Saving is closely related to investment. By not using income to buy consumer goods & services, it is possible for resources to be invested by being used to produce fixed capital, such as factory & machinery. Saving can therefore be vital to increase the amount of fixed capital available which contributes to economic growth.

Why saving for retirement early is important?

I’m a financial planner—I’m probably not ever going to tell you it’s a bad time to fund your retirement accounts... That said, there are a couple of reasons why right now is ... want to forget about the importance of saving to the Roth option ...

What are the advantages of saving money?

Top 8 Amazing Benefits of Saving Money

- Safety Net. On those rainy days, when there is very little money in your bank account, you need an safety net. ...

- Open the Parameters. When you save money, you can open the parameters. ...

- Less Stress. ...

- Travel Wherever You Want. ...

- You Will be Financially Independent Sooner. ...

- You Will Not Worry If You are Suffering From Unexpected Expenses. ...

What are some reasons to save money?

- Risk averse behaviour. We want to save money so that we hope that in case of dire emergencies, this money would bail us out.

- For the purpose of life goals. People have much more than bucket lists to fulfil. ...

- Some people are thrifty in nature. ...

- Many people would have had troubled instances in life due to lack of money. ...

Why we should save money?

The short and long term revenue consequences for the companies would be substantial and toxic for their quarterly earnings, so special to CEOs, shareholders and Wall Street. It takes minimal effort to participate, and the motivation to do so is quite clear to millions of citizens.

Why is saving beneficial to the economy?

A rise in aggregate savings would yield larger investments associated with higher GDP growth. As a result, the high rates of savings increase the amount of capital and lead to higher economic growth in the country.

Does saving help economic growth?

A boost in saving would make the US less dependent on foreign capital, make households more secure, and strengthen long-term economic growth.

What does saving mean in economics?

Savings is the amount of money left over after spending and other obligations are deducted from earnings. Savings represent money that is otherwise idle and not being put at risk with investments or spent on consumption.

What did Milton Keynes believe about the economy?

His concerns with the effects of excess savings lead to his ideas on active government support for the economy. Keynes believed that when the general population stops spending, government should step in to fill its place.

Who is the most important economist to our current-day economic understanding?

Other Problems With the Paradox of Thrift: "The Long Run". John Maynard Keynes, is probably the most important economist to our current-day economic understanding. (For better or worse) Keynes is credited with popularizing the Paradox of Thrift. However, Keynes also once said: " In the long run, we're all dead. ".

What is Waldman's point about banks and government?

Waldman makes an excellent point on banks & government, along with the savers who saved using banks and government debt: Banks screwed up their lending practices. We messed up by believing they would be good stewards of our money (in deposits over $100,000 and money market accounts).

What is the best way to deposit money in a bank?

When you deposit money in a bank, the bank doesn't just put it under a well-guarded mattress. Banks generally (see recent exception s) lend it out for various things: 1 Personal loans 2 Credit cards 3 Mortgages 4 Car loans 5 And other debt

Is investing in things a savings?

Oft-ignored is that " investing" in things is really savings as well. In this case it's usually funding a business or partaking in some other riskier venture. And that's the key - investing is generally riskier than saving in a bank. Confusingly, too, 'savings' often takes the form of 'investment', or at least 'spending'.

Does the government invest in the military?

such as the military. And, yes, governments do sometimes invest in the "traditional" way.

How much would the economy gain in the next 25 years?

The economy as a whole would gain a discounted $7 trillion cumulatively over the next 25 years, equivalent to roughly half of U.S. gross domestic product today, and GDP per capita would be $3,500 higher in today’s prices.

Should existing savings vehicles be preserved?

Existing savings vehicles should be preserved, improved, and extended to maximize saving, both in aggregate and among the groups currently least able to save. Matching contributions and other tools to support saving by low-income Americans, such as refundable tax credits, would help.

To Save or Not to Save?

When consumers spend money on goods and services, they are supporting that business, the wages of its employees, and its productivity. But what happens when they choose to hold on to their money? How does saving affect the economy?

