You may contact the Benefit Payment Control Unit via telephone at 410-767-2404 use prompts 1 1 4 1 4 to obtain a computer printout of repayments made to. If you received unemployment your tax statement is called form 1099-G not form W-2. For wages you should receive a W-2 from your employer or employers.

Full Answer

When does unemployment send out W2?

Request Your Unemployment Benefit Statement Online

- Log into MiWAM

- Under Account Alerts, click Please select a delivery preference for your 1099 Form

- Under Delivery Preference for Form 1099-G, click Electronic. Your email address will be displayed.

- â Review and Submit. You will receive an email acknowledging your delivery preference. ...

How to get my 1099 from unemployment to file taxes?

- Name, full mailing address, and phone number.

- Driver’s license or state ID number.

- Social Security or Alien Registration number and drivers license number.

- Proof of income, which can include 1099 tax forms, 1099 pay stubs, Form 1040 tax returns and tax returns.

- Bank account number and routing number for direct deposit of benefits.

How to get your 1099 G from unemployment?

Written requests for a hard copy of your 1099-G form from 2018, 2019, 2020 or 2021 may be:

- Faxed to 919-733-1370

- Emailed to [email protected]

- Or mailed to:

Where to find my 1099 G unemployment?

- Unemployment Services

- Employer eGov Services

- Alabama Works

- Equal Opportunity

- Labor Market Information

- FAQ - Secure Email Retrieval

How do I get a copy of my 1099 from unemployment PA?

If you did not receive your 2020 UC 1099-G or 2020-2021 PUA 1099-G forms in the mail or misplaced them, you can also retrieve your forms online using the UC dashboard or PUA dashboard. If you have never logged in before, please visit the How-to Log in to the UC System Guide or Resources page to help you.

How can I get my 1099 form online?

Request a Copy of Your Form 1099GLog in to Benefit Programs Online and select UI Online.Select Payments.Select Form 1099G.Select View next to the desired year. ... Select Print to print your Form 1099G information.Select Request Duplicate to request an official paper copy.

How do I get my 1099-G from EDD?

If you have a Paid Family Leave claim or you are unable to access your information online, you can request a copy of your Form 1099G by calling the EDD's Interactive Voice Response (IVR) system at 1-866-333-4606. The IVR system is available 24 hours a day, 7 days a week. A copy of your Form 1099G will be mailed to you.

When should I receive 1099-G?

January 31You should receive your Form 1099-G by January 31 of the year following the tax year. You may also access the form online if you received unemployment compensation by visiting your state's unemployment benefits website.

How can I get my W2 online for free?

The majority of businesses, and also the military services, now provide free w2 online retrieval. The forms are accessible for download and tax filing....Many Employers Have W2 Lookup OnlineTarget.Kohls.Macy's.Pizza Hut.Walmart.Mcdonalds.Starbucks.Comcast.More items...•

How can I get a copy of my W2 online?

TranscriptYou can get a wage and income transcript, containing the Federal tax information your employer reported to the Social Security Administration (SSA), by visiting our Get Your Tax Record page. ... You can also use Form 4506-T, Request for Transcript of Tax Return.

Do I have to claim EDD on my taxes?

The Form 1099G is provided to people who collected unemployment compensation from the EDD so they can report it as income on their federal tax return. California unemployment compensation is exempt from California state income tax.

Where is my 1099-g California?

0:000:58CA EDD how to download form 1099G 2021 in California to ... - YouTubeYouTubeStart of suggested clipEnd of suggested clipTax form 1099-g used to report your unemployment tax benefits to the irs is now available online inMoreTax form 1099-g used to report your unemployment tax benefits to the irs is now available online in california these are the instructions to access your form 1099-g from the edd log to your edd online

Will EDD affect my taxes?

If you received unemployment (also known as unemployment insurance ), the American Rescue Plan Act of 2021 reduced your federal adjusted gross income (AGI) for 2020 tax return. This means you may now qualify to receive more money from California tax credits, such as: California Earned Income Tax Credit (CalEITC)

Can I file taxes without 1099-G?

