How Are Disability Benefits Taxed?

- Social Security disability income. SSDI is treated exactly as Social Security retirement benefits are; benefits may be tax free or includible in gross income at 50% or 85%, depending upon ...

- Disability pensions. Employer-paid disability pensions are treated as taxable compensation (wages) until one attains retirement age.

- Workers’ compensation. ...

Do I have to file taxes when receiving disability benefits?

Whether or not you actually have to file taxes when receiving Social Security Disability depends on how much income you receive and whether or not your spouse receives an income. If Social Security Disability benefits are your only source of income and you are single, you do not necessarily have to file taxes.

How much does disability benefits pay?

Your disability must also be certified by a physician/practitioner. Your Weekly Benefit Amount (WBA) depends on your annual income. It is estimated as 60 to 70 percent of the wages you earned 5 to 18 months before your claim start date and up to the maximum WBA. Note: Your claim start date is the date your disability begins.

Do you have to claim disability on taxes?

Generally, you must pay taxes on long-term disability payments from an employer-paid accident or health insurance plan. If both you and your employer paid premiums, only the payments arising from your employer's premiums are taxable. If you paid all the premiums, exclude the disability payments from your taxable income.

Why are disability benefits taxable?

Why are disability benefits taxable?

- Taxes and Social Security Benefits. Disability benefits are offered through the Social Security Administration (SSA) to those who are unable to work due to a disability or medical condition.

- Income Limits. ...

- Back Payments. ...

- Marginal Tax Rate. ...

- Getting Help with Your Disability Benefits. ...

How much of disability income is taxable?

IndividualsAmount of Monthly IncomeAmount of Annual IncomeMaximum Portion of SSDI to Be Taxed0 - $2,0830 - $25,0000%$2,084 - $2,833$25,000 - $34,00050%$2,834 and upover $25,00085%

Do disability payments count as income?

The Social Security administration has outlined what does and doesn't count as earned income for tax purposes. While the answer is NO, disability benefits are not considered earned income, it's important to know the difference between earned and unearned income and know where your benefits fit in during tax season.

Do I have to report disability income on my tax return?

Generally, you must report as income any amount you receive for your disability through an accident or health insurance plan paid for by your employer. If both you and your employer pay for the plan, only the amount you receive for your disability that is due to your employer's payments is reported as income.

Is disability income taxable by the IRS?

If you retired on disability, you must include in income any disability pension you receive under a plan that is paid for by your employer. You must report your taxable disability payments as wages on line 1 of Form 1040 or 1040-SR until you reach minimum retirement age.

What is the disability tax credit for 2021?

$8,662The federal DTC portion is 15% of the disability amount for that tax year. The “Base Amount” maximum for 2021 is $8,662, according to CRA's Indexation Chart....YearMaximum Disability AmountMaximum Supplement For Persons Under 182021$8,662$5,0532020$8,576$5,0032019$8,416$4,9092018$8,235$4,8049 more rows•Mar 7, 2022

Does disability send you a w2?

Do I receive a W-2 form for Disability claim payments? A W-2 form lists the benefits paid and taxes withheld. It is required for every calendar year that you receive disability benefit payments. Your policy will dictate whether Guardian or your employer produces the W-2.

How do I prove my disability to the IRS?

Physician's statement. If you are under age 65, you must have your physician complete a statement certifying that you had a permanent and total disability on the date you retired. You can use the statement in the instructions for Schedule R Credit for the Elderly or the Disabled, page R-4.

How much of my Social Security is taxable in 2021?

For the 2021 tax year (which you will file in 2022), single filers with a combined income of $25,000 to $34,000 must pay income taxes on up to 50% of their Social Security benefits. If your combined income was more than $34,000, you will pay taxes on up to 85% of your Social Security benefits.

Federal Taxation of Social Security Disability Benefits

Here's how it works. If you are married and you file jointly, and you and your spouse have more than $32,000 per year in income (including half of...

Taxation of Social Security Disability Backpay

Large lump-sum payments of back payments of SSDI (payments of benefits for the months you were disabled but not yet approved for benefits) can bump...

State Taxation of Social Security Disability Benefits

Most states do not tax Social Security disability benefits. The following states, however, do. Some of these states use the same income brackets as...

How is Social Security Disability funded?

Social Security Disability Insurance, or SSDI, is funded by the payroll taxes withheld from workers’ paychecks or paid as a part of self-employment taxes. The benefits you may be eligible to receive are based on your earnings or the earnings of your spouse or parents.

What is SSDI disability?

If you receive Worker’s Compensation or other public disability benefits such as certain state and civil service benefits, your SSDI benefit amount may be reduced. Supplemental Security Income, or SSI, is for eligible disabled adults and children and adults 65 and older who have limited income and resources.

How long does short term disability last?

Short-term disability insurance, which may replace part of your income for up to two years, although most last for a few months to a year. Long-term disability insurance, which, after a waiting period, may pay disability benefits for a few years or until your disability ends.

How much was the average disability payment in 2017?

And the percentage of awards has declined every year. Among those who did receive benefits in 2017, the average monthly amount paid was about $1,197.

