How to tell if you are eligible for unemployment benefits?

You must be:

- Physically able to work.

- Available for work.

- Ready and willing to accept work immediately.

How to maximize your unemployment benefits?

Maximize your unemployment benefits by applying for this program if available. Ask your employer if they participate and ask them to submit an application to the state unemployment administration if they do not. You can also contact your state to find out if you qualify for shared work compensation. References.

How to calculate gross wages for unemployment benefits?

To calculate your weekly benefits amount, you should:

- Work out your base period for calculating unemployment.

- Take a look at the base period where you received the highest pay.

- Calculate the highest quarter earnings with a calculator.

- Calculate what your weekly benefits would be if you have another job.

- Calculate your unemployment benefits for every week if the partial gross income is different.

How do you estimate unemployment benefits?

- You must have lost your job through no fault of your own. ...

- If you quit your job, you may still be eligible for benefits if you left under certain circumstances, such as being asked to perform illegal acts or work in hazardous ...

- You must have earned at least $2,500 in wages during your standard base period. ...

How are unemployment rates calculated?

In simple terms, the unemployment rate for any area is the number of area residents without a job and looking for work divided by the total number of area residents in the labor force.

How many hours can you work and still get unemployment in Texas?

If you work part time, you can earn up to 25 percent of your weekly benefit amount (WBA) before TWC reduces your benefit payment. For example, if your WBA is $160, you may earn $40 without a reduction. If you earn $50, we reduce your WBA for the week to $150.

How does EDD determine weekly benefit amount?

Calculating Benefit Payment Amounts. Your Weekly Benefit Amount (WBA) depends on your annual income. It is estimated as 60 to 70 percent of the wages you earned 5 to 18 months before your claim start date and up to the maximum WBA. Note: Your claim start date is the date your disability begins.

Can I work part time and collect unemployment Texas?

Working Part Time If you work part time, you may be eligible to continue receiving unemployment benefits as long you meet all other requirements, including looking for full-time work.

What can disqualify you from unemployment benefits?

Unemployment Benefit DisqualificationsInsufficient earnings or length of employment. ... Self-employed, or a contract or freelance worker. ... Fired for justifiable cause. ... Quit without good cause. ... Providing false information. ... Illness or emergency. ... Abusive or unbearable working conditions. ... A safety concern.More items...•

How is unemployment calculated in Texas?

Amount and Duration of Unemployment Benefits in Texas As explained above, the Texas Workforce Commission determines your weekly unemployment benefit amount by dividing your earnings for the highest paid quarter of the base period by 25, up to a maximum of $535 per week. Benefits are available for up to 26 weeks.

Whats the most EDD will pay?

The unemployment benefit calculator will provide you with an estimate of your weekly benefit amount, which can range from $40 to $450 per week. Once you submit your application, we will verify your eligibility and wage information to determine your weekly benefit amount.

How much money can you make and still collect unemployment in California?

If your weekly earnings are $100 or less, the first $25 do not apply. Any amount over $25 is subtracted from your weekly benefit amount and you are paid the difference, if any. For example: Your weekly benefit amount is $145.

How much is EDD paying now 2021?

$167 plus $600 per week for each week you are unemployed due to COVID-19.

Will Texas unemployment benefits be extended 2021?

The new American Rescue Plan Act of 2021 ( ARP ) further extends unemployment benefits claims created under the Coronavirus Aid, Relief, and Economic Security Act ( CARES Act ) and the Continued Assistance Act ( CAA ) passed in December. Programs under this new act will extend benefits through September 4, 2021.

What can disqualify you from unemployment benefits in Texas?

You may be eligible for benefits if you were fired for reasons other than misconduct. Examples of misconduct that could make you ineligible include violation of company policy, violation of law, neglect or mismanagement of your position, or failure to perform your work adequately if you are capable of doing so.

Is Texas ending unemployment?

Extended unemployment benefits for jobless Texans will end in September, state agency says. The Texas Workforce Commission announced that the U.S. Department of Labor notified the commission that the state's unemployment rate fell below the threshold needed to continue the benefits.

How long can you collect unemployment?

