The variables in the calculation are as follows:

- Annual salary — States calculate benefits based on annual or quarterly earnings. ...

- The number of dependents — Some states give extra unemployment benefits depending on the size of your household.

- Benefits start date —You should apply for unemployment as soon as you lose your job. ...

How to tell if you are eligible for unemployment benefits?

You must be:

- Physically able to work.

- Available for work.

- Ready and willing to accept work immediately.

How to maximize your unemployment benefits?

Maximize your unemployment benefits by applying for this program if available. Ask your employer if they participate and ask them to submit an application to the state unemployment administration if they do not. You can also contact your state to find out if you qualify for shared work compensation. References.

How to calculate gross wages for unemployment benefits?

To calculate your weekly benefits amount, you should:

- Work out your base period for calculating unemployment.

- Take a look at the base period where you received the highest pay.

- Calculate the highest quarter earnings with a calculator.

- Calculate what your weekly benefits would be if you have another job.

- Calculate your unemployment benefits for every week if the partial gross income is different.

How do you estimate unemployment benefits?

- You must have lost your job through no fault of your own. ...

- If you quit your job, you may still be eligible for benefits if you left under certain circumstances, such as being asked to perform illegal acts or work in hazardous ...

- You must have earned at least $2,500 in wages during your standard base period. ...

How are unemployment rates calculated?

In simple terms, the unemployment rate for any area is the number of area residents without a job and looking for work divided by the total number of area residents in the labor force.

How much unemployment will I get if I make $1000 a week in California?

If you made $1,000 per week ($52,000 per year), have had your hours reduced to zero hours per week, and are not receiving pay from any other employer, your weekly State UI benefit will be $450 per week.

How do I calculate my EDD weekly benefit?

The EDD will compute your weekly benefit amount based on your total wages during the quarter in your base period when you earned the most. For all but very low-wage workers, the weekly benefit amount is arrive at by dividing those total wages by 26—up to a maximum of $450 per week.

What is the maximum time for which I can receive unemployment benefits in New Jersey?

26 weeksA claimant can collect a maximum of 26 weeks of benefits on a regular unemployment claim.

How much is EDD paying now 2021?

$167 plus $600 per week for each week you are unemployed due to COVID-19.

Can you get EDD If you work part-time?

Yes. You can receive benefits intermittently while working part-time as long as you continue to meet the other eligibility requirements.

How do I calculate my California unemployment gross pay?

Part 6a: To determine your gross wages, multiply the number of hours you worked that week, and multiply it by your hourly rate of pay. Enter this information in the space provided on the form.

Whats the most EDD will pay?

The unemployment benefit calculator will provide you with an estimate of your weekly benefit amount, which can range from $40 to $450 per week. Once you submit your application, we will verify your eligibility and wage information to determine your weekly benefit amount.

How much money can you make and still collect unemployment in California?

If your weekly earnings are $100 or less, the first $25 do not apply. Any amount over $25 is subtracted from your weekly benefit amount and you are paid the difference, if any. For example: Your weekly benefit amount is $145.

How is unemployment calculated in NJ?

If you are eligible to receive unemployment, your weekly benefit rate (WBR) will be 60% of your average weekly earnings during the base period, up to a maximum of $713. This number is then multiplied by the number of weeks that you worked during the base period, up to a maximum of 26 weeks.

Are they extending unemployment?

About the PEUC Extension Pandemic Emergency Unemployment Compensation (PEUC) provided up to 53 additional weeks of payments if you've used all of your available unemployment benefits. The first 13 weeks were available from March 29, 2020 to September 4, 2021.

What is the maximum unemployment benefit in NJ for 2021?

FOR IMMEDIATE RELEASE In the new year, the maximum weekly benefit amount for new Unemployment Insurance beneficiaries increases to $804, from $731.

How to calculate unemployment weekly?

To calculate your weekly benefits amount, you should: Work out your base period for calculating unemployment. Take a look at the base period where you received the highest pay. Calculate the highest quarter earnings with a calculator. Calculate what your weekly benefits would be if you have another job. Calculate your unemployment benefits ...

