How to maximize social security with spousal benefits?

According to the Social Security Administration, you may qualify for spousal benefits if:

- Your spouse is already collecting retirement benefits.

- You have been married for at least a year.

- You are at least 62 years old (unless you are caring for a child who is under 16 or disabled).

Does WEP affect spousal benefits?

When the Windfall Elimination Provision (WEP) applies to the worker's benefit, spousal benefits payable on that record are also reduced. This is because spousal benefits are based on 50% of the worker's full retirement age benefit amount (PIA), so if WEP reduces the worker's PIA, the spousal benefit is reduced accordingly.

When spouse dies Social Security benefits?

- For individuals with a combined income of between $25,000 and $34,000, up to 50% of your benefits are taxable

- For individuals with a combined income of more than $34,000, up to 85% of your benefits are taxable

- For couples with a combined income of between $32,000 and $44,000, up to 50% of your benefits are taxable

How your spouse earns Social Security Survivors Benefits?

How your spouse earns Social Security Survivors Benefits Social Security work credits are based on your total yearly wages or self-employment income. You get one credit quarterly for every $1,470 dollars you earn in 2021, and you can earn up to four credits .

Are spousal benefits subject to Windfall Elimination Provision?

WEP (Windfall Elimination Provision) only affects the Social Security benefits payable on your own record, so it won't have any effect on your potential spousal benefits.

Does WEP affect widow benefits?

This amount is adjusted annually by the growth in average wages in the economy, provided a cost-of-living adjustment (COLA) is payable. The WEP affects retired- or disabled- worker beneficiaries and their eligible dependents. However, it does not affect survivor beneficiaries.

Does spouse apply WEP?

The family benefit payable to the spouse of a retired worker subject to the WEP is also reduced, but only while that worker is alive.

Who is affected by the Windfall Elimination Provision?

The overwhelming majority of those affected (about 95%) were retired workers. Approximately 3% of all Social Security beneficiaries (including disabled workers and dependent beneficiaries) and 4% of all retired- worker beneficiaries were affected by the WEP in December 2021.

Does windfall affect survivor benefits?

Windfall Elimination does not affect a Social Security survivor's benefit unless the survivor (often the widow) is also a retired government employee.

Who is exempt from WEP?

Workers who have 30 years of coverage (YOCs) are fully exempt from the Windfall Elimination Provision (WEP). Workers with 21 to 29 YOCs are eligible for a partial exemption.

Will WEP be eliminated in 2021?

H.R. 82, titled the “Social Security Fairness Act,” was introduced in the House of Representatives in January 2021. It aims to eliminate both the WEP and GPO.

Will WEP be repealed in 2021?

January 4, 2021, Congressman Rodney Davis (R-IL-13) introduced H.R. 82 to repeal the WEP and GPO. It is important that CalRTA continues to push our California Representatives to sign on as co-sponsors. Check the list of co-sponsors to see if your representative is listed.

Can I avoid the Windfall Elimination Provision?

The WEP can reduce eligible Social Security benefits by as much as 60%. It has a maximum deduction equal to one-half of your pension payment. To avoid the WEP, you'll need to work at least 30 years in a qualifying (Social Security-eligible) position with substantial earnings (for 2021, this is $26,500 or more).

What is the max WEP reduction for 2021?

$498For 2021, the maximum WEP reduction at full retirement age (FRA) is $498, up from $480 in 2020.

What is the maximum WEP reduction for 2020?

$480The maximum WEP reduction in 2020 is $480. The WEP reduction will never reduce your Social Security benefit to zero. If you have less than 20 years of “substantial earnings” in the Social Security system, the full $480 reduction applies.

What is the max WEP reduction for 2022?

$512The maximum Windfall Elimination Provision (WEP) deduction for 2022 is $512.

Does WEP or GPO affect survivor benefits?

Survivor benefits are not adjusted for the WEP . The GPO adjustment is calculated by subtracting two-thirds of the value of the noncovered-work pension from the pensioner's spouse or survivor benefit.

