How to Increase Your Social Security Benefits

- Expand Your Earnings. The Social Security Administration (SSA) relies on a system of credits to figure out whether you qualify for payments.

- Keep on Earning. The SSA uses the 35 years of work history when you earned the most to figure out your AIME. ...

- Delay the Day You Retire. ...

- Coordinate With Your Spouse. ...

- Limit Your Taxes. ...

- Doing the Math. ...

- Work for at least 35 years.

- Earn more.

- Work until your full retirement age.

- Delay claiming until age 70.

- Claim spousal payments.

- Include family.

- Don't earn too much in retirement.

- Minimize Social Security taxes.

How do you maximize your social security?

- Emergency Rental Assistance Fund

- Emergency Assistance for Rural Housing/Rural Rental Assistance

- Homeowner Assistance Fund

- Housing Assistance and Supportive Services Programs for Native Americans

How to maximize your social security?

Key Points

- Larger Social Security checks are within your reach.

- Both young people and those nearing retirement can earn more Social Security benefits using these strategies.

- Maximizing your Social Security checks is smart because the benefits are guaranteed to last.

How to maximize my social security?

- How You Fund Retirement Matters. Let’s say you wait until age 70 to draw benefits. ...

- Age Matters. This may seem counter-intuitive, but the longer you wait to claim Social Security (up until age 70), the higher your benefit. ...

- Planning As a Couple Makes a Difference. ...

How can I get the most out of Social Security?

Using the bend points for 2020, your primary insurance amount is therefore the sum of:

- 90% of your AIME up to $960;

- 32% of your AIME between $960 and $5,785; and

- 15% of AIME above $5,785

Eight Ways to Boost Your Social Security Check

Yet in spite of its importance, Americans' understanding of Social Security, and most importantly how to increase their eventual payouts, is subpar...

Work in A High-Paying Field/Job

The Social Security Administration (SSA) takes three things into account when calculating your benefit. This first factor of interest is your avera...

Work For Longer Than 35 Years

The second factor that the SSA considers when calculating your Social Security benefit is your length of work history. The SSA averages your 35 hig...

Wait to Claim Benefits For as Long as Economically Feasible

Arguably the most important consideration is the age that you claim Social Security benefits. Qualifying seniors (those who've earned at least 40 l...

Consider A Social Security Do-Over

Another option to consider, especially for baby boomers with poor saving habits, is a "do-over" known as Form SSA-521 – officially, the "Request fo...

Weigh Your Survivor Benefit Option

While your Social Security claiming decision could rightly be viewed as one of the biggest personal decisions you'll ever make, if you're married o...

Use Your Ex-Spouse to Boost Your Benefit

If you're now divorced from your spouse, but you were married for at least 10 years, and you're still unmarried and of Social Security claiming age...

Consider Tax Benefits and Where You Retire

Retirees should also pay close attention to tax benefits and where they retire.One little-known fact about Social Security is that your benefits ma...

Check Your Social Security Earnings Statement

Last, but not least, make a habit of double-checking your Social Security earnings statements. If the SSA has your earnings history incorrect, it c...

How much will Social Security increase after retirement?

After your full retirement age, payments will increase by about 8 percent for each year you delay claiming Social Security up until age 70. After age 70, there is no additional benefit for waiting to sign up for Social Security.

How is Social Security calculated?

Social Security benefits are calculated based on the 35 years in which you earn the most. If you don't work for at least 35 years, zeros are factored into the calculation, which decreases your payout.

How much do you get from Social Security if you don't work?

Increasing your income by asking for a raise or earning income from a side job will increase the amount you receive from Social Security in retirement. Earnings of up to $132,900 in 2019 are used to calculate your retirement ...

How long do you have to work to get Social Security?

Try these strategies to maximize your payments: Work for at least 35 years. Social Security benefits are calculated based on the 35 years in which you earn the most.

How to check if your Social Security is paid?