Is disability insurance a government benefit?

Although SSDI and SSI are government benefits from the SSA, disability insurance is a private-sector source of disability income. It’s a type of insurance that may pay a portion of your salary when you’re disabled. Employers may provide disability insurance and might pay all or part of the premiums for you, but if your employer doesn’t provide the insurance you can purchase your own policy.

Is disability income taxable?

But in some cases, the IRS might view your disability benefits as taxable income. You may hope you never have to receive disability income.

Do I have to pay taxes on SSDI?

You may have to pay federal income tax on your SSDI benefits if the total of half of all your SSA benefits, other than SSI, plus all your other income (including tax-exempt interest) is greater than the base amount for your filing status.

Are Disability Benefits Taxable?

The taxability of disability benefits depends on their source and how premiums are paid. For example, Social Security disability benefits are taxable if the recipient (and spouse if the benefit recipient files taxes jointly) have earnings in addition to Social Security payments.

Are Lump Sum Settlements of Disability Benefits Subject to Taxes?

The taxability of a lump sum payment of disability benefits – either as the result of a lawsuit settlement or an agreement with the insurance company to accept a reduced payment now in place of payments over future years – is the same as the taxability of monthly payments.

If Part or All of an Overpayment Is Forgiven in a Settlement, Is the Amount That Is Forgiven Taxable?

In court cases involving long-term disability benefit payments that have been terminated after being paid for some time, the insurance company may assert a counterclaim alleging that the claimant has been overpaid as the result of an award of Social Security disability, workers’ compensation, or some other payment that reduces the amount of disability benefits the claimant should have received.

If My Disability Benefits Are Taxable and I Receive a Settlement of My Claim, Is There an Advantage to Receipt of a Structured Settlement?

Structured settlements are a popular way to resolve personal injury claims to preserve the settlement funds and avoid imprudent expenditures. However, personal injury payments differ from disability insurance benefits since damages received on bodily injuries are not included in gross income taxed by the IRS.

How much disability income can I avoid?

If you are single, the threshold amount is currently $25,000.

How does SSDI work?

How SSDI Works. When SSDI Benefits Are Taxed. State Taxes on SSDI. Social Security disability benefits may be taxable if you have other income that puts you over a certain threshold. However, the majority of recipients do not have to pay taxes on their benefits because most people who meet the strict criteria to qualify for ...

How many states will have tax benefits in 2020?

As of 2020, however, a total of 13 states tax benefits to some degree. Those states are Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia. Most of these states set similar income criteria to the ones used by the IRS to determine how much, if any, ...

How long does a disabled person have to be disabled to work?

First, the SSA says, "Your condition must significantly limit your ability to do basic work such as lifting, standing, walking, sitting, and remembering—for at least 12 months.".

Why did Roosevelt include Social Security in the New Deal?

The purpose of the New Deal was to lift the country out of the Great Depression and restore its economy.

Is SSDI income taxed?

Key Takeaways. Many Americans rely on Social Security Disability Income (SSDI) benefits for financial support. If your total income, including SSDI benefits, is higher than IRS thresholds, the amount that is over the limit is subject to federal income tax.

What is the tax rate for disability?

85%. Keep in mind that if your disability benefits are subject to taxation, they will be taxed at your marginal income tax rate. In other words, your tax rate would not be 50% or 85% of your benefits; your tax rate would probably be more like 15-25% of your benefits. Those with higher incomes (where 85% of your benefits would be taxed) ...

How much income is subject to tax on SSDI?

Here's how it works. If you are married and you file jointly, and you and your spouse have more than $32,000 per year in income (including half of your SSDI benefits), a portion of your SSDI benefits are subject to tax. If you are single, and you have more than $25,000 in income per year (including half of your SSDI benefits), a portion of your SSDI benefits will be subject to tax.

Do you pay taxes on Social Security Disability?

Social Security disability is subject to tax, but most recipients don't end up paying taxes on it. Social Security disability benefits (SSDI) can be subject to tax, but most disability recipients don't end up paying taxes on them because they don't have much other income.

Do you have to pay taxes on SSDI?

Most states do not tax Social Security disability benefits. The following states, however, do tax benefits in some situations. Some of these states use the same income brackets as the federal government (above) to tax SSDI benefits, but others have their own systems.

Can SSDI payments bump up your income?

Large lump-sum payments of back payments of SSDI (payments of benefits for the months you were disabled but not yet approved for benefits) can bump your income up for the year in which you receive them, which can cause you to pay a bigger chunk of your backpay in taxes than you should have to.

How are disability payments taxed?

How disability payments are taxed depends on the source of the disability income. The answer will change depending on whether the payments are from a disability insurance policy, employer-sponsored disability insurance policy, a worker’s compensation plan, or Social Security disability.

How much of my Social Security disability is taxable?

To figure your provisional income, use Publication 915, Worksheet A. If your provisional income is more than the base amount, up to 50% of your social security disability benefits will usually be taxable. However up to 85% of benefits will be taxable if your provisional income is more than the adjusted base amount.

