The EDD

Doctor of Education

The Doctor of Education is a doctoral degree that focuses on the field of education. It prepares the holder for academic, research, administrative, clinical, or professional positions in educational, civil, private organizations, or public institutions.

How does Edd pay benefits?

- Other services offered by the Edd

- How long does the unemployment compensation in California last

- Short Term disability benefits

- Conclusion

How do you estimate unemployment benefits?

- You must have lost your job through no fault of your own. ...

- If you quit your job, you may still be eligible for benefits if you left under certain circumstances, such as being asked to perform illegal acts or work in hazardous ...

- You must have earned at least $2,500 in wages during your standard base period. ...

How to calculate SDI Edd?

Rates, Withholding Schedules, and Meals and Lodging Values

- Contribution Rates. Your Unemployment Insurance (UI), Employment Training Tax (ETT), and State Disability Insurance (SDI) tax rates are combined on the Notice of Contribution Rates and Statement of UI Reserve ...

- California Withholding Schedules. ...

- Meals and Lodging Values. ...

How much is the maximum unemployment benefit?

- A personal medical illness or injury prevented you from working

- You are caring for a minor child who has a medical illness

- You are caring for a terminally ill spouse

- You have documented cases of sexual assault, family violence or stalking

- You entered Commission-Approved Training and the job is not considered suitable under Section 20

Is EDD based on gross or net income?

For regular employment, the documents must show your gross income (total paid before taxes and payroll deductions), such as a W-2. Providing check stubs showing your earnings each quarter would also be helpful.

Is EDD giving extra 300 a week?

We automatically added the federal unemployment compensation to each week of benefits that you were eligible to receive. Any unemployment benefits through the end of the program are still eligible for the extra $300, even if you are paid later.

What is the EDD weekly benefit amount?

The unemployment benefit calculator will provide you with an estimate of your weekly benefit amount, which can range from $40 to $450 per week. Once you submit your application, we will verify your eligibility and wage information to determine your weekly benefit amount.

What is the maximum unemployment benefit in California 2021?

$450The maximum unemployment benefit you can get in California is $750 a week through September 6, 2021. After that, the maximum weekly benefit is $450.

How much is EDD paying now 2021?

$167 plus $600 per week for each week you are unemployed due to COVID-19.

Is EDD going to end in September 2021?

Federal-State Extended Duration (FED-ED) benefits are no longer payable after September 11, 2021. The federal government does not allow benefit payments to be made for weeks of unemployment after this program ends, even if you have a balance left on your claim.

How do I calculate the unemployment rate?

In general, the unemployment rate in the United States is obtained by dividing the number of unemployed persons by the number of persons in the labor force (employed or unemployed) and multiplying that figure by 100.

Whats the most EDD will pay?

The maximum benefit amount is calculated by multiplying your weekly benefit amount by 8 or adding the total wages subject to State Disability Insurance (SDI) tax paid in your base period. For claims beginning on or after January 1, 2022, weekly benefits range from $50 to a maximum of $1,540.

How much money can you make and still collect unemployment in California?

If your weekly earnings are $100 or less, the first $25 do not apply. Any amount over $25 is subtracted from your weekly benefit amount and you are paid the difference, if any. For example: Your weekly benefit amount is $145.

Is Edd coming back 2022?

IMPORTANT NOTE: The employment data for the month of February 2022 is taken from the survey week including February 12....Employment and Unemployment in California.California Labor ForceMonth-over Change (January 2022–February 2022)Year-over Change (February 2021–February 2022)Unemployment (1,024,000)-65,700-583,6002 more rows•Mar 25, 2022

Can you work part time and collect unemployment in California?

If you are working part time, you may be able to receive reduced unemployment benefits even if your earnings are higher than your weekly benefit amount. We will calculate the amount to deduct and the amount you are eligible to receive.

How far can I backdate my EDD claim?

Your claim start date will be the Sunday of the week you applied for #unemployment benefits. You can request to backdate your claim date to the week you became unemployed due to #COVID19.