Create a My Social Security account and download your Social Security statement annually to check that your earnings history and Social Security taxes paid have been recorded correctly by the Social Security Administration. Make sure you are getting credit for the taxes you're paying into the system.

Can a spouse inherit a deceased spouse's Social Security?

When one member of a married couples dies, the surviving spouse can inherit the deceased spouse’s benefit payment if it’s more than his or her current benefit. Retirees can boost the amount the surviving spouse will receive by delaying claiming Social Security. Make sure your work counts.

How to increase Social Security check size?

1. Work at Least the Full 35 Years. The Social Security Administration (SSA) calculates your benefit amount based on your lifetime earnings.

How much will Social Security increase if you wait until 70?

If, for example, you are eligible for a primary insurance amount (PIA) of $2,000, or $24,000, at age 66, then by waiting until age 70, your annual benefit would increase to $31,680.

How does the SSA calculate your Social Security benefits?

The SSA calculates your benefit amount based on your earnings, so the more you earn , the higher your benefit amount will be . Some pre-retirees look for ways to increase their income, such as taking on part-time work or generating business income. Others, however, unaware of the impact on benefits, may scale back on their work or semi-retire, which can lower their Social Security income. 2

Why was Social Security not a primary income source?

Rather, its sole purpose was to provide a safety net for people who were unable to accumulate sufficient retirement savings. For the next several decades, the majority of Americans never gave much thought to their Social Security because of shorter lifespans and reliance on guaranteed pensions.

How long do you have to work to get the most Social Security?

Navigating Social Security income can be complicated, but there are strategies to maximize your Social Security benefits. Working for 35 years or more will help ensure you get the most money when your benefit amount is calculated.

Why did the majority of Americans never give much thought to their Social Security?

For the next several decades, the majority of Americans never gave much thought to their Social Security because of shorter lifespans and a reliance on guaranteed pensions.

When did the SECURE Act change retirement accounts?

Changes were made to the rules regarding retirement accounts with the passage of the SECURE Act in 2019 by the U.S. Congress. A few of those changes include the following:

What is a do over for Social Security?

Another option to consider, especially for baby boomers with poor saving habits, is a "do-over" known as Form SSA-521 – officially, the "Request for Withdrawal of Application." If you've regretted your decision to take Social Security benefits early (and 60% of seniors do file for benefits between ages 62 and 64, ensuring they receive a permanent reduction in their monthly payout), Form SSA-521 may allow you the opportunity to undo your filing.

What is the first factor of interest in Social Security?

This first factor of interest is your average earnings history. In other words, the more you earn, the bigger your payout, up to a certain point.

What happens if you file for Social Security incorrectly?

If the SSA has your earnings history incorrect, it could adversely affect what you're paid once you file for benefits – and it's a lot harder to fix those errors after you begin receiving a monthly benefit check .

Why do women get less Social Security?

That's because more women than men choose to stay home and raise their children, as well as provide caregiving services to sick friends and relatives. This adversely affects their income, which reduces their Social Security benefit. But if their higher-earning spouse passes away, they'll have the opportunity to trade their benefit based on their own work history for the survivor benefit based on their deceased spouse's work history, assuming the survivor benefit is higher.

How many states tax Social Security?

However, 13 states also tax Social Security benefits. Should you choose to live in a state that taxes Social Security benefits, you may be required to hand over some of your benefit. If you want to keep as much of your Social Security income as possible, you'll want to pay close attention to where you retire.

What age do you have to be to get a high wage?

Chances are you lacked the skill set necessary to garner a high wage in your teens or early 20s. By your 60s you'll likely have plenty of work experience, which could translate to a higher annual wage even after adjusting for inflation and lift your overall earning average over your 35 highest-earning years.

When do you have to file Form SSA-521?

First you'll have to file Form SSA-521 no later than 12 months after you begin receiving benefits. The other important component is you'll need to pay back every cent in benefits you, and other people receiving Social Security income based on your work history, have received.

How to increase Social Security payments?