How long does it take to get unemployment benefits?

If eligible for unemployment benefits, you can expect to receive your first payment within 3-4 weeks if there are no issues with your claim.

What happens if you work temporarily and get unemployment?

If you work temporarily then you must report those earnings to the state unemployment agency and they will determine how much of the unemployment benefits would be reduced. Ensure that you contact your state unemployment insurance department once you are unemployed.

What is unemployment based on?

These unemployment benefits provide a partial replacement for lost wages. The amount that you receive would be based on what you had earned. States have different formulae to calculate benefit payments but all states would take your prior earnings into account. While others look at the employee’s earnings during the highest paid quarter or two quarters of the base period.

How long does unemployment last?

This is beneficial for those that are out of work for a long period. The maximum benefits duration has increased from 26 to 99 weeks in some states.

How much of your federal income tax is withheld?

This would suggest that up to 10% of your benefit amount would be withheld to pay federal income taxes. In case you earn an income while receiving benefits, they would reduce the amount of benefits that you receive.

How to file a weekly claim?

You can file your weekly claim: Through the Internet – You can file your weekly claim online. You must have a User ID and PIN in order to file your weekly claim online. By phone – You must call the number given to you during the registration process.

How long do you have to work to get unemployment?

In order to qualify for a new claim, you must have worked for a certain amount of time before you apply again. You need to have worked at least four weeks and earned six times your last claim's weekly benefit rate in covered employment. You must also meet all other eligibility rules. We need all of this information to see if you are once again eligible for benefits.

How much unemployment is $200?

For example, if your weekly benefit rate is $200, your partial weekly benefit rate is $240 (20 percent more than $200.) If you earn $50 (gross) during a week, you would receive $190 in unemployment insurance benefits ($240 – $50 = $190).

What happens if you earn more than 20 percent of your weekly benefit?

If you earn more than 20 percent of your weekly benefit rate from an employer in a given week, your partial weekly benefit payment will be reduced dollar-for-dollar for all gross wages earned that week.

What is the maximum weekly benefit for 2021?

The weekly benefit rate is capped at a maximum amount based on the state minimum wage. For 2021, the maximum weekly benefit rate is $731. We will calculate your weekly benefit rate at 60% of the average weekly wage you earned during the base year, up to that maximum.

When do you stop receiving unemployment benefits?

Whether or not you have collected all the benefits in your claim, we stop paying benefits after one year has passed from the initial date of your claim. If after this one-year anniversary you are unemployed, you need to file a new claim because we have to recalculate your weekly benefit rate based on the new base year period.

Can you increase your dependency benefits if you are not entitled to the weekly maximum?

If you are not entitled to the weekly maximum benefit amount, you may be able to increase your entitlement with dependency benefits.

Do you report your gross earnings when you are paid?

Report your gross earnings and all hours worked for the week in which they were earned, not when they are paid.

How long can you get unemployment?

The maximum number of weeks you can receive full unemployment benefits is 30 weeks (capped at 26 weeks during periods of extended benefits and low unemployment). However, many individuals qualify for less than 30 weeks of coverage. The following examples show how to determine your duration of benefits.

How to calculate duration of benefits?

Your duration of benefits is calculated by dividing your maximum benefit credit by your weekly benefit amount.

How much unemployment is there in 2020?

As of October 4, 2020, the maximum weekly benefit amount is $855 per week.

How long is the benefit year?

Your benefit year. Once your claim is established, it will remain open for 1 year (52 weeks). This period of time is called your benefit year. Your maximum benefit credit (the total amount of benefits you are eligible to receive) is available to you for the duration of your benefit year or until you have exhausted your maximum benefit credit.

How much is the maximum UI benefit?

As of October 4, 2020, the maximum weekly benefit amount is $855 per week. Follow the steps below to calculate the amount ...

How to calculate weekly wage if you worked 2 or fewer quarters?

Note: If you worked 2 or fewer quarters, divide the highest quarter by 13 weeks to determine your average weekly wage.

What to do if you disagree with your wage?

