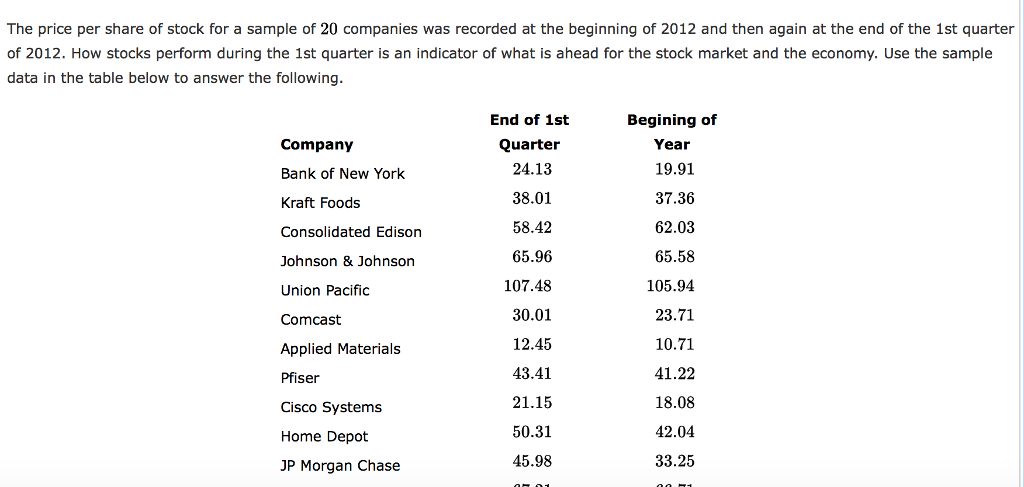

Why Do Companies Care About Their Stock Prices?

- Financial Health. Analysts evaluate the trajectory of stock prices in order to gauge a company’s general health. ...

- Financing. Most companies receive an infusion of capital during their initial public offering (IPO) stages. ...

- A Performance Indicator of Executive Management. ...

- Compensation. ...

- Risk of Takeover. ...

- Positive Press. ...

What are the benefits of a company when the stock price increases?

However, in the long run, the company is benefited indirectly as it is able to raise fresh equity in future, as and when the need arises. If the shares are trading at a discount to the issue price, obviously investors may be When the price of shares of a company increase in the market there is no direct and immediate benefit to the company.

What is a stock price and why is it important?

Publicly traded companies place great importance on their stock share price, which broadly reflects a corporation’s overall financial health. As a rule, the higher a stock price is, the rosier a company’s prospects become.

Why should you invest in a company’s stock?

This is good news for people who do own a company’s stock, their investors, because they are interested in capital accumulation over time, and everyone works together at the company to give yourself the best chance of making this happen.

How important is a company’s share price?

Publicly traded companies place great importance on their stock share price, which broadly reflects a corporation’s overall financial health. As a rule, the higher a stock price is, the rosier a company’s prospects become. Analysts evaluate the trajectory of stock prices in order to gauge a company’s general health.

How do companies benefit from the stock market?

How Companies Benefit from the Stock Market. Companies which become incorporated become a legal entity, apart from the owners. Corporations are persons to a certain extent, apart from the personhood of the individual owners. One’s equity in a company becomes measured by the percentage of shares one owns or controls of this legal entity. ...

Why is it important to have a publicly held company?

A publicly held company also has the ability to offer stock as compensation, which helps a company attract better talent. As the share price increases, this compensation ends up growing in value along with the company. This is of course tied into performance, serving to further inspire business results.

How is equity measured?

One’s equity in a company becomes measured by the percentage of shares one owns or controls of this legal entity. So companies issue a certain number of shares their shareholders, the business owners in the case of a privately held company. The distinction of private here means that the shares are not offered for sale on any stock market, ...

What happens when you give up control of a company?

