Benefits of the Stock Exchange

- Access to Capital. A 2012 National Small Business Association survey revealed that one of the major impediments to business growth was a lack of affordable capital.

- Enhanced Profile. ...

- Ability to Attract Better Employees. ...

- Increased Visibility. ...

- Ability to Maintain Control. ...

- Reduction of the Cost of Other Capital. ...

What are the advantages and disadvantages of stock market?

Advantages of using your personal money to invest in the stock market include the potential return on investment and ownership stake in a company. Disadvantages include higher risk and the time involved in investment.

What are the benefits of investing in the stock market?

Advantages of Investing in the Stock Market

- Investment Gains. One of the primary benefits of investing in the stock market is the chance to grow your money. ...

- Dividend Income. Some stocks provide income in the form of a dividend. ...

- Diversification. For investors who put money into different types of investment products, a stock market investment has the benefit of providing diversification.

- Ownership. ...

How does a company benefit from the stock market?

Stock investment offers plenty of benefits: Takes advantage of a growing economy: As the economy grows, so do corporate earnings. That's because economic growth creates jobs, which creates income, which creates sales. The fatter the paycheck, the greater the boost to consumer demand, which drives more revenues into companies' cash registers.

What are the advantages and disadvantages of stock?

What are the advantages and disadvantages of stock market? Advantages of using your personal money to invest in the stock market include the potential return on investment and ownership stake in a company. Disadvantages include higher risk and the time involved in investment.

How do companies benefit from their stocks?

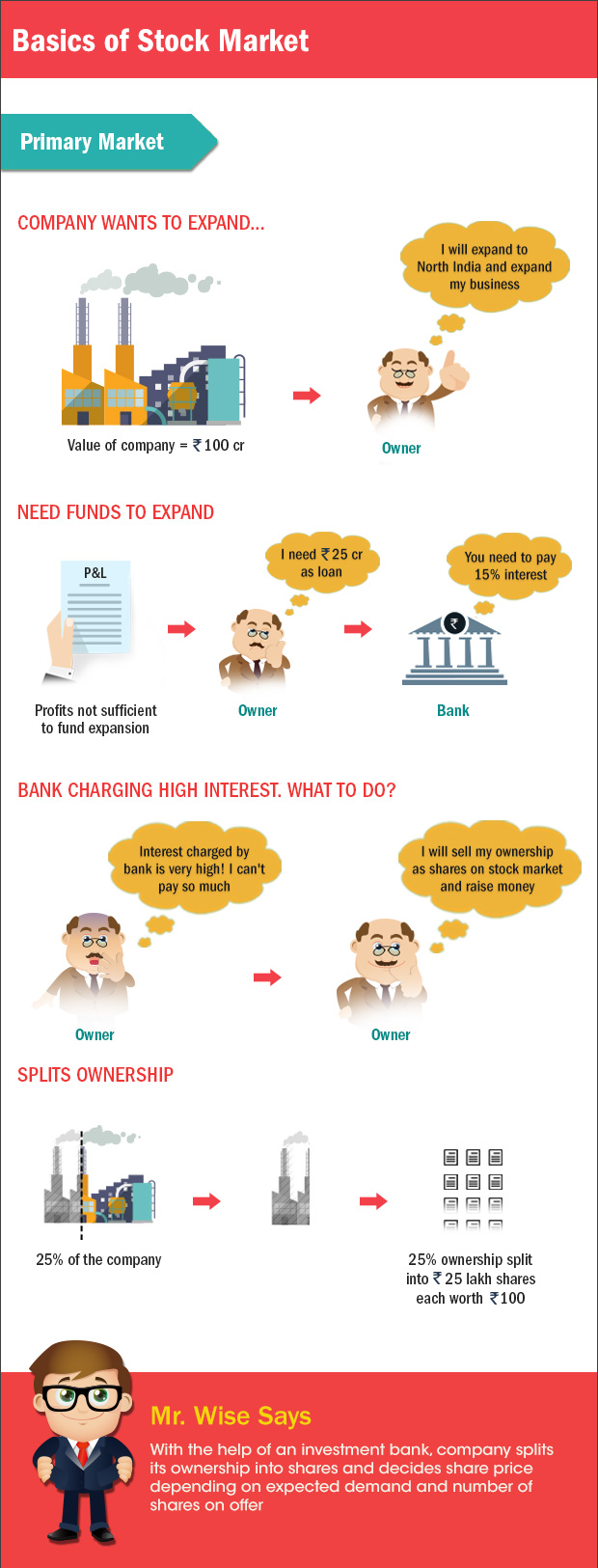

How do stocks work? Companies sell shares in their business to raise money. They then use that money for various initiatives: A company might use money raised from a stock offering to fund new products or product lines, to invest in growth, to expand their operations or to pay off debt.

Why is the stock market important to companies?

