- List your yearly earnings. Your Social Security benefit is based on your average indexed monthly earnings (AIME).

- Adjust earnings to account for inflation. If you have earnings decades in the past, the SSA increases these amounts so that all income is expressed in today's dollars.

- Add up your income for the 35 highest years. Social Security benefits are based on your average earnings for 35 years of work.

- Divide your total by 420. Once you've totaled your 35 highest-earning years, get the average by dividing that total amount by the number of months in 35 years, which ...

- Check your figure with the SSA's quick calculator. Once you've done the calculation yourself and understand how the AIME formula works, you can use the calculator available on the ...

How to estimate your Social Security benefits?

- Adjust all earnings for inflation

- Calculate your Average Indexed Monthly Earnings (AIME)

- Apply your AIME to the benefit formula to determine primary insurance amount (PIA)

- Adjust PIA for filing age

How do you estimate your Social Security benefit?

Key Points

- Social Security benefits may not be as high as you think.

- The average benefit is going up in 2022.

- Your benefit could be above or below average, depending on your wages over your career.

How do I estimate my SS Benefits?

You may want to may want to consider using my company's software — Maximize My Social Security or MaxiFi Planner — to ensure your household receives the highest lifetime benefits. Social Security calculators provided by other companies or non-profits may provide proper suggestions if they were built with extreme care. Best, Larry

How are monthly Social Security benefits determined?

the average monthly Social Security benefit for retired workers in July 2021 was only $1,556.72. “It’s important to remember that years worked, when you collect and other factors will determine your monthly Social Security benefit. Social Security ...

How do I determine the amount of Social Security I will receive?

Social Security benefits are typically computed using "average indexed monthly earnings." This average summarizes up to 35 years of a worker's indexed earnings. We apply a formula to this average to compute the primary insurance amount (PIA).

What is the formula to determine Social Security benefits?

For a worker who becomes eligible for Social Security payments in 2022, the benefit amount is calculated by multiplying the first $1,024 of average indexed monthly earnings by 90%, the remaining earnings up to $6,172 by 32%, and earnings over $6,172 by 15%.

How many years do you have to work to get maximum Social Security?

35 yearsQualifying for Social Security in the first place requires 40 work credits or approximately 10 years of work. 2 To be eligible to receive the maximum benefit, you need to earn Social Security's maximum taxable income for 35 years.

Is Social Security based on the last 5 years of work?

We: Base Social Security benefits on your lifetime earnings. Adjust or “index” your actual earnings to account for changes in average wages since the year the earnings were received. Calculate your average indexed monthly earnings during the 35 years in which you earned the most.

How much will I get from Social Security if I make $30000?

1:252:31How much your Social Security benefits will be if you make $30,000 ...YouTubeStart of suggested clipEnd of suggested clipYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars whichMoreYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars which comes out to just under 500 bucks.

How much Social Security will I get if I make $60000 a year?

That adds up to $2,096.48 as a monthly benefit if you retire at full retirement age. Put another way, Social Security will replace about 42% of your past $60,000 salary. That's a lot better than the roughly 26% figure for those making $120,000 per year.

Is it better to take Social Security at 62 or 67?

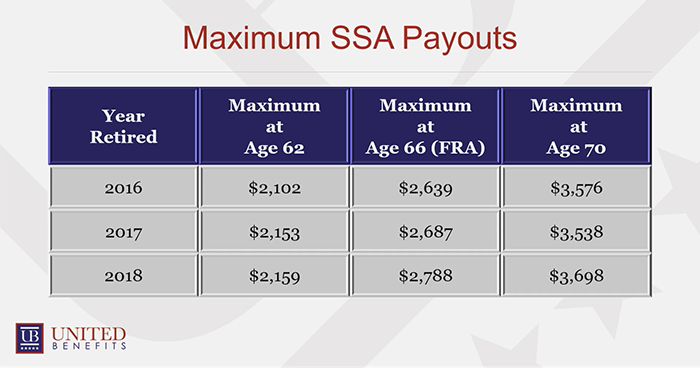

The short answer is yes. Retirees who begin collecting Social Security at 62 instead of at the full retirement age (67 for those born in 1960 or later) can expect their monthly benefits to be 30% lower. So, delaying claiming until 67 will result in a larger monthly check.

How much Social Security will I get if I make $75000 a year?

about $28,300 annuallyIf you earn $75,000 per year, you can expect to receive $2,358 per month -- or about $28,300 annually -- from Social Security.