What is disability insurance?

Disability insurance is a type of insurance that provides income in the event that an employee is unable to perform tasks at work due to an injury or disability. Disability insurance falls in two categories:

How long does a short term disability last?

Short-term disability: This type of insurance pays out a portion of your income for a short period of time – and can last from a few months to up to two years. Long-term disability: This type of insurance begins after a waiting period of several weeks or months – and can last from a few years to up to retirement age.

Is disability income taxable?

Disability benefits may or may not be taxable. You will not pay income tax on benefits from a disability policy where you paid the premiums with after tax dollars. This includes: A employer sponsored policy you contributed to with after-tax dollars.

What is the tax rate for disability?

In other words, you would not pay taxes of 50% or 85% of your benefits, you would probably pay taxes of about 10-12% on 50%-85% ...

How much income can you have if you are married and file jointly?

If you are married and you file jointly, you can have a combined income of up to $32,000 before having to pay taxes on half your benefits. If you are single and you make more than $34,000 (or married and make more than $44,000), 85% of your benefits could be taxed. At what rate are your benefits taxed?

Is Social Security disability taxable?

Answer: For the majority of people, Social Security disability benefits are effectively not taxable. This is true for people who have income in addition to disability benefits as well as those who do not.

Do you have to pay taxes on retroactive benefits?

If you receive a lump-sum payment for retroactive benefits and/or back payments, you could have to pay taxes on this amount all in one year, and your tax rate might be higher than usual because of receiving the large lump sum.

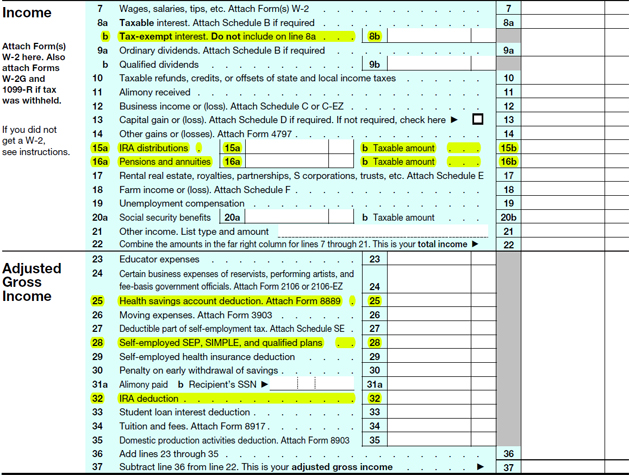

What line do you report Social Security benefits on?

You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040-SR. Your benefits may be taxable if the total of (1) ...

Do you have to add spouse's income to joint tax return?

If you're married and file a joint return, you and your spouse must combine your incomes and social security benefits when figuring the taxable portion of your benefits. Even if your spouse didn't receive any benefits, you must add your spouse's income to yours when figuring on a joint return if any of your benefits are taxable.

Is Social Security income taxable?

Social security benefits include monthly retirement, survivor and disability benefits. They don't include supplemental security income (SSI) payments, which aren't taxable. The net amount of social security benefits that you receive from the Social Security Administration is reported in Box 5 of Form SSA-1099, Social Security Benefit Statement, and you report that amount on line 6a of Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors. The taxable portion of the benefits that's included in your income and used to calculate your income tax liability depends on the total amount of your income and benefits for the taxable year. You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040-SR.

How many states tax Social Security disability?

As of 2020, 12 states imposed some form of taxation on Social Security disability benefits, though they each apply the tax differently. Nebraska and Utah, for example, follow federal government taxation rules.

How long does a disability last?

Your disability must have lasted at least 12 months or be expected to last 12 months. Social Security disability benefits are different from Supplemental Security Income (SSI)and Social Security retirement benefits. SSI benefits are paid to people who are aged, blind or disabled and have little to no income. These benefits are designed ...

How much of my Social Security benefits do I get if I'm married?

Up to 50% of your benefits if your income is between $25,000 and $34,000. Up to 85% of your benefits if your income is more than $34,000. If you’re married and file a joint return, you’d pay taxes on: Up to 50% of your benefits if your combined income is between $32,000 and $44,000.

How much income can you report on Social Security?

This means that if you’re married and file a joint return, you can report a combined income of up to $32,000 before you’d have to pay taxes on Social Security disability benefits. There are two different tax rates the IRS can apply, based on how much income you report and your filing status.

Is disability income taxable?

Whether you receive SSDI or SSI, your disability benefits are generally not taxable. Here's how to determine if you need to pay income tax on your benefits. Menu burger. Close thin.

Is Social Security taxable if you are working part time?

Social Security retirement benefits, on the other hand, can be taxable if you’re working part-time or full-time while receiving benefits. Is Social Security Disability Taxable? This is an important question to ask if you receive Social Security disability benefits and the short answer is, it depends.

Do you have to pay taxes on Social Security?

For most people, the answer is no. But there are some scenarios where you may have to pay taxes on Social Security disability benefits. It may also behoove you to consult with a trusted financial advisoras you navigate the complicated terrain of taxes on Social Security disability benefits.