Can the unemployed get Medicaid?

Can the Unemployed Get Medicaid? People who have lost their jobs, for whatever reason, may be eligible for health coverage through Medicaid. Medicaid provides basic health insurance for tens of millions of Americans with a limited ability to pay.

Are pandemic unemployment benefits counted as income for Medicaid?

Pandemic Unemployment Benefits will be disregarded in determining eligibility for Medicaid. The Stimulus Payments provided under the CARES Act are not countable as income for both Modified Adjusted Gross Income and non-MAGI determinations. Additionally, the Stimulus Payment is an exempt resource for non-MAGI applicants for 12 months.

Does unemployment count as income for health insurance?

Unemployment payments count as income, and so do withdrawals from a 401(k) or IRA account. The HealthCare.gov website says calculating your adjusted gross income gives you a good estimate. If your family income is too much for Medicaid, you may still qualify to buy a low-cost policy in the Affordable Care Act's insurance marketplace.

Does extra $600 a week unemployment count as income for Medicaid?

But the $600 a week in extra federal unemployment stimulus, created by the CARES Act and available through July 31, doesn’t count as income in determining Medicaid eligibility. However, it is taken into consideration for SNAP.

What is the maximum Pandemic Emergency Unemployment Compensation benefits (PEUC) eligibility in weeks?

No PEUC is payable for any week of unemployment beginning after April 5, 2021. In addition, the length of time an eligible individual can receive PEUC has been extended from 13 weeks to 24 weeks.

Can I get unemployment assistance if I am partially employed under the CARES Act?

A gig economy worker, such as a driver for a ride-sharing service, is eligible for PUA provided that he or she is unemployed, partially employed, or unable or unavailable to work for one or more of the qualifying reasons provided for by the CARES Act.

How suitable employment is connected to unemployment insurance eligibility?

Most state unemployment insurance laws include language defining suitable employment. Typically, suitable employment is connected to the previous job’s wage level, type of work, and the claimant’s skills.Refusing an offer of suitable employment (as defined in state law) without good cause will often disqualify individuals from continued eligibility for unemployment compensation.

Are individuals eligible for PUA if they quit their job because of the COVID-19 pandemic?

There are multiple qualifying circumstances related to COVID-19 that can make an individual eligible for PUA, including if the individual quits his or her job as a direct result of COVID-19. Quitting to access unemployment benefits is not one of them.

Can I remain on unemployment if my employer has reopened?

No. As a general matter, individuals receiving regular unemployment compensation must act upon any referral to suitable employment and must accept any offer of suitable employment. Barring unusual circumstances, a request that a furloughed employee return to his or her job very likely constitutes an offer of suitable employment that the employee must accept.

What is the Pandemic Emergency Unemployment Compensation Program for COVID-19?

See full answerTo qualify for PUA benefits, you must not be eligible for regular unemployment benefits and be unemployed, partially unemployed, or unable or unavailable to work because of certain health or economic consequences of the COVID-19 pandemic. The PUA program provides up to 39 weeks of benefits, which are available retroactively starting with weeks of unemployment beginning on or after January 27, 2020, and ending on or before December 31, 2020.The amount of benefits paid out will vary by state and are calculated based on the weekly benefit amounts (WBA) provided under a state's unemployment insurance laws.

What if an employee refuses to come to work for fear of infection?

Your policies, that have been clearly communicated, should address this.Educating your workforce is a critical part of your responsibility.Local and state regulations may address what you have to do and you should align with them.

Are self-employed, independent contractor and gig workers eligible for the new COVID-19 unemployment benefits?

See full answerSelf-employed workers, independent contractors, gig economy workers, and people who have not worked long enough to qualify for the other types of unemployment assistance may still qualify for PUA if they are otherwise able to work and available for work within the meaning of the applicable state law and certify that they are unemployed, partially unemployed or unable or unavailable to work for one of the following COVID-19 reasons:You have been diagnosed with COVID-19, or have symptoms, and are seeking a medical diagnosis.A member of your household has been diagnosed with COVID-19.You are caring for a family member of a member of your household who has been diagnosed with COVID-19.A child or other person in your household for whom you have primary caregiving responsibility is unable to attend school or another facility that is closed as a direct result of COVID-19 and the school or facility care is required for you to work.

Is there additional relief available if my regular unemployment compensation benefits do not provide adequate support?

