Your SSDI

Social Security Disability Insurance

Social Security Disability Insurance is a payroll tax-funded federal insurance program of the United States government. It is managed by the Social Security Administration and designed to provide income supplements to people who are physically restricted in their ability to be employed because of a notable disability. SSD can be supplied on either a temporary or permanent basis, usually directly correlated to …

Social Security Administration

The United States Social Security Administration is an independent agency of the U.S. federal government that administers Social Security, a social insurance program consisting of retirement, disability, and survivors' benefits. To qualify for most of these benefits, most workers pay Social …

How long can I collect SDI benefits?

How Long Can I Receive California SDI While Disabled?

- Qualifying for SDI. To qualify for SDI, you must be unable to do your usual and customary work, pregnant or taking paid family leave.

- SDI Benefits. SDI pays out 55 percent of your previous wages. ...

- SSDI. ...

- SSI. ...

How are SSDI payments calculated?

Social Security payments are calculated by combining your highest paid 35 years (if you have worked more than 35 years). First, all salaries are indexed to account for inflation. Previous years ...

How much does SDI staffing pay?

How much does SDI Staffing in the United States pay? Average SDI Staffing hourly pay ranges from approximately $15.97 per hour for Claims Assistant to $35.82 per hour for Examiner. The average SDI Staffing salary ranges from approximately $37,417 per year for Producer to $130,477 per year for Senior Underwriter.

How to claim SDI on taxes?

- Has lasted continuously for at least a year or

- Will last continuously for at least a year or

- Can lead to death

Is SDI based on gross or net?

California State Disability Insurance (SDI) The wages are determined as follows: Gross Pay (including tips and taxable fringe benefits including employer contributions to HSA plans).

How is SDI pay calculated?

To compute the dollar value of the SDI tax multiply the total taxable wages for the current payroll period by the current SDI tax rate. For example, assuming the 2021 SDI tax rate of 1.2 percent, or 0.0120, an employee who receives $1,000 wages in 2021 would be subject to $12 SDI tax (1000 x 1.0120 = 1,012).

How do I increase my SDI benefits?

If You Need to Extend Your DI Period You will receive a Physician/Practitioner's Supplementary Certificate (DE 2525XX) with your final payment. Have your physician/practitioner complete and submit this form to find out if you are eligible for an extension. Your physician/practitioner can find your claim in SDI Online.

How much is SDI benefit?

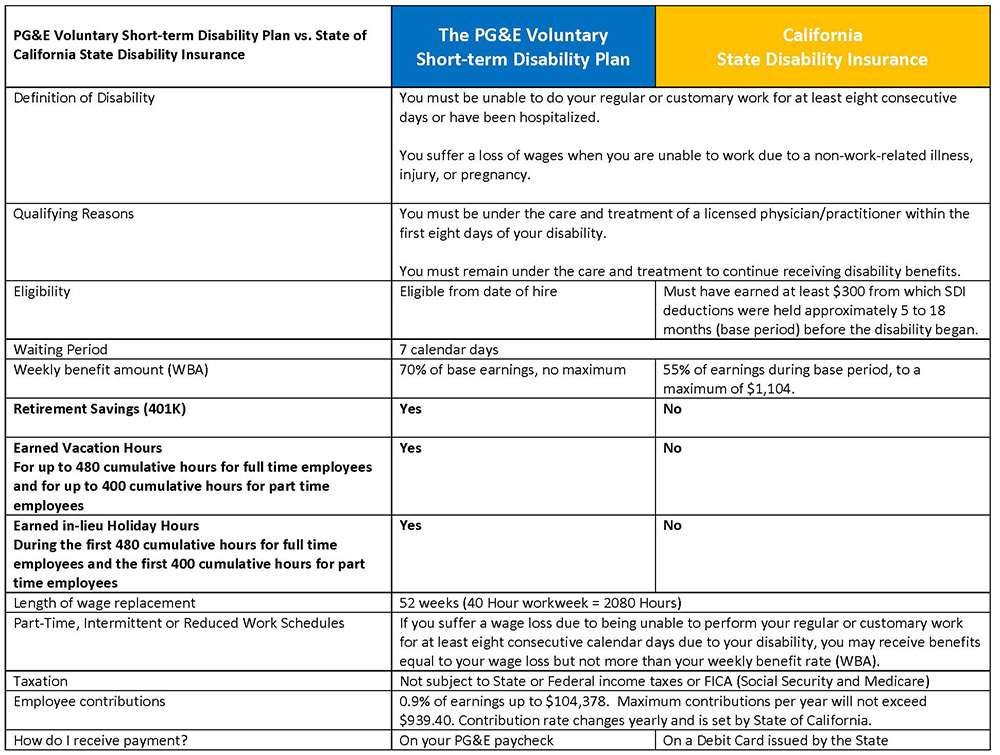

Most California employees are entitled to an SDI benefit equal to 60% of their regular wages, up to a cap. In 2022, the cap is $1,540 per week; the state adjusts the cap as necessary to adjust for inflation. Lower-income employees may be entitled to 70% of their regular wages.

