How do you determine your Social Security benefit amount?

- For earnings that fall within the first band, you multiply by 90%. That is the first part of your benefit.

- For earnings that fall within the second band, you multiply by 32%. That is the second part of your benefit.

- For earnings that are greater than the maximum of the second band, you multiply by 15%. This is the third part of your benefit.

Can you collect two Social Security benefits?

If you were already receiving Social Security benefits when began caring for your grandchild, you must adopt the child in order for him or her to collect ... pandemic nearly two years ago, nearly ...

How is SoC SEC calculated?

- the latest earnings figure you provide,

- the national average wage indexing series, and

- a relative growth factor that is initially set to 2 percent.

When are Social Security benefits paid each month?

Social Security benefits will be paid on either the second, third, or fourth Wednesday of each month. Which of these three is chosen will depend on the day of the month when a retiree was born.

Where does the money for the Social Security funds come from?

Social Security benefits are paid from the reserves of the Old-Age, Survivors, and Disability Insurance ( OASDI ) trust fund. The reserves are funded from dedicated tax revenues and interest on accumulated reserve holdings, which are invested in Treasury securities.

How does Social Security fund itself?

Social Security benefits are funded by a dedicated payroll tax, which workers pay into as they earn income. Social Security is a pay-as-you-go system, with contributions paid in today funding the benefits being paid out.

What president took money from the Social Security fund?

President Lyndon B. Johnson1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19647.STATEMENT BY THE PRESIDENT COMMENORATING THE 30TH ANNIVERSARY OF THE SIGNING OF THE SOCIAL SECURITY ACT -- AUGUST 15, 196515 more rows

How are Social Security benefits currently funded and paid to beneficiaries?

Employees pay a 6.2 percent contribution from earnings up to a maximum of $142,800 in 2021, which their employers match. Self-employed workers pay both shares of the contribution, or 12.4 percent.

Has the federal government borrowed from Social Security?

Myth #5: The government raids Social Security to pay for other programs. The facts: The two trust funds that pay out Social Security benefits — one for retirees and their survivors, the other for people with disabilities — have never been part of the federal government's general fund.

What happens if Social Security runs out of money?

Reduced Benefits If no changes are made before the fund runs out, the most likely result will be a reduction in the benefits that are paid out. If the only funds available to Social Security in 2033 are the current wage taxes being paid in, the administration would still be able to pay around 75% of promised benefits.

How much has Congress borrowed from Social Security?

The total amount borrowed was $17.5 billion.

Who was the first president to dip into Social Security funds?

Which political party started taxing Social Security annuities? A3. The taxation of Social Security began in 1984 following passage of a set of Amendments in 1983, which were signed into law by President Reagan in April 1983.

How much does the government owe Social Security?

As of 2021, the Trust Fund contained (or alternatively, was owed) $2.908 trillion The Trust Fund is required by law to be invested in non-marketable securities issued and guaranteed by the "full faith and credit" of the federal government.

Why is Social Security facing a funding crisis?

Why is Social Security facing a funding crisis? There are too many retirees and not enough workers.

Who is the benefactor of Social Security?

Monthly benefits are payable from the Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI) Trust Funds.

How much money has Social Security taken in?

Treasury. Throughout its history, Social Security generally has taken in more money than it paid out, generating a reserve that totaled $2.9 trillion at the end of 2019.

What percentage of income goes into Social Security in 2021?

In 2021, 12.4 percent of income up to $142,800 goes into the Social Security pot. Job holders and their employers split the contribution at 6.2 percent each; self-employed people pay both shares.

What percentage of payroll taxes go to Medicare?

FICA and SECA taxes also are set aside for Medicare. Payroll taxes amounting to 2.9 percent of earnings go into separate trust funds that subsidize the federal health-care program for older and disabled people.

How much is FICA tax?

In 2019, those taxes — called FICA for people with wage-earning jobs and SECA for the self-employed — brought in nearly $945 billion, accounting for 89 percent of Social Security's revenue, according to the 2020 annual report from Social Security's board of trustees.

When will Social Security be depleted?

