How Can a Company Merger Affect Consumers?

- Prices Might Change. By eliminating at least one competitor, a merger may allow the remaining companies to implement coordinated price increases.

- Different Product Offerings. Mergers can decrease or increase the choices available to consumers. ...

- Changes to Customer Service. ...

- Quality Often Improves. ...

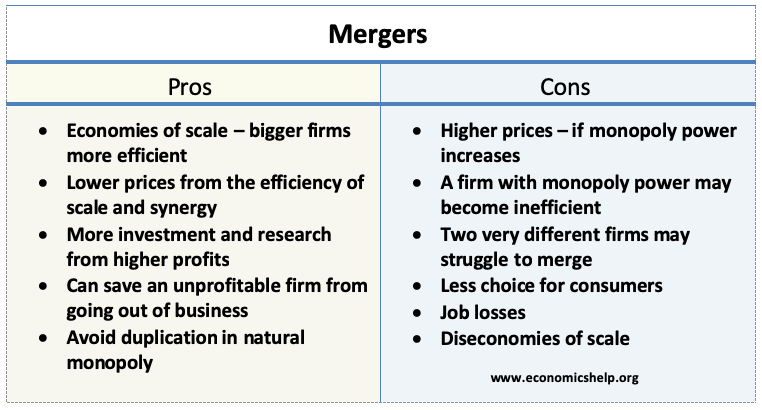

What are the advantages and disadvantages of mergers?

Mergers can save a company from going bankrupt and also save many jobs. Disadvantages of a Merger . 1. Raises prices of products or services. A merger results in reduced competition and a larger market share. Thus, the new company can gain a monopoly and increase the prices of its products or services. 2. Creates gaps in communication

Do mergers benefit or harm the economy?

Over the years, corporations and economists have argued that mergers benefit consumers by increasing efficiency, reducing production costs, and, in turn, lowering prices. A new paper by economists Justin Pierce of the Federal Reserve Board of Governors and Bruce Blonigen from the University of Oregon, however, shows the opposite is the case. By utilizing new techniques to isolate the effects of mergers, they find no evidence that mergers increase efficiency, but do find evidence that they ...

What you can learn from successful mergers?

Why Merger and Acquisitions?

- Capacity augmentation: One of the most common causes of a merger is capacity augmentation through combined forces. Usually, companies target such a move to leverage expensive manufacturing operations.

- Achieving a competitive edge. Let’s face it. ...

- Surviving tough times. ...

- Diversification. ...

- Cost cutting. ...

Are mergers good or bad for stocks?

Tags: Roku Stock, Roku, NASDAQ: ROKU. Stock Market, Latest News on C N N.

Who benefits the most from a merger?

A merger occurs when two firms join together to form one. The new firm will have an increased market share, which helps the firm gain economies of scale and become more profitable. The merger will also reduce competition and could lead to higher prices for consumers.

How consumers benefit from horizontal mergers?

The most obvious benefit is an increased market share or market power. When the two companies merge, they also combine the product base, technology, and services that are available on the market. With more products under one name, the new company can increase its foothold among consumers.

Are mergers beneficial to society?

Firms engage in mergers because they see a profitable opportunity. If profits rise due to lower costs — through higher productivity or economies of scale, for example — the result can be lower prices for consumers and improved overall economic welfare.

How do mergers communicate with customers?

Six steps to building and executing effective merger communicationsIdentify key stakeholders. ... Identify the main milestones and trigger events. ... Set up governance and resourcing for the communications team. ... Develop core messages and a 'deal narrative' to anchor all communications.More items...•

Does a merger of two companies leave the consumer better or worse off?

According to his research, while mergers do push up prices in the short term they are "usually consumer positive" in the long term. "The costs to mergers tend to come straight after the deal happens," he explains.

What are the advantages of mergers for businesses?

Advantages of mergers and acquisitionsImproved economic scale. ... Lower labor costs. ... Increased market share. ... More financial resources. ... Enhanced distribution capacities. ... Increased legal costs. ... Expenses associated with the deal. ... Potentially lost opportunities.More items...•

Which is advantage of the merging from buyers point of view?

Answer: The most common reason for firms to enter into merger and acquisition is to merge their power and control over the markets. Another advantage is Synergy that is the magic power that allow for increased value efficiencies of the new entity and it takes the shape of returns enrichment and cost savings.

How do stakeholders benefit from mergers?

Companies often merge to boost shareholder value by entering new markets or gaining greater share in those where they already compete.

How does a merger affect consumers?

Their impacts on consumers' finances can also vary widely, depending on everything from the type of merger taking place to the size of the companies and the existence (or absence) of robust competition in the marketplace. When a merger works for consumers, it can lead to long-term lower prices, says Michael Noel, ...

