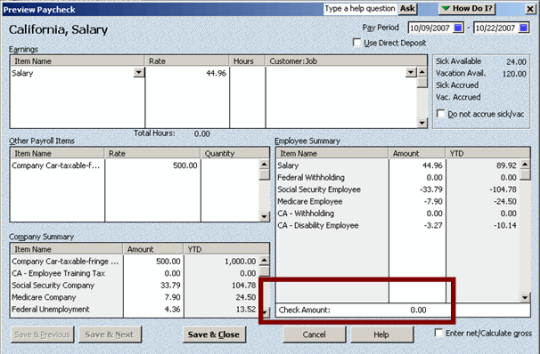

To calculate the fringe benefit rate, divide the employee’s total fringe benefits by their annual salary and multiply that number by a hundred. The equation looks like this: Fringe rate = (Total fringe benefits/Annual wages) X 100

How do you calculate prevailing wage?

- records of all laborers, mechanics and other workers employed by them on the project, which records must include each worker"s name, address, telephone number when available, social security number,

- classification or classifications

- the hourly wage paid (including itemized hourly cash and fringe benefits paid in each pay period),

How to calculate prevailing wage?

Determine the wage level by summing the numbers in the Wage Level Column of the worksheet. The sum total shall equal the wage for the prevailing wage determination. If the sum total is greater than 4, then the wage level shall be Level 4. The process described above should not be implemented in an automated fashion.

How to find prevailing wage?

- Requesting a prevailing wage from the NPWC;

- Using a survey conducted by an independent authoritative source; or

- Using another legitimate source of information.

Does prevailing wage include benefits?

What are prevailing wage fringe benefits? These benefits come in two parts. First, there’s the basic rate of money that must be paid to the employee. Second, there’s the fringe benefits, which are a combination of items such as healthcare, vacation, pension and others that are provided by the employer.

How is fringe benefits calculated?

A fringe benefit rate is the proportion of benefits paid to the wages paid to an employee. The rate is calculated by adding together the annual cost of all benefits and payroll taxes paid, and dividing by the annual wages paid.

How is Fringe amount calculated?

To calculate the employee's fringe benefit rate:Add together the cost of an employee's fringe benefits for the year.Divide it by the employee's annual salary.Multiply the total by 100 to determine the percentage of fringe benefit rate.

How are reportable fringe benefits calculated?

Calculating reportable fringe benefits amount The lower gross-up rate for the FBT year ending 31 March 2021 is 1.8868. For example, if the taxable value of your fringe benefits is $2,000.00, your reportable fringe benefit amount is calculated as $2,000.00 × 1.8868 = $3,773.

How is prevailing wage level calculated?

Determine the wage level by summing the numbers in the Wage Level Column of the worksheet. The sum total shall equal the wage for the prevailing wage determination. If the sum total is greater than 4, then the wage level shall be Level 4.

What is a typical fringe benefit rate?

Fringe benefit rates vary from business to business. The rate depends on how much you pay employees and how much an employee receives in benefits. Although rates vary, according to the Bureau of Labor Statistics, the average fringe benefit rate (aka benefit costs) is 30%.

What are fringe benefits examples?

What Are Fringe Benefits Examples. Some of the most common examples of fringe benefits are health insurance, workers' compensation, retirement plans, and family and medical leave. Less common fringe benefits might include paid vacation, meal subsidization, commuter benefits, and more.

What is total reportable fringe benefits amounts?

The reportable fringe benefit is the amount that appears on an employee's end of financial year payment summary. The reportable amount is the 'grossed-up' value of the fringe benefit. A grossed up value of both non-exempt and exempt employer fringe benefits totals will appear on the payment summary.

What are examples of reportable fringe benefits?

Examples of reportable fringe benefits provided by employers:helping you pay your rent or home loan.providing a home phone.providing a car.paying your child(ren)'s school fees.paying your health insurance premiums.paying your child care expenses.More items...

How is FBT payroll tax calculated?

The formula is total NSW wages (excluding fringe benefits) divided by total Australian wages (excluding fringe benefits) multiplied by the taxable value from your FBT return for the year ending 31 March immediately before the current financial year divided by 12.

How is PERM prevailing wage calculated?

1:402:58The level of supervision required of the position. Based on these metrics the position is assignedMoreThe level of supervision required of the position. Based on these metrics the position is assigned to one of four wage levels with level one being entry level wages and level four being an advanced.

What is the current prevailing wage rate in California?

Employers in this example must pay at least $32.34 per hour in wages for straight time. In addition, they must pay $19.74 into approved health, pension, vacation and training plans or pay it directly in wages. Either way, the total hourly wage paid by the employer must be $52.08 per hour for straight time.

How is prevailing wage calculated in NY?

The hourly value for 'paid time off' would be calculated as follows: hourly wage rate X 8 hours per day X total number of paid days off divided by 2080 hours. For example: $16.00 per hour wage rate X 8 hours per day = $128.00; $128.00 X 5 paid days off = $640.00; $640.00 divided by 2080 hours = $0.31 per hour.

How to determine if a wage is fringe?