Instead of settling for lowered payments for life, check out these methods to get the most from your benefits. 1. Delay Claiming Social Security Benefits. The simplest way to increase your monthly payments is to delay claiming Social Security benefits.

How much will Social Security increase at 67?

Brotman, CEO of BFG Financial Advisors, there is an 8% annual increase in benefits due for each year you wait from full retirement age through 70. That means the $1,500 benefit at age 67 could increase by 24% ...

How to beef up my Social Security?

Collecting spousal benefits, based upon your spouse’s work record , is another way to beef up your Social Security benefits. You qualify for spousal benefits in one of two ways: You either lack sufficient work history to claim Social Security benefits on your own, or your spousal benefit would be larger than the benefit you are entitled to.

How does Uncle Sam determine what percentage of Social Security benefits are taxable?

To determine what percentage of your benefits are taxable, the Social Security Administration looks at your combined income— also known as your provisional income.

How much do you lose if you start Social Security early?

If you choose to begin receiving Social Security early, for each month there is between when you start and your full retirement age you lose about half a percentage point of the total value you would have earned if you’d waited.

Can you increase your retirement benefits if you take your benefits too early?

If it takes you more than one year to realize you took benefits too early, you can still increase your future payments by suspending your benefits . This option, however, is only available after you’ve reached full retirement age.

When will Social Security be reinstated?

If you voluntarily suspend your benefits, the Social Security Administration will automatically reinstate them once you reach age 70 if you haven’t not already done so.

How to boost Social Security benefits?

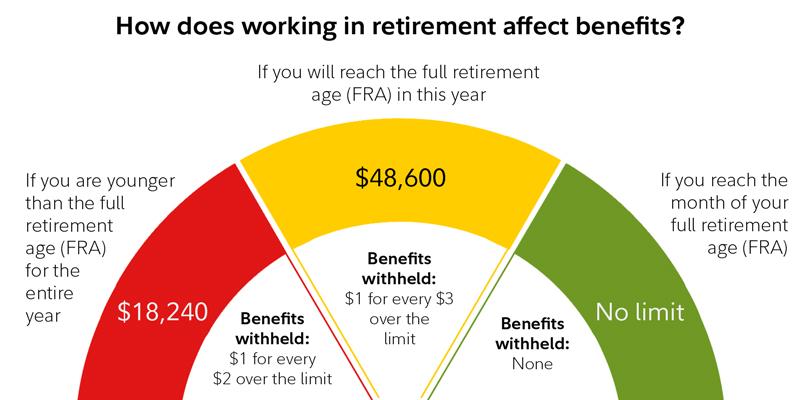

Retirees can boost their Social Security with a few key strategies. Wait to retire until full retirement age (FRA). Delay applying until age 70 and you’ll get your maximum amount. If you work while getting benefits, make sure you don’t run into the earned-income limits that will reduce your benefits.

How to start collecting Social Security?

Wait until at least full retirement age to start collecting. Collect spousal benefits. Receive dependent benefits. Keep track of your earnings. Watch out for tax-bracket creep if you’re still working. Apply for survivor benefits. Check Social Security statement for mistakes. Stop collecting benefits temporarily.

How old do you have to be to get spousal benefits?

If you’re at least 62 years old and have a child in your care, you may be eligible to receive benefits through your spouse. The spousal benefit can be as much as 50% of the amount of the partner’s benefit, depending on when the partner retires. 7 . Even divorcees are eligible.

What is the maximum retirement benefit for 2021?

As your benefit is based on your highest-earning years, the more you earn, the higher your benefit. There are limits, though. The maximum benefits for 2021 are $2,324 for those retiring at age 62, $3,113 for those retiring at the full retirement age of 66, and $3,895 for those retiring at age 70. 3. 2.

How often do you get a Social Security statement?

You get a Social Security statement every year. 13 Do not assume it is accurate. Check the numbers and report any errors to the Social Security Administration. Remember, your benefits are based on the average of your 35 highest-earning years. A miscalculation for even one or two of those years could impact your benefit for the rest of your life.