Interest Rates Balance Savings and Investment

Interest rates equalize savings and investments in the same way that prices equalize supply and demand. Interest rates are simply the price of loaned capital. When savings rise, banks can offer lower interest rates to borrowers, which enables more businesses to take out loans in order to invest in capital.

How does saving affect the economy?

How Savings Affect the Economy? Economics is divided on the role of savings. Many economists believe that saving is a personal virtue but social vice. This is because if all the people start saving, the expenditure will go down.

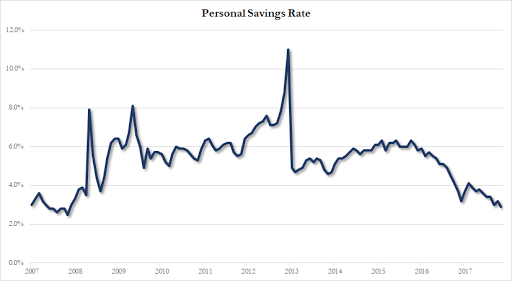

What is the savings rate in 2017?

The Bureau of Economic Research has declared that the savings rate in America has fallen to a meager 3.8% in 2017! This means that over three-quarter Americans do not have the wherewithal to sustain for even six months in the event of a personal emergency like a job loss or any health issues.

What is the unanimity in economic history?

They refer to the unanimity in all of economic history. No country in the world has achieved economic prosperity without having a high savings rate. Right from the United States to China, any country that has reached the peak of global finance has been largely powered by their high savings rate. In this article, we will have a closer look at ...

How much should the second lowest quartile save?

According to the survey by the Bureau of economic research, they need to save twenty-one percentage points more! The second lowest quartile needs to save eight percentage points more . However, the top two quartiles are not in dire needs of savings.

Why is income tax so discouraging?

The income tax policy of the United States has been discouraging saving by reducing the incentive to save. The reason is that policymakers often get caught between long-term and short-term objectives. In the long run, they would like to see the individuals become more self-sufficient. However, in the short run, they fear that the economy would spiral into a recession if savings were done more aggressively.

Why do people have to work longer than 60 years?

A lot of them may have to work longer than the sixty-five-year retirement age in order to have the financial capability to sustain during retirement. The other alternative is to have a significantly lower standard of living. They also run the risk of running out of money completely if any health issues arise.

Do 401(k) plans increase welfare payments?

If the government focuses on tax collection now, they may have to pay a significantly higher amount in welfare payments shortly. The problem is that plans like 401 (k) incentivize the top earners to save their income. However, these plans are expensive and therefore only provided by large employers.

Why is saving money important?

Having some amount in savings can help one to limit the amount of debt burden that they have. Savings can be used to finance certain expenses instead of using a credit card. This will definitely limit the amount of debt liability and will also save the amount that could have been spent on interest.

What can be financed through savings?

Other emergencies that could be financed through savings are funeral expenses, urgent house repairs and even car repairs. That said, such emergencies usually require a large sum of money.

What are the benefits of Thrifty Two?

Have a read of Thrifty Two for tips on saving your money then read some of the benefits as described below: 1. Helps in emergencies: Emergencies are always unexpected. Therefore, when they occur, the funds required are usually not part of the regular budget.

What is the benefit of further education in Singapore?

Accumulated savings will enable one to further his or her education without having to source funds elsewhere. This will help one to progress quickly in his or her career. This is especially beneficial for those who may not be eligible to apply for a personal loan or education loan.

Why is it so hard to save money for retirement?

This is because of future uncertainties such as whether you will be alive to spend the money or not. Despite this, it would be best to consider saving money which may also come in handy for your beneficiaries if you will not be there to spend it.

Is saving money a habit?

Saving money requires a lot of discipline. However, with firm determination and setting financial goals, it is not a difficult habit to adopt. Many Singaporeans can benefit greatly from the habit of saving if they choose to do it faithfully. Have a read of Thrifty Two for tips on saving your money then read some of the benefits as described below:

Can you use savings to finance a car?

