Social Security Disability Insurance (SSDI

Social Security Death Index

The Social Security Death Index is a database of death records created from the United States Social Security Administration's Death Master File Extract. Most persons who have died since 1936 who had a Social Security Number and whose death has been reported to the Social Security Administration are listed in the SSDI. For most years since 1973, the SSDI includes 93 percent to 96 percent of deaths of i…

Social Security Administration

The United States Social Security Administration is an independent agency of the U.S. federal government that administers Social Security, a social insurance program consisting of retirement, disability, and survivors' benefits. To qualify for most of these benefits, most workers pay Social …

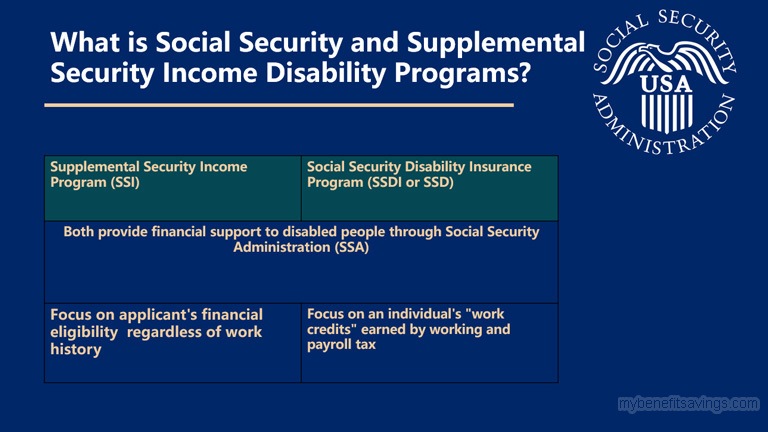

What is the difference between SSI and SSA?

- Medicare will soon provide free at-home covid tests

- Billions distributed from the Provider Relief Fund

- Reasons why Congress won’t send another stimulus check

How does SSDI affect my SSA retirement benefits?

In most cases, you cannot receive Social Security disability and retirement benefits at the same time, since SSDI benefits are meant for those who cannot work due to injury or illness. If you’re receiving retirement benefits, it is already implicit that you are no longer working. There is one exception to this rule, however.

How your SSDI monthly benefit will be calculated?

The Social Security Administration (SSA ... 2Gd6YaeTZV #BLSdata pic.twitter.com/EzuVUbZpry The easiest way to calculate your benefit is by taking your monthly payment and multiplying it by ...

How much does social security pay in disability benefits?

Up to 85 percent of a taxpayer’s benefits could become taxable if:

- You're filing as a single, head of household, or qualifying widow or widower with more than $34,000 in income.

- You're married and filing jointly with more than $44,000 in income.

- You're married but filing separately and have lived apart from your spouse for the entire tax year, and you had more than $34,000 in income.

How much is SSI monthly?

If you meet the qualifications as described below, and your application for SSI is approved, you will receive benefits of $733 per month (for individuals) or $1,100 per month (for couples), minus a portion of your current income.

What is SSI disability?

SSI is called a “means-tested program,” meaning it has nothing to do with work history, but strictly with financial need. SSI disability benefits are available to low-income individuals who haven’t earned enough work credits to qualify for SSDI.

What is back payment on SSDI?

Back payments are any disability benefits that are past due, or the benefits that you would have been paid if your initial application was approved right away. Retroactive payments are for the months that you were disabled and could not work. You are eligible for retroactive payments only with SSDI and not SSI.

How long does a person have to be on SSDI to receive SSI?

In order to receive SSDI, the prospective recipient must be able to demonstrate they have a disability that is medically determinable, that will continue to last no less than twelve months, and that prevents the individual from engaging in substantial gainful activity.

What is the AIME on SSDI?

This income is called your “covered earnings”. The average of your covered earnings over several years is called your average indexed monthly earnings (AIME).

What is SGA in Social Security?

Substantial Gainful Activity – SGA. is an important concept to understand when pursuing Social Security Disability Insurance or Supplemental Security Income. The Social Security Administration defines it as “the performance of significant mental and/or physical duties for profit”. SGA maximum amounts are set by the Social Security Administration ...

How much income do I need to qualify for SSI?

The amount is set by your particular state, and it is usually between $700 and $1400 per month, and some states allow individuals with higher incomes to still qualify for SSI. You must own less than $2,000 in property (minus your home and car) for individuals, or $3,000 for a couple.

Benefit Calculators

The best way to start planning for your future is by creating a my Social Security account online. With my Social Security, you can verify your earnings, get your Social Security Statement, and much more – all from the comfort of your home or office.

Online Benefits Calculator

These tools can be accurate but require access to your official earnings record in our database. The simplest way to do that is by creating or logging in to your my Social Security account. The other way is to answer a series of questions to prove your identity.

Additional Online Tools

Find your full retirement age and learn how your monthly benefits may be reduced if you retire before your full retirement age.

How are Social Security disability benefits calculated?

Social Security Disability Insurance ( SSDI ) Your SSDI benefits are based on the amount of income on which you have paid social security taxes. Your average earnings are called your Average Indexed Monthly Earnings (AIME). Using your AIME, the SSA will calculate your Primary Insurance Amount (PIA).