1. Determine what types of wages are required by law . If a wage is required by law, it will not be considered a fringe benefit. One easy way to identify fringe benefits is to eliminate the benefits you know are not fringe. Examples of non-fringe benefits include: Base wages and salaries; Payments to fund social security;

How much is fringe benefits for employee one?

The value of their fringe benefits package is $3,200.

What is fringe benefit?

Fringe benefits are the variety of benefits some employers give to employees in addition to their hourly wage or salary. They can be offered to all employees or as a benefit to those in certain positions or with certain accomplishments. After you identify the fringe benefits you as an employer are offering, or the benefits you as an employee are ...

What are the disadvantages of fringe benefits?

2. Think about the disadvantages of offering fringe benefits. Especially if you are a small employer, fringe benefits may be prohibitively expensive to provide. For example, paying an employee's healthcare (or multiple employees) can become very expensive.

Why do employees prefer fringe benefits?

In addition, employees might prefer fringe benefits for the reduced tax liability when fringe benefits aren't taxed (while your sala ry will be ). For example, companies that provide health insurance can ensure their workforce stays healthy so they can come to work and be productive.

What are non-fringe benefits? What are some examples?

Examples of non-fringe benefits include: Base wages and salaries; Payments to fund social security; Unemployment compensation; and. Workers' compensation. [1] X Trustworthy Source US Department of Labor Federal department responsible for promoting the wellbeing of workers Go to source.

Is a company car a fringe benefit?

If your employer states you will have access to a company car, this would be a fringe benefit as well. In another example, your employment contract may state your employer will pay you a salary of $75,000 per year. This type of payment is required by law and will therefore not be considered a fringe benefit.

How to calculate fringe benefits?

The first step is to figure out what amount of fringe benefits should be credited to each employee annually, this is the benefit rate on the prevailing wage rate for each employee. The second step is to analyze the benefit-cost and divide it by the total cost of the benefit given by 40 hours per week in 52 weeks.

What is fringe benefit?

Those employees who do not incur any cash benefits or are not given any contributions are eligible for fringe benefits that equal the amount in cash they should have been given. If an employee is being given a contribution, it should be properly defined. The contribution could be a pension plan, medical help or anything along these lines. In regards to pension plans if there is an immediate need for it then the employee has a 100% vesting. If there is no immediate vesting then the employee is afforded credit according to an annual rate based on work hours of the previous year.

What happens if you have no immediate vesting?

If there is no immediate vesting then the employee is afforded credit according to an annual rate based on work hours of the previous year.

Can you lower the minimum wage?

Under the new Public Service Contract Act regarding the discharging of Fringe benefits obligations, employers can decrease the minimum wage of a worker as long as he/she is given fringe benefits that equal the total wage rate that is mandated by law. The path to reaching the minimum wage rate required may be, fringe benefits and cash or minimum wage rate in cash and a small portion of fringe benefits. This choice is up to the employer or according to employee choice.

Can an employer take credit for fringe benefits?

According to law, an employer must make sure that he does not receive any credit for a benefit given to an employee which is required by law. Things like social security, compensations, etc. are a part of the job package and should not be considered or taken credit as a fringe benefit. The only way an employer can take credit is via converting ...

Fringe Benefit Definition

Have you ever wondered what the real value of your work is? You work hard for your money and your fringe benefits, but have you ever wondered exactly how much that work is worth to the company that you’re devoting hours of your life to? Use this calculator to be sure of the exact amount, every time.

Why Use Our Calculator?

Sure, you could do it yourself but why? When a boss tells you to get back to work or you’re pushing towards that all important deadline, do you really want to sit there with an old jeweled calculator or one of those stupid promotional calculators that has a curved middle and never seems to work right? What if you’re rushing to meet that deadline but that quiet nagging voice in the back of your head is wondering about your fringe benefits? Satisfy that random curiosity with this calculator!.

Can I Share This Calculator?

We highly encourage the use of the Fringe Benefit Calculator as much as possible. Download it and put it as a widget on your web site or just share it with your friends on Facebook, Twitter, StumbleUpon or other social media website.

How to Calculate Fringe Benefit

Let's be honest - sometimes the best fringe benefit calculator is the one that is easy to use and doesn't require us to even know what the fringe benefit formula is in the first place! But if you want to know the exact formula for calculating fringe benefit then please check out the "Formula" box above.

Add a Free Fringe Benefit Calculator Widget to Your Site!

You can get a free online fringe benefit calculator for your website and you don't even have to download the fringe benefit calculator - you can just copy and paste! The fringe benefit calculator exactly as you see it above is 100% free for you to use.

What are fringe benefits?

Fringe benefits are benefits employees receive in addition to their wages. Independent contractors and business partners can also receive fringe benefits (not taxed). Examples of fringe benefits include: Company car. Health insurance. Life insurance coverage.

What is fringe rate?

The fringe rate shows you how much an employee actually costs your business beyond their base wages. Fringe benefit rates vary from business to business. The rate depends on how much you pay employees and how much an employee receives in benefits. Although rates vary, according to the Bureau of Labor Statistics, ...

Is fringe benefit taxable?

Although fringe benefits are typically taxable, some are nontaxable. Taxable fringe benefits can include personal use of a company car, bonus pay, and paid time off. Some nontaxable fringe benefits include group-term life insurance up to $50,000 and employee discounts.