If you disagree with the wages reported on your Monetary Determination notice, you can provide proof of the wage amounts you are disputing by completing and returning the Wage and Employer Correction sheet that was mailed to you with your notice.

How long can you get unemployment?

The majority of states offer 26 weeks’ worth of unemployment benefits. This is usually a monetary cap, which is calculated by multiplying your weekly benefit by 26. This means that if you qualify for partial unemployment, you could benefit for more than 26 weeks .

What is the base period for unemployment?

The base period is generally the first four of the last five calendar quarters prior to your claim. If your earnings in the base period aren’t enough for you to qualify for unemployment assistance, you may be automatically reconsidered using an alternate base period, which is usually the last four calendar quarters.

How much is the minimum weekly benefit in Minnesota?

The weekly benefit amount in Minnesota is 50% of 1/13 of your earnings in the highest quarter of your base period, or 50% of 1/52 of your average weekly earnings over your base period, whichever is higher. The minimum weekly benefit amount a Minnesotan could receive is $28 and the maximum is $740.

What is the maximum unemployment benefit in Vermont?

The minimum weekly benefit amount a Vermonter could receive is $72 and the maximum is $513 . If you collect income while on unemployment benefits, Vermont will disregard 1/2 of gross wages.

What is the minimum weekly unemployment benefit in Nevada?

The weekly benefit amount in Nevada is 1/25th of your earnings in the highest quarter of your base period. The minimum weekly benefit amount a Nevadan could receive is $16 and the maximum is $469. If you collect income while on unemployment benefits, Nevada will disregard 1/4 of your wages.

How much unemployment benefits do you get in Hawaii?

The weekly benefit amount in Hawaii is 1/21 of your earnings in the highest quarter of your base period. The minimum weekly benefit amount a Hawaiian could receive is $5 and the maximum is $648. If you collect income while on unemployment benefits, Hawaii will disregard $150.

What is the weekly benefit amount in the District of Columbia?

The weekly benefit amount in the District of Columbia is 1/26 of your earnings in the highest quarter of your base period.

How to calculate unemployment rate?

The following are the steps to take when calculating the unemployment rate in the United States: 1. Determine the percentage of people in the labor force. The first step in calculating the unemployment rate is to calculate the total percentage of individuals in the labor force, ...

When is the unemployment rate published?

The United States reports the unemployment rate by year, which is published in December of each year.

What are the different types of unemployment?

