5 Steps to Apply for Social Security

- Make sure you want to apply. Make sure you make the right decision about when to apply. ...

- Assess eligibility. Make sure you are eligible. ...

- Gather documents. This step might be the hardest part, but still very straightforward. ...

- Complete application. With the information listed above, you should be able to complete your application. ...

- Monitor status. ...

- Online; or.

- By calling our national toll-free service at 1-800-772-1213 (TTY 1-800-325-0778) or visiting your local Social Security office. ...

- If you do not live in the U.S. or one of its territories, you can also contact your nearest U.S. Social Security office, U.S. Embassy or consulate.

How much can you make while collecting Social Security?

- Be aware that we are talking about Social Security income limits for retirement benefits, not disability or SSI.

- The earnings limit on Social Security is not the same as income taxes on Social Security. ...

- The earnings limit does not apply if you file for benefits at your full retirement age or beyond. ...

- The earnings limit is an individual limit. ...

What is the best way to collect Social Security?

These include:

- Your date and place of birth

- Your Social Security number

- If you are not a United States citizen, you will need your permanent resident card number

- Name of current spouse and the name of any prior spouse (if you were married for more than 10 years or if the marriage ended in death). ...

What happens if you work after starting Social Security?

If you start a new job after you begin receiving Social Security benefits ... How Much Can You Earn While Receiving Social Security? If you opt to work while receiving Social Security before your full retirement age, you will only be able to receive ...

What are the rules for collecting Social Security?

While there's a lot of complicated Social Security rules that apply in different situations, such as to married couples, there are two basic rules every senior considering early retirement needs to know in order to avoid accidentally ending up with far less money than they expect from Social Security. 1.

How long does it take to start receiving Social Security benefits after applying?

The Social Security approval process is relatively speedy, but as it is a government program with a huge number of applicants, you can expect to wait approximately six weeks before you get your approval for benefits.

What is the best month to start Social Security?

Individuals first become eligible to receive a benefit during the month after the month of their 62nd birthday. So, someone born in May becomes eligible in June. Since Social Security pays individuals a month behind, the person will receive the June benefit in July.

Is it better to apply for Social Security online or in person?

Applying online is the easiest way to complete your application at a time that works for you, without a trip to the Social Security office.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

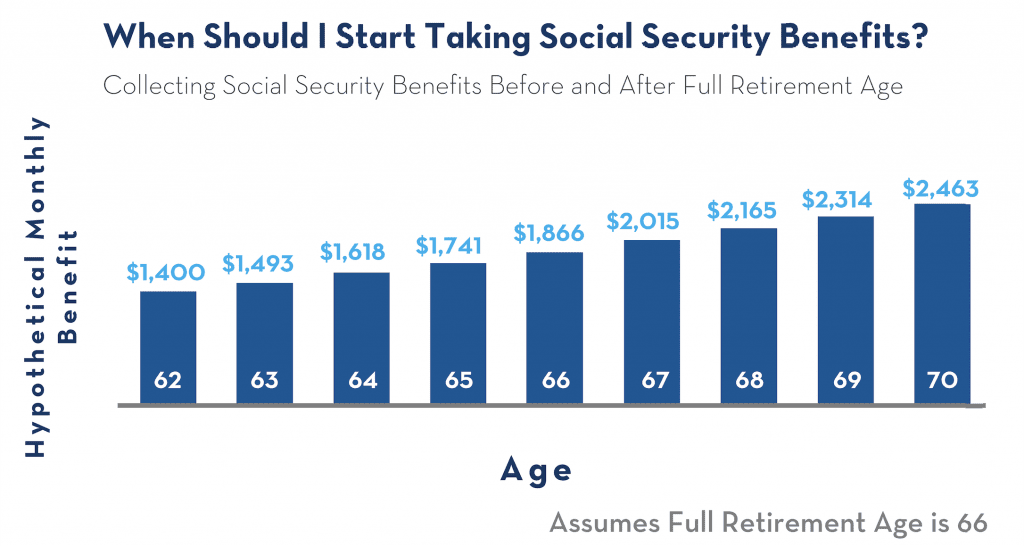

Starting Your Retirement Benefits Early

You can start receiving your Social Security retirement benefits as early as age 62. However, you are entitled to full benefits when you reach your full retirement age. If you delay taking your benefits from your full retirement age up to age 70, your benefit amount will increase.

