Submitting Your Application Download Article.

- Your birth certificate.

- Proof of US citizenship status or lawful permanent residence.

- US military discharge papers.

- W-2 forms or self-employment tax returns for the past year.

- Your final divorce decree, if you're applying as a divorced spouse.

- Your marriage certificate 2.

How to know if you qualify for spousal support?

When determining spousal support, family courts look at the following factors:

- The financial need of one of the spouses for financial support

- The ability of the other spouse to pay for financial support

- Length of the marriage

When should I file for Social Security benefits?

You may need to produce these documents when you apply

- Your Social Security card.

- An original birth certificate or other proof of your birth.

- A copy of your W-2 form or self-employment tax return for the previous year.

- Your marriage certificate.

- If you weren't born in the United States, proof of U.S. citizenship or lawful alien status.

How do I know if I qualify for spousal support?

- The financial means, needs and circumstances of both spouses;

- The length of time the spouses have lived together;

- The roles of each spouse during their marriage;

- The effect of those roles and the breakdown of the marriage on both spouses' current financial positions;

- The ongoing responsibilities for care of the children, if any;

When can you apply for spousal benefits?

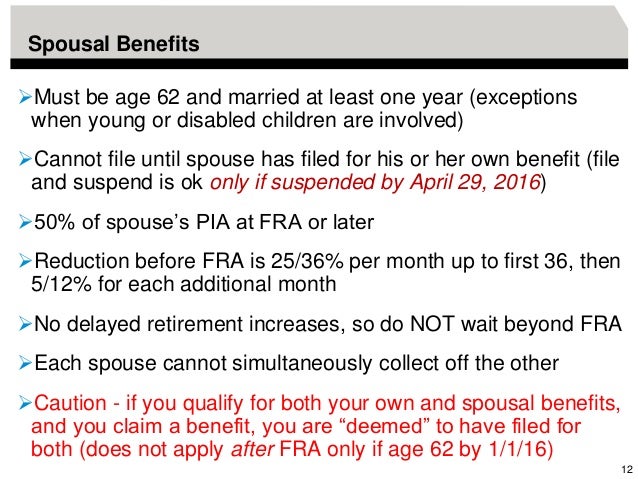

To qualify for spouse’s benefits, you must be one of these: At least 62 years of age. Any age and caring for a child entitled to receive benefits on your spouse’s record and who is younger than age 16 or disabled. Your full spouse’s benefit could be up to one-half the amount your spouse is entitled to receive at their full retirement age. If you choose to begin receiving spouse’s benefits before you reach full retirement age, your benefit amount will be permanently reduced.

When can a spouse claim spousal benefits?

You must have been married at least 10 years. You must have been divorced from the spouse for at least two consecutive years. You are unmarried. Your ex-spouse must be entitled to Social Security retirement or disability benefits.

Who qualifies for spousal retirement benefits?

Benefits For Your Spouse Even if they have never worked under Social Security, your spouse may be eligible for benefits if they are at least 62 years of age and you are receiving retirement or disability benefits. Your spouse can also qualify for Medicare at age 65.

How long does it take to be approved for spousal benefits?

Typically, it takes 6 weeks to process your application and for the benefits to start.

How does spousal benefit work?

The spousal benefit can be as much as half of the worker's "primary insurance amount," depending on the spouse's age at retirement. If the spouse begins receiving benefits before "normal (or full) retirement age," the spouse will receive a reduced benefit.

When can my spouse collect half of my Social Security?

You can receive up to 50% of your spouse's Social Security benefit. You can apply for benefits if you have been married for at least one year. If you have been divorced for at least two years, you can apply if the marriage lasted 10 or more years. Starting benefits early may lead to a reduction in payments.

How much does a wife get of her husband's Social Security?

Key Takeaways. The maximum spousal benefit is 50% of the other spouse's full benefit. You may be eligible if you're married, formerly married, divorced, or widowed. You can collect spousal benefits as early as age 62, but in most cases, the benefits are reduced permanently if you start collecting early.

Can I get spousal benefits if my spouse has not filed?

To be eligible for a spousal benefit, your spouse must have filed for their own benefits. An ex-spouse is exempt from that rule.

How old do you have to be to get spouse's Social Security?

To qualify for spouse’s benefits, you must be one of these: At least 62 years of age.