What is merger in business?

A merger takes place when separate companies become a single new entity. The more newsworthy mergers tend to be "horizontal," experts say. That means the consolidation happens between businesses operating in the same space, like when two airlines join forces. Other mergers are "vertical," meaning the two companies operate at different stages ...

What happens if one company has a unionized labor force and the other does not?

Additionally, if one company has a unionized labor force and the other does not, a merger could threaten the union and the job benefits that come with it. Mergers can also create challenges for aspiring entrepreneurs and innovators, some experts say.

What happens when two companies merge?

If two companies merge, it may also result in fewer businesses at which job seekers can compete for new career opportunities, Stage r says. For example, if two restaurants in a community merge, servers lose a business through which they could change jobs, negotiate for a higher salary and grow their career.

Can mergers hurt consumers?

But mergers may have a negative impact on consumers' pocketbooks when they place a stranglehold on competition, some experts say. "A merger can be bad for consumers if, instead, a company uses that merger to restrict competition and consumer choice, which could lead to increased prices for consumers," says Joshua Stager, ...

Will mergers and acquisitions promote consumer welfare?

The short answer for those curious consumers is: It depends. "There are some mergers and acquisitions that will probably promote consumer welfare, " says Bill Galston, senior fellow at the Brookings Institution, a District of Columbia-based think tank.

Can consumers register antitrust concerns?

Concerned consumers can also register antitrust concerns with the Department of Justice , says Becky Chao, a millennial public policy fellow in New America's Open Technology Institute. Their state's attorney general may also be able to bring a lawsuit that blocks mergers that threaten competition, Chao says.

Why are mergers important?

Despite of the number of shortcomings that are associated with mergers, they are sometimes important in the society. They have some positive contribution to the industry, society as well as the customers. In some cases, mergers lead to increase in the level of employment.

How do mergers affect the economy?

This has raised a concern of whether mergers should be encouraged in the economy or not. Another effect of mergers lies on the employment level in the economy.

Why are mergers likely to lead to low quality goods and services?

Mergers are likely to lead into low quality goods & services. This is as a result of lack of competition in the market. Therefore, the resultant company will not be having any fear of losing customers to its competitors. This denies the customers a right to access high quality goods and services.

How do mergers eliminate competition?

One way through which mergers can eliminate competition is through coordinated interaction among companies which will adversely affect customers (U.S. Department of Justice and the Federal Trade Commission, 2010, p. 27). This involves actions by firms which are likely to favor their profitability.

What is the most common type of merger?

There are several types of mergers. The first type of merger is known as vertical merger . This is the most common type of mergers in the business world. This is a form of merging where a corporation merges with its client (or suppliers) in order to build up on the chain of supply. The second type is horizontal merger.

What happens to the tiles after a merger?

The newly formed company after merging will consequently raise the prices of the tiles. This consequently leads to an increase in consumer prices by the other firms. For instance, after the combination of Keystone and Saint-Gobain into one company, the company will raise the prices of the tiles.

Why do companies merge?

The main aim for the companies to form merges is to increase their profitability. When two companies merge, the resultant company enjoys the advantages of bulk buying of the law materials, which significantly reduces its production costs. There are several types of mergers.

Why do companies seek mergers?

Summary. Companies seek mergers to gain access to a larger market and customer base, reduce competition, and achieve economies of scale. There are different types of mergers that the companies can follow, depending on their objectives and strategies. A merger is different from an acquisition. Mergers happen when two or more companies combine ...

How does a merger affect the market?

1. Raises prices of products or services. A merger results in reduced competition and a larger market share. Thus, the new company can gain a monopoly and increase the prices of its products or services. 2. Creates gaps in communication. The companies that have agreed to merge may have different cultures.

How do mergers happen?

Why do Mergers Happen? 1 After the merger, companies will secure more resources and the scale of operations will increase. 2 Companies may undergo a merger to benefit their shareholders. The existing shareholders of the original organizations receive shares in the new company after the merger. 3 Companies may agree for a merger to enter new markets or diversify their offering of products and services#N#Products and Services A product is a tangible item that is put on the market for acquisition, attention, or consumption while a service is an intangible item, which arises from#N#, consequently increasing profits. 4 Mergers also take place when companies want to acquire assets that would take time to develop internally. 5 To lower the tax liability, a company generating substantial taxable income may look to merge with a company with significant tax loss carry forward#N#NOL Tax Loss Carryforward A Net Operating Loss (NOL) or Tax Loss Carryforward is a tax provision that allows firms to carry forward losses from prior years to offset future profits#N#. 6 A merger between companies will eliminate competition among them, thus reducing the advertising price of the products. In addition, the reduction in prices will benefit customers and eventually increase sales. 7 Mergers may result in better planning and utilization of financial resources.