There is a price to be paid for that though, as you give up the percentage of control of the company that you issue as new shares, and in that sense the public issue of stock is selling off a portion of the business to the public. Depending on how much is given up, a company can be subject to a takeover, or be subject to the wishes of the masses, ...

Can a company be subject to a takeover?

Depending on how much is given up, a company can be subject to a takeover, or be subject to the wishes of the masses, if the owners do not retain enough stock to maintain a majority.

Does equity get paid back?

Money raised through offering equity does not have to get paid back though, it results from a sale of part of the company and a portion of this could be bought back on the open market if desired, but it never has to be.

What happens when profits rise?

When profits rise they are used either for expansion or for payment of dividends. Expansion of the company would increase the price of its share (i.e. capital appreciation).

Why do companies have high valuations?

Companies which command high valuation find it easier to get credit lines from financial institutions. Also, promoters of a company with high share price / valuation will be able to get a bigger loan sanctioned when they pledge their stock.

What is a bank business?

A bank’s business is to find viable businesses to extend money to earn interest on. Companies which command high valuation find it easier to get credit lines from financial institutions. Also, promoters of a company with high share price / valuation will be able to get a bigger loan sanctioned when they pledge their stock.

What happens when profits rise?

When profits rise they are used either for expansion or for payment of dividends. Expansion of the company would increase the price of its share (i.e. capital appreciation).

What is a bank business?

A bank’s business is to find viable businesses to extend money to earn interest on. Companies which command high valuation find it easier to get credit lines from financial institutions.

Why is a high stock price good?

First, the company only makes money on the initial sale of a share of stock; once it's in a third party's hands, any profit from further sale of the stock goes to the seller, not the company.

What is the problem with adding stocks to the open market?

The problem with simply adding stocks to the open market, getting their initial purchase price, is that a larger overall percentage of the company is now on the open market, meaning the "controlling interests" have less control of their company.

What is the difference between preferred and common stock?

Typically, "common" stock carries equal voting rights and equal shares of profits. "Preferred stock" typically trades a higher share of earnings for no voting rights. A company may therefore keep all the "common" stock in private hands and offer only preferred stock on the market.

What is an IPO?

In an IPO (initial public offering) or APO (additional public offering) situation, a small group of stakeholders (as few as one) basically decide to offer an additional number of "shares" of equity in the company. Usually, these "shares" are all equal; if you own one share you own a percentage of the company equal to that of anyone else who owns one share. The sum total of all shares, theoretically, equals the entire value of the company, and so with N shares in existence, one share is equivalent to 1/Nth the company, and entitles you to 1/Nth of the profits of the company, and more importantly to some, gives you a vote in company matters which carries a weight of 1/Nth of the entire shareholder body.

How much of the equity does a company retain in a dilution?

The dilution comes about because in the first scenario the company retains ownership of 900 or 90% of the equity. In the second scenario it retains ownership of only 800 shares or 80% of the equity. The benefit to the company and shareholders of a higher price is basically just math.

How much does a company raise if it sells 100 shares for $1?

They decide to sell 100 shares for $1 to raise their $100. If there is demand for 100 shares for at least $1 then they achieve their goal. But if the market decides the shares in this company are only worth 50 cents then the company only raises $50.

Can you see superstock on the open market?

You'll never see a "superstock" on the open market; where they exist, they are very closely held. But, if a company issues "superstock", the market will see that and the price of their publicly-available "common stock" will depreciate sharply.

Why do companies issue more stock?

A company may issue more stock to the public, which can raise more money for the company , but it dilutes the shares . The more stock a company releases, the lower the share price will go, so companies try to avoid doing this. But a company can also benefit from stocks in other ways.

What does it mean when a company has a high stock price?

A company with a high stock price signals to the public that they must be a good company. A company with an ever-increasing stock price makes people money, and people also like companies that make them money. It’s mostly good PR. But basically, it’s a giant, extremely complicated, trading card game.

How do Pokemon make money?

