- A widow, widower, or surviving divorced spouse cannot apply online for survivors benefits. You should contact Social Security at 1-800-772-1213 to request an appointment. ...

- If you wish to apply for disability benefits as a survivor, you can speed up the disability application process if you complete an Adult Disability Report and have it available ...

- We use the same definition of disability for widows and widowers as we do for workers.

What are the social security rules for widows?

Understanding the Social Security Rules for Widows and Widowers

- Biden's Ideas for Social Security Survivor Benefits. Biden has proposed several reforms which, if enacted, would boost benefits for the surviving spouse, typically women.

- The Goal of Social Security Survivor Benefits. ...

- Social Security Claiming Advice for Married Couples. ...

- Resources for Claiming Social Security Benefits. ...

When to collect survivors Social Security benefits?

You can collect a Social Security survivor benefit as early as age 60. If you are disabled, you can collect this payment as early as age 50. 1 3 At age 60 you will receive only about 70% of the amount you could get if you wait until your Full Retirement Age (FRA).

What percentage of Social Security does a widow receive?

- A widow or widower over 60.

- A widow or widower over 50 and disabled.

- Surviving divorced spouses, assuming the marriage lasted at least ten years.

- Widow or widower who is caring for a deceased child who is either under 16 or disabled.

How do you apply for Social Security Survivors' Benefits?

- Proof of death

- Birth certificate

- Proof of citizenship

- Proof of disability

- Certain SSA forms

- W-2s and tax forms

- Marriage certificate

- Divorce decree

- Child’s birth certificate

- Proof of adoption

When can a widow collect her husband's Social Security?

age 60The earliest a widow or widower can start receiving Social Security survivors benefits based on age will remain at age 60. Widows or widowers benefits based on age can start any time between age 60 and full retirement age as a survivor.

Do I qualify for my deceased husband's Social Security?

Your spouse, children, and parents could be eligible for benefits based on your earnings. You may receive survivors benefits when a family member dies. You and your family could be eligible for benefits based on the earnings of a worker who died. The deceased person must have worked long enough to qualify for benefits.

Can you apply online for widow's benefits?

Widows, widowers, and surviving divorced spouses cannot apply online for survivor's benefits.

What is the difference between survivor benefits and widow benefits?

It is important to note a key difference between survivor benefits and spousal benefits. Spousal retirement benefits provide a maximum 50% of the other spouse's primary insurance amount (PIA). Alternatively, survivors' benefits are a maximum 100% of the deceased spouse's retirement benefit.

How much Social Security does a widow get?

Widow or widower, full retirement age or older—100% of your benefit amount. Widow or widower, age 60 to full retirement age—71½ to 99% of your basic amount. A child under age 18 (19 if still in elementary or secondary school) or has a disability—75%.

How much are widows benefits?

As previously noted, if you have reached full retirement age, you get 100 percent of the benefit your spouse was (or would have been) collecting. If you claim survivor benefits between age 60 and your full retirement age, you will receive between 71.5 percent and 99 percent of the deceased's benefit.

How long are you considered a widow?

two yearsRead on to learn more about the qualified widow or widower filing status. Qualifying Widow (or Qualifying Widower) is a filing status that allows you to retain the benefits of the Married Filing Jointly status for two years after the year of your spouse's death.

What documents do I need to apply for Social Security?

Social SecurityYour Social Security card or a record of your number.Your original birth certificate, a copy certified by the issuing agency, or other proof of your age. ... If you were not born in the U.S., proof of U.S. citizenship or lawful alien status.More items...

Who qualifies for a widows pension?

If your civil partner, husband or wife has died, you may be eligible to apply to the benefits scheme to receive a lump sum followed by regular payments for up to 18 months. This money can be used to help you manage your bills and cover other vital spending during what is a distressing time.

How much is a widows pension in Canada?

In 2020 the maximum amount of a normal age 65 pension is $1175.83. (few people get the max.) If a survivor is under 65, they will receive a flat rate of $197.34 and 37.5% of the deceased spouse's normal age 65 CPP pension for a maximum of $638.28/month.

What to do if you are not getting survivors benefits?

If you are not getting benefits. If you are not getting benefits, you should apply for survivors benefits promptly because, in some cases, benefits may not be retroactive.

How old do you have to be to get a mother's or father's benefit?

Mother's or Father's Benefits (You must have a child under age 16 or disabled in your care.)

Can you get survivors benefits if you die?

The Basics About Survivors Benefits. Your family members may receive survivors benefits if you die. If you are working and paying into Social Security, some of those taxes you pay are for survivors benefits. Your spouse, children, and parents could be eligible for benefits based on your earnings.

Can you collect survivors benefits if a family member dies?