The latest trustees’ report projects that the reserve will be depleted by 2034. That does not mean Social Security is going “broke,” as the situation sometimes is described.

Is Social Security a savings plan?

Keep in mind. Social Security is not a savings plan. What you pay into the system does not go into an account for your retirement. Workers in each generation finance Social Security payments for their retired elders and other beneficiaries. Down the road, their benefits will be paid for in turn by younger workers.

What is SSI for disabled people?

We are with those who need a helping hand. The Supplemental Security Income (SSI) program provides support to disabled adults and children who have limited income and resources, as well as people age 65 and older who are not disabled but have limited income and resources.

Why do we pay disability benefits to people who can't work?

We pay disability benefits to those who can’t work because they have a medical condition that’s expected to last at least one year or result in death. Find out how Social Security can help you and how you can manage your benefits. LEARN MORE.

Who Receives Social Security Benefits?

Retired workers account for 71 percent of the program’s beneficiaries. Disabled workers make up another 13 percent of beneficiaries. The remainder are the survivors of deceased workers as well as spouses and children of retired and disabled workers.

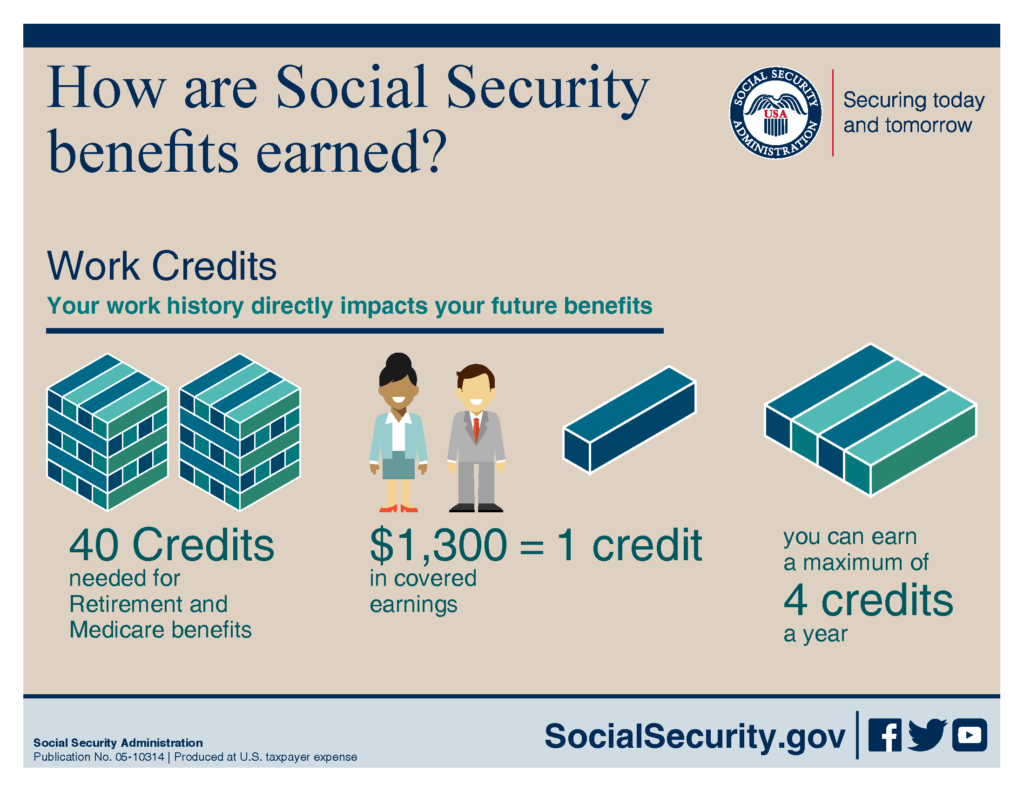

How Are Social Security Benefits Determined?

Workers become eligible for Social Security benefits for themselves and their family members by working and paying Social Security taxes. Generally, a worker must have 10 years of employment to be eligible for retirement benefits. Disability benefits depend on the worker’s earnings before disability and the worker’s age at disability.

