What is a "contributory defined benefit plan"?

With a contributory retirement plan, the employee pays a portion of her regular base salary into the pension plan. With a non-contributory or defined benefit plan, the employer promises to pay in the future an amount that is based on pay rate and the number of years with the company.

How to correct an overfunded defined benefit plan?

Overfunded Defined Benefit Plan: The #1 Solution [Illustration]

- Some background. Minimum and maximum contributions (as well as benefit limits) are established under the Internal Revenue Code.

- Possible Overfunding Solutions. When a plan is overfunded, there are many ways to get the plan back in line. ...

- Strategic Sale or Plan Merger. ...

- Example of a Strategic Sale. ...

- Final Thoughts. ...

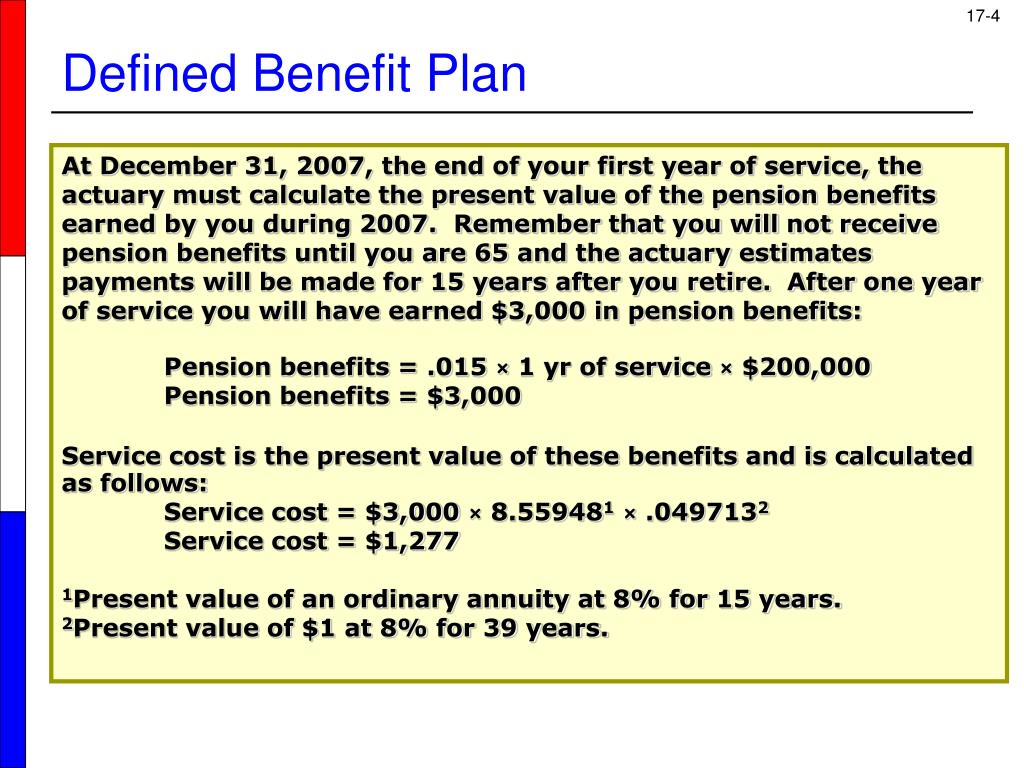

How to calculate pension expense for a defined benefit plan?

The pensions accounting treatment for defined benefit plans requires:

- Determine the fair value of the assets and liabilities of the pension plan at the end of the year

- Determine the amount of pension expense for the year to be reported on the income statement

- Value the net asset or liability position of the pension plan on a fair value basis

How are defined benefit plans taxed?

pensions can be grouped into 4 categories:

- Private pensions: These are pensions that are arranged by the individual with a financial institution. ...

- Workplace pensions: A workplace pension us set up by an employer. ...

- Defined benefit plans: The pension amount is based on the employee’s final salary.

How are defined benefit contributions calculated?

How is the Defined Benefit Plan contribution calculated? Defined Benefit Plans have a contribution range (i.e., minimum required and maximum deductible contribution amounts). An actuary calculates both the minimum amount required to fund the Defined Benefit Plan and the maximum annual amount that can be deducted.

How are defined contribution pension plans calculated?

A pension benefit formula that determines the benefit by multiplying a certain percentage (up to 2%) of the final average or best average earnings for a stated period before retirement by the years of service (i.e. monthly pension = 2.0% x average monthly earnings of last 5 years x years of service).

