Are long term care expenses tax deductible?

If you or a family member lives in an assisted living facility, you know that assisted living costs continue to rise every year. But did you know some of those costs may be tax deductible? Medical expenses, including some long-term care expenses, are deductible if the expenses are more than 7.5 percent of your adjusted gross income.

Are long term care insurance fees deductible?

The tax code also permits a limited deduction for certain long-term-care insurance premiums. Like the deduction for long-term-care services, this is an itemized deduction for medical expenses. As a result, only premiums exceeding the 7.5% of AGI threshold are deductible.

Is long-term care insurance tax deductible?

Premiums for "qualified" long-term care insurance policies (see explanation below) are tax deductible to the extent that they, along with other unreimbursed medical expenses (including Medicare premiums), exceed a certain percentage of the insured's adjusted gross income.

What is long term care expenses deduction?

Medical care policies can provide payment for treatment that includes:

- Hospitalization, surgical services, X-rays;

- Prescription drugs and insulin;

- Dental care;

- Replacement of lost or damaged contact lenses; and

- Long-term care (subject to additional limitations). See Qualified Long-Term Care Insurance Contracts under Long-Term Care, later.

Are long-term care payments taxable income?

When you receive benefits from a long-term care insurance policy, you typically won't owe taxes. The IRS treats these payouts similarly to reimbursements for medical expenses, which they don't consider taxable income.

In which case are long-term care benefits taxable?

If payments exceed the greater of $360 per day (adjusted annually for inflation) or the actual amount of qualified long-term care expenses incurred, the excess payment amounts are taxable as income when benefits are paid.

Do you report 1099 LTC on tax return?

You should retain the enclosed IRS Form 1099-LTC for your tax records, but, since your benefits are not taxable, you are not required to file any IRS Forms or take any other action as the result of receiving the enclosed Form 1099-LTC.

Is long-term care a tax deduction?

Long-term-care costs. You can deduct unreimbursed costs for long-term care as a medical expense if certain requirements are met. This includes eligible expenses for in-home, assisted living and nursing-home services. First, the long-term care must be medically necessary.

Are long-term care premiums tax deductible in 2021?

Premiums for "qualified" long-term care insurance policies (see explanation below) are tax deductible to the extent that they, along with other unreimbursed medical expenses (including Medicare premiums), exceed 7.5 percent of the insured's adjusted gross income in 2021.

What is the 2021 standard deduction?

$12,5502021 Standard Deductions $12,550 for single filers. $12,550 for married couples filing separately. $18,800 for heads of households. $25,100 for married couples filing jointly.

Who receives a 1099-LTC?

Key Takeaways. Providers of Form 1099-LTC are typically insurance companies or governmental units, among others. Payments reported include those made directly to you, to the insured, or to third parties. Your 1099-LTC may list a large amount in benefits for which you may not necessarily owe taxes.

How can LTC benefits be received tax free by an individual?

To exclude payments from your taxable income, your plan must meet a few requirements: You, your spouse, or dependent receiving care must be considered chronically ill by a licensed health care practitioner. Your plan must only provide coverage for long-term care and must be renewable.

How do I enter a 1099-LTC in Turbotax?

How do I enter a 1099-LTCFrom the top, select tab Federal Taxes.Wages and Income /Scroll down to Less Common Income section.Choose Miscellaneous Income, 1099-A, 1099-C / Start.Scroll down to Long-term care account distributions (Form 1099-LTC) , continue to follow the prompts.

Are long-term care benefits taxable 2022?

2022 Tax Year Remember, benefits paid under a qualified Long-Term Care Insurance policy are generally excluded from taxable income.

What states have a long-term care tax?

For decades many states and the federal government have implemented tax incentives to encourage the purchase of Long-Term Care Insurance....In addition to California the other states are starting the process include:Alaska.Colorado.Hawaii.Illinois.Michigan.Missouri.Minnesota.North Carolina.More items...

Are long-term care premiums tax deductible in 2020?

The Internal Revenue Service just announced the increased limits for tax deductibility of long-term care insurance premiums. According to IRS Revenue Procedure 2019-44, a couple age 70 or older who both have the right kind of long-term care insurance policy can deduct as much as $10,860 in 2020.

What is tax qualified long term care insurance?

A tax-qualified Long-Term Care Insurance contract qualifies for favorable federal income tax treatment. If the policy only pays benefits that reimburse you for qualified long-term care expenses you will not owe federal income tax on these benefits. 2. If Box 3 is marked "Reimbursed Amount" and you have a Non-Tax Qualified Contract, ...