Imagine a trading card company, like Pokemon or something. Pokemon only makes money when you buy their cards from a store. After you buy their cards from a store, you trade them with your friends. However, Pokemon doesn’t make any money when you trade cards with your friends. You and your friends may make money if you buy and sell these cards to each other, but Pokemon doesn’t make any more money until they release more cards for the public to buy. However, the more Pokemon releases these cards to the public, the less valuable they become. Let’s say Pokemon keeps making a lot of pikachu cards,

What is the first time a company sells stock?

The first time a company sells stock, it is called and Initial Public Offering (IPO). When you purchase stock during the IPO, the money goes to the company whose stock you are buying. The second time the same company wants to sell stock (raise money from the public), it is called as a Follow on Public Offer (FPO).

Why is the secondary market important?

Therefore, the secondary market is a necessary mechanism for price discovery and attracting investors by allowing them to exit. It is a barometer of performance of the company. It allows the market to signal support or unhappiness with the way the company is performing.

Is Pokemon like a business?

You and your friends are not going to value pikachu cards so highly now. So in this analogy, Pokemon is like a business going public. When they first issue shares (like cards), they make a lot of money from people buying them. But after that, these stocks are simply traded between investors.

What are the benefits of higher stock price?

Companies don’t benefit directly, but there are indirect benefits to a company with a higher stock price. Some of the benefits are; Cheaper Acquisitions: Companies can use their stock to make acquisitions or other deals. Higher stock price means fewer shares are paid for the same cash value.

Why is a higher stock price good?

Attracts Investors: A higher share price increases the interest of customers because they expect a greater return from your company. Earns Employee’s Trust: Companies with increasing stock prices have a tendency to attract better quality employees.

Why do companies issue more stock?

A company may issue more stock to the public, which can raise more money for the company , but it dilutes the shares . The more stock a company releases, the lower the share price will go, so companies try to avoid doing this. But a company can also benefit from stocks in other ways.

How do corporations raise capital?

Corporations can raise cash (capital) by selling shares of stock, and the higher the price is, the more cash they can raise in exchange for a given number of shares. On a given day, the price of a company’s stock doesn’t matter to it operationally, unless it’s trying to buy or sell its shares that day.

What does the stock price of a company reflect?

A company's stock price reflects investor perception of its ability to earn and grow its profits in the future. If shareholders are happy, and the company is doing well, as reflected by its share price, the management would likely remain and receive increases in compensation.

What is the job of a company?

The job of a company is to benefit its shareholders. The more it benefits them, the more it benefits as companies that don’t benefit their shareholders go out of business or get dissolved. An increase in a company’s share price benefits the shareholders. So that is the company doing the very thing that it exists to do.

Why do higher stock prices attract investors?

Attracts Investors: A higher share price increases the interest of customers because they expect a greater return from your company. Earns Employee’s Trust: Companies with increasing stock prices have a tendency to attract better quality employees. If employees have shares in the company like the stock option.

Why do people invest in stocks?

Stocks are how ordinary people invest in some of the most successful companies in the world. For companies, stocks are a way to raise money to fund growth, products and other initiatives.

How do companies issue stock?

Companies typically begin to issue shares in their stock through a process called an initial public offering, or IPO. (You can learn more about IPOs in our guide.) Once a company’s stock is on the market, it can be bought and sold among investors.

How do long term investors hold on to stocks?

Many long-term investors hold on to stocks for years, without frequent buying or selling, and while they see those stocks fluctuate over time, their overall portfolio goes up in value over the long term. These investors often own stocks through mutual funds or index funds, which pool many investments together.

What does a company use the money raised from a stock offering for?

They then use that money for various initiatives: A company might use money raised from a stock offering to fund new products or product lines, to invest in growth, to expand their operations or to pay off debt. “Once a company’s stock is on the market, it can be bought and sold among investors.”.

Is the S&P 500 a historical return?

It’s important to note that that historical return is an average across all stocks in the S&P 500, a collection of around 500 of the biggest companies in the U.S. It doesn’t mean that every stock posted that kind of return — some posted much less or even failed completely. Others posted much higher returns.