What is vertical merger?

A vertical merger occurs when companies operating in the same industry, but at different levels in the supply chain, merge. Such mergers happen to increase synergies, supply chain#N#Supply Chain Supply chain is the entire system of producing and delivering a product or service, from the very beginning stage of sourcing the raw materials to the final#N#control, and efficiency.

How is merger different from acquisition?

Mergers happen when two or more companies combine to form a new entity, whereas an acquisition is the takeover of a company by another company.

What is the difference between a congeneric and a product extension merger?

Such mergers happen between companies operating in the same market. The merger results in the addition of a new product to the existing product line of one company. As a result of the union, companies can access a larger customer base and increase their market share. 2.

How can companies achieve economies of scale?

Companies can achieve economies of scale, Economies of Scale Economies of scale refer to the cost advantage experienced by a firm when it increases its level of output.The advantage arises due to the. such as bulk buying of raw materials, which can result in cost reductions.

What happens when a company merges?

Some mergers result in both brands continuing to operate, sharing back office functions such as marketing, accounting and human resources. When mergers result in one brand ending or one set of products leaving the marketplace, consumers have fewer options.

What happens when you merge two companies?

When you merge two companies, warranties, guarantees and other customer service issues can affect your customers. If customers shopped at one business because of the proximity of its stores, they might move to your competitor if you close stores near them and require them to travel farther for service issues.

What happens when two providers merge?

If the only two providers in a marketplace merge, the temptation to raise prices makes it easier for a competitor to enter the market. If a merger results in reduced operating expenses, the new business can increase gross profits by lowering prices and increasing sales volumes. References.

How does less competition affect prices?

Less competition means more of an opportunity for you to raise your prices. If customers are willing to expand their geographic shopping area because of fewer choices, their willingness to travel becomes more likely if less competition leads to higher prices. If the only two providers in a marketplace merge, the temptation to raise prices makes it easier for a competitor to enter the market. If a merger results in reduced operating expenses, the new business can increase gross profits by lowering prices and increasing sales volumes.

Is a merger a good idea?

A merger might present a wide variety of cost-containment, product line and economies of scale benefits for two businesses, but whether the union is a good idea also comes down to how the public accepts it. Before you consider combining two companies, review the effects the merger will have on your customers and how likely they will be to stay ...

Why do acquisitions bring tax benefits?

Tax Benefits. Acquisitions can sometimes bring tax benefits if the target company is in a strategic industry or a country with a favorable tax regime. The example of US pharmaceutical companies looking at smaller Irish companies and moving their headquarters to Ireland to avail of its lower tax base is a case in point.

What are the benefits of M&A?

Underpinning all of M&A activity is the promise of economies of scale. The benefits that will come from becoming bigger: 1 Increased access to capital, 2 lower costs as a result of higher volume, 3 better bargaining power with distributors, and more.

What is synergy in business?

Synergies are typically described as ‘ one plus one equalling three ’: the value that comes from two companies working together in tandem to make something far more powerful. An example is provided by Disney acquiring Lucasfilm. Lucasfilm was already a huge cash generator through the Star Wars franchise, but Disney can add theme park rides, toys and merchandise to the customer offering.

Why are consumers supportive of mergers and acquisitions?

They get strategy. Consumers understand that companies make acquisitions to expand into other markets, add new capabilities and increase revenue. They are concerned about employees at both companies.

Why are consumers concerned about services?

They are concerned about services. Consumers want to know whether the services they like will be available post-transaction. In spite of the fact that a majority of consumers finds that the offerings of the companies doing mergers and acquisitions got better post-deal, they express anxiety about it during the deal process.

What happens when you hear about a deal?

Now when they hear about a deal, they assume an unjustified price increase is coming. They believe they are forgotten. Consumers don’t believe they are thought about by management during a deal process.

Do consumers think about management during a deal?

Consumers don’t believe they are thought about by management during a deal process. Most of the time, consumers hear about an announcement and they hear when a deal is complete but they don’t hear anything in between. A high percentage of consumers believe there should be more communication with consumers.

Why do we care about market power and markups?

Consumers are paying higher prices, so consumers are losing what’s called consumer surplus, and it can be shown that the loss of consumer surplus is larger than the extra profit that the firms are making, and that’s a loss to society. So that’s why we care about market power and markups.

What is markup in marketing?

A markup is how much your price is above your marginal cost. Suppose the cost of producing a product is $2 and you can charge $3. That’s a 50 percent markup.

Can a monopolist charge prices over the cost of producing a product?