How to get 1099 LTC?

If you are preparing your own taxes make sure you order or download the Instructions for Form 1099-LTC from the Internal Revenue Service. You can request free tax forms and guides by calling the IRS at 1-800-TAX-Form or 1-800-829-3676. Otherwise, your tax preparer should have access to this form.

What is the box in a health insurance claim?

Box 1. Gross benefits paid by the insurance company. Box 2. Does not apply to long-term care insurance. Box 3. This indicates benefits paid (as reflected in Box 1) as either on a Per Diem (Indemnity) basis or as a Reimbursement for actual long-term care expenses incurred. Box 4: This is an optional field that indicates if benefits were paid ...

When will insurance companies issue 1099?

The insurance companies typically will issue these special 1099 forms in January for the previous tax year. All payments which were made directly to you, as well as those that were paid to a third party on your behalf, will be reflected on the Form 1099-LTC.

Is per diem insurance taxable?

Because benefits were paid on a per diem (indemnity) basis , without regard to the actual long-term care expenses incurred, the amount of benefits that may be excluded from income is subject to a daily maximum amount. If this per diem (indemnity) limitation is exceeded, part of the benefits received may be taxable.

Is long term care insurance tax deductible?

Usually, the benefits from a Long-Term Care Insurance policy are tax-free and, in some cases, premiums can be tax-deductible. All tax-qualified Long-Term Care Insurance benefits will come to you tax-free in most cases. The insurance companies that pay these benefits are required by the Internal Revenue Service ...

Is Box 3 taxable?

If Box 3 is marked "Reimbursed Amount" and you have a Non-Tax Qualified Contract, then some or all of your benefits may be taxable. Again, the insurance company can tell you if your policy is considered a Non-Tax Qualified policy. A Non-Tax Qualified policy may result in a tax liability. You should consult a tax-advisor.

What is the floor for medical expenses?

The federal tax code has a 7.5 percent floor governing medical expenses deductions taken on Schedule A (Form 1040), meaning that the premium expense is deductible to the extent that it exceeds 7.5 percent of the individual’s Adjusted Gross Income. There are other considerations with regard to the policyholder’s age.

What is the primary purpose of maintenance and personal care services?

For individuals with severe cognitive impairment, the maintenance and personal care services provided must have a primary purpose of assisting the person with his or her disabilities and/or protect them from threats to their health and safety. Q.

Is long term care insurance taxable?

In general, the income from a long-term care insurance policy is non-taxable, and the premiums paid to buy the insurance are tax deductible. Similar tax advantages exist at the state level, but each state treats the subject differently. The fact that there are tax benefits to purchasing long-term care coverage testifies to ...

Can nursing home expenses be deducted?

The costs of care in a nursing home or similar institution, as well as the wages and other amounts paid for nursing services at home, can be included as medical expenses deductions. In such cases the services provided must be connected with the individual’s chronic illness.

Is a medical conference tax deductible?

Medical conference costs are deductible if the conference is primarily for and necessary to the medical care of you, your spouse or dependent. Expenses for prescribed drugs and medicines are tax deductible. Q.

Why do people need long term care insurance?

Since long-term care expenses can quickly wipe out a person's investments, having insurance can protect assets for future use or heirs. Those who do buy a plan may be in line to receive tax benefits as well.

How much can seniors deduct for medical expenses?

Seniors born before Jan. 2, 1952, can deduct any health care expenses in excess of 7.5 percent of their adjusted gross income in 2016. However, beginning in 2017, seniors will see their deduction threshold jump to 10 percent, just like everyone else.

Is life insurance deductible?

Life insurance premiums are not tax deductible, so only the portion paid for a long-term care rider may be eligible for a deduction. What's more, a policy must bill monthly rather than be paid in a lump sum. Godsey advises caution when it comes to expecting a tax deduction from a combo long-term care and life insurance policy.

Is long term care insurance expensive?

Long-term care insurance is expensive, but you could get a tax break from Uncle Sam if you buy it. Long-term care insurance premiums have been rising for many consumers, but financial experts agree that everyone, including the very wealthy, should consider buying coverage. "I consider it portfolio insurance," says Ken Moraif, ...

Can you write off long term care insurance?

However, it isn't as simple as writing off the amount you pay each year. Instead, the government lumps long-term care insurance premiums into health care expenses on itemized deductions. For most people, if their health care expenses exceed 10 percent of their adjusted gross income, they can deduct the excessive amount.

Does 1035 exchange allow for tax free transfers?