How is OASI calculated?

A worker’s initial monthly benefit under the OASI program is based on their average indexed monthly earnings during the 35 years in which their earnings were highest. 1 Benefits are calculated using a progressive formula that provides a higher replacement rate for workers with lower earnings. 2 In 2021, a worker who retires at age 66 with $26,600 in career-average earnings would receive Social Security benefits that replace 53 percent of her pre-retirement earnings. By contrast, Social Security benefits to workers earning $59,000 would replace only 40 percent of their career-average earnings.

What will happen to Social Security in 2034?

If reforms are not enacted, beneficiaries could face an across-the-board benefit cut of 22 percent in 2034 (on average) when the combined trust fund reserves are depleted. Because of the critical importance of this program for ensuring financial security for many retired and disabled people — especially those with low incomes — reforms are needed to ensure that the program can continue to provide benefits.

How many people receive Social Security?

Today, Social Security is the largest program in the federal budget and makes up almost one-quarter of total federal spending. The program provides benefits to about 64 million beneficiaries, or 19 percent of the American population. Nearly 9 out of 10 individuals over the age of 65 receive benefits, and those benefits represent about 33 percent ...

How does social security work in old age?

The social security system provides a form of social insurance against the risk of extreme poverty in old age by redistributing income form higher earners to lower earners.

What was the ratio of workers paying taxes to support each Social Security beneficiary in 2001?

In 2001, the ratio of workers paying taxes to support each Social Security beneficiary was 3:1 ; by 2041, that ratio is expected to decline to 2:1. As the population of beneficiaries grows faster than the population of workers, expenses will grow faster than income, and the finances of the system will become increasingly strained.

Who manages Social Security accounts?

The Treasury manages the Social Security accounts in much the same way that a bank manages a checking account: Accurate accounts are kept of the cash deposits and the accruing interest; cash (plus interest) withdrawals are allowed whenever needed; and in the meantime, the bank can put the cash to other uses.

What is the SSA?

SSA. Social Security Administration . Social Security benefits are paid from the reserves of the Old-Age, Survivors, and Disability Insurance ( OASDI) trust fund. The reserves are funded from dedicated tax revenues and interest on accumulated reserve holdings, which are invested in Treasury securities.

How much was the Oasdi Trust Fund in 2013?

During fiscal year ( FY) 2013 (October 2012–September 2013), 13 the combined OASDI trust fund had gross income (including interest) of $851 billion and gross expenditures of $813 billion, producing a net surplus of $38 billion. The OASDI trust fund holdings of Treasury securities increased by $37 billion that year, on purchases of $1,065 billion and redemptions of $1,027 billion (rounded values). 14

Why raise the trust fund surplus?

Policymakers occasionally propose raising the trust fund surplus—with either a benefit reduction or a tax increase—as a means of balancing the consolidated budget. Early in the Clinton administration, for example, officials considered reducing the cost-of-living adjustment to OASDI benefits as one of several measures to improve the consolidated budget balance. In the long run, however, such changes would only help maintain trust fund solvency while effectively delaying balance in the general account budget. To the extent that they help postpone general account balance, measures such as these can exacerbate a budget imbalance.

What is a trust fund?

In this article, “trust funds” refers to the two Social Security funds ( and the singular “trust fund” refers to the combined OASDI fund) unless otherwise noted. The “general account” or “general fund” refers to the rest of the federal government, which includes the Medicare trust funds 4 and smaller funds such as the Highway Trust Fund.

When will the Oasdi fund be depleted?

In the 2014 edition of the Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds (henceforth, the Trustees Report ), reserves are projected to peak around 2020 and to be depleted around 2033 if no changes are made to the tax or benefit provisions before then. 6 (Once the reserves are depleted, an estimated 77 percent of scheduled benefits would continue to be payable from tax receipts alone.) Chart 1 shows the annual cash flows underlying this rise and fall relative to gross domestic product ( GDP ). Chart 2 shows the reserve levels under six alternative measures. The overall patterns, if not the exact depletion date, have changed little over the years: For example, charts showing similar projections that appear in Hambor (1987) closely resemble Chart 2, panels A and D.