Significance of the Stock Market It allows companies to raise money by offering stock shares and corporate bonds. It lets common investors participate in the financial achievements of the companies, make profits through capital gains, and earn money through dividends—although losses are also possible.

How does a company benefit from stock price increase?

Some of the benefits are; Cheaper Acquisitions: Companies can use their stock to make acquisitions or other deals. Higher stock price means fewer shares are paid for the same cash value. Attracts Investors: A higher share price increases the interest of customers because they expect a greater return from your company.

What happens to a company when stock prices fall?

When a stock price is falling, the company must sell more shares to raise money. If a stock price falls by a large amount, a company might be forced to borrow to raise money instead, which is usually more expensive. There's also some personal fortunes of company executives tied to the stock price.

What would happen if there was no stock market?

Key Takeaways. Without a stock market, purchasing shares directly from a company or selling directly to new investors would be more complex and expensive. Business growth would be more difficult if companies could not have an initial public offering or issue new shares to raise money.

Why do companies buy back their stock?

The main reason companies buy back their own stock is to create value for their shareholders. In this case, value means a rising share price. Here's how it works: Whenever there's demand for a company's shares, the price of the stock rises.

Does higher stock price mean better company?

In general, a high stock price indicates good financial health and a low stock price indicates poor overall financial health. As a business grows and goes through hard times, its stock price usually rises and falls, respectively.

What does stock price say about a company?

The stock's price only tells you a company's current value or its market value. So, the price represents how much the stock trades at—or the price agreed upon by a buyer and a seller. If there are more buyers than sellers, the stock's price will climb. If there are more sellers than buyers, the price will drop.

Do companies get money when you buy their stock?

When you buy a stock your money ultimately goes to the seller through an intermediary (who takes its share). The seller might be the company itself but is more likely another investor.

What happens when a share price increases?

Increasing share prices indicate that investors are expecting higher earnings growth from the company in the future. As the company invests in itself, its potential value for greater earnings increases. Investors will be attracted to this potential.

What does it mean when a stock increases?

By this we mean that share prices change because of supply and demand. If more people want to buy a stock (demand) than sell it (supply), then the price moves up. Conversely, if more people wanted to sell a stock than buy it, there would be greater supply than demand, and the price would fall.

What is outbound telemarketing?

Outbound telemarketers, as opposed to inbound telemarketers, make direct contact with prospective clients to promote and sell their companies' products and services. When it comes to outbound telemarketing, the customer has no prior knowledge of or interest in the products that the agent will present to them. To ensure a successful and profitable outbound telemarketing campaign, outbound telemarketers must be properly trained on product knowledge.

What is it called when a customer initiates a telemarketing call to know more about a product or?

When a customer initiates a telemarketing call to know more about a product or service, it is called inbound telemarketing. People in this demographic are already aware of and somewhat interested in the products and services that are advertised on various media outlets. Magazines, catalogs, postcards, radio and television commercials, and social media marketing are included.

What is telemarketing used for?

Telemarketing is also used by business owners for marketing purposes, such as conducting market research or obtaining accurate information in order to execute various marketing techniques. It is also known as inside sales or telesales and has received a lot of criticism for its intrusive nature. Various companies use it as one of the most popular forms of marketing to reach out to potential clients.

What is the use of the telephone or web-based video conferencing by businesses, salespeople, and telemarket?

The use of the telephone or web-based video conferencing by businesses, salespeople, and telemarketers to promote their products and services to potential customers is known as telemarketing. Its sales process involves calling, researching, and approaching prospective clients to pitch their products with the primary goal of generating leads and sales.

Why is telemarketing important?

To increase sales and profit potential , telemarketing can be a cost-effective method for a business to use. As a result of this sales strategy, small businesses can expand beyond their local market. Even though telemarketing allows businesses to reach out to more potential customers, it can take a while for positive sales results to appear.

Why do you need a telemarketer?

Consider hiring professional telemarketers to help you promote and sell products and services to increase your company's sales. The assistance of experts can also provide your company with improved customer service and access to the latest technology.

What are the benefits of telemarketing survey?

Determining what aspects of their operations, products, and services need to be improved is another benefit of the survey. Businesses will be able to gather direct and immediate feedback from clients through telemarketing.

Why do governments use stock market?

Stock markets provide a trading platform for governments too. Sometimes a local, state or national government may need more money to develop a community housing estate, build a water treatment plant or initiate any other public projects. Instead of increasing taxes to raise the required revenue, it can issue bonds through the stock market. When investors buy these bonds, the government is able to raise the money it needs to launch various projects that can ease the cost of living or even create jobs for locals. In the long run, this improves the economy.

Why is the stock market important?