How much will I make on disability?

SSDI payments range on average between $800 and $1,800 per month. The maximum benefit you could receive in 2020 is $3,011 per month.

What is the max CA SDI for 2021?

The State Disability Insurance (SDI) withholding rate for 2021 is 1.2 percent. The taxable wage limit is $128,298 for each employee per calendar year. The maximum to withhold for each employee is $1,539.58.

What is the highest paying state for disability?

The highest paying states for SSI benefits as of 2022 are New Jersey, Connecticut, Delaware, New Hampshire and Maryland....The breakout for those states are as followed:New Jersey: $1,689 per month.Connecticut: $1,685 per month.Delaware: $1,659 per month.New Hampshire: $1,644 per month.Maryland: $1,624 per month.

How much does disability pay a month in California?

It is estimated as 60 to 70 percent of the wages you earned 5 to 18 months before your claim start date and up to the maximum WBA. Note: Your claim start date is the date your disability begins. We will calculate your WBA using a base period.

How long can you be on disability in California?

52 weeksHow long can I collect Disability Insurance benefits? You can collect up to 52 weeks of full Disability Insurance (DI) benefits, or the amount of wages in your base period, whichever is less.

What is the maximum disability benefit in California 2020?

For 2020, the maximum weekly benefit will increase from $1,252 to $1,300. California permits employers to opt out of SDI and establish a private plan for Voluntary Disability Insurance (knows as a “Voluntary Plan”), provided certain requirements are met.

Whats the most EDD will pay?

The unemployment benefit calculator will provide you with an estimate of your weekly benefit amount, which can range from $40 to $450 per week. Once you submit your application, we will verify your eligibility and wage information to determine your weekly benefit amount.

How much is the SDI in California?

Most California employees are entitled to an SDI benefit equal to 60% of their regular wages, up to a cap. Currently, the cap is $1,357 per week; the state adjusts the cap as necessary to adjust for inflation. Lower-income employees may be entitled to 70% of their regular wages.

What is the maximum amount of SDI in 2021?

The maximum weekly benefit amount paid in 2021 is $1,357. Coronavirus Update: California has changed some rules to make it easier for those affected by coronavirus to get SDI benefits. If you are or have been off work due to COVID-19 illness or exposure, see our article on changes to California's SDI program for coronavirus.

How much is the EDD weekly benefit in 2021?

Because this daily amount times seven days ($1,477) is more than the state's current weekly maximum of $1,357 (in 2021), your weekly benefit would be the maximum of $1,357. The EDD has published a schedule you can use to calculate your benefit amount, once you know your earnings for the highest-paid quarter of the base period.

How much does EDD pay?

The EDD will pay you 60% of that amount, or about $65 per day. Note that this is the amount you will earn for every single day you are not working, including weekends. So your weekly benefit would add up to $65 times seven days, or $458. If you have high earnings, you may be subject to the cap.

What happens after EDD receives your claim?

After the EDD receives your claim for benefits, it will contact your employer and may contact you for information. If the EDD decides you are eligible for benefits, it will send you a notice of eligibility, along with its initial calculation of your benefit amount.

What is the California short term disability program?

In California, employees must contribute a small payroll tax to the state's short-term disability insurance (SDI) program. These payments fund disability benefits for employees who are temporarily unable to work due to disability, including pregnancy. If you qualify for benefits, you'll receive a percentage of your regular wages.

How much of your California unemployment benefits do you get if you are unable to work?

However, you won't necessarily receive 60-70% of what you were earning just before becoming unable to work. Instead, California benefits depend on your earnings during the "base period.". The base period is the 12-month period ending just before the last complete calendar quarter you were able to work.

How much is the AIME for SSDI 2020?

You can use a formula to help calculate your potential SSDI benefits if approved in 2020. In the following example, an applicant’s AIME is $3,500/month. For the year 2020, the dollar amounts in PIA consist of the first bend point being $960 and the second bend point being $5,785.

What is the bend point for SSA?