State benefits are typically paid for a maximum of 26 weeks. Some states provide benefits for a lower number of weeks, and maximum benefits also vary based on where you live. In times of high unemployment, additional weeks of unemployment compensation may be available. Regardless of how much you make, you never can collect more than ...

What percentage of unemployment is taxed?

Some states withhold a percentage of your unemployment benefits to cover taxes—typically 10%. If the option to have taxes withheld is available, you will be notified when you sign up for unemployment.

How long do you get unemployment if you are laid off?

The amount you receive depends on your weekly earnings prior to being laid off and on the maximum amount of unemployment benefits paid to each worker. In many states, you will be compensated for half of your earnings, up to a certain maximum. State benefits are typically paid for a maximum of 26 weeks. Some states provide benefits ...

What does it mean to be ineligible for unemployment?

It typically means you are ineligible if you quit—although there are exceptions, like if you quit because of impossible work conditions. If you are fired for cause, you also are likely ineligible. You also have to have been employed for a minimum amount of time or have earned a minimum amount in compensation.

Is unemployment taxable income?

Taxes on Unemployment. Unemployment benefits are considered taxable income, and the unemployment compensation you receive must be reported when you file your federal and state tax returns. 2 . Both state unemployment benefits and federally funded extended benefits are considered income and must be reported when you file your federal ...

How long can you collect unemployment in the US?

Before the coronavirus, most states offered unemployment benefits for a maximum of 26 weeks. The CARES Act allowed states to add an additional 13 weeks of eligibility. And later coronavirus relief bills gave further extensions, with a current end date of September 6, 2021.

When will the supplemental unemployment benefits end?

Second, about half of states intend to end these supplemental benefits before the September 6, 2021 deadline. Third, the length of time a person could get unemployment got extended.

How much does Jane make on unemployment?

Specifically, they can earn the equivalent of 50% of their weekly unemployment benefits without penalty. Because Jane receives $470 each week, she can earn up to $235 per week without it having any effect on her $470 per week benefit. Unfortunately for Jane, she makes $400 per week.

Can I get unemployment if I work full time?

If you’re in school. If you choose to attend classes full time, most states will no longer consider you unemployed. A few states will have exceptions to this rule.

Can I work part time while receiving unemployment?

Some states will let you work part-time while still receiving unemployment. Other states will deduct a certain amount of money from your weekly benefits based on how much money you earn from your job. Keep in mind that in some states, working part-time could result in an unreasonable loss in unemployment benefits.

Is there a one size fits all method for unemployment?

They also determine what effect working part-time or going to school can have on your unemployment eligibility. Unfortunately, there’s no one-size-fits-all method of determining the unemployment you can receive.

Does unemployment go up or down?

Your unemployment benefits can go up or down based on other factors that don’t relate to your total wages. These variables will mainly affect how much money you receive, but they can also affect how long you can receive weekly unemployment payments. Some of these variables include:

How long can you get unemployment?

The maximum number of weeks you can receive full unemployment benefits is 30 weeks (capped at 26 weeks during periods of extended benefits and low unemployment). However, many individuals qualify for less than 30 weeks of coverage. The following examples show how to determine your duration of benefits.

How to calculate duration of benefits?

Your duration of benefits is calculated by dividing your maximum benefit credit by your weekly benefit amount.

How much is dependent allowance?

Dependency allowance. If you are the whole or main support of a child, you may be eligible for a weekly dependency allowance of $25 per dependent child. Spouses are not included. The total dependency allowance you receive cannot be more than 50% of your weekly benefit amount.

How much unemployment is there in 2020?

As of October 4, 2020, the maximum weekly benefit amount is $855 per week.

How long is the benefit year?

Your benefit year. Once your claim is established, it will remain open for 1 year (52 weeks). This period of time is called your benefit year. Your maximum benefit credit (the total amount of benefits you are eligible to receive) is available to you for the duration of your benefit year or until you have exhausted your maximum benefit credit.

How much is the maximum UI benefit?

As of October 4, 2020, the maximum weekly benefit amount is $855 per week. Follow the steps below to calculate the amount ...

What to do if you disagree with your wage?

If you disagree with the wages reported on your Monetary Determination notice, you can provide proof of the wage amounts you are disputing by completing and returning the Wage and Employer Correction sheet that was mailed to you with your notice.