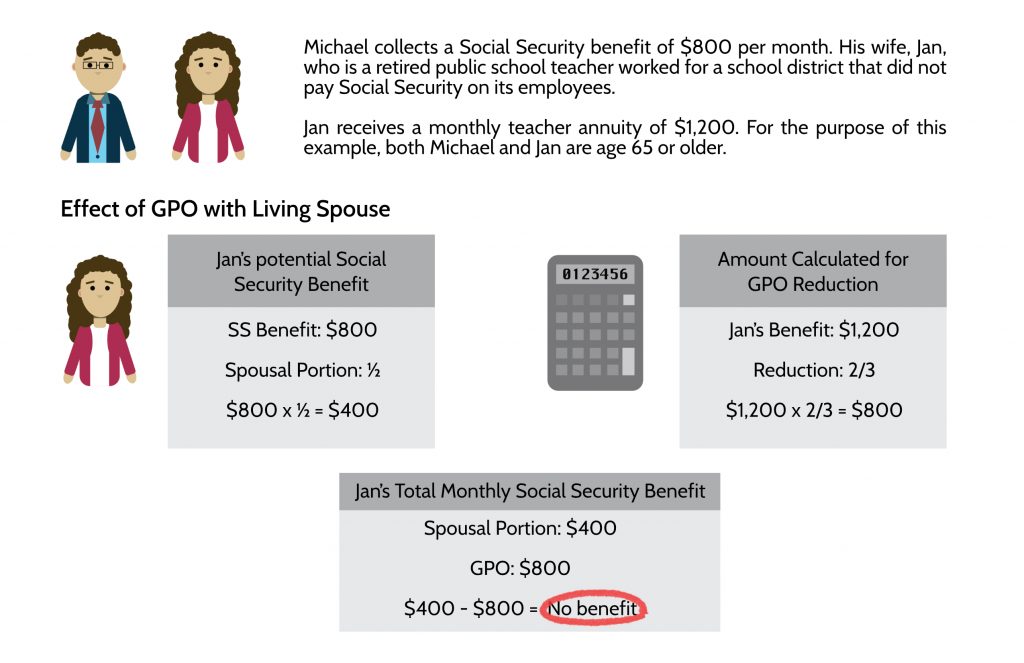

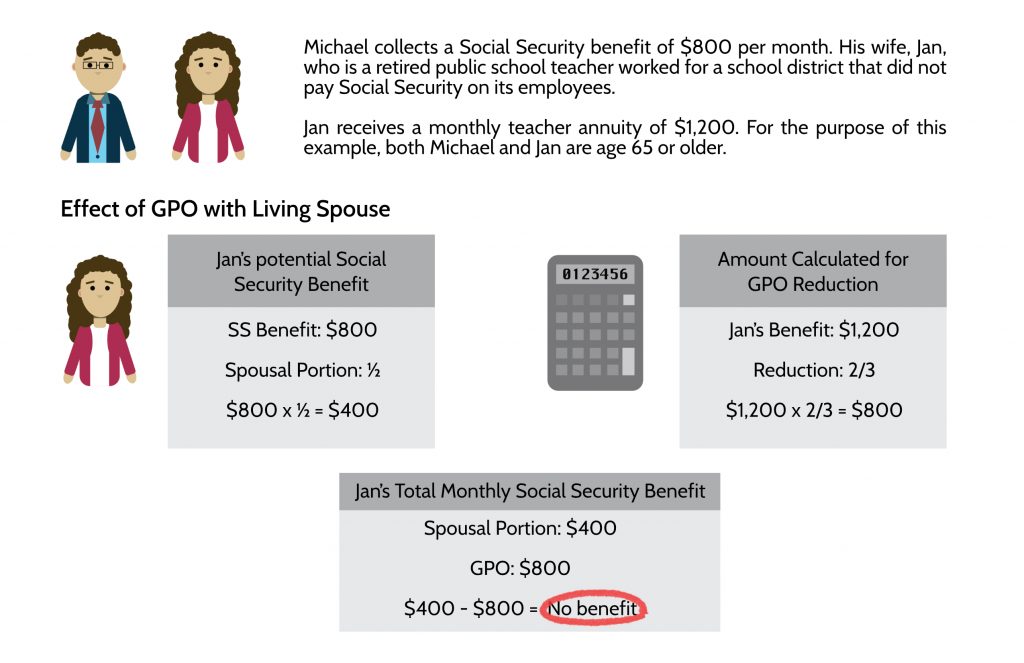

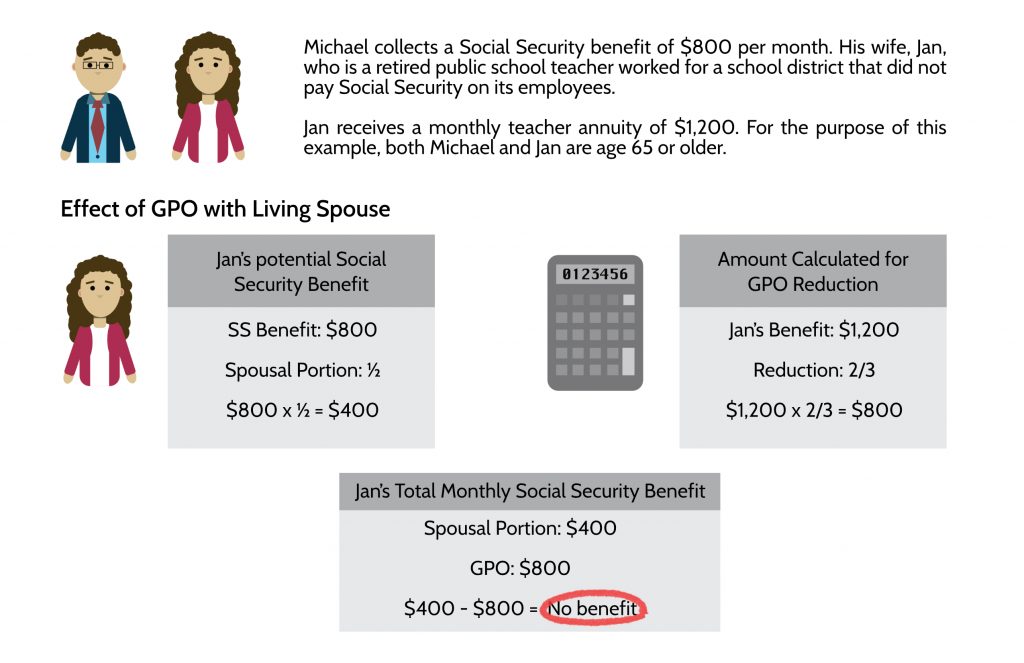

Does Government Pension Offset affect survivor benefits?

Key Takeaways. The Government Pension Offset (GPO) affects any worker with a government pension who also receives Social Security benefits through their spouse. The GPO reduces the amount of Social Security spousal or survivor benefits by two-thirds of the amount of the pension.

Can survivor benefits be reduced?

If you work while getting Social Security survivors benefits and are younger than full retirement age, we may reduce your benefits if your earnings exceed certain limits.

Can you collect retirement and survivor benefits?

Social Security allows you to claim both a retirement and a survivor benefit at the same time, but the two won't be added together to produce a bigger payment; you will receive the higher of the two amounts. You would be, in effect, simply claiming the bigger benefit.

What is the ELY benefit after WEP reduction?

Your full retirement age is 66 and 8 months. If your full retirement benefit is $1,396, your ELY benefit after the WEP reduction would be $916 ($1,396 - $480). *

What is WEP reduction?

The WEP reduction is limited to one-half of your pension from non-covered employment. The amounts in the chart do not reflect the effect of cost-of-living adjustments (COLA), early retirement, delayed retirement, or other factors.

How much does a full retirement increase?