Before You Make Your Decision

There are advantages and disadvantages to taking your benefit before your full retirement age. The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person's situation is different. It is important to remember:

Ways to Apply

You can complete an application for Retirement, Spouse's, Medicare or Disability Benefits online.

Retirement or Spouse's Benefits

You can apply online for Retirement or spouse's benefits or continue an application you already started.

Disability Benefits

You can apply online for disability benefits or continue an application you already started.

Appeal a Disability Decision

If your application for disability benefits was denied recently for medical reasons, you can request an appeal online or continue working on an appeal you already started.

Medicare Benefits

You can apply online for Medicare or continue an application you already started.

Extra Help with Medicare Prescription Drug Costs

You can apply online for Extra Help with Medicare prescription drug costs.

Supplemental Security Income (SSI) Benefits

If you want to apply for Supplemental Security Income (SSI), please read:

How to maximize Social Security?

Or, you might consider the following rules of thumb: 1 Take Early: The only people who should consider taking their Social Security early are those who absolutely need the money immediately, or those who do not expect to live for very long, due to illness 2 Take at Full Retirement Age: Should you have reason to believe that you will not live past the age of 80, then generally speaking you will maximize your social security benefits if you take them when you reach your Full Retirement Age. 3 Wait as Long as Possible: On the other hand, if you are confident that you will live past the age of 80 or 85, then most experts recommend that you defer your social security for as long as you can (age 70), so as to maximize the benefits you receive from it. 4 Other: If you have dependent children, the additional benefits you receive for them might make filing when you are younger worthwhile.

What age do you need to be to get your spouse's Social Security number?

Spouse’s Social Security number and birth date and the beginning and ending dates of marriage (s) Names and birth dates of any children who became disabled prior to age 22 or who are under age 18 (and unmarried). You will also want names and birth dates for children who are aged 18-19 who are still attending secondary school full time.

What is Social Security Explorer?

If you are confused about when to start, you can use the Social Security Explorer — part of the NewRetirement Retirement Planner to compare your monthly income and maximum lifetime payout at different ages.

How much is deducted from Social Security?

For every month prior to your full retirement age that you begin taking benefits, around 0.55% is deducted from your payout. And, for every year that you defer your benefits, you will receive a larger amount when you finally do begin drawing Social Security. The amount of the bonus is dependent, once more, on your birth date.

How much is deducted from your pension?

For every month prior to your full retirement age that you begin taking benefits, around 0.55% is deducted from your payout.

Is it a good idea to have a retirement plan?

It can also be a very good idea to have an overall retirement plan before you decide when to start your Social Security benefits. The NewRetirement Retirement Planner can help you assess all of your sources of retirement income and whether or not you will have enough to cover your expenses. This tool was recently named a best retirement calculator by the American Association of Individual Investors ( AAII ).

When are Social Security benefits paid?

Social Security benefits are paid the month after they are due.

How long can you withhold unemployment benefits?

This means we cannot withhold benefits for any month we consider you retired, regardless of your yearly earnings.

How long do you have to retire in mid year?

Sometimes people who retire in mid-year already have earned more than the annual earnings limit. However: We have a special rule that applies to earnings for one year, usually the first year you begin receiving benefits.

When does Social Security reduce your benefits?

However, Social Security reduces your payment if you start collecting before your full retirement age, or FRA. (FRA 66 and 2 months for people born in 1955 and is gradually rising to 67 for people born in 1960 or later.) Only then do you qualify for 100 percent of your basic monthly benefit, which is calculated from your 35 highest-earning years.

Is there an age limit for Social Security Disability?

There is no minimum age requirement for Social Security Disability Insurance . You may qualify for disability benefits with less time in the workforce than you need to collect retirement benefits, but you must also demonstrate that your medical condition meets Social Security’s strict definition of disability and show evidence ...