How to calculate unemployment rate?

The following are the steps to take when calculating the unemployment rate in the United States: 1. Determine the percentage of people in the labor force. The first step in calculating the unemployment rate is to calculate the total percentage of individuals in the labor force, ...

When is the unemployment rate published?

The United States reports the unemployment rate by year, which is published in December of each year.

What are the different types of unemployment?

The BLS incorporates three different categories of unemployed people into its calculations of the "real" unemployment rate: 1 Marginally attached labor force workers: These are individuals who have not sought work in the past four weeks but have looked for a job at least once in the last year. 2 Long-term unemployed individuals: This group of people includes those who have been looking for work in the past four weeks and have been unemployed for 27 or more weeks. 3 Discouraged workers: This population describes a group of workers who have searched for work over the past year, but not in the last four weeks. Because they haven't sought work in the last four weeks, the government does not consider them unemployed. However, these workers still wish to have full-time jobs.

What is the lagging indicator of unemployment?

The unemployment rate is a lagging indicator, or an indicator of how an economic event affected employment during a certain time period. For example, a recession is an economic event, and high unemployment rates are the lagging indicator of the effects of the recession. This also indicates that unemployment will steadily rise for a period of time even after the recession is over.

What is the primary unemployment rate?

The primary, or official, unemployment rate is the rate that the government uses to make decisions, such as the monetary policy. This is the traditional rate that only includes the unemployment of persons who have no job but are actively seeking employment. Another type of unemployment rate calculated by the BLS is the "real" unemployment rate, ...

Why is unemployment important?

The unemployment rate is important because unemployment can affect the economy and individual people. Here are the ways that the unemployment rate affects both the economy and individuals:

How does unemployment affect people?

Unemployment also affects individuals by increasing or decreasing the competition when looking for a job. The more people that are looking for work, the more competition you will have when searching for and applying for a position.

When will I know my weekly benefit amount?

After you apply for benefits, we will mail you an Unemployment Claim Determination letter that tells you how much you are potentially eligible to receive.

How much can I get each week?

In Washington state, the maximum weekly benefit amount is $929. The minimum is $295. No one eligible for benefits will receive less than $295, regardless of their earnings.

How can I estimate my weekly benefit amount?

You can estimate your own weekly benefit amount to see how much you are potentially eligible to receive. To do this, you need to know which calendar quarters will make up your base year.

Alternate base year (ABY) claims

You could be eligible for an alternate base year claim if you do not have the required 680 hours of work in your regular base year.

Earning deductions chart

This chart helps determine how much you may get if you report partial earnings during a week.

Can I File A Claim If I Am Not A United States Citizen

If you are not a citizen or national of the United States, you must have legal authority to work in the U.S. You must present either:

What Are The Requirements To Qualify For Unemployment Benefits In North Carolina

To be eligible to receive payments you must meet the requirements as set forth by the DES. The state has three basic criteria.

Will The Bill Pass

The bill has wide support with Republican lawmakers in the General Assembly, who control both the state House and Senate.

How Are Benefits Calculated

The formula and method to calculate benefits are very state-specific. About half of the states use the highest quarter method in which the calendar quarter in which your earnings are the highest is taken into consideration.