See full answerThe new law creates the Federal Pandemic Unemployment Compensation program (FPUC), which provides an additional $600 per week to individuals who are collecting regular UC (including Unemployment Compensation for Federal Employees (UCFE) and Unemployment Compensation for Ex-Servicemembers (UCX), PEUC, PUA, Extended Benefits (EB), Short Time Compensation (STC), Trade Readjustment Allowances (TRA), Disaster Unemployment Assistance (DUA), and payments under the Self Employment Assistance (SEA) program). This benefit is available for weeks of unemployment beginning after the date on which your state entered into an agreement with the U.S. Department of Labor and ending with weeks of unemployment ending on or before July 31, 2020.

What kinds of relief does the CARES Act provide for people who are about to exhaust regular unemployment benefits?

Under the CARES Act states are permitted to extend unemployment benefits by up to 13 weeks under the new Pandemic Emergency Unemployment Compensation (PEUC) program.

What does it mean to be unable to work, including telework for COVID-19 related reasons?

You are unable to work if your employer has work for you and one of the COVID-19 qualifying reasons set forth in the FFCRA prevents you from being able to perform that work, either under normal circumstances at your normal worksite or by means of telework.If you and your employer agree that you will work your normal number of hours, but outside of your normally scheduled hours (for instance early in the morning or late at night), then you are able to work and leave is not necessary unless a COVID-19 qualifying reason prevents you from working that schedule.

Who is considered to be essential worker during the COVID-19 pandemic?

Essential (critical infrastructure) workers include health care personnel and employees in other essential workplaces (e.g., first responders and grocery store workers).

Do unemployment payments count as income?

Unemployment payments count as income, and so do withdrawals from a 401 (k) or IRA account.

Does medicaid cover children?

Medicaid may cover your child even if it doesn't pay for you. If you try to qualify for Medicaid, it doesn't matter whether you're employed or not. What matters is that your income is low enough for you to qualify and that you meet whatever other standards your state imposes -- although Medicaid is a federal program, each state sets its own rules.