If your retirement benefits start after your full retirement age (66 and 8 months) the benefit increases 8% for each year before age 70 that you delay retirement. If your benefits start at age 70, you get credit for the 40 additional months when you did not get benefits and your monthly benefit will be 26.67% higher.

Is WEP reduced based on age?

The monthly retirement benefits are increased or reduced based on your age after WEP reduces your ELY benefit.

Does WEP apply to Social Security?

If you paid Social Security taxes on 30 years of substantial earnings, WEP does not apply to you.

Does WEP reduction include future COLA increases?

The examples above apply only to benefits paid to the worker and do not include future COLA increases. The WEP reduction may be larger if family members qualify for benefits on the same record. However, the total WEP reduction is limited to one-half of the pension based on the earnings that were not covered by Social Security.

What is the effect of WEP on Social Security?

When your Social Security retirement benefit is subject to the Windfall Elimination Provision (WEP), you’re likely painfully aware of the reduction to your own benefit by this provision. What you may not be aware of is that the effect goes beyond your own benefit – your spouse’s and other dependents’ benefits are also impacted by this provision. However, the impact of WEP does not continue after your death.

How much is Danny's Social Security?

He is eligible for a Social Security benefit of $1,200 (before WEP impact) in addition to his government pension of $2,000 (monthly figures).