How much can an employer contribute to a defined benefit plan?

Under 2006 Pension Protection Act legislation, your business can make employer contributions to a defined contribution plan of up to 6% of compensation (with each employee's compensation capped at the IRS limit).

How is defined benefit cost calculated?

1:225:02How to Calculate Pension Expense for a Defined-Benefit Plan - YouTubeYouTubeStart of suggested clipEnd of suggested clipNow we're going to calculate the expected. Return not the actual return on our plan assets rememberMoreNow we're going to calculate the expected. Return not the actual return on our plan assets remember the assets of the pension are invested somewhere in a stock market and bonds. It's.

How is DB pension value calculated?

A defined benefit (DB) pension scheme is one where the amount you're paid is based on how many years you've been a member of the employer's scheme and the salary you've earned when you leave or retire. They pay out a secure income for life which increases each year in line with inflation.

What is the pension benefit formula?

Multipliers are sometimes known by other terms, such as “accrual rate” or “crediting rate” but they mean the same thing. A typical multiplier is 2%. So, if you work 30 years, and your final average salary is $75,000, then your pension would be 30 x 2% x $75,000 = $45,000 a year.

How much can you contribute to a DB plan?

Defined Benefit Plan Contribution Limits In 2022, the annual benefit for an employee can't exceed the lesser of 100% of their average compensation for their highest earning three consecutive calendar years or $245,000. This is up from $230,000 in 2021 and 2020.

How does defined contribution plan Work?

How Do Defined Contribution Plans Work? All defined contribution plans work largely the same way. The employee elects how much they want to contribute, and the employer puts the money into an account on the employee's behalf. Usually, an employee contributes a fixed percentage of their pay or a specific dollar amount.

Do employees make contributions to defined benefit plans?

Employers and employees can typically make contributions to a defined benefit plan. Employee contributions can be voluntary or required. However, most contributions are made by the employers. Also, the contribution limits for defined benefit plans are typically higher than those for defined contribution plans.

What are the components of a defined benefit cost?

Components of defined benefit cost Under US GAAP, net periodic benefit cost comprises service cost, interest cost on the projected benefit obligation, expected return on plan assets, amortization of prior service cost, and amortization of gains or losses recognized in the other comprehensive income previously.

How is a defined benefit plan calculated?

Contributions to a defined benefit plan are generally calculated by an actuary based on the age and the annual income of the individual. However, our one-of-a-kind Defined benefit calculator can ease the pain for you. Use our Defined benefit calculator to get an approximate estimate about how much you can contribute each year to a defined benefit plan.

How much can you contribute to a defined benefit plan?

In the first year, a maximum contribution of $ 82,788.00 can be made to the defined benefit plan.

Why do defined benefit plans favour older participants?

The Defined Benefit Plan favours older participants as they are closer to retirement and need to accrue benefits at a faster rate than younger participants.

What is defined benefit plan?

A Defined benefit plan is an employer sponsored pension plan, so this is typically set up by a business. All types of businesses can set it up, however, a prudent decision needs to be made based on the goals and the profitability of the business.

What are some examples of defined benefit pension plans?

Typical examples of businesses that set up a defined benefit pension plan are: Individual consultants who are self-employed. People who have a small business and a full time job. Small business with only independent contractors. A medical practice with a few full time employees.

How much money do you need to retire at 62?

Without any interest rate plays, when the person retires at age 62, he will need $2 million in his account to be able to withdraw $100,000 each year. The mortality estimates may not play out accurately for a single individual but this is the concept of the defined benefit plan.

When do you have to take a taxable distribution from a defined benefit plan?

The IRS typically requires participants to take a taxable distribution from the plan after age 72 (was age 70.5 prior to the Secure Act passed in Dec-2019). However, the defined benefit plan can utilize unique vesting schedule options to suspend the distributions for a few years.

What is defined benefit retirement plan?

A defined benefit retirement plan provides a benefit based on a fixed formula.

When can defined benefit plans not make in-service distributions?

Generally, a defined benefit plan may not make in-service distributions to a participant before age 59 1/2.

Can you deduct more than you contribute to a defined benefit plan?

On the employer side, businesses can generally contribute (and therefore deduct) more each year than in defined contribution plans. However, defined benefit plans are often more complex and, thus, more costly to establish and maintain than other types of plans. If you establish a defined benefit plan, you: Can have other retirement plans.

