- Have worked in jobs covered by Social Security.

- Have a medical condition that meets Social Security's strict definition of disability.

What conditions are considered a disability?

The legal definition of “disability” states that a person can be considered disabled if they are unable to perform any substantial gainful activity due to a medical or physical impairment or impairments which can be expected to result in death or which has lasted or can be expected to last for a continuous period of ...

What is the most approved disability?

1. Arthritis. Arthritis and other musculoskeletal disabilities are the most commonly approved conditions for disability benefits. If you are unable to walk due to arthritis, or unable to perform dexterous movements like typing or writing, you will qualify.

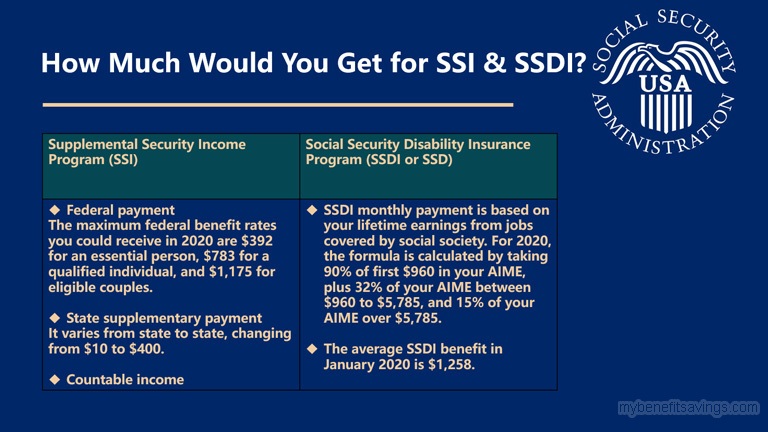

What determines how much SSDI you get?

average lifetime earningsIf you are eligible for SSDI benefits, the amount you receive each month will be based on your average lifetime earnings before your disability began. This is the only factor that determines your benefit amount, although it may be reduced if you're receiving disability payments from other sources (more on this below).

What is the minimum you can receive on SSDI?

The first full special minimum PIA in 1973 was $170 per month. Beginning in 1979, its value has increased with price growth and is $886 per month in 2020. The number of beneficiaries receiving the special minimum PIA has declined from about 200,000 in the early 1990s to about 32,100 in 2019.

What is the hardest state to get disability?

OklahomaOklahoma is the hardest state to get for Social Security disability. This state has an SSDI approval rate of only 33.4% in 2020 and also had the worst approval rate in 2019 with 34.6% of SSDI applications approved. Alaska had the second-worst approval rate, with 35.3% of applications approved in 2020 and 36.2% in 2019.

Why is SSDI so hard to get?

The SSA will not approve you for SSDI benefits if you perform work that brings in more than the substantial gainful activity rate, which is $1,260 per month in 2020. If you are working and earning more than this rate every month, you will not qualify for benefits.

How much will I get from Social Security disability If I make $30000?

1:252:31You get 32 percent of your earnings between 996. Dollars and six thousand and two dollars whichMoreYou get 32 percent of your earnings between 996. Dollars and six thousand and two dollars which comes out to just under 500 bucks.

Can you get both SSI and SSDI?

Many individuals are eligible for benefits under both the Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) programs at the same time. We use the term “concurrent” when individuals are eligible for benefits under both programs.

What is the highest Social Security benefit you can get?

The maximum benefit depends on the age you retire. For example, if you retire at full retirement age in 2022, your maximum benefit would be $3,345. However, if you retire at age 62 in 2022, your maximum benefit would be $2,364. If you retire at age 70 in 2022, your maximum benefit would be $4,194.

Do you need a lawyer to file for Social Security disability?

En español | It's not required, but you do have a right to professional representation in your dealings with the Social Security Administration (SSA).

What's the difference between SSI and SSDI?

The major difference is that SSI determination is based on age/disability and limited income and resources, whereas SSDI determination is based on disability and work credits. In addition, in most states, an SSI recipient will automatically qualify for health care coverage through Medicaid.

Does disability pay more than Social Security?

In general, SSDI pays more than SSI. Based on data from 2020: The average SSDI payment is $1,258 per month. The average SSI payment is $575 per month.

How do I apply for disability benefits?

You can apply for Disability benefits online, or if you are unable to complete the application online, you can apply by calling our toll-free number, 1-800-772-1213, between 8:00 a.m. and 7:00 p.m.

How long does it take to get SSDI?

Social Security Disability Insurance (SSDI) benefits have a five month waiting period, which means that benefit payments will not begin before the sixth full month of disability. The SSDI waiting period begins the first full month after the date we decide your disability began.

When will I get my ALS disability?

There is no waiting period if your disability results from amyotrophic lateral sclerosis (ALS) and you are approved for SSDI benefits on or after July 23, 2020. We pay Supplemental Security Income (SSI) disability benefits for the first full month after the date you filed your claim, or, if later, the date you become eligible for SSI.