Importance of the Stock Market to the Economy. Stock markets like the New York Stock Exchange (NYSE) and London Stock Exchange (LSE) provide a trading platform where shares of publicly-held companies are sold and bought. Along with the debt markets dominated by commercial lenders, stock exchanges are an invaluable source of capital for businesses.

What happened on Black Tuesday 1929?

Back in October 29, 1929 – a day that would later come to be known as Black Tuesday – US stock market prices collapsed. The Great Depression would then follow, throwing much of the world into a downward economic spiral that lasted a decade or so. Many economists agree that Black Tuesday contributed greatly to the Great Depression.

What would happen if there were no stock markets?

Without stock markets, businesses would largely resort to borrowing huge loans - which must be repaid with interest- from banks or individuals with well-oiled pockets. Fortunately, businesses in both the developed and developing world can issue share to the public, raising vast amounts of cash that doesn’t come along with a repayment burden (public companies are under no obligation to pay dividends, especially when they incur losses). When businesses have access to such capital, they can easily expand their operations and create more job opportunities. From a national perspective, this will lower unemployment levels, and enable a government to earn move revenue from business taxes.

Is the UK an economic powerhouse?

Even when the economies of nations like the US and the UK are hurting or doing badly, they are still considered economic powerhouses. How so? Welcome to the school of economic perceptions.

Why do analysts evaluate stock prices?

Analysts evaluate the trajectory of stock prices in order to gauge a company’s general health. They likewise rely on earning histories, and price-to-earnings (P/E) ratios, which signal whether a company’s share price adequately reflects its earnings. All of this data aids analysts and investors in determining a company’s long-term viability.

Why is it important to know the stock price of a company?

Publicly traded companies place great importance on their stock share price, which broadly reflects a corporation’s overall financial health . As a rule, the higher a stock price is, the rosier a company’s prospects become.

Why do companies keep their share price high?

Consequently, management strives to keep the share price high in order to discourage this activity. Conversely, a company whose shares trade for high prices are better positioned to take over a competitive interest.

Why is compensation important?

Compensation likewise represents a critical rationale for a company's decision-makers to do everything in their power to make sure a corporation's share price thrives. This is because many of those occupying senior management positions derive portions of their overall earnings from stock options .

What does the stock price of a company reflect?

A company's stock price reflects investor perception of its ability to earn and grow its profits in the future.

Why is a corporation concerned about its stock price?

The prevention of a takeover is another reason that a corporation might be concerned with its stock price.

Why are share prices so high?

Companies with high share prices tend to attract positive attention from the media and from equity analysts. The larger a company's market capitalization, the wider the coverage it receives. This has a chain effect of attracting more investors to the company, which infuses it with the cash it relies on to flourish over the long haul.

How do Pokemon make money?

Imagine a trading card company, like Pokemon or something. Pokemon only makes money when you buy their cards from a store. After you buy their cards from a store, you trade them with your friends. However, Pokemon doesn’t make any money when you trade cards with your friends. You and your friends may make money if you buy and sell these cards to each other, but Pokemon doesn’t make any more money until they release more cards for the public to buy. However, the more Pokemon releases these cards to the public, the less valuable they become. Let’s say Pokemon keeps making a lot of pikachu cards,

What is Pokemon like?

So in this analogy, Pokemon is like a business going public. When they first issue shares (like cards), they make a lot of money from people buying them. But after that, these stocks are simply traded between investors. When you buy a stock, your money is going to the person who just sold that stock, not to the company.

How do company promoters benefit?

Also, the company promoters being one of the largest shareholders of the company get benefited when more people buy its stocks at higher prices as then promoters holdings also gets price boost leading to increase in their own net-worth. They may sell a small part or even mortgage a part of their stocks holdings to convert them to cash.

Why do we buy shares from secondary market?

When we buy shares from the Secondary Market, it does not benefit the Company directly. There are a re a lot of indirect benefits though. The first is the boost in the brand value of the Company. Next comes the market capitalisation, which helps the Company to negotiate better terms with financial Institutions and the financial markets. It also helps the Company in raising Capital fom the market in future as and when required.

Why do companies issue more stock?

A company may issue more stock to the public, which can raise more money for the company , but it dilutes the shares . The more stock a company releases, the lower the share price will go, so companies try to avoid doing this. But a company can also benefit from stocks in other ways.

What happens if you buy a share from someone else?

If, however, you buy the share from someone else (ie - a shareholder), then the company doesn’t benefit at all. That’s just between you and the seller.

What happens after an IPO?

After that, the shares are traded on the open market. The company does not benefit in any way from the trading that goes on after an IPO.

How did Dutch East India Company change the way people made investments?

Previously, investors would help fund the ship owner’s voyages in exchange for part of the profits . This could be risky for the investor, though, since if the voyage was not successful, the investor lost his money. The East India companies created a new model. They would allow investors to purchase stock that paid dividends based on all the voyages of the company, as opposed to one individual voyage. In 1602, the Dutch East India Company began issuing paper shares. Paper shares could be traded among shareholders, which meant stocks could be bought and sold with other investors (the definition of a stock market). The East India companies were huge and essentially had a government-backed monopoly. This led to massive profits for investors.