How much is my unemployment check at 62?

In other words, you’ll get 25% less per month, and your check will be $1,500. 1 .

How much is a month of benefits at 62?

If, for example, you’d get $1,500 a month starting at age 62 or $2,000 a month starting at age 66, you will have received roughly the same amount in total benefits by age 77 or so. At that point the higher monthly benefits you’d get as a result of waiting will begin to pay off.

How much will Social Security be reduced in 2021?

You should also note that if you decide to return to work, even part-time, and aren’t yet at your FRA, your Social Security benefits may be temporarily reduced. The reduction is $1 for every $2 of earned income over $18,960 in 2021 (and $19,560 in 2022). During the year when you reach your FRA, your benefits will be reduced by $1 for every $3 in income over $50,520 in 2021 ($51,960 in 2022) until the month when you become fully eligible. 17 That money isn’t lost, however. The SSA will credit it to your record when you reach your FRA, resulting in a higher benefit. 18

How much extra insurance do you get at 70?

If you wait until you’re 70 to start claiming benefits, you’ll get an extra 8% per year , or, in total, 132% of your primary insurance amount ($2,640 per month in the example above) for the rest of your life.

Does Social Security increase at age 66?

That reduced benefit won’t increase once you reach age 66. Rather, you’ll continue to receive it for the rest of your life. It may go up over time due to cost-of-living adjustments (COLAs), but only slightly. You can do the math for your own situation using the Social Security Administration (SSA) Early or Late Retirement Calculator, one of a number of benefit calculators provided by the SSA that can also help you determine your FRA, the SSA’s estimate of your life expectancy for benefit calculations, rough estimates of your retirement benefits, individualized projections of your benefits based on your personal work record, and more. 5 6

Do marginal tax rates affect Social Security?

At today’s marginal tax rates, they may not have much of an impact on most people. Still, tax rates and income thresholds can change, so it’s worth remembering that you will lose less of your Social Security to taxes if you are in a lower marginal tax bracket when you begin to collect.

Is Social Security taxable?

Your Social Security benefits may be partially taxable if your combined income exceeds certain thresholds. Regardless of how much you make, the first 15% of your benefits are not taxed. 10

What is the decision to receive retirement benefits?

Deciding when to start receiving your retirement benefit is a personal decision, based on many factors that are unique to each individual. For example, in addition to the monthly benefit amount, you may want to consider personal and family circumstances, including whether you are working or plan to work, current and future financial resources and obligations, and current and anticipated health and longevity.

Is it important to decide when to start receiving Social Security?

Choosing when to start receiving your Social Security retirement benefits is an important decision that affects your monthly benefit amount for the rest of your life. Your monthly retirement benefit will be higher if you delay claiming it.

How to apply for Social Security online?

A. The first question is easy to answer. You can apply online, call Social Security at 800-772-1213 (TTY 800-325-0778) or go to your local Social Security office. It's best to apply three months before you want the money to begin arriving. But the second question — how much will you get — has no simple answer.

How long do you have to wait to receive Social Security?

Two, you wait until your full retirement age — currently 66 for people born from 1943 to 1954 — and receive what Social Security calls "full benefits" each month. Or, three, you wait until age 70, earning delayed retirement credits that raise your benefit above the "full" amount.

What is the maximum amount you can make in retirement?

However, the earnings limit goes away in the year you reach full retirement age. In that year, the earnings limit is $44,880 , and $1 in benefits will be withheld for every $3 in earnings above the limit. But the limit applies only to earnings in months prior to the one when you mark your full retirement age birthday.

How much of Social Security is taxable?

Depending on how much other income you have, up to 85 percent of your Social Security benefits can be taxable. But, of course, only if you receive the benefits. So, by postponing benefits, you also postpone those taxes, which might make sense for your overall financial planning. Q.

Will Social Security recipients receive the same amount?

He'll receive fewer payments over a shorter period of time, so each check will be larger. By the way, Social Security does the numbers with the goal that, on average, people will receive the same lifetime amount regardless of when they begin benefits.