How long can you collect unemployment?

State benefits are typically paid for a maximum of 26 weeks. Some states provide benefits for a lower number of weeks, and maximum benefits also vary based on where you live. In times of high unemployment, additional weeks of unemployment compensation may be available. Regardless of how much you make, you never can collect more than ...

What percentage of unemployment is taxed?

Some states withhold a percentage of your unemployment benefits to cover taxes—typically 10%. If the option to have taxes withheld is available, you will be notified when you sign up for unemployment.

How long do you get unemployment if you are laid off?

The amount you receive depends on your weekly earnings prior to being laid off and on the maximum amount of unemployment benefits paid to each worker. In many states, you will be compensated for half of your earnings, up to a certain maximum. State benefits are typically paid for a maximum of 26 weeks. Some states provide benefits ...

What does it mean to be ineligible for unemployment?

It typically means you are ineligible if you quit—although there are exceptions, like if you quit because of impossible work conditions. If you are fired for cause, you also are likely ineligible. You also have to have been employed for a minimum amount of time or have earned a minimum amount in compensation.

Is unemployment taxable income?

Taxes on Unemployment. Unemployment benefits are considered taxable income, and the unemployment compensation you receive must be reported when you file your federal and state tax returns. 2 . Both state unemployment benefits and federally funded extended benefits are considered income and must be reported when you file your federal ...

How to calculate unemployment benefits?

To calculate the benefit, determine the base period, calculate wages in the highest-earning quarter and determine the corresponding weekly benefit amount.

How is unemployment calculated in California?

How Weekly Benefit is Calculated. The California unemployment calculation uses the highest quarter's earnings and converts that into a weekly earning. Benefits are paid at 55 percent of that weekly earning. Assuming you make $13,000 in your highest paid quarter, you convert that into a weekly benefit. Since there are 13 weeks in a quarter, your ...

What is unemployment in California?

California unemployment benefits provides a cash cushion for employees who have been laid off. The State of California Employment Development Department offers resources explaining how to calculate your unemployment benefits. The amount of unemployment benefits is a factor of how much the claimant earned in wages during a base period.

What is the standard base period for unemployment?

The standard base period is the earning time frame the state considers when evaluating your claim. Your standard base period is the first four of the last five calendar quarters before you submitted your unemployment claim. For example, say you submitted an unemployment claim on Jan. 1, 2017.

How long does unemployment last in California?

The weekly maximum unemployment benefit available in California is $450, and California offers unemployment benefits for six months. Unless Congress approves a federal extension of unemployment benefits, the checks will stop coming after you exhaust your six-month fund. Read More: Ways to Collect Unemployment.

How to calculate unemployment weekly?

To calculate your weekly benefits amount, you should: Work out your base period for calculating unemployment. Take a look at the base period where you received the highest pay. Calculate the highest quarter earnings with a calculator. Calculate what your weekly benefits would be if you have another job. Calculate your unemployment benefits ...

How long does it take to get unemployment?

If eligible for unemployment benefits, you can expect to receive your first payment within 3-4 weeks if there are no issues with your claim. In general, it takes approximately 3 weeks to process a claim; however, you will still need to claim benefits every week. The information you need before filing a claim:

What happens if you work while receiving unemployment?

In case you earn an income while receiving benefits, they would reduce the amount of benefits that you receive. If you work temporarily then you must report those earnings to the state unemployment agency and they will determine how much of the unemployment benefits would be reduced.

How long does unemployment last?

This is beneficial for those that are out of work for a long period. The maximum benefits duration has increased from 26 to 99 weeks in some states.

How to file a weekly claim?

You can file your weekly claim: Through the Internet – You can file your weekly claim online. You must have a User ID and PIN in order to file your weekly claim online. By phone – You must call the number given to you during the registration process.

Do higher wages get a larger benefit check?

In a way, this would be up to a cap that is tied to the average earnings in that state. So the employees with a higher wage would receive a larger benefits check but it is still a percentage of what they used to earn. The amount that an employee would receive differs from each state.