Helps to finance the down payment for a car: Depending on the amount required for the car, one can use savings either to purchase the car in full or pay the initial deposit for a car loan. It is more ideal for one to budget for a cheaper car which can be fully financed by the savings, and avoid taking the car loan.

What is the purpose of money in saving?

Money fulfills the role of a medium of exchange. It enables the produce of one producer to be exchanged for the produce of another producer.

Why is money important?

Money only facilitates this payment . Another important role of money is to serve as a medium of saving. Instead of saving goods, which must be stored, people can save money. In the world of barter, perishable goods are difficult to save for too long. These difficulties are resolved by the money economy.

What happens when a producer exchanges his goods for money?

Once a producer has exchanged his goods for money, he has in fact begun saving. When a baker sells his bread for $1 to a shoemaker, he has supplied the shoemaker with his saved ( i.e., unconsumed) bread. The supplied bread will sustain the shoemaker and allow him to continue making shoes.

What is the ultimate payment in the money economy?

Also, it should be remembered that in the money economy, the ultimate payment is with real goods and services for other real goods and services. Thus, a baker exchanges his bread for money and then employs the obtained money to buy other goods and services, implying that he pays for other goods and services with his bread.

What is economic activity?

Economic activity is depicted as a circular flow of money. Spending by one individual becomes part of the earnings of another individual, and vice versa. If, however, people have become less confident about the future, it is held that they will cut back on their outlays and hoard more money.

Is saving short a form of spending?

Any of these projects puts as much money into circulation and gives as much employment as the same amount of money spent directly on consumption. Saving in short in the modern world, is only another form of spending.

Why do people save money?

Reasons for saving; individuals may choose to save for some of the following reasons. To provide for old age or for future expenditure. To guard against a rainy day or unforeseen circumstances. To leave an estate for immediate children or grand children.

What does it mean to have more investment but less savings?

On the contrary, more investment but less savings, will mean employment of more factors leading to greater total output and , hence, a higher national income. There is stability, that is, balance or equilibrium in the level of national income only when saving is equal to investment.

What is savings rate?

Saving rate is the amount of money, expressed as a percentage or ratio which one deducts from his/her disposable personal income to set aside for retirement or for investment in the money or the capital market in instruments like bonds treasury bills, shares etc. Savings rate can also refers to the percentage of gross domestic product (GDP) that is saved by households in a country (Ewa and Agu 2005). This indicates the financial state and growth of the country because households’ savings constitute the major source of government borrowing to finance public projects and also provides funds for private investments. It is an obvious fact that income is received as wages or salaries, rents, interests or profits by owners of factors of production. With the received income households buy the consumer goods they need. Not all personal income available to the individual or family, or the household is for personal use. The government takes a sizable amount in the form of personal income taxes. After these taxes are paid, what is left with the individual is disposable income (Ogunbitan 2010). Disposable income is used to pay for consumer goods and services, to pay interest on debts and for savings. Disposable income is an important concept because the income enables the consumer to decide how much to spend on current goods and services and how much to save.

What happens when investment is improved?

When investment is improved, there is increase in the volume of goods and services produced, stimulated by the savings rate which in turn leads to higher gross national income figures. This figures when measured leads to higher income per head and increased real income of the citizens.

Why is disposable income important?

Disposable income is an important concept because the income enables the consumer to decide how much to spend on current goods and services and how much to save.

What is the third form of savings?

Government policy: an increase tax on company’s profit will reduce tax and vice versa. The third form of savings is government saving. Government saving is achieved chiefly through a budget surplus. This may be secured by increasing revenue through additional taxation or by reducing current government expenditure.

When savings exceeds investment income, will income rise?

For instance, when savings exceeds investment income will fall but when investment exceeds savings, income will rise. This is because more saving but less investment will mean less employment of factors leading to lower total output and hence lower national income. On the contrary, more investment but less savings, ...

The Dire State of Savings Rate in The United States

Savings Rate and Income Tax Policy

Savings Rate and The Government