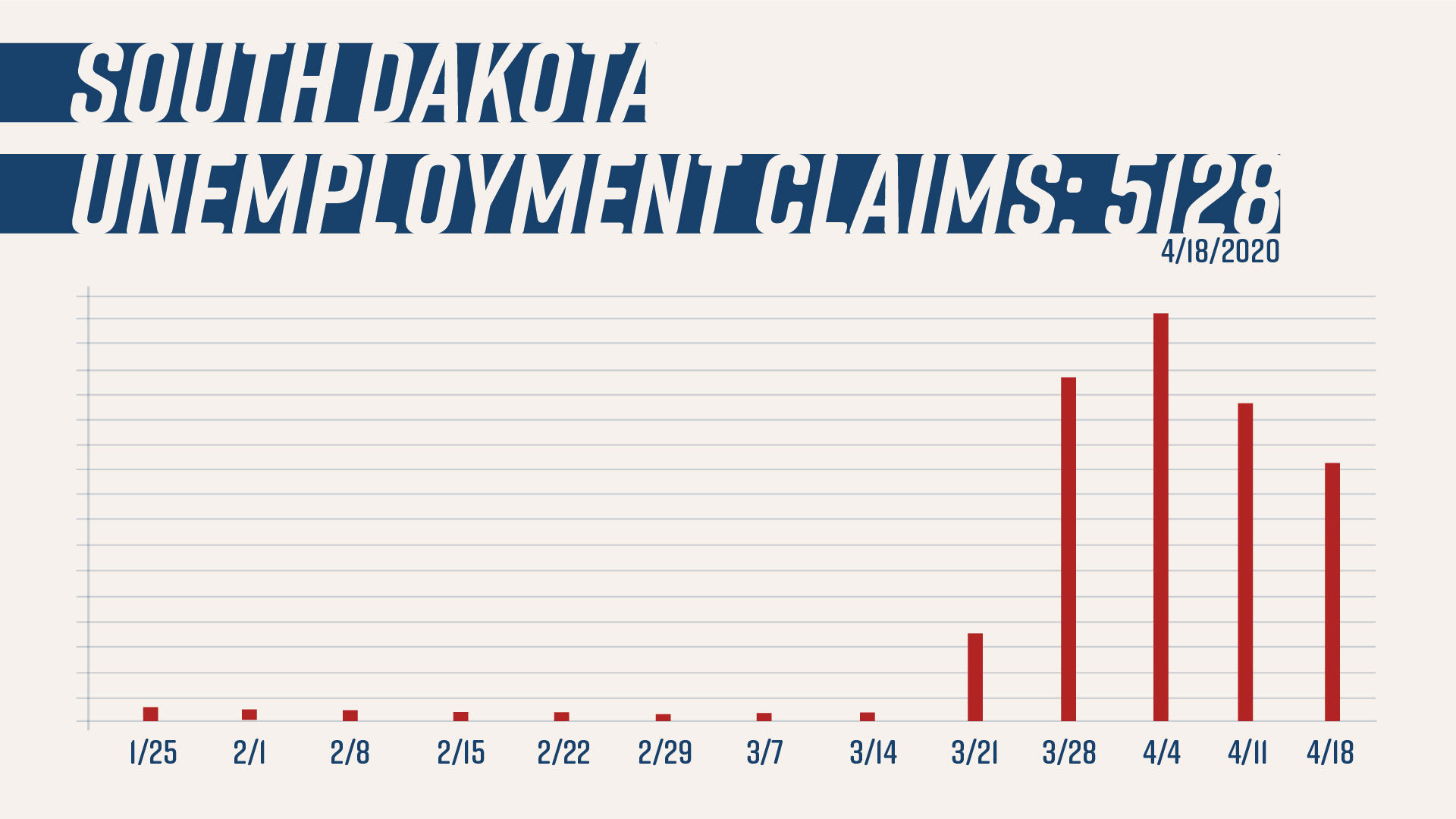

Expanded Unemployment In North Carolina During The Covid

On March 11, 2021, President Biden signed into law a $1.9 trillion COVID-19 relief bill known as the American Rescue Plan .

How North Carolina Determines Benefit Amounts

Each state determines how much it will pay in unemployment benefits. Generally, the weekly benefit amount is some fraction or percentage of your earnings in the base period or your highest paid quarter of the base period.

North Carolina Unemployment Benefits And Eligibility

COVID-19 UPDATE: Because the coronavirus pandemic has left so many Americans jobless, the federal government has given states more flexibility in granting unemployment benefits.

How is unemployment computed?

Unemployment is computed and one half of what your weekly pay was at the time of the discharge up to your state's maximum benefit. You will have to verify with your state's unemployment office to see what the highest payout for your state is. For further details refer unemployment benefits article.

How long can I get unemployment?

How long will I receive benefits: Usually, most states permit an individual to obtain unemployment for a maximum of 26 weeks, or half the benefit the benefit year. A few states have standardized benefit duration, while most have different durations depending upon the worker.

What is the base period for unemployment?

The base period is the first four of the last five completed calendar quarters before you filed your claim.