How much Social Security do you get if you are retired but still have dependents?

If you are retired but still have dependents under age 19, they are entitled to up to 50% of your benefit . This dependent benefit doesn’t decrease the amount of Social Security benefits that a parent can receive. They are added to what the family receives. 8

What is the maximum amount you can earn on Social Security in 2021?

For 2021, the limit on earned income is $18,960 for recipients below full retirement age and $50,520 in the year when you reach full retirement age. Your benefit payment is reduced for the year if you exceed these limits. 10 After that, however, there is no penalty for earned income at any level.

What is the most commonly known increase for Social Security?

The COLA is the most commonly known increase for Social Security payments. We annually announce a COLA, and there’s usually an increase in the Social Security and Supplemental Security Income (SSI) benefit amount people receive each month.

How much did Social Security increase in 2018?

More than 66 million Americans saw a 2.0 percent increase in their Social Security and SSI benefits in 2018. For more information on the 2018 COLA, visit our website. Social Security uses your highest thirty-five years of earnings to figure your benefit amount when you sign up for benefits.

How does a benefit check increase?

Once you begin receiving benefits, there are three common ways benefit checks can increase: a cost of living adjustment (COLA); additional work; or an adjustment at full retirement age if you received reduced benefits and exceeded the earnings limit.

How long has Social Security been in place?

Social Security has been securing your today and tomorrow for more than 80 years with information and tools to help you achieve a successful retirement.

How does Social Security work before becoming disabled?

If you worked for a number of years and paid Social Security taxes before becoming disabled, your benefit will be based on your earnings and tax history. The Social Security Administration allows you to set up an account where you can view a personalized estimate of disability benefits. Your Social Security statement will explain what you are eligible for and how much to expect each month.

How does Social Security work?

The Social Security Administration allows you to set up an account where you can view a personalized estimate of disability benefits. Your Social Security statement will explain what you are eligible for and how much to expect each month. By and large, the formula used to calculate your disability benefits is set.

How long do you have to wait to apply for disability?

If your impairment makes it impossible to work and is predicted to last, you can apply for disability benefits right away. You don’t have to wait until a full year has passed to apply. Ask your physician for help filling out forms, communicating the diagnosis and reporting the information.

How many people are disabled on Social Security?

(Getty Images) Approximately 1 in 4, or 61 million, adults in the United States report a disability, according to data from the U.S. Department of Health and Human Services.

Can life changes affect disability?

Life changes could impact your disability eligibility. There may be other ways to receive assistance. Read on to learn how Social Security disability checks are issued and what you can do to increase your overall income when facing a disability. A Guide to Social Security Disability. ]

How to find out if you qualify for Social Security?

To find out if you, or a family member, might be eligible for a benefit based on another person’s work, or a higher benefit based on your own work, see the information about benefits on the Social Security website. You can also use the Benefit Eligibility Screening Tool (BEST) to find out if you could get benefits that Social Security administers. Based on your answers to questions, this tool will list benefits for which you might be eligible and tell you more information about how to qualify and apply.

Why do we have a second Social Security representative?

We also want to make sure you receive accurate and courteous service. That is why we have a second Social Security representative monitor some telephone calls.

How old do you have to be to get unemployment benefits?

If you are at least 62 years old and unmarried, you may be eligible for a benefit based on a former spouse’s work if that marriage lasted 10 years or more.

Can my survivor benefit increase if my spouse dies?

Has your spouse or ex-spouse died? If your spouse or ex-spouse has died, you may be eligible for a higher survivor benefit based on his or her work. The death of an ex-spouse may allow you to be eligible for a higher survivor benefit even ...

Can you get a higher Social Security if your spouse dies?

It's not unusual for a benefit recipient's circumstances to change after they apply or became eligible for benefits. If you, or a family member, receive Social Security or Supplemental Security Income (SSI), certain life changes may affect eligibility for an increase in your federal benefits. For example, if your spouse or ex-spouse dies, you may become eligible for a higher Social Security benefit.