When will my spouse receive my full retirement?

You will receive your full spouse’s benefit amount if you wait until you reach full retirement age to begin receiving benefits. You will also receive the full amount if you are caring for a child entitled to receive benefits on your spouse’s record who is younger than age 16 or disabled.

What happens if your spouse's retirement benefits are higher than your own?

If your benefits as a spouse are higher than your own retirement benefits, you will get a combination of benefits equaling the higher spouse benefit. Here is an example: Mary Ann qualifies for a retirement benefit of $250 and a spouse’s benefit of $400.

Documents you may need to provide

We may ask you to provide documents to show that you are eligible, such as:

What we will ask you

You should also have your checkbook or other papers that show your account number at a bank, credit union or other financial institution so you can sign up for Direct Deposit, and avoid worries about lost or stolen checks and mail delays.

How much of my spouse's retirement is my full benefit?

Your full spouse’s benefit could be up to 50 percent of your spouse’s full retirement age amount if you are full retirement age when you take it. If you qualify for your own retirement benefit and a spouse’s benefit, we always pay your own benefit first. You cannot receive spouse’s benefits unless your spouse is receiving his or her retirement ...

What is the maximum survivor benefit?

The retirement insurance benefit limit is the maximum survivor benefit you may receive. Generally, the limit is the higher of: The reduced monthly retirement benefit to which the deceased spouse would have been entitled if they had lived, or.

Can my spouse's survivor benefit be reduced?

On the other hand, if your spouse’s retirement benefit is higher than your retirement benefit, and he or she chooses to take reduced benefits and dies first, your survivor benefit will be reduced, but may be higher than what your spouse received.

How much is spousal benefit?

Depending on how old you are when you file, the spousal benefit amount will range between 32.5% and 50% of the higher-earning spouse’s full retirement benefit. Check out the chart below to get an idea of how the benefit works and what your payment might be if you can take advantage ...

How long do you have to be married to get spousal benefits?

The Two Exceptions to Know Around the 1 Year Marriage Requirement. Normally, you must be married for at least 12 continuous months to meet the spousal benefit duration-of-marriage requirement. However, there are two exceptions to this rule.

How many people receive Social Security benefits as a spouse?

A recent Social Security report found that 2.3 million individuals received at least part of their benefit as a spouse of an entitled worker. Some of these spouses had benefits of their own, but were eligible to receive higher benefit because the spousal benefit amount was greater than their own benefit. Others never worked outside the home ...

What is the 1 year requirement for Social Security?

The 1-year requirement is also waived if you were entitled (or potentially entitled!) to Social Security benefits on someone else’s work record in the month before you were married. An example of these benefits would be spousal benefits, survivor benefits or parent’s benefits.

How much of my spouse's Social Security is my full retirement?

Remember, in that case, it’s between 32.5% and 50% of the higher-earning spouse’s full retirement age benefit, depending on your filing age. However, it can seem a little more complicated if you have Social Security benefits from your work history.

Can a spouse receive Social Security?

They have no benefit of their own, but thanks to the Social Security spousal benefit available under their spouse’s work record, they can still receive payments. This particular benefit doesn’t just provide retirement income, either. As an eligible spouse, you could also receive premium-free Medicare benefits.

Does spousal benefit increase after full retirement?

You may have also noticed that the spousal benefit does not increase beyond your full retirement age. When considering your own Social Security benefit, there can be a lot of advantages to waiting to file and delaying when you start receiving payments well past your retirement age, but that’s not the case here.

What age can a spouse file for Social Security?

When a worker files for retirement benefits, the worker's spouse may be eligible for a benefit based on the worker's earnings. Another requirement is that the spouse must be at least age 62 or have a qualifying child in her/his care. By a qualifying child, we mean a child who is under age 16 or who receives Social Security disability benefits.

How much is spousal benefit reduced?

A spousal benefit is reduced 25/36 of one percent for each month before normal retirement age, up to 36 months. If the number of months exceeds 36, then the benefit is further reduced 5/12 of one percent per month.

What is the reduction factor for spousal benefits?

For a spouse who is not entitled to benefits on his or her own earnings record, this reduction factor is applied to the base spousal benefit, which is 50 percent of the worker's primary insurance amount. For example, if the worker's primary insurance amount is $1,600 and the worker's spouse chooses to begin receiving benefits 36 months ...