How do defined benefit plans differ from defined contribution plans?

As the name implies , a defined benefit plan focuses on the ultimate benefits paid out. Your employer promises to pay you a certain amount at retirement and is responsible for making sure that there are enough funds in the plan to eventually pay out this amount, even if plan investments don't perform well.

What are defined benefit plans?

Defined benefit plans are qualified employer-sponsored retirement plans. Like other qualified plans, they offer tax incentives both to employers and to participating employees. For example, your employer can generally deduct contributions made to the plan. And you generally won't owe tax on those contributions until you begin receiving distributions from the plan (usually during retirement). However, all qualified plans, including defined benefit plans, must comply with a complex set of rules under the Employee Retirement Income Security Act of 1974 (ERISA) and the Internal Revenue Code.

How are retirement benefits calculated?

Many plans calculate an employee's retirement benefit by averaging the employee's earnings during the last few years of employment (or, alternatively, averaging an employee's earnings for his or her entire career), taking a specified percentage of the average, and then multiplying it by the employee's number of years of service.

What are some advantages offered by defined benefit plans?

They're generally designed to replace a certain percentage (e.g., 70 percent) of your preretirement income when combined with Social Security .

What is cash balance plan?

Cash balance plans are defined benefit plans that in many ways resemble defined contribution plans. Like defined benefit plans, they are obligated to pay you a specified amount at retirement, and are insured by the federal government. But they also offer one of the most familiar features of a defined contribution plan: Retirement funds accumulate in an individual account (in this case, a hypothetical account).

What is hybrid retirement plan?

Some employers offer hybrid plans. Hybrid plans include defined benefit plans that have many of the characteristics of defined contribution plans. One of the most popular forms of a hybrid plan is the cash balance plan.

What is a single life annuity?

A single life annuity: You receive a fixed monthly benefit until you die; after you die, no further payments are made to your survivors.

How are defined benefit plans distributed?

Defined-benefit plans can be distributed in many ways depending on the preference of the company. A joint and survivor annuity will administer the benefits through a life annuity to the employee. Once the primary employee passes away, the spouse will continue to receive benefits of at least 50% until their passing.

What is defined benefit plan?

A defined-benefit plan is an employer-promised specified/pre-determined pension payment plan that can be received in a lump sum, periodically, or both. The payment plan is “defined” in advance and based on the employee’s earnings history, tenure, and age – not solely on the individual investment returns. For most defined-benefit plans, the employer ...

How to find the benefit of a company?

The benefit is found by multiplying the defined % (less than 2%) of the average monthly earnings over the last 5 years by the number of years worked for the company.

What happens if you fall short of a defined plan?

Contributions that fall short or contributions above the defined plan will be subject to federal taxes. Often, to receive full benefits, the employee will have had to be with the company for a certain number of years known as the “vesting period.”.

Why do employers prefer defined contribution plans over defined benefit plans?

Often, employers now prefer defined-contribution plans over defined-benefit plans because it costs the company less money, and the investment risk falls on the employee rather than the organization.

What is pension fund?

Pension Fund A pension fund is a fund that accumulates capital to be paid out as a pension for employees when they retire at the end of their careers. Variable-Benefit Plan. Variable-Benefit Plan A variable-benefit plan is a type of pension plan wherein the payout that the beneficiary is entitled to is subject to changes according to ...

What is the difference between defined contribution and defined benefit?

The defined-contribution plan is funded by employees, which results in them bearing the investment risk. Defined-benefit programs don’t rely on the investment returns , and the employees will know the amount of the benefit they are expected to receive post-retirement.

How long should a business make a defined benefit plan?

In order for a defined benefit plan to be a good option, the business owner should feel confident about being able to make the required annual contribution for 3 years.

What is the rate of return assumption for a defined benefit plan?

When a traditional defined benefit plan is established there is an rate of return assumption (approximately 5% to 5.5%) that is factored into the actuarial calculation to determine the annual contribution amount that is necessary in order to fund the future retirement income benefit. Each year the actual return of the portfolio will be compared to the rate of return assumption. When the portfolio's actual return is greater than rate of return assumption then there will be a smaller required annual contribution. Conversely, when the actual return is less than the rate of return assumption then the annual contribution will need to be increased to make up the shortfall. On an annual basis, an actuary makes calculations to determine the amount needed to be contributed into the plan to ensure the future target retirement income goal is reached.