Bend Point #2: The SSA will take 32% of these earnings. Bend Point #3: The SSA will take 15% of these earnings. The bend points help ensure that lower earners receive a higher amount of benefits. You can find the bend points of each year from 1979 to 2020 on the SSA website.

How long can you keep your SSA benefits?

In the extended period, the SSA gives you a 36-month extended period of eligibility to keep your benefits as long as you do not make more than $1,260 a month. Receiving additional income from other sources such as disability payments from workers’ compensation and public disability benefits may reduce your benefits.

What is the total of Bend Point 3?

Bend Point #3: No Bend Point #3 because earnings did not exceed $5,785. The sum of $864 and $812.80 will be equal to a total of $1,676.80. The final PIA amount is an estimated amount of SSDI benefits that you are entitled to.

What is covered earnings?

Covered earnings are work-related earnings subject to Social Security taxation and include most types of wages and self-employment income. Over a period of years, the average covered earnings become your average indexed monthly earnings ( AIME ).

How much can you deduct from your Social Security if you are disabled?

If you are receiving either workers’ compensation or public disability and Social Security Disability benefits, the total amount of these benefits can not exceed 80% of your average earnings before you become disabled. If the total amount of these benefits exceeds 80% , the excess amount will be deducted from your Social Security benefit.

What happens if your Social Security benefits exceed 80%?

If the total amount of these benefits exceeds 80%, the excess amount will be deducted from your Social Security benefit. Therefore, it is important to keep the SSA informed of any monthly payment increase or decrease or if you receive a lump-sum payment.

How much of Rhode Island's wages are for temporary disability?

Rhode Island requires employers withhold 1.2% of the first $ 68,100 of employee wages for Temporary Disability Insurance. The insurance protects workers against wage loss resulting from a non-work related illness or injury, and is funded exclusively by Rhode Island workers.

How many states have state disability taxes?

As we have seen, there are only five states with State or Temporary Disability taxes, and each have their own system for calculating the withholding. California, Rhode Island, and New Jersey administer the state disability insurance.

How much is Bob's semi monthly salary?

Example: Bob is paid semi-monthly. On this paycheck, he earned $8,000 in salary. In addition, Bob gets a semi-monthly auto allowance of $1,000. He has an HSA deduction of $500, and his employer contributes $250 to his HSA. Bob has a dental deduction of $100 and he also contributes 10% of his income to his 401k.

Does Rhode Island increase wages for employer contributions to HSA?

Rhode Island does not increase wages for employer contributions to HSA, and deferred compensation reduces the wages in the tax calculation. In our example for Bob above, Rhode Island TDI would be calculated as follows: Example: Rhode Island TDI based on Bob’s information above:

Can an employer purchase TDI?

Employers can purchase TDI from an authorized insurance carrier or establish a self-funded plan. Payroll providers will withhold TDI taxes from employees if their employer elects to have employees contribute, but will not pay the amounts to the carrier.

What is SSI disability?

SSI is called a “means-tested program,” meaning it has nothing to do with work history, but strictly with financial need. SSI disability benefits are available to low-income individuals who haven’t earned enough work credits to qualify for SSDI.

How much is SSI monthly?

If you meet the qualifications as described below, and your application for SSI is approved, you will receive benefits of $733 per month (for individuals) or $1,100 per month (for couples), minus a portion of your current income.

What is back payment on SSDI?

Back payments are any disability benefits that are past due, or the benefits that you would have been paid if your initial application was approved right away. Retroactive payments are for the months that you were disabled and could not work. You are eligible for retroactive payments only with SSDI and not SSI.

How long does a person have to be on SSDI to receive SSI?

In order to receive SSDI, the prospective recipient must be able to demonstrate they have a disability that is medically determinable, that will continue to last no less than twelve months, and that prevents the individual from engaging in substantial gainful activity.

What is the AIME on SSDI?

This income is called your “covered earnings”. The average of your covered earnings over several years is called your average indexed monthly earnings (AIME).

What is SGA in Social Security?

Substantial Gainful Activity – SGA. is an important concept to understand when pursuing Social Security Disability Insurance or Supplemental Security Income. The Social Security Administration defines it as “the performance of significant mental and/or physical duties for profit”. SGA maximum amounts are set by the Social Security Administration ...

How much income do I need to qualify for SSI?

The amount is set by your particular state, and it is usually between $700 and $1400 per month, and some states allow individuals with higher incomes to still qualify for SSI. You must own less than $2,000 in property (minus your home and car) for individuals, or $3,000 for a couple.