Why would a company buy back its own stock?

- Increasing shareholders' ownership. Buying back stock can reduce the total supply of shares in the market, which means...

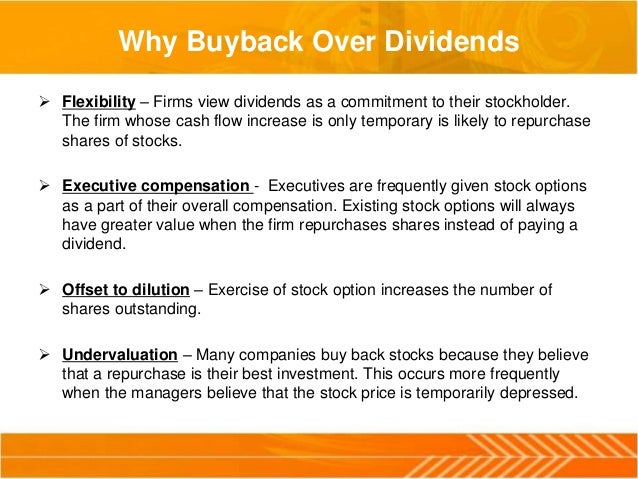

- Offsetting shares created through employee stock options. When employees exercise stock options, that can increase the...

- Improving financial metrics. Stock buybacks can be used when management and the board...

Why would company buy back its own shares?

What is a share buyback and top 4 reasons why companies do it

- Give back surplus cash. Companies announce a buyback when they have surplus cash at hand and they don’t know what to do with it.

- Reduce cost of equity. Surplus cash is costly for companies. ...

- Signal that their shares are undervalued. ...

- Improve financial metrics. ...

Are stock buybacks a good thing or not?

– Valuation of shares: Buybacks may not be good when there is overvaluation of shares. A good assessment of share worth helps. If a company buys back shares for more than they are worth, it signals that the decision making is on shaky ground and the investment is not a good one.

Why are stock buybacks good for investors?

- Limited potential to reinvest for growth.

- Management feels the stock is undervalued.

- Buybacks can make earnings and growth look stronger.

- Buybacks are easier to cut during tough times.

- Buybacks can be more tax-friendly for investors.

- Buybacks can help offset stock-based compensation.

What happens when company buys back shares?

- The articles of association do not prohibit share buybacks – these can be amended to allow a share buyback by passing a special resolution;

- a company cannot buy back all of its own non-redeemable shares as it must have at least one non-redeemable share in issue;

- the shares being bought must be fully paid; and

News about How Does Stock Buyback Benefits A Companybing.com/news

Videos of How Does Stock Buyback Benefits A Companybing.com › videos

What happens when a company has a stock buyback?

A stock buyback, also known as a share repurchase, occurs when a company buys back its shares from the marketplace with its accumulated cash. A stock buyback is a way for a company to re-invest in itself. The repurchased shares are absorbed by the company, and the number of outstanding shares on the market is reduced.

Is share buyback good for company?

Share buybacks are generally seen as less risky than investing in research and development for new technology or acquiring a competitor; it's a profitable action, as long as the company continues to grow. Investors typically see share buybacks as a positive sign for appreciation in the future.

How does stock buyback benefit shareholder?

A buyback benefits shareholders by increasing the percentage of ownership held by each investor by reducing the total number of outstanding shares. In the case of a buyback the company is concentrating its shareholder value rather than diluting it.

Does share price fall after buyback?

A buyback will increase share prices. Stocks trade in part based upon supply and demand and a reduction in the number of outstanding shares often precipitates a price increase. Therefore, a company can bring about an increase in its stock value by creating a supply shock via a share repurchase.

Do stock buybacks create value?

Contrary to the common wisdom, buybacks don't create value by increasing earnings per share. The company has, after all, spent cash to purchase those shares, and investors will adjust their valuations to reflect the reductions in both cash and shares, thereby canceling out any earnings-per-share effect.

Does buying back shares reduce equity?

Occasionally, a company might buy back shares of its stock through an arranged transaction with a large stockholder. Stock buybacks do not reduce shareholder equity. They increase it.

What are advantages and disadvantages of share repurchase?

Share buyback boosts some ratios like EPS, ROA, ROE, etc. This increase in ratios is not because of the increase in profitability but due to a decrease in outstanding shares. It is not an organic growth in profit. Hence, the buyback will show an optimistic picture that is away from the company's economic reality.

What is a Stock Buyback?

A stock buyback (or share repurchasing) is when a company buys back its own stock, often on the open market at market value. Much like dividends, a...

Why would a company buy back its own stock?

Stock buyback greatly improves financial ratios, in particular the EPS (earnings per share), which investors use to estimate corporate value. Moreo...

How is stock buyback beneficial for investors?

Reducing the number of shares traded on the open market increases share price, leaving the remaining shareholders with a heftier chunk of the compa...

What are the downsides to share repurchases?

A stock buyback will often follow a successful period, meaning the company will have to buy its own stock at a higher valuation. For investors thou...