Can a spouse reduce their spousal benefit?

However, if a spouse is caring for a qualifying child, the spousal benefit is not reduced. If a spouse is eligible for a retirement benefit based on his or her own earnings, and if that benefit is higher than the spousal benefit, then we pay the retirement benefit. Otherwise we pay the spousal benefit. Compute the effect of early retirement ...

What Are Social Security Spousal Benefits?

Social Security spousal benefits are retirement benefits paid by the Social Security Administration to the spouse of a primary beneficiary. When Social Security started, many women did not work outside the home.

Who Qualifies For Social Security Spousal Benefits?

There are a few eligibility criteria that must be met to qualify for spousal benefits. Here are the basics, and then we will dive into a few exceptions to the basic rules. First, your spouse must already have filed for his or her own benefits. You cannot apply for spousal benefits until your spouse has already applied for their own benefits.

When Can A Spouse Claim Social Security Spousal Benefits?

A spouse can claim Social Security spousal benefits as early as age 62, as long as the other spouse has already applied for benefits. You cannot claim benefits until your spouse has claimed benefits using their own record. This rule applies to both a current spouse and a divorced spouse.

How Social Security Spousal Benefits Are Calculated

The calculation for spousal benefits is fairly straightforward. If you wait until full retirement age, then your benefit will be 50% of the spouse’s benefit amount. However, starting your benefits early will reduce your monthly payment.

Social Security Spousal Benefits For Divorced & Widowed Spouses

When it comes to retirement planning, many divorced and widowed spouses wonder whether they can still receive spousal benefits. The answer depends on a few different facts. Here are the rules you need to know when it comes to divorced or widowed spouses receiving spousal benefits.

Maximizing Spousal Benefits For Divorced & Widowed Spouses

Now that most of the spousal benefit loopholes have been closed, there are not as many strategies for maximizing your spousal benefits. One of the biggest tips for maximizing your benefits now is to wait as long as possible to start your benefits.

The Bottom Line

A spouse can claim spousal benefits at age 62 as long as the primary spouse has already applied for benefits. The age requirement can be waived if the spouse is caring for a child under 16 or a disabled child. An ex-spouse can claim spousal benefits at age 62 as well, as long as the marriage lasted for ten years.

Ways to Apply

You can complete an application for Retirement, Spouse's, Medicare or Disability Benefits online.

Retirement or Spouse's Benefits

You can apply online for Retirement or spouse's benefits or continue an application you already started.

Disability Benefits

You can apply online for disability benefits or continue an application you already started.

Appeal a Disability Decision

If your application for disability benefits was denied recently for medical reasons, you can request an appeal online or continue working on an appeal you already started.

Medicare Benefits

You can apply online for Medicare or continue an application you already started.

Extra Help with Medicare Prescription Drug Costs

You can apply online for Extra Help with Medicare prescription drug costs.

Supplemental Security Income (SSI) Benefits

If you want to apply for Supplemental Security Income (SSI), please read:

What happens if my spouse has already filed for spousal support?

If your spouse has already filed, you will automatically receive the larger of your own or the spousal benefit. If your spouse has not filed yet but you have, when your spouse files, the deemed filing rules come into play.

How old do you have to be to claim spousal benefits?

To claim a spousal benefit based on an ex-spouse's earnings record, your ex-spouse has to be 62 and eligible for benefits, but there is no requirement that they must have already filed for benefits. 1 . To claim a spousal benefit based on your current spouse's earnings record, your current spouse must have filed for their own benefits already ...

What is deemed filing for Social Security?

Deemed Filing Rules. When you file for your Social Security retirement benefits you are deemed to be filing for both your own benefit and a spousal benefit, and you will be given the higher of the two. 3 .

Is Social Security confusing?

Social Security spousal benefits are confusing, and among the most common thing readers ask about. The most frequent cause for confusion comes from one small difference between benefits for a spouse versus an ex-spouse.

Can a spouse collect spousal benefits if their spouse is suspended?

Due to Social Security laws that were passed in November 2015 anyone who suspends benefits after April 30, 2016, will end up suspending all benefits based on their record — which means a spouse cannot collect spousal benefits during a time when their spouse has " suspended" benefits. 3 .