Security taxes. That applies regardless of how much money you earn.

What is unearned income?

Unearned Income is all income that is not earned such as Social Security benefits, pensions, State disability payments, unemployment benefits, interest income, dividends and cash from friends and relatives. In-Kind Income is food, shelter, or both that you get for free or for less than its fair market value.

What is income in SSI?

Income is any item an individual receives in cash or in-kind that can be used to meet his or her need for food or shelter. Income includes, for the purposes of SSI, the receipt of any item which can be applied, either directly or by sale or conversion, to meet basic needs of food or shelter. Earned Income is wages, net earnings from ...

What are some examples of payments or services that do not count as income for the SSI program?

Examples of payments or services we do not count as income for the SSI program include but are not limited to: the first $20 of most income received in a month; the first $65 of earnings and one–half of earnings over $65 received in a month; the value of Supplemental Nutrition Assistance Program (food stamps) received;

What is considered in-kind income?

In-Kind Income is food, shelter, or both that you get for free or for less than its fair market value. Deemed Income is the part of the income of your spouse with whom you live, your parent (s) with whom you live, or your sponsor (if you are an alien), which we use to compute your SSI benefit amount.

Can I get SSI if my income is over the limit?

Generally, the more countable income you have, the less your SSI benefit will be. If your countable income is over the allowable limit, you cannot receive SSI benefits. Some of your income may not count as income for the SSI program.

How does earned income affect SSI?

There are two steps to determine how your earned income will affect your SSI benefits: Step one: The SSA will subtract any income it does not count from your total gross income. The remaining amount is “countable income.”. Step two: The SSA will subtract your countable income from the SSI Federal benefit rate.

What is the maximum amount of income you can make to qualify for SSI?

As of January 2018, the monthly maximum Federal amount of income you can make and still qualify for SSI is: $750 for an eligible individuals.

What happens if a recipient pays less than his or her fair share?

If a recipient pays less than his or her fair share, the SSA may reduce the recipient’s disability benefits. The SSA uses one of the following rules to determine how in-kind support affects a recipient’s benefits:

How much is SSA tax for each child?

However, if the couple has children who reside in the home, a portion of the spouse’s income can be excluded from the deemed income amount. The SSA excludes $368 of the spouse’s income for each child. There may be additional deductions from the spouse’s income.

What are public needs based benefits?

Public needs-based benefits. Loans that you have to repay. Income tax refunds. A portion of a recipient’s wages. Impairment-related work expenses. Small amounts of income that is received infre quently or irregularly. Income that the recipient sets aside to become self-sufficient. Disaster assistance.

What is earned income?

Earned Income. Earned income is the amount of money you have made from working, including your wages, net earnings from self-employment and certain royalties. The amount of earned income you make is important when determining your SSI benefits.

Can I receive Social Security if my monthly income is over $1,180?

A person who is receiving SSI cannot have income that exceeds certain limits. As of 2018, you cannot receive SSI benefits if your monthly earnings exceed $1,180. However, the Social Security Administration (SSA) does not consider all income toward the SSI limit.

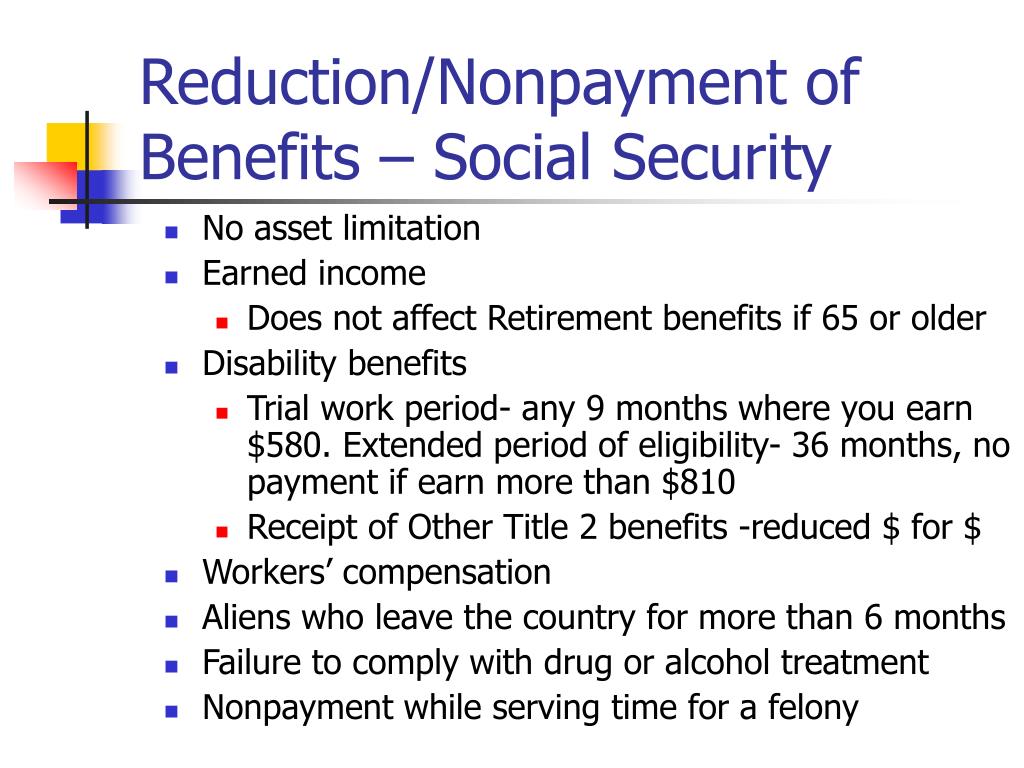

What is earned income for a DIB?

For DIB recipients, earned income is limited to a specific substantial gainful activity (SGA) amount after a recipient completes the program’s trial work and extended eligibility periods. Unearned income is all other income, including gifts, interest, inheritances, pension payments, disability insurance benefits and veterans payments. For DIB recipients, unearned income is unlimited and only some forms reduce DIB payments.

Is wealth an issue for DIB recipients?

As opposed to Supplemental Security Income (SSI) beneficiaries, building wealth is not an issue for DIB recipients, because these benefits are not income-based. Additionally, there are no restrictions on savings or assets.

Do you lose your DIB if you have unearned income?

However, this is not true for excluded unearned income.

Does unearned income reduce DIB?

Outside of workers’ compensation , some other state disability benefits and government pensions, all other unearned income will not reduce DIB payment s. So, if DIB recipients earn money from selling items or from interest gained on investments, this unearned income is excluded from calculation of their DIB payments.