How does a trust fund redeem its securities?

In a separate operation, securities from the funds' investment holdings are redeemed in amounts sufficient to pay that day's estimated benefits. If, for example, a fund on a particular day has $2 billion in estimated tax income and $3 billion in estimated benefits, the fund will purchase $2 billion in Treasury securities in one operation and redeem $3 billion in another. The net effect is approximately the same as if the fund had redeemed only $1 billion in existing securities and used that cash, plus the $2 billion in tax income, to pay the benefits. 15

How is SSI financed?

SSI is financed by general funds of the U.S. Treasury--personal income taxes, corporate and other taxes. Social Security taxes collected under the Federal Insurance Contributions Act (FICA) or the Self-Employment Contributions Act (SECA) do not fund the SSI program. In most States, SSI recipients also can get medical assistance ...

When is SSI paid?

In some States, an application for SSI also serves as an application for food assistance. SSI benefits are paid on the first of the month.

What does SSI mean?

SSI stands for Supplemental Security Income. Social Security administers this program. We pay monthly benefits to people with limited income and resources who are disabled, blind, or age 65 or older. Blind or disabled children may also get SSI.

How old do you have to be to get SSI?

To get SSI, you must be disabled, blind, or at least 65 years old and have "limited" income and resources. In addition, to get SSI, you must also: be either a U.S. citizen or national, or a qualified alien; reside in one of the 50 States, the District of Columbia or the Northern Mariana Islands; and.

Can I apply for SSI and Social Security?

Many people who are eligible for SSI may also be entitled to Social Security benefits. In fact, the application for SSI is also an application for Social Security benefits. However, SSI and Social Security are different in many ways.

Is disability the same as SSI?

Both programs pay monthly benefits. The medical standards for disability are generally the same in both programs for individuals age 18 or older. For children from birth to the attainment of age 18 there is a separate definition of disability under SSI.

Can you get Social Security if you are insured?

Social Security benefits may be paid to you and certain members of your family if you are “insured” meaning you worked long enough and paid Social Security taxes. Unlike Social Security benefits, SSI benefits are not based on your prior work or a family member's prior work.

How long have Social Security benefits been paid?

Since the inception of the Social Security program in 1935, scheduled benefits have always been paid on a timely basis through a series of modifications in the law that will continue. Social Security provides a basic level of monthly income to workers and their families after the workers have reached old age, become disabled, or died. The program now provides benefits to over 50 million people and is financed with the payroll taxes from over 150 million workers and their employers. Further modifications of the program are a certainty as the Congress continues to evolve and shape this program, reflecting the desires of each new generation.

When will Social Security be paid in full?

As a result of changes to Social Security enacted in 1983, benefits are now expected to be payable in full on a timely basis until 2037 , when the trust fund reserves are projected to become exhausted. 1 At the point where the reserves are used up, continuing taxes are expected to be enough to pay 76 percent of scheduled benefits. Thus, the Congress will need to make changes to the scheduled benefits and revenue sources for the program in the future. The Social Security Board of Trustees project that changes equivalent to an immediate reduction in benefits of about 13 percent, or an immediate increase in the combined payroll tax rate from 12.4 percent to 14.4 percent, or some combination of these changes, would be sufficient to allow full payment of the scheduled benefits for the next 75 years.

How much will the OASDI cost?

Projected OASDI cost is expected to rise from about 4.5 percent of GDP since 1990, to about 6 percent of GDP over the next 20 years, and to roughly stabilize at that level thereafter (see Chart 5). Although an increase in the cost of the program from 4.5 to 6 percent of GDP is substantial, the fact that the increase is not projected to continue after this "level shift" is important. Chart 5 focuses on the question of whether the level of benefits scheduled in current law should be maintained for future generations, at the price of higher taxes, or whether scheduled benefits should be reduced to levels affordable with the current taxes in the law.

Why did the 1983 amendments have a low trust fund level?

