- The SSA counts up the number of years from the year you turned 22 to the year before you became disabled.

- It throws out between one and five years (the longer you’ve been working, the more “dropout years”).

- The resulting number is how many of your highest-earning years will go into the PIA calculation.

What is the difference between SSI and SSA?

- Medicare will soon provide free at-home covid tests

- Billions distributed from the Provider Relief Fund

- Reasons why Congress won’t send another stimulus check

How does SSDI affect my SSA retirement benefits?

In most cases, you cannot receive Social Security disability and retirement benefits at the same time, since SSDI benefits are meant for those who cannot work due to injury or illness. If you’re receiving retirement benefits, it is already implicit that you are no longer working. There is one exception to this rule, however.

How your SSDI monthly benefit will be calculated?

The Social Security Administration (SSA ... 2Gd6YaeTZV #BLSdata pic.twitter.com/EzuVUbZpry The easiest way to calculate your benefit is by taking your monthly payment and multiplying it by ...

How much does social security pay in disability benefits?

Up to 85 percent of a taxpayer’s benefits could become taxable if:

- You're filing as a single, head of household, or qualifying widow or widower with more than $34,000 in income.

- You're married and filing jointly with more than $44,000 in income.

- You're married but filing separately and have lived apart from your spouse for the entire tax year, and you had more than $34,000 in income.

Benefit Calculators

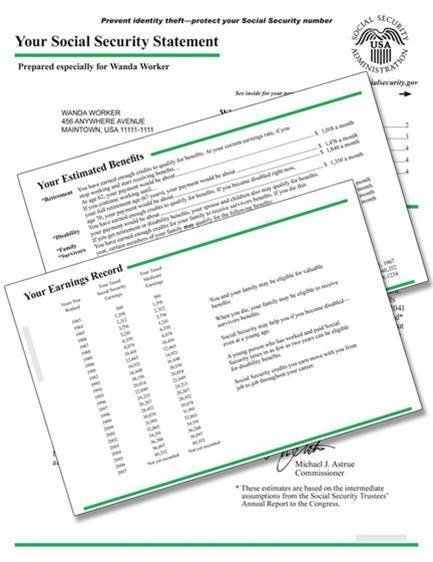

The best way to start planning for your future is by creating a my Social Security account online. With my Social Security, you can verify your earnings, get your Social Security Statement, and much more – all from the comfort of your home or office.

Online Benefits Calculator

These tools can be accurate but require access to your official earnings record in our database. The simplest way to do that is by creating or logging in to your my Social Security account. The other way is to answer a series of questions to prove your identity.

Additional Online Tools

Find your full retirement age and learn how your monthly benefits may be reduced if you retire before your full retirement age.

What is SSI disability?

SSI is called a “means-tested program,” meaning it has nothing to do with work history, but strictly with financial need. SSI disability benefits are available to low-income individuals who haven’t earned enough work credits to qualify for SSDI.

How much is SSI monthly?

If you meet the qualifications as described below, and your application for SSI is approved, you will receive benefits of $733 per month (for individuals) or $1,100 per month (for couples), minus a portion of your current income.

What is back payment on SSDI?

Back payments are any disability benefits that are past due, or the benefits that you would have been paid if your initial application was approved right away. Retroactive payments are for the months that you were disabled and could not work. You are eligible for retroactive payments only with SSDI and not SSI.

How long does a person have to be on SSDI to receive SSI?

In order to receive SSDI, the prospective recipient must be able to demonstrate they have a disability that is medically determinable, that will continue to last no less than twelve months, and that prevents the individual from engaging in substantial gainful activity.

What is the AIME on SSDI?

This income is called your “covered earnings”. The average of your covered earnings over several years is called your average indexed monthly earnings (AIME).

What is SGA in Social Security?

Substantial Gainful Activity – SGA. is an important concept to understand when pursuing Social Security Disability Insurance or Supplemental Security Income. The Social Security Administration defines it as “the performance of significant mental and/or physical duties for profit”. SGA maximum amounts are set by the Social Security Administration ...

