Will My Social Security Benefits Be Affected by My Zip Code? State-by-state, you can get different Medicare benefits depending on where you live in the United State of America. The differences in prices, rules, and availability are determined in part by the state or even by a zip code.

Does my ZIP code affect my Medicare coverage?

You might be surprised to know that your zip code can affect your Medicare coverage. Here’s how the availability of certain Medicare programs can change based on where you live. Skip to main content Check Your Symptoms Find A Doctor Find A Dentist

Where is the ZIP code that gives 148 dollars extra on social security?

Where is the zip code that gives 148 dollars extra on social security? It’s not a location. The deal is, if you switch to a Medicare Advantage plan, available everywhere, SSA won’t deduct $144 mas o menos from your benefit to pay for Part B.

What happens to my Social Security benefits if I move States?

No matter where in the United States you live, your Social Security retirement, disability, family or survivor benefits do not change. (Along with the 50 states, that includes the District of Columbia, Puerto Rico, Guam, the U.S. Virgin Islands, American Samoa and the Northern Mariana Islands.)

What is a billing ZIP code?

A Billing Zip Code is the one that the card’s financial institution has on record for the user of that card. If you live in the USA then you know where your bank thinks you live. If you don’t live in the USA then you do not have a Zip Code.

Is Social Security based on where you live?

The benefit amount is based on Federal and State laws which take into account where you live, who lives with you and what income you receive.

What state pays the highest Social Security?

These states have the highest average Social Security retirement benefitsNew Jersey: $1,553.63.Connecticut: $1,546.67.Delaware: $1,517.11.New Hampshire: $1,498.01.Michigan: $1,493.77.Maryland: $1,482.87.Washington: $1,472.50.Indiana: $1,464.61.More items...•

Do I have to notify Social Security of address change?

Yes, you have to notify Social Security of your address change within 10 days of your move. If you fail to notify Social Security of your address change within the required time-frame: You may experience a delay in the receipt of your benefits. You might not receive the full amount of your benefits.

Why does zip code affect Medicare?

Because Medicare Advantage networks of care are dependent upon the private insurer supplying each individual plan, the availability of Medicare Advantage Plans will vary according to region. This is where your zip code matters in terms of Medicare eligibility.

What is the average monthly Social Security check?

Table of ContentsAgeRecipientsAverage monthly payment b (dollars)Number (thousands)18–644,307659.0265 or older2,292511.38SOURCE: Social Security Administration, Supplemental Security Record, 100 percent data.5 more rows

What is the average Social Security check at age 65?

At age 65: $2,993. At age 66: $3,240. At age 70: $4,194.

Do Social Security benefits change if you move?

No matter where in the United States you live, your Social Security retirement, disability, family or survivor benefits do not change.

How do I do an address change with Social Security?

How can I change my address?Call us at 1-800-772-1213 (TTY 1-800-325-0778), Monday through Friday, 8:00 am – 7:00 pm; or.Contact your local Social Security office.

How do I change my address with SS and Medicare?

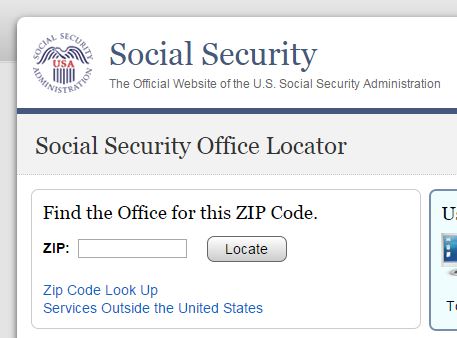

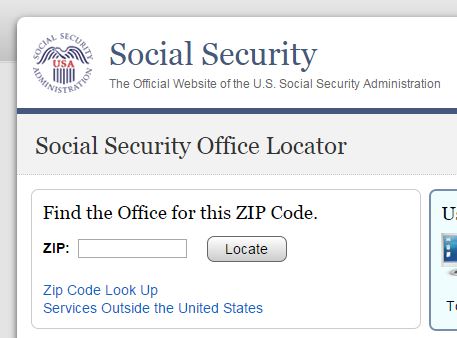

You may also report a change of name or address for the Medicare program by calling the Social Security Administration at 1-800-772-1213 or by visiting your local field office. Addresses and directions to the Social Security field offices may be obtained from the Social Security Office Locator.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.