The fact that the 1983 amendments were enacted with a projected trust fund level that was declining rapidly at the end of the period toward exhaustion soon thereafter may be attributed at least in part to an overreliance on the single measure of actuarial balance. Since 1983, many additional measures have been developed and have been used widely. One of the best measures has been the concept of "sustainable solvency."

Why is the trust fund expected to be exhausted?

Exhaustion of trust fund assets is projected to occur under the intermediate assumptions because program cost will begin to exceed the tax revenues dedicated to the trust funds in the future, requiring increasing amounts of net redemptions from the trust funds.

What is included in the annual report of Social Security?

The Social Security Act requires that the annual report include (1) the financial operations of the trust funds in the most recent past year, (2) the expected financial operations of the trust funds over the next 5 years, and (3) an analysis of the actuarial status of the program. The recent financial operations and the operations projected for ...

What happens to the Treasury if the trust fund is exhausted?

If trust fund assets are exhausted without reform, benefits will necessarily be lowered with no effect on budget deficits. The author is the Chief Actuary of the Social Security Administration.

Funding

History

- The Social Security trust funds date back to the Old-Age Reserve Account, established under the 1935 Social Security Act. The act authorized Congress to appropriate funds to the reserve account and separately established a new payroll tax sufficient to provide those funds. However, because a recent Supreme Court decision (unrelated to Social Security) had raised questions ab…

Function

- The Social Security Act provides that the funds are maintained on the books of the Treasury. The Treasury manages the Social Security accounts in much the same way that a bank manages a checking account: Accurate accounts are kept of the cash deposits and the accruing interest; cash (plus interest) withdrawals are allowed whenever needed; and in the meantime, the bank c…

Future

- It is also important to identify certain assumptions about future Social Security financing. Throughout this article it is assumed, unless otherwise noted, that OASDI will continue to be financed through its own dedicated receipts. That assumption implies that adjustments to currently scheduled OASDI taxes and benefits will at some point be enacted. This article focuse…

Content

- This article is arranged in nine sections. The first section gives an overview of the historical and projected trust fund flows and reserves. The three sections that follow describe the monthly flows, the process by which the Treasury manages them, and their treatment in the Federal budget accounts. The next three sections discuss aspects of the interaction between the trust f…

Performance

- Chart 1 shows trust fund total income exceeding trust fund expenditures from 1984 through 2019, generating annual surpluses. Beginning in 2020, total income is projected to be less than expenditures, generating annual deficits (shown as negative surpluses). The point at which the surplus changes to a deficit in 20192020 corresponds with the nominal-dollar peak in reserves s…

Effects

- The interest income line rises and falls according to trust fund reserve levels and changes in the interest rate earned on those reserves. Relative to GDP, it reaches a broad, flat peak around 2010 that coincides with the peak in reserves seen in Chart 2, panel D. Interest income is projected to decline as the reserves themselves decline, reaching zero in 2033. During the recession, interes…

Charts

- Chart 2 shows the rise and projected decline of the combined OASDI trust fund reserves over the period 19802040.10 In each panel, the reserves are currently near their peak and will decline (under current provisions and projections) toward depletion in 2033. The fact that reserves are currently near their peak is not widely understood. For that reason, showing the reserves under s…

Details

- Each panel includes a correspondingly adjusted measure of trust fund expenditures, which assumes a reduction in payable benefits in 2033 when the reserves are depleted. The conventional test of the adequacy of the reserves against unexpected near-term fluctuations in income and costs is that they equal at least 100 percent of projected annual costs. Like the rese…

Example

- Panels AC measure the reserves in dollarsnominal, wage-adjusted, and present value, respectively. The measures are constructed to have the same value for the reserves at the end of 2013 (about $2.8 trillion), but they apply different adjustments to the reserves in earlier and later years. The most straightforward measure is nominal dollars (panel A), under which reserves ris…

Introduction

- These dollar measures (as well as others not shown here, such as dollars adjusted for growth in the consumer price index or in a GDP price deflator) share the problem of simply being too vast to interpret easily. It is hard enough to comprehend the current reserves of over $2.8 trillion. Reserves a decade or more away are yet more difficult to grasp, even after adjusting for price or …