And then the opposite end of the spectrum is a monopolist, who is the only producer of a product, they definitely will be able to charge prices over the cost of producing the product if demand is reasonably sufficient.

Why is CVS and Aetna merger different?

But a CVS-Aetna merger might be different because their business lines complement each other. The most significant overlap is in the management of Medicare drug benefits: Both companies offer stand-alone Medicare prescription drug plans.

Why do pharmacy benefits managers increase prescription drug prices?

This is because they make money through opaque rebates that are tied to drug prices (so their profits rise as those prices do).

Why is pharmacy benefit not on the hook?

When pharmacy benefits are managed by a company that’s not on the hook for the cost of other care, like hospitalization, it doesn’t have as strong an incentive for increasing access to drugs that reduce other types of health care use. That could end up costing more over all.

Is consolidation good for health care?

Consolidation in health care has generally not been good for Americans. Here’s why this seems to be an exception. There are reasons for consumers to be optimistic about CVS’s reported purchase of Aetna for $69 billion on Sunday. It’s one of the largest health care mergers in history, and in general, consolidation in health care has not been good ...

Is outsourcing pharmacy benefits management good for consumers?

These insurers, and UnitedHealth Group, have concluded that outsourcing pharmacy benefits management may not serve their interests. This removal of profit-taking middlemen could be good for consumers in the short run if it leads to lower drug prices.

Introduction

- Merger is the process whereby two or more companies combine together such that all their operations are carried out as one. Over the recent past, there have been several mergers of firms within oligopolies. When two or more companies merge, the control of their assets becomes vested on under one control. However, there are some regulations which guide the process. In th…

Discussion

- In most cases, the Federal Trade Commission has to be notified in advance about any proposed merger in order to access the impacts of the merge to the consumer. This is in attempt to protect the customer from unnecessary merges which can be dangerous. The commission has the right to stop any merger which poses a major threat to the consumer’s welfare. One of the proposed …

Reasons For and Against Mergers

- Over the past, mergers have impacted both negatively and positively in the economy. These impacts can be viewed in different perspectives, that is, the impacts of the mergers to the industry, society, and consumers.

Conclusion

- In conclusion, this discussion has clearly brought out the impacts of mergers in the economy. It has been found that it is very critical to find an exact impact of a merger in an economy. It affects the economy both positively and negatively. However, the study has indicated that mergers can significantly cause consumer suffering. In other words, m...

Reference List

- Blurt (n.d.). What Are The Advantages And Disadvantages Of A Cross-cultural Merger? Web. Economics Help. (n.d.). Benefits of Mergers. Web. Federal Trade Commission. (2010). Protecting America’s Consumers. Web. Gugler, K. (2003). The Effects of Mergers on Company Employment in the USA and Europe-U.S. Department of Justice and the Federal Trade Commission. Web. Ma…

Why Do Mergers Happen?

- After the merger, companies will secure more resources and the scale of operations will increase.

- Companies may undergo a merger to benefit their shareholders. The existing shareholders of the original organizations receive shares in the new company after the merger.

- Companies may agree for a merger to enter new markets or diversify their offering of produc…

- After the merger, companies will secure more resources and the scale of operations will increase.

- Companies may undergo a merger to benefit their shareholders. The existing shareholders of the original organizations receive shares in the new company after the merger.

- Companies may agree for a merger to enter new markets or diversify their offering of products and services, consequently increasing profits.

- Mergers also take place when companies want to acquire assets that would take time to develop internally.

Types of Merger

- 1. Congeneric/Product extension merger

Such mergers happen between companies operating in the same market. The merger results in the addition of a new product to the existing product line of one company. As a result of the union, companies can access a larger customer base and increase their market share. - 2. Conglomerate merger

Conglomerate merger is a union of companies operating in unrelated activities. The union will take place only if it increases the wealth of the shareholders.

Advantages of A Merger

- 1. Increases market share

When companies merge, the new company gains a larger market share and gets ahead in the competition. - 2. Reduces the cost of operations

Companies can achieve economies of scale,such as bulk buying of raw materials, which can result in cost reductions. The investments on assets are now spread out over a larger output, which leads to technical economies.

Disadvantages of A Merger

- 1. Raises prices of products or services

A merger results in reduced competition and a larger market share. Thus, the new company can gain a monopoly and increase the prices of its products or services. - 2. Creates gaps in communication

The companies that have agreed to merge may have different cultures. It may result in a gap in communication and affect the performance of the employees.

More Resources

- Thank you for reading CFI’s guide to Mergers. To keep advancing your career, the additional resources below will be useful: 1. Due Diligence 2. M&A Considerations and Implications 3. Diseconomies of Scale 4. Types of Synergies