Does WEP affect Social Security?

The good news is that the impact of WEP does not reach beyond the grave. After the primary numberholder (Danny from our example above) has passed away, the pension based on the earnings not subject to Social Security taxes ceases to be paid to Danny. Even if Sandy receives a survivor pension from Danny’s government work, WEP will no longer impact any Social Security benefits that Sandy receives based upon Danny’s record. Danny’s PIA is restored to the former level, and the Survivor Benefit that Sandy is eligible to receive will be based upon the restored, $1,200/month PIA.

Does Danny's wife work outside the home?

Danny’s wife Sandy did not work outside the home. When Danny files for his own Social Security Benefit, Sandy is looking forward to receiving a Spousal Benefit based on Danny’s record. But Sandy will be surprised to find out that the amount of her Spousal Benefit will not be $600 per month (50% of Danny’s projected $1,200), but rather it will only be $396 per month. This is due to the fact that Danny’s PIA of $1,200 is reduced by WEP at the rate of $408/month (for 2014). Danny’s recalculated PIA therefore becomes $792 ($1,200 minus $408), and 50% of that figure is $396. (Both Danny and Sandy are at Full Retirement Age when benefits are applied for).

Does WEP affect PIA?

Since the PIA is recalculated and reduced by the WEP, all benefits based on that PIA are likewise reduced. This means that even though the WEP does not directly impact Spousal Benefits of an individual, the Spousal Benefit is still reduced since the PIA of the other spouse is impacted. This impact occurs regardless of whether ...

How does WEP work?

The WEP works by tweaking the formula Social Security uses to calculate your retirement benefit.

Can you cut your Social Security payment by half?

By law, the Windfall Elimination Provision cannot cut your Social Security payment by more than half of the amount of your monthly pension, and it cannot zero out your retirement benefit.

What happens if you no longer receive a pension that triggers WEP?

Not sure I’m fully understanding your question… But if you no longer were receiving a pension that triggers WEP, then WEP would no longer apply.

When will WEP be reduced in 2020?

says: August 16, 2020 at 9:13 am. Most likely your Canadian Social Insurance pension will cause a WEP reduction to your US Social Security benefit. If the Canadian pension is relatively small, the WEP guarantee will cap the reduction at no more than 50% of the amount of the Canadian pension.

What is WEP capped at?

WEP is capped at no more than 50% of the pension amount (if the pension is small), so if you give up the pension the most you’d increase your SS by eliminating WEP would be 50% of the pension amount. Kinda like cutting off your nose to spite your face – unless I’m missing something altogether in your situation.

When does WEP start in 2021?

June 21, 2021 at 3:31 pm. WEP is applied only when you are first both receiving SS benefits and the pension. So if you start your SS benefit at age 62, WEP will not apply since your pension doesn’t start until 65. At 65 however, WEP will be applied.

Does a pension based on work affect your Social Security?

In this case, the pension is not based on your work, it is based on your spouse’s work.

Is WEP based on your work?

In this case, the pension is not based on your work, it is based on your spouse’s work.

Will the SSA calculate the lump sum?

The SSA will likely calculate the lump sum as a series of payments over her lifetime, and reduce her Social Security benefit based on the calculated series. This is just my opinion, SSA will have to make the call on how to handle it.

What is WEP in Social Security?

Congress designed the Social Security Windfall Elimination Provision (WEP) to address those public sector workers whose state or local government jobs paid them pensions that were not subject to FICA taxes, along with private employers who similarly paid pensions without collecting FICA tax. Those state and local workers, along with private sector ...

When was the WEP passed?

The result was two significant pieces of legislation: the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO), both passed in 1983. You don't have to worry about the long-term viability of Social Security right now.

What did the Social Security reforms do?

Congress created both of these laws to reduce the Social Security benefits certain public sector workers collect. These reforms changed the formulas that determined the amount of benefits workers and their spouses and widow (er)s were able to collect. If you work in government or for an employer who does not collect FICA taxes, ...

What changes for the workers affected by the Windfall Elimination Provision?

What changes for the workers affected by the Windfall Elimination Provision is the percentage used for that first calculation. Instead of multiplying the first $996 of monthly earnings by 90%, the SSA uses a lower percentage. For people reaching 62 or becoming disabled in 1990 or later, the 90% factor goes down to as low as 40%. This chart provides the figures for the Windfall Elimination Provision in 2021.

When did WEP and GPO start?