Statistics

- Chart 2 panel D shows the reserves as a percentage of GDP, consistent with Chart 1's presentation of cash flows relative to GDP. Reserves reached a year-end peak of close to 18 percent of GDP in 2009, and since then have been moving downward. Reserves as a percentage of taxable payroll (Chart 2, panel E) show a very similar pattern. The shape (althoug…

Status

- Which measure is most useful for indicating the status of the reserves? All of them indicate that reservesfor the combined fund, anywayare more than adequate for the near term; on that basis, no single measure emerges as clearly superior. However, the three ratio measures provide a more interpretable context than do the dollar measures; and for policy proposals (such as changes to …

Benefits

- By design, these procedures keep the trust funds' surplus income continuously and completely invested in interest-earning securities, allowing the reserves to be built up and spent down as if they were cash, while at the same time earning market-based interest rates. Some observers worry that because the general account of the Treasury has borrowed the trust funds' surplus in…

Management

- Perhaps the most confusing aspect of Social Security financing is the management of the trust fund cash flows on the books of the Treasury. The methods of managing the funds can create the impression that the interest income and even the investment holdings are mere accounting conventions. However, if one looks past the cash flow transactions to the impact on actual pay…

Operations

- The financing operations described in the preceding sectionthe purchase of Treasury securities from OASDI tax or interest income and the redemption of Treasury securities to meet OASDI expensesare actually handled by the Treasury Department, whose secretary is the managing trustee of the trust funds. (The Treasury is reimbursed from the trust funds for the managemen…

Usage

- Table 1 broadly summarizes the Treasury's operating cash account operations in FY 2013. The account began the year with $85 billion in operating cash and ended the year with $88 billion, an increase of $3 billion. That increase is the net result of $11,746 billion in withdrawals and $11,749 billion in deposits.

Risks

- Most of the withdrawals and deposits, each totaling $8,273 billion, are in offsetting security rollover transactions. Publicly held Treasury securities are continually maturing and being rolled over into newly issued securities, an operation that requires cash payment to the owners of maturing securities and cash receipt from the purchasers of newly issued securities. If the gover…

Criticisms

- Some may think that the Treasury's financing of OASDI when the government is running a surplus differs from that when the government is running a deficit. Because of the continual stream of maturing securities, however, the mechanics of the financing are similar in both cases. For example, Table 1 indicates that in FY 2013, $8,273 billion in publicly held securities matured. Go…

Analysis

- For most of this analysis, we can ignore the offsetting $8,273 billion rollover transactions and focus instead on the nonrollover transactions$3,473 billion in withdrawals and $3,476 billion in deposits, netting, like the total transactions, to $3 billion in deposits. Unlike the rollover transactions, these amounts can be tied to annual amounts in the budget accounts.

Components

- The largest component of the $3,473 billion in nonrollover operating cash withdrawals was the $2,420 billion in primary expenditures from the general account. Smaller amounts of cash covered OASDI expenses ($813 billion) and interest on the publicly held debt ($221 billion).19

Results

- In addition to the $221 billion in interest paid to public holders of the debt, the general account also paid $106 billion in interest to the OASDI funds for their holdings of Treasury securities; but because the Treasury simultaneously borrowed those interest payments back, a separate operating cash transaction was not necessary. This does not mean that the OASDI holdings hav…

Significance

- In an important sense, net new borrowing from the public is a residual value because if any of the legislatively controlled primary amounts changes, net new borrowing must also change to maintain the operating cash level. Each additional dollar of tax revenue requires one less dollar to be borrowed from the public. Each additional dollar of general account or OASDI benefit expendi…

Impact

- The $68 billion in additional borrowing attributable to the OASDI primary deficit and the $106 billion reduction in borrowing because of the reduced cash interest payments combined to produce a $38 billion net reduction in borrowing from the public. That amount corresponds to the OASDI surplus for that period and the amount by which OASDI reduced the consolidated budget …