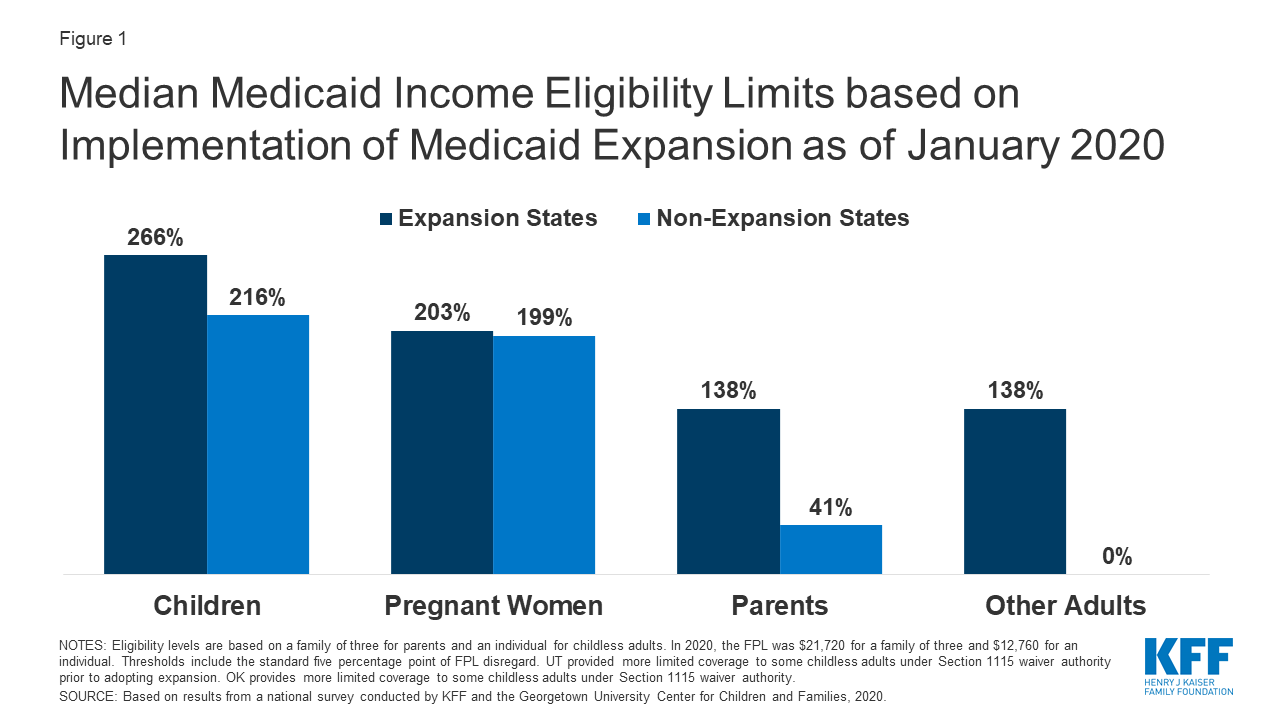

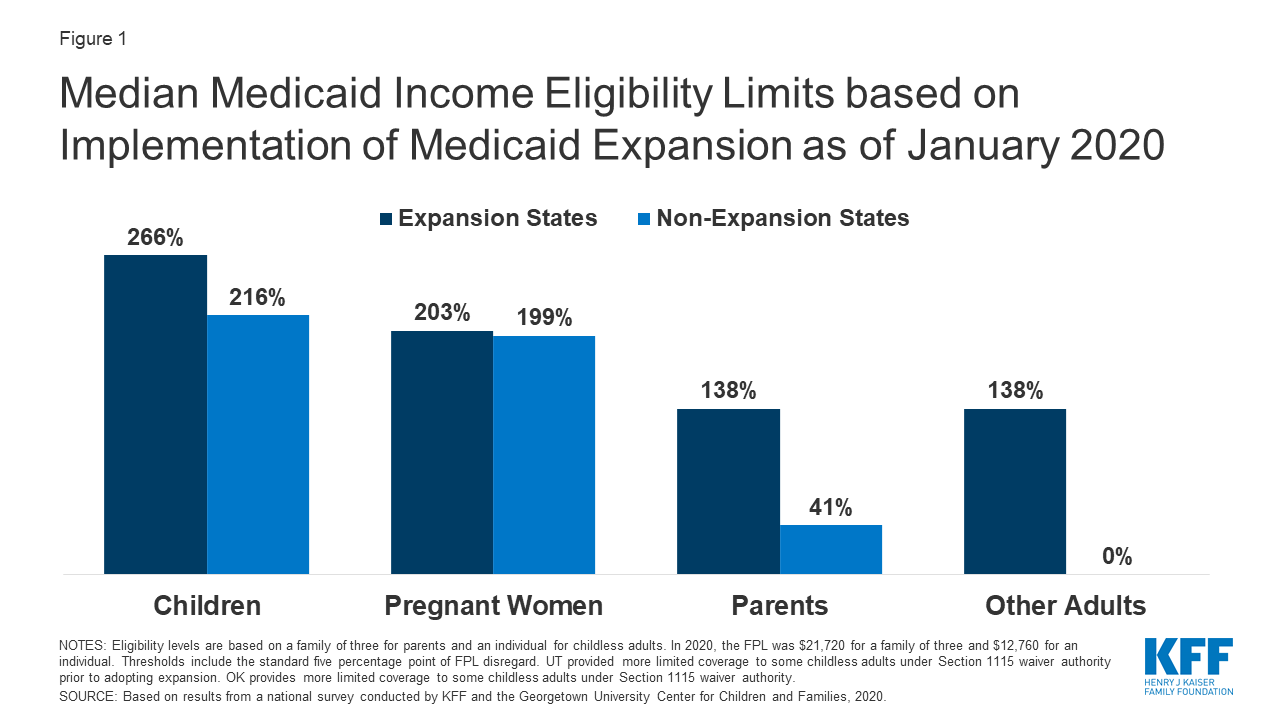

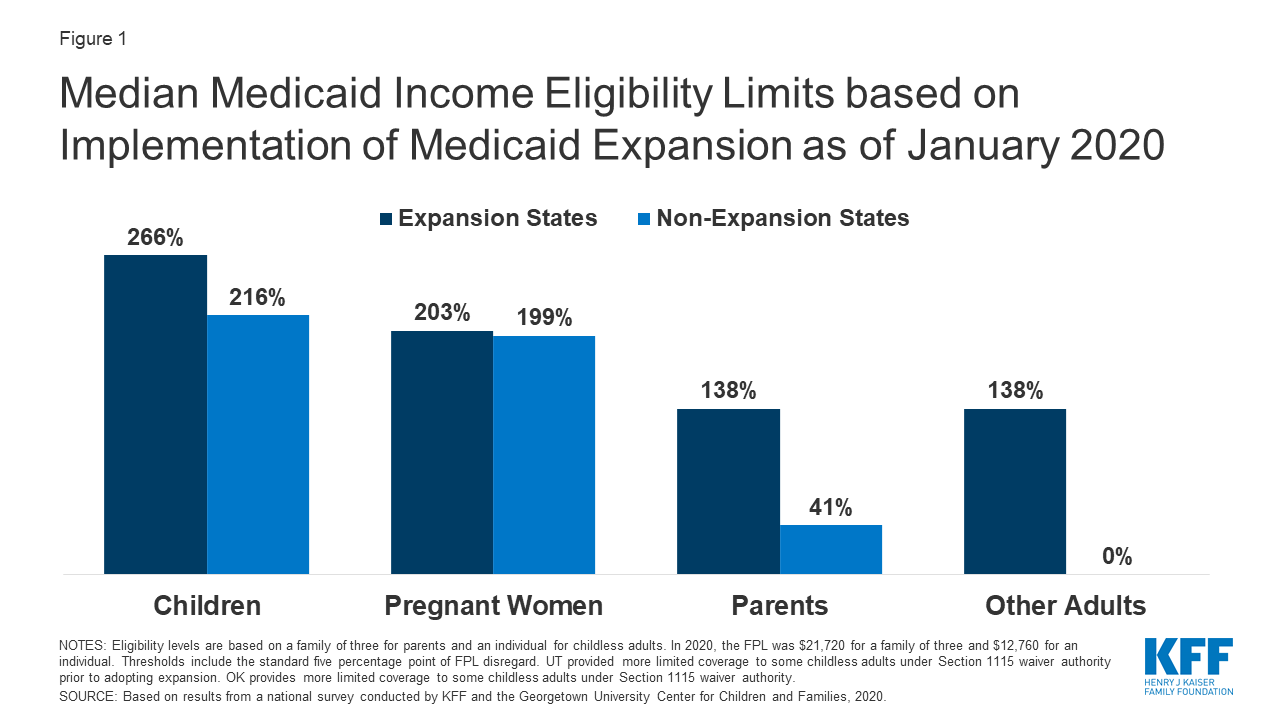

Can Medicaid be expanded to cover the poor?

Cut-Off Points. Under the federal Affordable Care Act, states can expand Medicaid to cover more of the poor and uninsured. Some states, at time of writing, have opted to reject the expansion. If a family of three, for instance, lives in an expansion state at time of writing, it may qualify for Medicaid if the family income is under $27,310.

When will unemployment end?

Federal unemployment compensation through the end of 2020. Both state and federal unemployment compensation and these were not included in the income eligibility calculation.

What percentage of Medicaid recipients are eligible for expansion?

In this case, the Medicaid expansion states would see 83 percent of their workers be eligible for some form of assistance, with 67 percent of their vulnerable populations being eligible for Medicaid. This would leave 17 percent unable to rely on any assistance.

When will the additional federal compensation be extended?

If the additional federal compensation was extended from the current 16 weeks through to the end of 2020 and still included in the income eligibility calculations, the population of workers eligible for subsidies would be lower than if policymakers did not make any changes at all. Eligibility would drop for both expansion and nonexpansion states.

Does unemployment affect Medicaid?

Unemployment Impacts Eligibility in Medicaid Expansion States. Workers in states that embraced Medicaid expansion would have a better chance of accessing healthcare coverage assistance if unemployment compensation were not included in the eligibility determinations, a recent Kaiser Family Foundation study found.

Is Medicaid affordable in expansion states?

This would make healthcare more affordable for Medicaid-eligible workers in Medicaid expansion states. In both Medicaid expansion and nonexpansion states, under the current law, a similar percentage of vulnerable workers are not eligible for any federal funding (around 30 percent). The percentage is slightly lower in Medicaid expansion states.

Can the Unemployed Get Medicaid?

People who have lost their jobs, for whatever reason, may be eligible for health coverage through Medicaid. Medicaid provides basic health insurance for tens of millions of Americans with a limited ability to pay.