"When a consumer is looking at these, they need to ask their planner or the company [for guidance].". 1035 exchanges allow for tax-free transfers.

How much is long term care insurance taxable?

Benefit payments: Traditional long-term care insurance with a cash indemnity, the maximum tax-free benefit is now $380 per day or $11,558 a month. Anything over those limits is taxable. For example, if your long-term care needs are $400 a day, then only $20 per day is taxable.

Is long term care insurance expensive?

Long-term care insurance is quite expensive , whether you have traditional long-term care insurance or the more popular hybrid LTC/life insurance type. Getting the most deductions possible is one way to save yourself a little money.

Is life insurance tax deductible?

In this case, since the primary function of the insurance is the life insurance part, while the chronic illness benefit and death benefit of the policy are tax-free, the premiums are not tax-deductible.

How does long term care affect taxes?

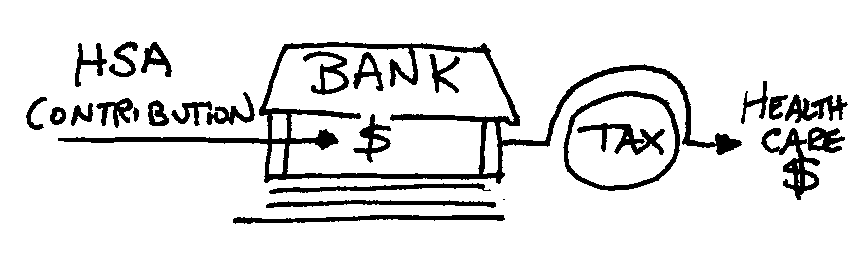

How does long-term care insurance affect my taxes? If you’re already covered by long-term care (LTC) insurance, you may be eligible to deduct some or even all of your LTC premiums. Or, if you’re receiving payments from a LTC insurance plan, you could exclude from your taxable income any payments made to you.

How much can you pay for per diem in 2020?

However, if payments are made regardless of expenses paid, then there’s a limit. If you’re receiving payments on a periodic or per diem basis, the limit is $380 for each day for the 2020 tax year.

Can I deduct LTC premiums?

You may deduct LTC insurance premiums as a medical expense. As with all deductible medical expenses, you’ll need to meet the percentage of AGI floor requirement first. See Deducting Medical Expenses. You can deduct premiums up to a certain limit based on your age.

Can you exclude long term care from your taxable income?

To exclude payments from your taxable income, your plan must meet a few requirements: You, your spouse, or dependent receiving care must be considered chronically ill by a licensed health care practitioner. Your plan must only provide coverage for long-term care and must be renewable.

Does a long term care plan have to be renewable?

Your plan must only provide coverage for long-term care and must be renewable. Your plan must not provide cash or have a surrender value or money that is pledged, assigned, or borrowed. Check with your HR department or LTC provider to make sure your plan meets these requirements.

Is LTC insurance taxable?

Payments from a LTC insurance plan are considered taxable income, but you may be able to exclude that income from your return. But: If your employer makes any contributions toward your LTC premiums, the contributions must be reported as income on your return.

When is the 10 percent floor effective?

The 10 percent floor is effective for tax years beginning after 2012, but the 7.5 percent floor remains effective for senior citizens aged 65 and older (and their spouses) through 2016. The deduction for eligible long-term care premiums that are paid during any taxable year for a qualified long-term care insurance contract as defined in IRC Section ...

Is long term care insurance deductible?

Amounts paid for any qualified long-term care insurance contract or for qualified long-term care services generally are included in the definition of medical care and, thus, are eligible for income tax deduction, subject to certain limitations.

What About The Tax Paperwork?

- People might think long-term care benefits are taxable because of how the paperwork goes out. When you receive benefits, the insurance company sends you a 1099-LTC tax form showing what they paid, which may lead you to believe you owe taxes. However, the 1099-LTC form helps with …

Are There Any Exceptions?

- If you receive cash on a per diem basis, there is a limit to how much of it can be tax-free. As of 2021, the maximum is up to $400 per day. This is true even if your daily long-term care expenses are under $400. If your policy pays more than the limit and your expenses are lower than what you receive, the excess counts as taxable income. For example, if you receive $450 a day and your e…

How Can You Prepare For Taxes?

- You should ask your insurer whether your long-term care insurance policy is tax-qualified or nonqualified. These days, most policies are qualified, but if yours is nonqualified, you may want to prepare by saving for potential taxes. Alternatively, you could explore converting your policy into a qualified one. If your policy offers a per diem benefit, you could also ask your insurer whether it'…