You are required and responsible for reporting any taxable income you received - including state or local income tax refunds - even if you did not receive Form 1099-G.

Do I have to wait for my 1099-G to file taxes?

It is not necessary to attach the 1099-G to your tax return.

How do I file taxes without a 1099 or w2?

If you cannot get a copy of your W-2 or 1099, you can still file taxes by filling out Form 4852, “Substitute for Form W-2, Wage and Tax Statement.” This form requests information about your wages and taxes that were withheld. It may be helpful to have documentation, such as a final pay stub, available to complete it.

This Process Of Determining Eligibility Can Take Several Weeks

How to get a W-2 IRS form W2. What to do if your w2 is lost or missing

How Can I Download My 1099

If you were out of work for some or all of the previous year, you aren’t off the hook with the IRS. Those who received unemployment benefits for some or all of the year will need a 1099-G form. You’ll also need this form if you received payments as part of a governmental paid family leave program.

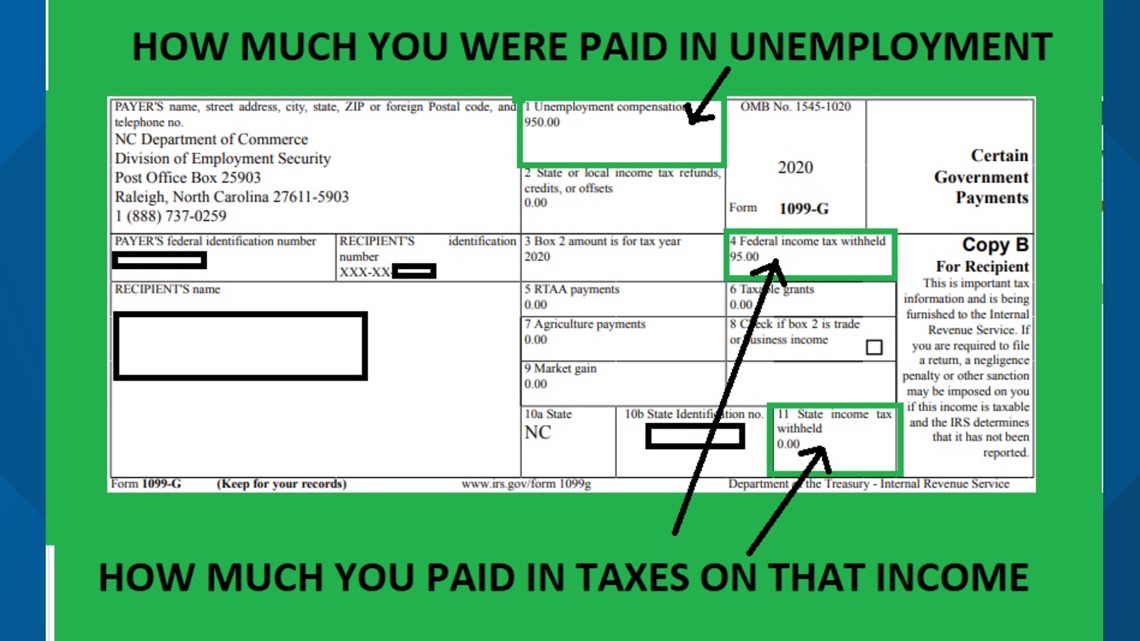

Unemployment Insurance Benefits Tax Form 1099

The Department will begin mailing IRS Forms 1099-G for the calendar year 2020 no later than January 31, ;2021. ;We will post an update on this page when the forms are mailed out and when UI Benefit payment information for 2020 can be viewed online. The address shown below may;be used to request forms for prior tax years.

Withholding Taxes From Your Payments

If you are receiving benefits, you may have federal income taxes withheld from your unemployment benefit payments. Tax withholding is completely voluntary; withholding taxes is not required. If you ask us to withhold taxes, we will withhold;10 percent of the gross amount of each payment before sending it to you.

If You Dont Receive Your 1099

If you havent received a 1099-G by the end of January, log in to your eServices account and find it under the 1099s tab.