Do common stocks pay dividends?

Common stock comes with voting rights, and may pay investors dividends. There are other kinds of stocks, including preferred stocks, which work a bit differently. You can read more about the different types of stocks here.

Why do companies issue stock?

Not directly. A company issues stock in order to raise capital for building its business. Once the initial shares are sold to the public, the company doesn't receive additional funds from future transactions of those shares of stock between the public.

What does higher stock price mean?

Higher stock price means fewer shares are paid for the same cash value. Companies dilute shareholders by issuing stock compensation to employees, which shows up (these days) as an expense on the financial statements, lowering EPS to reflect the harm to shareholders.

Why is a high stock price not a risk for a takeover?

If the stock price is higher, fewer shares are needed to make employees happy. A company with a high stock price is not as vulnerable to a takeover. In a takeover, shareholders might receive less than the company is worth.

Is a takeover a good deal?

Though generally at least some parties will feel the takeover is a good deal that gives shareholders more than the company is worth - after all shareholders are getting more than the stock price. One way a high stock price can hurt a company is that many companies do share buybacks when the price is too high.

How does the stock market affect a company?

The Stock Market and Business Operations. The stock market's movements can impact companies in a variety of ways. The rise and fall of share price values affects a company’s market capitalization and therefore its market value. The higher shares are priced, the more a company is worth in market value and vice versa.

What happens when you buy more stocks?

When consumers buy more, businesses that sell those goods and services choose to produce more and sell more, reaping the benefit in the form of increased revenues . Stock market losses erode wealth in both personal and retirement portfolios. A consumer who sees his portfolio drop in value is likely to spend less.

Why do stocks rise?

A rising stock market is usually aligned with a growing economy and leads to greater investor confidence. Investor confidence in stocks leads to more buying activity which can also help to push prices higher. When stocks rise, people invested in the equity markets gain wealth. This increased wealth often leads to increased consumer spending, ...

How does stock performance affect issuance decisions?

Share issuance decisions can also be affected by stock performance. If a stock is doing well, a company might be more inclined to issue more shares because they believe they can raise more capital at the higher value. Stock market performance also affects a company’s cost of capital.

How does stock market performance affect cost of capital?

The higher the expected market performance, the higher the cost of equity capital will be .

What happens when stocks rise?

When stocks rise, people invested in the equity markets gain wealth. This increased wealth often leads to increased consumer spending, as consumers buy more goods and services when they're confident they are in a financial position to do so.

What happens when a company's stock falls?

Companies may also have substantial capital investments in their stock which can lead to problems if the stock falls. For example, companies may hold shares as cash equivalents or use shares as backing for pension funds. In any case, when shares fall, the value decreases, which can lead to funding problems.

Financial Health

Financing

- Most companies receive an infusion of capital during their initial public offering (IPO) stages. But down the line, a company may rely on subsequent funding to finance expanded operations, acquire other companies, or pay off debt. This can be achieved with equity financing, which is the process of raising capital through the sale of new shares. However, for this to happen, the comp…

Compensation

- Compensation likewise represents a critical rationale for a company's decision-makers to do everything in their power to make sure a corporation's share price thrives. This is because many of those occupying senior management positions derive portions of their overall earnings from stock options. These perks afford management personnel the ability to acquire shares of the corporati…

Risk of Takeover

- The prevention of a takeover is another reason a corporation might be concerned with its stock price. When a company's stock price falls, the likelihood of a takeover increases, mainly due to the fact that the company's market value is cheaper. Shares in publicly traded companies are typically owned by wide swaths of investors. Therefore, bidders who seek to take over a company by obt…

Positive Press

- Companies with high share prices tend to attract positive attention from the media and from equity analysts. The larger a company's market capitalization, the wider the coverage it receives. This has a chain effect of attracting more investors to the company, which infuses it with the cash it relies on to flourish over the long haul.