What is the eligibility for SSDI?

To qualify for SSDI, you must have obtained enough work credits.

How many credits do you need to work to qualify for disability?

For example, if you are 40, you will need 20 work credits while someone who is 50 will need 28 work credits. Typically, if you worked five of the last ten years, you will have obtained enough work credits. To qualify for total disability, according to the SSA’s definition, you must be completely unable to perform any work which you have ever ...

Why are disability claims denied?

Often it is because of a lack of medical evidence. If you want to qualify for disability benefits, you will need to prove that you are unable to work because your condition is disabling.

How long can you work with SSDI?

SSDI is available for those who were able to work in the past but are now finding they can’t work for at least twelve months because they are experiencing a disabling condition.

What if I can't work because of disability?

If you are unable to work because you are experiencing a disabling condition, you may be eligible for financial help from the Social Security Administration (SSA). The SSA has two different programs to assist those unable to work – Supplemental Security Income and Social Security Disability Insurance (SSDI).

Do you have to work to qualify for FICA?

In most cases, if you have worked for an outside employer in the United States, you have made FICA contributions (as has your employer). The number of work credits needed to qualify vary by age.

Do you have to work with an attorney to get a disability claim approved?

Claimants who work with an attorney are more likely to have a disability claim approved. An attorney will review your medical records and determine if your records match the criteria of the listing. Your attorney will gather all your supporting evidence and will be able to determine what your records are lacking in order to be approved.

What is considered income for SSI?

Income, for the purposes of SSI includes: money you earn from work; money you receive from other sources, such as Social Security benefits, workers compensation, unemployment benefits, the Department of Veterans Affairs, friends or relatives; and. free food or shelter.

How long can I get SSI?

You may receive SSI for a maximum of 7 years from the date DHS granted you qualified alien status in one of the following categories, and the status was granted within seven years of filing for SSI: Refugee admitted to the United States (U.S.) under section 207 of the Immigration and Nationality Act (INA);

What is a non-citizen on SSI?

the non–citizen must be in a qualified alien category, and. meet a condition that allows qualified aliens to get SSI benefits. A non–citizen must also meet all of the other requirements for SSI eligibility, including the limits on income, resources, etc.

Why does my SSI stop?

For example, your SSI will stop if you lose your status as a qualified alien because there is an active warrant for your deportation or removal from the U.S. If you are a qualified alien but you no longer meet one of the conditions that allow SSI eligibility for qualified aliens, then your SSI benefits will stop.

What is CAL disability?

Compassionate Allowances (CAL) are a way to quickly identify diseases and other medical conditions that, by definition, meet Social Security’s standards for disability benefits. These conditions primarily include certain cancers, adult brain disorders, and a number of rare disorders that affect children.

How long can you be ineligible for Social Security if you give away a resource?

If you give away a resource or sell it for less than it is worth in order to reduce your resources below the SSI resource limit, you may be ineligible for SSI for up to 36 months.

What are resources for SSI?

Resources, for the purposes of SSI, are things you own such as: cash; bank accounts, stocks, U.S. savings bonds; land; vehicles; personal property; life insurance; and. anything else you own that could be converted to cash and used for food or shelter. We do not count the value of all of your resources for SSI.

How much income do I need to get SSDI?

To qualify for an SSI payment in addition to an SSDI payment, your unearned income (meaning SSDI) must be less than $794 per month. The SSI income limits are fairly complicated, however; this limit is higher in some states, and if you are working and making some money, some of that income doesn't count towards the limit.

How much is the monthly payment for SSDI?

Monthly Payment of Concurrent SSDI and SSI Benefits. If your SSDI benefit and any other income is under $794 per month (the current SSI monthly payment amount) and you qualify for SSI, you will receive an SSI payment. For instance, if your SSDI payment is $500, and you have no other income, you would also receive a $294 SSI payment.

How much does SSI raise monthly?

The benefit to collecting SSI when you are collecting a low monthly SSDI benefit is that the SSI payment will raise your benefit up to $794 per month. The benefit to being able to collect SSDI when you are eligible for SSI is that you may be eligible to get on Medicare as an SSDI recipient, ...

Can I get both SSI and SSDI at once?

If your income and assets are low enough to qualify for Supplemental Security Income (SSI), and you also worked long enough to qualify for Social Security disability insurance (SSDI), it's not unlikely you'll receive both types of benefits at once.

Can I apply for both Social Security and SSDI at the same time?

Applying for both benefits is called a "concurrent claim.". In certain circumstances, you can collect SSI and SSDI at the same time (this is called receiving "concurrent benefits"). This happens when a disability applicant is approved for Social Security disability insurance benefits (abbreviated as SSDI) but receives only a low monthly payment.

Can I get SSDI and SSI?

Here's when that might happen. If you've been approved for SSDI but are within the five-month waiting period (before you receive any actual benefits), you won't get an SSDI payment, but you could get SSI payments if you have little countable income.