What is a high annual contribution in a fully insured plan?

Higher annual contributions in a fully insured plan can be a benefit for business owners who are in a high tax bracket and want to maximize their tax deductions. Typically the investments in a traditional defined benefit plan are stocks, bonds, mutual funds and ETFs.

What is the annual contribution for 2020?

Annual contributions are made to fund a chosen level of retirement income at a predetermined future retirement date. Contributions are made according to an actuarial formula to meet the target retirement income benefit. In 2020, the annual benefit payable at retirement can be as high as $230,000 per year. As a result, annual contributions ...

How much is the retirement benefit for 2020?

In 2020, the annual benefit payable at retirement can be as high as $230,000 per year. As a result, annual contributions into a Defined Benefit Plan can be even larger than $230,000 in some cases in order to meet that level of retirement income target. There are a number of factors involved with this calculation.

What is the retirement age?

Planned retirement age - In general, planned retirement age is at least 5 years from the year the plan is adopted. Age 62 or age 65 is typical. Investment performance.

Is a fully insured plan higher than a cash balance plan?

As a result, the fully insured plan has level annual contributions from plan inception to retirement. Annual contributions to a fully insured defined benefit plan may potentially be higher than a cash balance plan or traditional defined benefit plan. Higher annual contributions in a fully insured plan can be a benefit for business owners who are in ...

How much can an employee contribute to a defined benefit plan?

Annual contributions under a defined benefit plan can be upwards of $300,000. This is especially true for employees getting close to retirement age.

Why are defined benefit plans important?

That is why defined benefit plans are great for business owners who have higher-than-average compensations. It may be the best financial decision you can make for your future. It is important to understand all your options when determining which type of retirement plans you will offer in your company or practice.

Why do they adjust defined benefit plans?

They typically adjust it each year due to cost of living, much like IRA and 401k contribution limits.

What is the maximum compensation for 2021?

The IRS will place a compensation maximum used in the benefit calculation. For the year 2021, the maximum compensation is $290,000. The IRS annually indexes these compensation and benefit limits. This is either in the form of a certain lump sum dollar amount or a specific percentage of compensation. In contrast, a defined contribution plan is ...

Why are defined benefit plans good for business owners?

That is why defined benefit plans are great for business owners who have higher-than-average compensations. It may be the best financial decision you can make for your future.

How much can you contribute to a pension plan?

There is no maximum dollar amount per se. The contribution amount must be enough to satisfy an annual benefit paid out in the future. This will not be able to exceed 100% of the employees average compensation over 3 consecutive years.

Is the $225,000 compensation amount accurate?

This is why plans must have an actuary review and certify the plans annually. The compensation amount of $225,000 is not entirely accurate. The annual defined benefit limits may not exceed the lesser of:

Distribution of A Defined-Benefit Plan

Formulas

- 1. Career Average Earnings Benefit/Year

The benefit is found by multiplying the defined % (less than 2%) of the average monthly earnings over their career by the number of years worked for the company. - 2. Final Earnings Benefit/Year

The benefit is found by multiplying the defined % (less than 2%) of the average monthly earnings over the last 5 years by the number of years worked for the company.

Defined-Benefit Plans vs. Defined-Contribution Plans

- Similar to a defined-benefit plan, defined-contribution plansare another type of employer-sponsored retirement savings plan. The core difference between the two methods is who the investment risk falls on. The defined-contribution plan is funded by employees, which results in them bearing the investment risk. Defined-benefit programs don’t rely on the investment returns…

Pros and Cons of A Defined-Benefit Plan For The Employee

- 1. Fixed payout

A defined-benefit plan gives the employee a fixed payout that is not based on the investment results. Instead, it is determined using the previously agreed-upon formula that considers the aforementioned factors, which can include earnings, length of employment, and age. - 2. Less risky for the employee

The investment risk then falls onto the employer and not the employee. The employee is also not required to contribute to the plan, meaning there is no cost to them. From the negative side, employees do not have any input on how the money is invested, leaving the potential for poor m…

More Resources

- CFI is the official provider of the global Commercial Banking & Credit Analyst (CBCA)™certification program, designed to help anyone become a world-class financial analyst. To keep advancing your career, the additional CFI resources below will be useful: 1. Pension Fund 2. Variable-Benefit Plan 3. Roth IRA 4. Vesting Schedule