Medicaid Provides Health Coverage for Low-Income Americans

Medicaid developed during the 1960s as a low-cost health insurance program for Americans with a limited ability to pay for care. Organized as a joint federal-state program, Medicaid operates somewhat differently in each of the 53 regions where it is available (50 states, plus the District of Columbia, Puerto Rico and Guam ).

Who Is Eligible for Medicaid?

Medicaid has somewhat different eligibility criteria in every territory and state, but all state-level programs use federal guidelines as a starting point for approval of applicants. As a rule, Medicaid enrollees must be:

Other Help for the Unemployed

Medicaid is not the only resource you might be eligible for if you have lost a job. Apart from your state’s unemployment compensation program, you could benefit from a range of support services intended to help financially struggling people get by until another job opens up. Programs you might consider looking into include:

How long does medicaid last?

Benefits also may be covered retroactively for up to three months prior to the month of application, if the individual would have been eligible during that period had he or she applied. Coverage generally stops at the end of the month in which a person no longer meets the requirements for eligibility.

How many people are covered by medicaid?

Medicaid is a joint federal and state program that, together with the Children’s Health Insurance Program (CHIP), provides health coverage to over 72.5 million Americans, including children, pregnant women, parents, seniors, and individuals with disabilities. Medicaid is the single largest source of health coverage in the United States.

What is Medicaid Spousal Impoverishment?

Spousal Impoverishment : Protects the spouse of a Medicaid applicant or beneficiary who needs coverage for long-term services and supports (LTSS), in either an institution or a home or other community-based setting, from becoming impoverished in order for the spouse in need of LTSS to attain Medicaid coverage for such services.

What is dual eligible for Medicare?

Eligibility for the Medicare Savings Programs, through which Medicaid pays Medicare premiums, deductibles, and/or coinsurance costs for beneficiaries eligible for both programs (often referred to as dual eligibles) is determined using SSI methodologies..

What is MAGI for Medicaid?

MAGI is the basis for determining Medicaid income eligibility for most children, pregnant women, parents, and adults. The MAGI-based methodology considers taxable income and tax filing relationships to determine financial eligibility for Medicaid. MAGI replaced the former process for calculating Medicaid eligibility, ...

What is Medicaid coverage?

Medicaid is the single largest source of health coverage in the United States. To participate in Medicaid, federal law requires states to cover certain groups of individuals. Low-income families, qualified pregnant women and children, and individuals receiving Supplemental Security Income (SSI) are examples of mandatory eligibility groups (PDF, ...

Does Medicaid require income?

Certain Medicaid eligibility groups do not require a determination of income by the Medicaid agency. This coverage may be based on enrollment in another program, such as SSI or the breast and cervical cancer treatment and prevention program.

What would happen if unemployment increased?

An increase in income from unemployment could reduce aid through programs like welfare, food stamps and Medicaid, or may render people ineligible for the programs. Rules differ between states and programs.

What is the poverty level for Medicaid?

States that expanded Medicaid under the Affordable Care Act generally set their income threshold at 138% of the poverty level — $1,436 a month for a single adult and $2,453 for a family of three, for example, Wagner said. Being just $1 over the threshold typically renders people ineligible.

How many people have applied for unemployment in March?

Nearly 41 million Americans have applied for jobless benefits since mid-March.

Do stimulus checks count as income?

Some aid recipients may be unaware of the potential interplay between expanded unemployment benefits and the social assistance they receive, especially since the one-time economic stimulus checks millions of Americans have received from the federal government don’t count as income toward these means-tested programs.

Does unemployment count as income?

That’s because unemployment benefits generally count as income ...

What does MAGI mean for Medicaid?

MAGI stands for Modified Adjusted Gross Income. The best way to figure it out is to work through the numbers backward. Start with your gross income, which is your total taxable income.

Does foreign earned income count as MAGI?

Foreign earned income needs to be added back into your gross income to calculate your MAGI. The second factor is exempt interest. When you are filing your income taxes, some interest you may receive throughout the year is exempt from you having to pay taxes on it as part of your income.

Do you have to include TANF income when applying for medicaid?

You do not have to include this income when applying for Medicaid. Types of non-taxable include may include child support, gifts, veterans’ benefits, insurance proceeds, beneficiary payments, AFDC payments, injury payments, relocation pay, TANF payments, workers’ compensation, federal income tax refunds, and SSI payments.