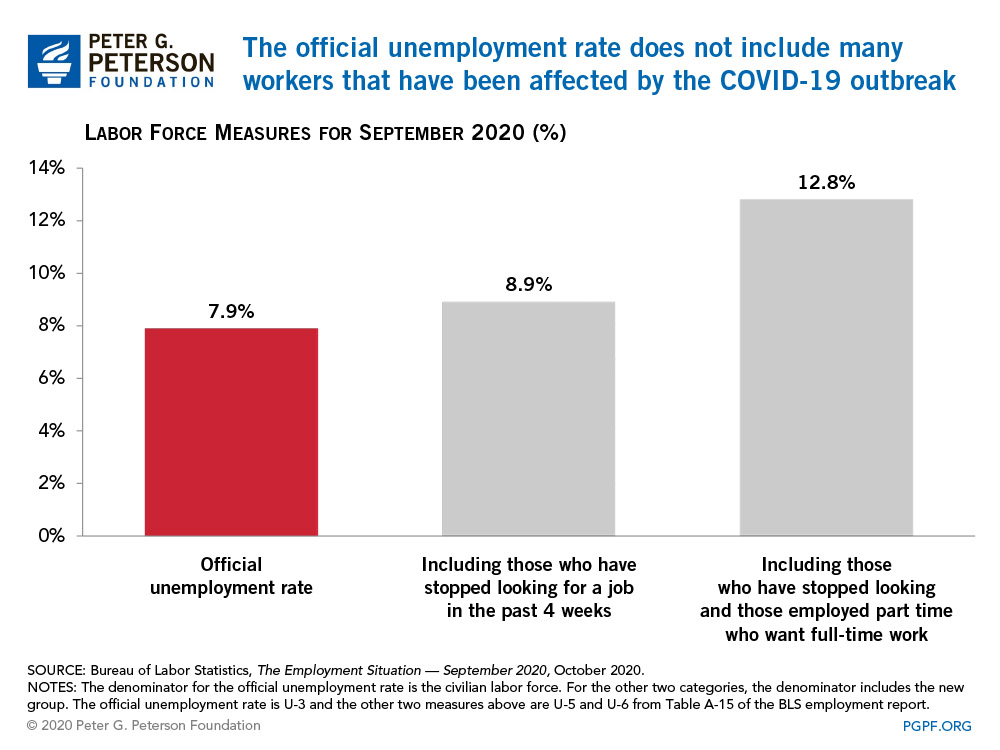

The BLS incorporates three different categories of unemployed people into its calculations of the "real" unemployment rate: 1 Marginally attached labor force workers: These are individuals who have not sought work in the past four weeks but have looked for a job at least once in the last year. 2 Long-term unemployed individuals: This group of people includes those who have been looking for work in the past four weeks and have been unemployed for 27 or more weeks. 3 Discouraged workers: This population describes a group of workers who have searched for work over the past year, but not in the last four weeks. Because they haven't sought work in the last four weeks, the government does not consider them unemployed. However, these workers still wish to have full-time jobs.

What is the lagging indicator of unemployment?

The unemployment rate is a lagging indicator, or an indicator of how an economic event affected employment during a certain time period. For example, a recession is an economic event, and high unemployment rates are the lagging indicator of the effects of the recession. This also indicates that unemployment will steadily rise for a period of time even after the recession is over.

What is the primary unemployment rate?

The primary, or official, unemployment rate is the rate that the government uses to make decisions, such as the monetary policy. This is the traditional rate that only includes the unemployment of persons who have no job but are actively seeking employment. Another type of unemployment rate calculated by the BLS is the "real" unemployment rate, ...

Why is unemployment important?

The unemployment rate is important because unemployment can affect the economy and individual people. Here are the ways that the unemployment rate affects both the economy and individuals:

Why does the Federal Reserve use unemployment?

Additionally, the Federal Reserve uses the unemployment rate to gauge the overall health of the economy when it establishes a monetary policy. This policy is used to manage economic growth, inflation and unemployment.

What is the maximum amount you can receive in unemployment?

Your maximum benefit amount ( MBA) is the total amount you can receive during your benefit year. Your MBA is 26 times your weekly benefit amount or 27 percent of all your wages in the base period, whichever is less. To receive benefits, you must be totally or partially unemployed and meet the eligibility requirements.

How to calculate WBA?

To calculate your WBA, we divide your base period quarter with the highest wages by 25 and round to the nearest dollar.

What is past wages?

Past Wages. Your past wages are one of the eligibility requirements and the basis of your potential unemployment benefit amounts. We use the taxable wages, earned in Texas, your employer (s) have reported paying you during your base period to calculate your benefits. If you worked in more than one state, see If You Earned Wages in More ...

How long can you be out of work for APB?

You may be able to use an alternate base period ( APB) if you were out of work for at least seven weeks in one base-period quarter because of a medically verifiable illness, injury, disability, or pregnancy. The ABP uses wages paid before the illness or injury. To be eligible, you must have filed your initial claim no later than 24 months after the date that the illness, injury, disability, or pregnancy began. Call a TWC Tele-Center at 800-939-6631 to ask if you qualify for an ABP.

How many times is your base period wage?

Your total base period wages are at least 37 times your weekly benefit amount.

What is the date of a medical claim?

The date and nature of your illness, injury, disability, or pregnancy. It must be medically verifiable, i.e., substantiated by a health care practitioner, a health professional, or evidenced by sufficiently strong physical facts.

Can you get unemployment if you were fired?

You may be eligible for benefits if you were fired for reasons other than misconduct. Examples of misconduct that could make you ineligible include violation of company policy, violation of law, neglect or mismanagement of your position, or failure to perform your work adequately if you are capable of doing so.