Employer contributions help spread out the cost of health insurance between employees and employers so it’s easier for both sides to handle. Employers choose a health insurance plan and then determine the amount they’ll cover—for instance, 75%. Your employees will be responsible for the plan’s remaining costs.

How much should employers contribute to employee benefits?

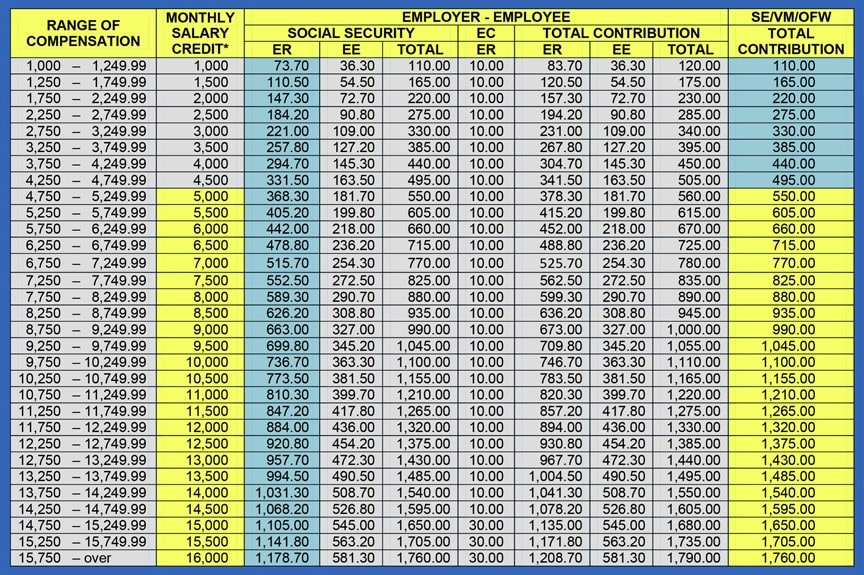

There are two HSA contribution levels for employers. For employers whose companies have fewer than 500 employees, the average contribution for a single employee is $750 and $1,200 for an employee with a family.

What does the average employer spend on employee benefits?

What do employee benefits cost? Breaking down the numbers further, the study finds that benefits cost the average employer $21,726 annually per employee. With wages, the total cost is $71,334...

Why do employers provide employees with retirement benefits?

The following are some of the pros of offering retirement benefits:

- You can receive some significant tax advantages for your business because Congress wants to encourage employers to provide retirement benefits to employees.

- If the plan is based on profits, the plan may enhance employee motivation and productivity.

- Retirement benefits may give you a recruiting advantage.

How to offer affordable employee benefits?

When you administer benefits, you’re responsible for:

- Creating the benefits program

- Enrolling new employees

- Communicating what benefits are available

- Helping employees update benefits selections

- Liaising with providers to ensure your benefits are competitive

- Ensuring benefit providers are paid each month

- Making sure the correct amount is withheld from each employee’s paycheck

What are employer contribution benefits?

An employer contribution is the amount an employer pays into a plan. These contributions help pay for employees' healthcare costs, ranging from premiums to prescription drugs.

Why do employers match your employee contributions?

It's a way to help them hedge their bets on you as an employee by reducing the amount of money they'd lose if you were to leave the company. It's also meant to give you a shiny incentive to stay.

How do employee contributions work?

Key Takeaways. When an employer matches your contributions, they add a certain amount to your 401(k) account based on how much you contribute annually. The most common way employers determine matching contributions is to match a percentage of an employee's contribution, up to a certain limit.

What are 2 examples of employer contributions?

Common Types Of Retirement Plans Offered By Employers401(k) Plan. This is the most common type of employer-sponsored retirement plan. ... Roth 401(k) Plan. This type of plan offers the same benefits as a traditional Roth IRA with the same employee contribution limits as a traditional 401(k) plan. ... 403(b) Plan. ... SIMPLE Plan.

Does employer contribution count towards limit?

Employer Match Does Not Count Toward the 401(k) Limit For tax year 2022 (which you'll file a return for in 2023) that limit stands at $20,500, which is up $1,000 from the 2021 level.

Should I only contribute what my employer matches?

If you have a 401(k) at work and your employer offers a match, you should always invest enough in the 401(k) to claim the full match. If you don't, you're giving up free money. You can't afford to give up free money and should take advantage of the help your employer provides to ensure you save enough for retirement.

How can an employee contribute to the success of a company?

How You Can Contribute to the Success of Your CompanyBe Goal Oriented. ... Communicate Effectively. ... Manage Your Time. ... Learn to Delegate. ... Understand the Importance of Time Away. ... Learn to Ask for Help.

What is employer contribution account?

Employer Contribution Account means the Accounts maintained for a Participant to record his or her share of the contributions made by a Participating Employer that are subject to the Plan's vesting schedule, including accounts for Matching Contributions, and Discretionary and Company Contributions.

What is a contributory employee benefit plan?

A defined contribution plan is a common workplace retirement plan in which an employee contributes money and the employer typically makes a matching contribution. Two popular types of these plans are 401(k) and 403(b) plans.

Who benefits most from a defined contribution plan?

Employers fund and guarantee a specific retirement benefit amount for each participant of a defined-benefit pension plan. Defined-contribution plans are funded primarily by the employee, as the participant defers a portion of their gross salary.

What is the most common basis for an employer's contributions to a defined contribution plan?

Employer-sponsored DC plans may also receive matching contributions. The most common employer matching contribution is 50 cents per $1 contributed up to a specified percentage but some companies match $1 for every $1 contributed up to a percentage of an employee's salary, generally 4% to 6%.

Which of the following is a benefit of contributing to a retirement account?

The primary benefits of contributing to an individual retirement account (IRA) are the tax deductions, the tax-deferred or tax-free growth on earnings, and if you are eligible, nonrefundable tax credits.