Can I file unemployment if I received severance pay?

Have your entire information ready before filing your claim. If you have received severance pay upon your separation from work, you may still be eligible for unemployment benefits. So it is still important to call and file your initial claim during your first week of total or partial unemployment.

How Do You Calculate Your Unemployment Benefits?

The answer is, it's complicated, because the process of calculating unemployment benefits varies by state.

Unemployment Benefits for Jobless Workers

Unemployment insurance is an important benefit that can help keep workers afloat between paying jobs. With the pandemic-related shutdowns of 2020, tens of millions of Americans had to rely on unemployment to make ends meet, many for the first time.

How to apply for unemployment in California?

1. Meet the work search requirements. When you apply for unemployment insurance with the state of California, you will need to actively seek employment. You will also have to register with CalJOBS. Keep a record of your efforts and contact information of the employers you apply with in case of an eligibility interview.

What is base period wage?

Base-period wages cover the first four of the last five calendar quarters you have worked. These amounts earned will determine your maximum and weekly benefits. This period begins from the day you apply, not the date you became unemployed. Your base-period wage will determine your: Weekly benefit allowance (WBA)

How Long Does The Unemployment Compensation In California Last

The benefits can go up to 26 weeks, and the amount that you will receive will depend on three months before your claim was filed. However, during the Corona period, the EDD has extended unemployment benefits to last for 13 more weeks.

How Unemployment Benefits Are Calculated with The EDD

Your eligibility for unemployment benefits and your earnings is based on your earnings during the base period. The base period is calculated within 4 or 5 calendar quarters. For example, a base year can be between May 1, 2020, to April 30, 2021, for claims filled in August 2021.