What is a typical Social Security disability benefit?

It is not based on how severe your disability is or how much income you have. Most SSDI recipients receive between $800 and $1,800 per month (the average for 2020 is $1,258). However, if you are receiving disability payments from other sources, as discussed below, your payment may be reduced.

How long does Social Security disability payments last?

To put it in the simplest terms, Social Security Disability benefits can remain in effect for as long as you are disabled or until you reach the age of 65. Once you reach the age of 65, Social Security Disability benefits stop and retirement benefits kick in.

How Work Affects Your Social Security disability benefits?

You can get Social Security retirement or survivors benefits and work at the same time. But, if you’re younger than full retirement age, and earn more than certain amounts, your benefits will be reduced. The amount that your benefits are reduced, however, isn’t truly lost.

What is the highest paying state for disability?

At 8.9 percent, West Virginia came in at the top of the list among states where the most people receive disability benefits. Residents there received $122.4 million in monthly benefits. West Virginia’s labor force participation rate was 52.7 percent – the lowest in the country.

What is the most approved disability?

According to one survey, multiple sclerosis and any type of cancer have the highest rate of approval at the initial stages of a disability application, hovering between 64-68%. Respiratory disorders and joint disease are second highest , at between 40-47%.

How much can I earn on disability in 2020?

A person who earns more than a certain monthly amount is considered to be “engaging in SGA.” Federal regulations use the national average wage index to set the income limit for determining the SGA each year. In 2020 , the amount is $1,260 for disabled applicants and $2,110 for blind applicants.

What is the formula for Social Security benefits?

The Social Security benefits formula is designed to replace a higher proportion of income for low-income earners than for high-income earners. To do this, the formula has what are called “bend points." These bend points are adjusted for inflation each year.

How is Social Security decided?

Your Social Security benefit is decided based on your lifetime earnings and the age you retire and begin taking payments. Your lifetime earnings are converted to a monthly average based on the 35 years in which you earned the most, adjusted for inflation. Those earnings are converted to a monthly insurance payment based on your full retirement age.

What is wage indexing?

Social Security uses a process called wage indexing to determine how to adjust your earnings history for inflation. Each year, Social Security publishes the national average wages for the year. You can see this published list on the National Average Wage Index page. 3 .

Is Social Security higher at age 70?

If you have already had most of your 35 years of earnings, and you are near 62 today, the age 70 benefit amount you see on your Social Security statement will likely be higher due to these cost of living adjustments .

Can you calculate inflation rate at 60?

Until you know the average wages for the year you turn 60, there is no way to do an exact calculation. However, you could attribute an assumed inflation rate to average wages to estimate the average wages going forward and use those to create an estimate.

How much can you deduct from your Social Security if you are disabled?

If you are receiving either workers’ compensation or public disability and Social Security Disability benefits, the total amount of these benefits can not exceed 80% of your average earnings before you become disabled. If the total amount of these benefits exceeds 80% , the excess amount will be deducted from your Social Security benefit.

What is the bend point for SSA?

Bend Point #2: The SSA will take 32% of these earnings. Bend Point #3: The SSA will take 15% of these earnings. The bend points help ensure that lower earners receive a higher amount of benefits. You can find the bend points of each year from 1979 to 2020 on the SSA website.

How much is the AIME for SSDI 2020?

You can use a formula to help calculate your potential SSDI benefits if approved in 2020. In the following example, an applicant’s AIME is $3,500/month. For the year 2020, the dollar amounts in PIA consist of the first bend point being $960 and the second bend point being $5,785.

How long can you keep your SSA benefits?

In the extended period, the SSA gives you a 36-month extended period of eligibility to keep your benefits as long as you do not make more than $1,260 a month. Receiving additional income from other sources such as disability payments from workers’ compensation and public disability benefits may reduce your benefits.

What is the total of Bend Point 3?

Bend Point #3: No Bend Point #3 because earnings did not exceed $5,785. The sum of $864 and $812.80 will be equal to a total of $1,676.80. The final PIA amount is an estimated amount of SSDI benefits that you are entitled to.

What is covered earnings?

Covered earnings are work-related earnings subject to Social Security taxation and include most types of wages and self-employment income. Over a period of years, the average covered earnings become your average indexed monthly earnings ( AIME ).

What happens if your Social Security benefits exceed 80%?

If the total amount of these benefits exceeds 80%, the excess amount will be deducted from your Social Security benefit. Therefore, it is important to keep the SSA informed of any monthly payment increase or decrease or if you receive a lump-sum payment.

What is the benefit estimate?

Benefit estimates depend on your date of birth and on your earnings history. For security, the "Quick Calculator" does not access your earnings record; instead, it will estimate your earnings based on information you provide. So benefit estimates made by the Quick Calculator are rough. Although the "Quick Calculator" makes an initial assumption ...

How old do you have to be to file for Social Security?

You must be at least age 22 to use the form at right. Lack of a substantial earnings history will cause retirement benefit estimates to be unreliable. Enter your date of birth ( month / day / year format) / /. Enter earnings in the current year: $. Your annual earnings must be earnings covered by Social Security.

How old do you have to be to use Quick Calculator?

You must be at least age 22 to use the form at right.