The History of WEP and GPO. Beginning in 1981, the U.S. Congress took up an important challenge: reforming Social Security to keep the program financially viable into the 21st century.

Why did people who worked in government jobs not have to pay federal insurance contributions?

Specifically, people who worked in government jobs and didn’t have to pay Federal Insurance Contribution Act (FICA) taxes benefited because the Social Security Department did not know they had government jobs. To understand why Congress wanted to change this, consider that Social Security is designed to pay lower-wage workers a higher percentage ...

Do people who did not pay FICA tax get Social Security?

What this means is that some people who worked in government but did not pay FICA tax were able to claim Social Security benefits at a significantly higher rate.

What is a review of spousal benefits?

A Review of Spousal Social Security Benefits. In order to fully understand the impact of the GPO and how it works, it is important to first review spousal (including ex-spousal) and surviving spousal benefits under Social Security. An individual may receive a Social Security retirement benefit by working the minimum required number ...

How does the Windfall Elimination Provision affect Social Security?

A recent column discussed how the Windfall Elimination Provision (WEP) affects the Social Security benefits of individuals who are covered by a government (federal, state or local)-sponsored guaranteed pension plan, such as federal employees who are covered by the Civil Service Retirement System (CSRS). In short, the WEP will reduce a CSRS annuitant’s own Social Security retirement benefit by as much as 50 to 60 percent.

How much is Michael's spousal benefit?

One-half of $2,800, or $1,400 is Michael’s spousal benefit. Because it is less than $1,500, which is Michael’s benefit, Michael keeps his benefit of $1,500 and does not receive 50 percent of Susan’s Social Security benefit which is $1,400.

What is dual entitlement?

Under what is called the “dual entitlement” law, when an individual becomes eligible for a Social Security retirement benefit based on both his own Social Security earnings and a spouse’s (or ex-spouse’s) Social Security retirement benefit, then the individual is entitled to the higher of the two benefits. In particular, the individual’s own ...

How much does Nancy's husband get from Social Security?

Nancy’s husband, Ralph, is entitled to a Social Security retirement benefit of $2,400 per month at his FRA.

Does GPO affect Medicare?

The GPO has no effect on Medicare benefits.

Does spouse W pay Social Security?

Spouse W worked outside the home in a job in which Spouse W did not pay into Social Security, such as the federal government under CSRS, or a state or local government in which Spouse W earned a defined benefit pension but did not pay into Social Security.

How much is Amy's spousal benefit?

However, since Amy is only 64 when she becomes eligible for spousal benefits, her addition, or excess, spousal rate is reduced to $161. That amount is then paid in addition to Amy's own reduced rate of $590 to give her a combined rate of $751 (i.e. $590 + $161).

What happens if you suspend your retirement?

And if you were to suspend your retirement benefit, you wouldn't be able to receive any other benefits while your retirement benefit is suspended.

What happens if you draw reduced retirement benefits on your own record?

If a person starts drawing reduced retirement benefits on their own record prior to full retirement age (FRA), the resulting reduction for age that's applied to their benefit rate continues even if they subsequently become entitled to spousal benefits.

Does Social Security offset spousal pension?

However, there is another provision called Government Pension Offset (GPO) that does apply to spousal and survivor benefits . Based on the GPO provision, if a person receives a government pension based on their earnings that were exempt from Social Security taxes, any Social Security spousal or survivor benefits for which the person qualifies would be offset by 2/3rds of their government pension.

Can WEP be applied to Social Security?

WEP can only apply to Social Security retirement or disability benefits payable based on a person's own work record. WEP can indirectly affect spousal benefits, though, in that spousal benefits are paid based on a percentage of the worker's primary insurance amount (PIA). A person's PIA is equal to their Social Security retirement benefit rate ...

Does the new law eliminate spousal benefits?

The new law did not eliminate spousal benefits. It just extended deeming for those born on or after 1/2/1954. Deeming means that when you apply for either your spousal benefit or your retirement benefit, you're deemed to have filed for both and you only receive essentially the larger of the two.

Can my husband collect my PIA?

It sounds like your husband's PIA is much higher than 50% of your PIA, in which case he would never be able to collect spousal or divorced spousal benefits from your record as long as you're living. Even if your husband could collect benefits from your record, though, it would have no adverse effect on your benefit rate. If you were to predecease him, he could be eligible for divorced survivor's benefits from your record. Best, Larry