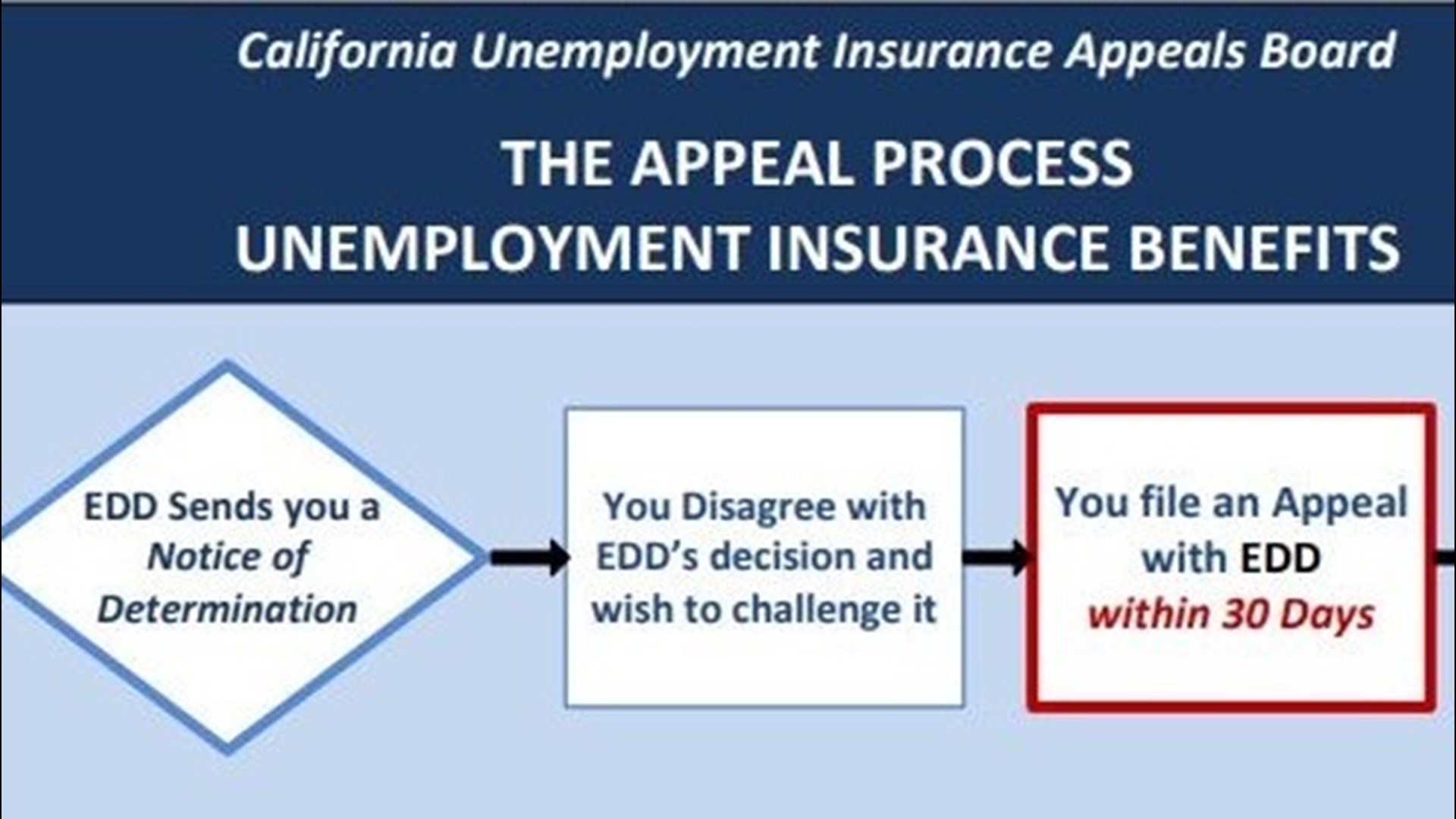

What comes next after filing unemployment benefits with the EDD?

After filing your unemployment benefits online or by phone, or by mail, or by fax. The EDD will go through your application and then send you some documents to fill. It will include a notice Of unemployment insurance awards Will indicate how much the ad is going to pay you once you are found eligible for benefits.

Short Term Disability Benefits

All the employees in California State have deducted short-term disability Insurance through payroll. If an employee is unable to work due to disability, they can receive weekly benefits from the SDI Program. You will receive the benefits from the EDD until you are ready to work or until it expires.

What Does The EDD View As A Disability?

If the doctor certifies that you are not able to do your job then the EDD will see it as a disability. The EDD is concerned with whether you are unable to do the regular duties of your job.

How long are the payments made for short-term disability?

SDI Payments are made up to one year for the majority of the employees. For those who are self-employed, the payments are made up to 39 weeks. Those going rehab, receive payments up to 90 days unless they have certified disability from a doctor for alcohol or drug addiction.

How long is the base period for unemployment?

In the majority of the states, the base period is 12 months consisting of the first four of the last five quarters of the calendar year before filing the claim.

When is a claimant eligible for UI?

Although wages from all jobs are used to calculate monetary eligibility, a claimant is eligible for UI benefits only upon the loss of a primary job. If a claimant leaves a subsidiary part-time job before eight weeks before the establishment of an eligible claim, the UI benefits are subject to a constructive deduction.

When is the base period for a claim?

Example, If a claim is filed anytime between January to March 2020, the base period will be 12 months from October 1, 2018, through September 30, 2019.

When will I know my weekly benefit amount?

After you apply for benefits, we will mail you an Unemployment Claim Determination letter that tells you how much you are potentially eligible to receive.

How much can I get each week?

In Washington state, the maximum weekly benefit amount is $929. The minimum is $295. No one eligible for benefits will receive less than $295, regardless of their earnings.

How can I estimate my weekly benefit amount?

You can estimate your own weekly benefit amount to see how much you are potentially eligible to receive. To do this, you need to know which calendar quarters will make up your base year.

Alternate base year (ABY) claims

You could be eligible for an alternate base year claim if you do not have the required 680 hours of work in your regular base year.

Earning deductions chart

This chart helps determine how much you may get if you report partial earnings during a week.