You may receive survivors benefits when a family member dies. You and your family could be eligible for benefits based on the earnings of a worker who died. The deceased person must have worked long enough to qualify for benefits.

What percentage of a widow's benefit is a widow?

Widow or widower, full retirement age or older — 100 percent of the deceased worker's benefit amount. Widow or widower, age 60 — full retirement age — 71½ to 99 percent of the deceased worker's basic amount. A child under age 18 (19 if still in elementary or secondary school) or disabled — 75 percent.

How long do you have to wait to receive Social Security if you die?

If the eligible surviving spouse or child is not currently receiving benefits, they must apply for this payment within two years of the date of death. For more information about this lump-sum payment, contact your local Social Security office or call 1-800-772-1213 ( TTY 1-800-325-0778 ).

Who receives benefits?

Certain family members may be eligible to receive monthly benefits, including:

How do survivors benefit amounts work?

We base your survivors benefit amount on the earnings of the person who died. The more they paid into Social Security, the higher your benefits would be.

How to report a death to the funeral home?

You should give the funeral home the deceased person’s Social Security number if you want them to make the report. If you need to report a death or apply for benefits, call 1-800-772-1213 (TTY 1-800-325-0778 ). You can speak to a Social Security representative between 8:00 am – 5:30 pm. Monday through Friday.

Who gets lump sum when spouse dies?

Generally, the lump-sum is paid to the surviving spouse who was living in the same household as the worker when they died. If they were living apart, the surviving spouse can still receive the lump-sum if, during the month the worker died, they met one of the following:

Can a family member receive survivors benefits?

Eligible family members may be able to receive survivors benefits for the month that the beneficiary died.

Ways to Apply

You can complete an application for Retirement, Spouse's, Medicare or Disability Benefits online.

Retirement or Spouse's Benefits

You can apply online for Retirement or spouse's benefits or continue an application you already started.

Disability Benefits

You can apply online for disability benefits or continue an application you already started.

Appeal a Disability Decision

If your application for disability benefits was denied recently for medical reasons, you can request an appeal online or continue working on an appeal you already started.

Medicare Benefits

You can apply online for Medicare or continue an application you already started.

Extra Help with Medicare Prescription Drug Costs

You can apply online for Extra Help with Medicare prescription drug costs.

Supplemental Security Income (SSI) Benefits

If you want to apply for Supplemental Security Income (SSI), please read:

How many widows receive Social Security?

The Social Security Administration reports that 5 million widows and widowers receive benefits based on the deceased spouse's earnings record.

How long do you have to work to get Social Security?

No worker has to have more than 10 years of work history and payment into the Social Security system. Under a special rule, a deceased worker can work 1 1/2 years within the three years prior to death and the survivor can qualify for benefits.

What happens to survivors benefits if spouse is deceased?

The survivors benefits are limited to what the deceased would have received while alive.

How long does a divorced spouse have to be married to receive Social Security?

Social Security also provides survivor benefits to a divorced spouse if the marriage lasted 10 years, or if the divorced spouse cares for a natural or adopted child of the deceased who qualifies for benefits. The Social Security Administration reports that 5 million widows and widowers receive benefits based on the deceased spouse's earnings record.

How old do you have to be to collect survivors benefits?