What Is Form 1099

Form 1099-G reports the total amount of taxable unemployment compensation paid to you. This includes:

Your New York State Form 1099

Your New York;State Form 1099-G statement;reflects the amount of state and local taxes you overpaid through withholding or estimated tax payments. For most people, the amount shown on their 2020;New York;State Form 1099-G statement is the same as the 2019 New York State income tax refund;they actually received.

How To Request Previous Employers W

How to get a W-2 IRS form W2. What to do if your w2 is lost or missing

Requesting A Tax Return Transcript From The Irs

The IRS provides a service to request a tax return transcript from previous employers. This process can be done in one of two ways:

Requesting A Duplicate 1099

If you do not receive your Form 1099-G by February 1, and you received unemployment benefits during the prior calendar year, you may request a duplicate 1099-G form by phone:

Federal Income Taxes On Unemployment Insurance Benefits

Although the state of New Jersey does not tax Unemployment Insurance benefits, they are subject to federal income taxes. To help offset your future tax liability, you may voluntarily choose to have 10% of your weekly Unemployment Insurance benefits withheld and sent to the Internal Revenue Service .

How To Get Your W

You might still be able to get your W-2 data electronically if, for whatever reason, it didnt work out with your employer or the IRS. The authorized IRS e-file providers H& R Block and TurboTax provide a free W-2 form finder.

How Can I Download My 1099

If you were out of work for some or all of the previous year, you arenât off the hook with the IRS. Those who received unemployment benefits for some or all of the year will need a 1099-G form. Youâll also need this form if you received payments as part of a governmental paid family leave program.

Income Tax 1099g Information

Form 1099-G, Statement for Recipients of Certain Government Payments, is issued to any individual who received Maryland Unemployment Insurance benefits for the prior calendar year. The 1099-G reflects Maryland UI benefit payment amounts that were issued within that calendar year.

Do You Have To Pay For A Tax Id Number

Its free to apply for an EIN, and you should do it right after you register your business. Your business needs a federal tax ID number if it does any of the following: Files tax returns for employment, excise, or alcohol, tobacco, and firearms. Withholds taxes on income, other than wages, paid to a non-resident alien.

Notice To Representatives Of Deceased Claimants

Q: How do I access the 1099-G tax form if I am the representative of a deceased claimant?;

Federal Income Taxes On Unemployment Insurance Benefits

Although the state of New Jersey does not tax Unemployment Insurance benefits, they are subject to federal income taxes. To help offset your future tax liability, you may voluntarily choose to have 10% of your weekly Unemployment Insurance benefits withheld and sent to the Internal Revenue Service .

The Louisiana Workforce Commission Lwc Has Begun The Process Of Mailing 698000 1099

How do i get my w2 from unemployment in louisiana. Call your local unemployment office to request a copy of your 1099-G by mail or fax. Your employer first submits Form W-2 to SSA. If you already have an active unemployment claim and wish to file for weekly.

Check Back For Updates To This Page

For the latest updates on coronavirus tax relief related to this page, check IRS.gov/coronavirus. Were reviewing the tax provisions of the American Rescue Plan Act of 2021, signed into law on March 11, 2021.

Get More With These Free Tax Calculators And Money

See if you qualify for a third stimulus check and how much you can expect

Information Needed For Your Federal Income Tax Return

How to get a W-2 IRS form W2. What to do if your w2 is lost or missing

How to get a copy of my 1099 G?

If you can't download your 1099-G online or you have technical issues with it, contact your state's Department of Revenue. Some states only issue the form by mail, so you'll have to request it and wait for it to arrive if you never received a copy. If it's convenient, consider stopping by the state unemployment office. You may be able to get a copy of your form immediately, rather than waiting for it to arrive.

What Is Form 1099-G?

The IRS supplies special forms to help taxpayers stay organized with their income. It also allows the government to tax different incomes at different rates.

Is it easier to file taxes online?

Filing taxes is much easier when you have all the forms you need in front of you. Many states now offer online access to 1099-G forms, which is a big help when it's time to file but you never received the form. Advertisement. references. IRS: Instructions for Form 1099-G.