How much income do I need to qualify for SSI?

The amount is set by your particular state, and it is usually between $700 and $1400 per month, and some states allow individuals with higher incomes to still qualify for SSI. You must own less than $2,000 in property (minus your home and car) for individuals, or $3,000 for a couple.

Eligibility Requirements

Before we talk about how social security disability benefits are calculated, you first need to figure out whether or not you qualify for Social Security Disability Insurance (SSDI) benefits. In a nutshell, there are only two eligibility requirements for SSDI:

How to Calculate SSDI Benefits

Your average covered earnings for a period of years are referred to as Average Indexed Monthly Earnings (AIME). The SSA applies a formula to your AIME to calculate your Primary Insurance Amount (PIA). The final PIA is the maximum amount of SSDI benefits you are entitled to.

Calculating Social Security Backpay

As per the SSA’s policy, your disability payments should start on the day you become disabled. But since it takes some time for the SSA to process your claim, you’ll usually receive your benefits after a few months. This is why most disability claims include back payments.

Factors That Can Reduce Your SSDI Benefits

As mentioned earlier, the SSA also considers your other sources of income to determine your benefit amount. If you earned more than 80% of your average income before you got disabled, your benefits will be reduced.

How to Calculate SSI Benefits

Disabled people who don’t have enough work credits for SSDI may still receive disability benefits through Supplemental Security Income (SSI). Unlike SSDI, SSI is a needs-based benefit. This means that SSA only grants it to those with limited income and resources. Though some people may also qualify for SSI even if they’re already receiving SSDI.

Why You Need an Experienced Lawyer

Applying for social security disability benefits might be easy for you. But getting it approved is an altogether different story. A large percentage of first time SSDI applications are denied. This is why you need an experienced social security disability attorney like Victor Malca. He has already helped thousands of injured workers in Florida.

What is SSDI benefits?

SSDI is a benefit for disabled workers who have sufficiently paid into the Social Security system over the course of their employment. You must have earned a certain number of work credits to qualify for benefits if you become disabled before retirement age. The exact number of credits you need depends on your age.

What is a PIA in SSA?

PIAs are complex to calculate and even harder to explain. “The PIA is the sum of three separate percentages of portions of average indexed monthly earnings, ” states the SSA. Essentially, the SSA separates your AIME into three portions that it calls “bend points”:

What is the maximum amount of SSI you can collect in 2017?

In 2017, the FBR is $735. This is maximum amount of SSI you can collect each month. Then, the SSA simply deducts your countable unearned income and your countable earned income from the $735 to determine your monthly SSI benefit amount. The SSA counts various types of income against your benefit amount, including:

How Social Security Retirement Benefits Are Calculated

When the Social Security Administration calculates your retirement benefit, they start by inflating your historical earnings to reflect historical wage growth using the Average Wage Index. The formula sums up your highest 35 years, divides by 35, and then divides again by 12. The result is your average indexed monthly earnings, or AIME.

How Social Security Disability Benefits Are Calculated

When calculating disability benefits, the Social Security Administration first determines how many years should be used in your calculation. To make this determination, they take the number of years from the calendar year you turn 22 through the year the Social Security disability waiting period begins.

Another Key Difference Between Disability Benefits and Retirement Benefits Calculations

Another key difference between how Social Security disability benefits are calculated and how the SSA determines retirement benefits is that with retirement benefits, AIME is calculated through the formula which is in place the year you turn 62.

What is the work incentive for Social Security?

There are also a number of special rules, called "work incentives," that provide continued benefits and health care coverage to help you make the transition back to work. If you are receiving Social Security disability benefits when you reach full retirement age, your disability benefits automatically convert to retirement benefits, ...

Does Social Security pay for partial disability?

Social Security pays only for total disability. No benefits are payable for partial disability or for short-term disability. We consider you disabled under Social Security rules if all of the following are true: You cannot do work that you did before because of your medical condition.