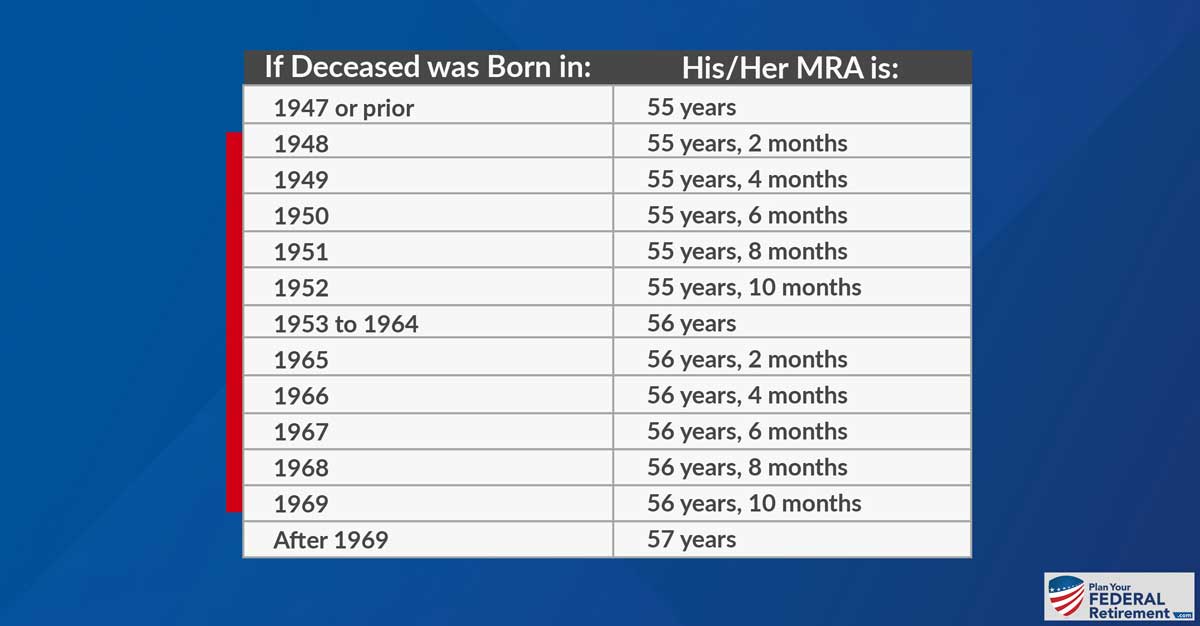

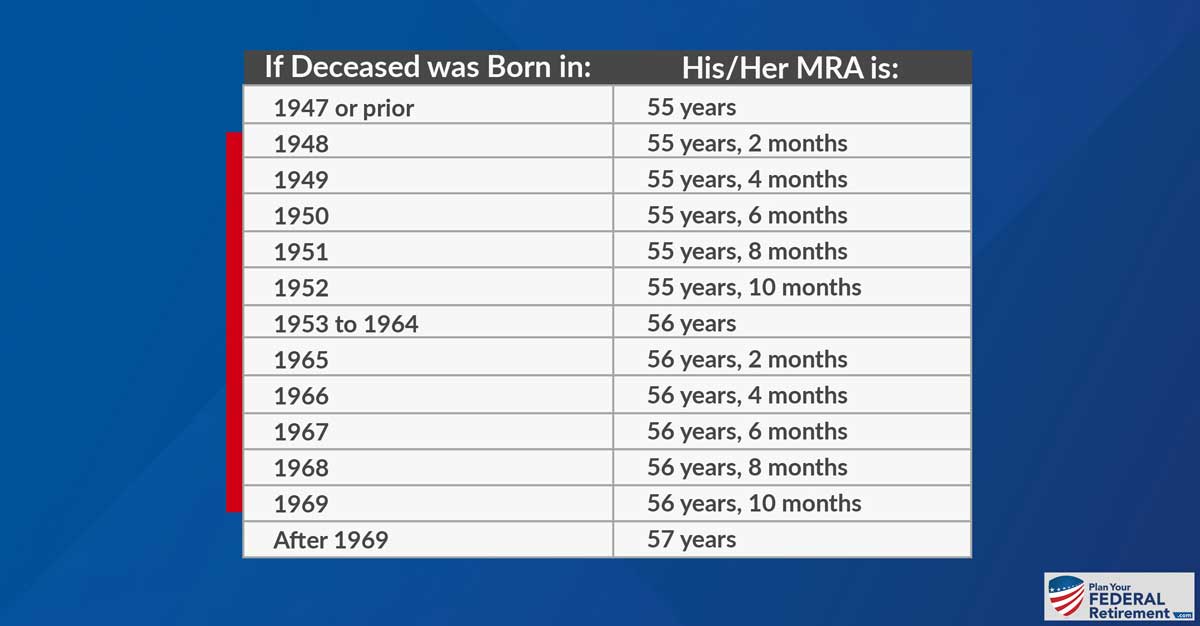

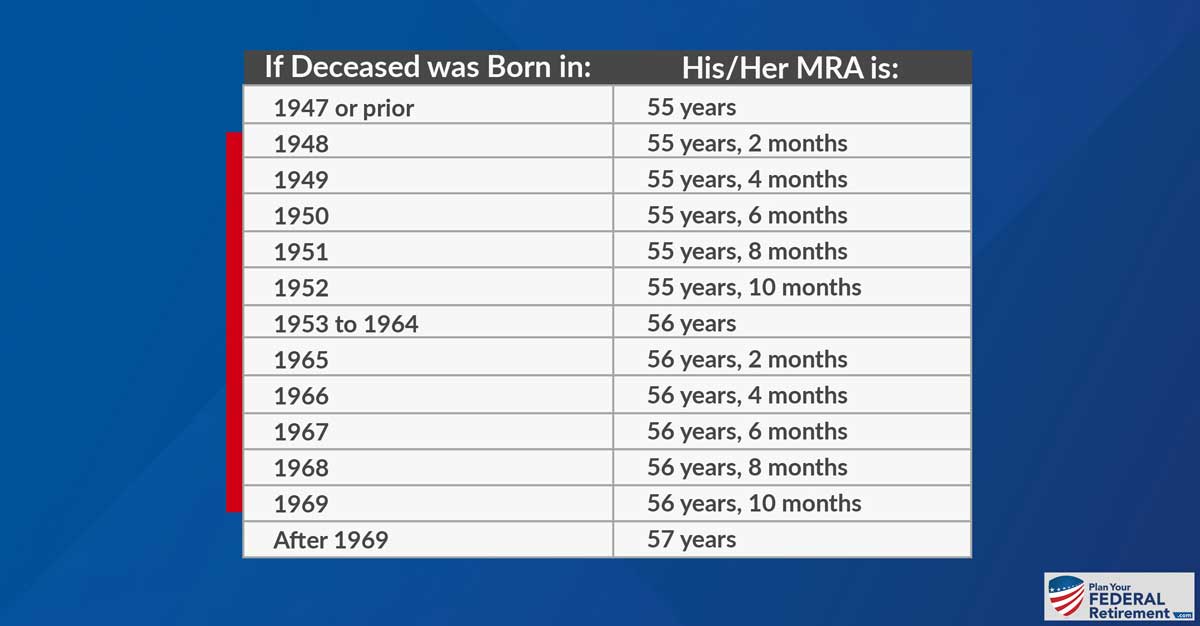

A widow or widower can collect survivors benefits as early as age 60, at a reduced amount. Full retirement age for the survivor is determined by birth date. Age 66 is full retirement age for those born between 1945 and 1954. If the deceased spouse collected benefits before full retirement age while alive, the benefits reflect early retirement ...

When can you cut out a survivor from your benefits?

Autoplay. Brought to you by Sapling. Brought to you by Sapling. Remarriage prior to age 60 can cut the survivor out of survivors benefits unless the marriage ends by divorce, death or annulment.

Can you get Social Security if you die?

If a deceased worker receives retirement or disability benefits at the time of death, Social Security does not require qualification, but will consider the credits already calculated as sufficient for determining survivors benefits. Remarriage prior to age 60 can cut the survivor out of survivors benefits unless the marriage ends by divorce, ...

Who pays widower's Social Security?

Social Security Administration (SSA). These benefits are paid to the widow or wido wer of a deceased worker who had earned enough work credits.

What is widower's insurance?

Social Security Widow (er)'s Insurance Benefits. This benefit is paid to the widow or widower of a deceased worker who earned enough work credits.

How old do you have to be to qualify for Social Security?

To qualify for this benefit program, you must meet all of the following requirements: Be at least age 60. Be the widow or widower of a fully insured worker. Meet the marriage duration requirement. Be unmarried, unless the marriage can be disregarded. Not be entitled to an equal or higher Social Security retirement benefit based on your own work. ...

What happens after you complete the eligibility screening?

Once you have completed the eligibility screening questionnaire, you will be provided with a list of benefits for which you may be eligible. Print this page for your records before going to the application site.

Can a widow apply for survivor benefits?

Widows, widowers, and surviving divorced spouses cannot apply online for survivor’s benefits. For application information, please visit the How To Apply page.

How many widows were mistreated by Social Security?

It only carefully examined the case of 50 of them; of those, 44 were owed money — a lot of money. But there may be more than 13,514 widows and widowers who were mistreated. Social Security focused on widows and widowers who should have filed for their survivor benefit first and their retirement benefit later.

How much does Sue get from Social Security?

Sue's full retirement benefit from Social Security, at 66 (her Full Retirement Age), is $2,500 per month. Her monthly widows benefit, if she were to take it starting at Full Retirement Age, is $2,700.

Can Sue file for Social Security and widows?

Sue is told by Social Security that she must file for her retirement and widows benefit at the same time

Can a widow and widower file for Social Security?

Doing so, however, prevents widows and widowers from taking one Social Security benefit first and the other later, after it has grown.

Did the Social Security Administration fix the computer system?

But many senior-level people in the Social Security Administration knew the staff had not been formally trained to prevent them from costing widows and widowers potentially huge amounts of lifetime benefits. Nor did anyone in the staff fix their computer system to ensure that the practice could not continue. Finally, no one on the staff used the computer system to search for widows or widowers who had been defrauded and then compensate them or their heirs for the fraud.

Can a widow take Social Security first?

Doing so, however, prevents widows and widowers from taking one Social Security benefit first and the other later, after it has grown.

Can Social Security grow if you don't receive it?

Once you file for a Social Security benefit, it can no longer grow even if you aren’t effectively receiving it. Yes, that's hard to follow, but I'll explain.

How long before you can file for survivor benefits?

You should apply four months before you want your retirement benefit to start.

Does Social Security pay for survivor benefits?

If you are eligible for both survivor and retirement benefits, Social Security will pay your own retirement benefit first , then top it up to match the survivor benefit if that amount is higher.