What does it mean when the stock market is closed today?

When a person refers to the stock market saying something like “the stock market closed down today” this term is a shorthand for how stocks have recently performed and is usually referring to one of the major indices, often the S&P 500 or the Dow Jones Industrial Average . These indices act as a representation of how all stocks are doing, though they do not come close to including all the stocks in the market.

What is the stock market?

The stock market is where investors can buy and sell stocks. The stock market is often described as a singular entity - “the” stock market. In reality, the stock market is not one place or one exchange. Instead, any investment made on a stock exchange is part of the stock market. The United States has a significant presence in ...

What is the most significant opportunity for foreign investors?

Foreign Investing and the Stock Market One of the most significant opportunities the stock market provides is a way for people to invest in foreign markets. For U.S. investors, this offers the chance to diversify by investing outside of the United States. While this is a useful diversification strategy, it is more often the reverse that happens - foreign investors purchasing U.S. stocks. These foreign investments account for a substantial amount of U.S. stock investing.

How does the stock market benefit companies?

The existence of the stock market allows companies to grow in ways that would be impossible otherwise, including giving businesses a way to raise massive amounts of capital.

Why do companies have an IPO?

It would then have to repay that loan with interest. Because of the existence of the stock market, when a business wants to raise capital, it can instead create an initial public offering (IPO). An IPO allows a company to raise a large amount of capital, without having to pay back a loan or worry about interest.

Why do stocks exist?

Why Does The Stock Market Exist? Stock markets exist to serve the economy. They do this by providing the opportunity for companies to raise capital, investors to make money, and the government to collect taxes from both. This answer may raise more questions than it answers.

What is the stock market?

Defined as the market in which equity shares of publicly-traded businesses are bought and sold, the stock market measures the aggregate value of all publicly-traded companies. Comprehensively, this can be represented by the Wilshire 5000, but generally, most analysts and investors focus on the S&P 500. Both indexes can be valuable tools for gauging the health of the overall economy, though occasionally stocks may be misleading.

Why do stocks rise?

A rising stock market is usually aligned with a growing economy and leads to greater investor confidence. Investor confidence in stocks leads to more buying activity which can also help to push prices higher. When stocks rise, people invested in the equity markets gain wealth. This increased wealth often leads to increased consumer spending, ...

How does stock performance affect issuance decisions?

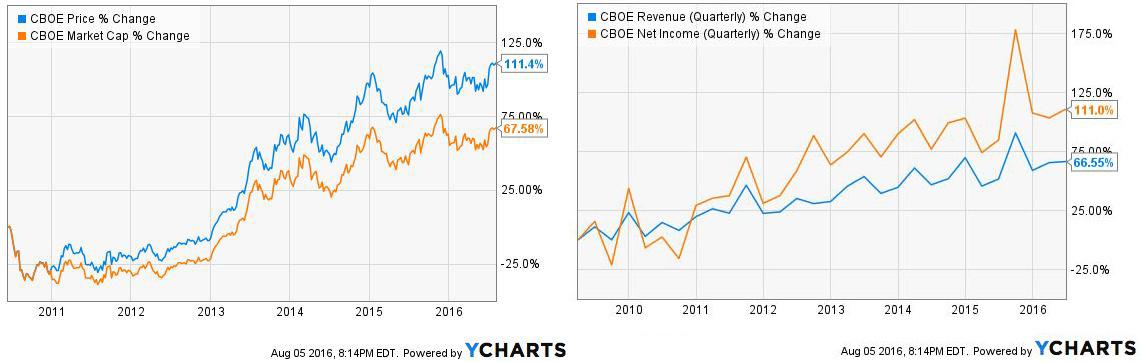

Share issuance decisions can also be affected by stock performance. If a stock is doing well, a company might be more inclined to issue more shares because they believe they can raise more capital at the higher value. Stock market performance also affects a company’s cost of capital.

What is the effect of expanding business activity on the stock market?

Expanding business activity usually increases valuations and leads to stock market gains. Historically, steep market declines preceded the Great Depression in the 1930s as well as the Great Recession of 2007–2009. However, some market crashes, most famously Black Monday in 1987, were not followed by recessions.

What happens when stocks rise?

When stocks rise, people invested in the equity markets gain wealth. This increased wealth often leads to increased consumer spending, as consumers buy more goods and services when they're confident they are in a financial position to do so.

How does the stock market affect a company?

The Stock Market and Business Operations. The stock market's movements can impact companies in a variety of ways. The rise and fall of share price values affects a company’s market capitalization and therefore its market value. The higher shares are priced, the more a company is worth in market value and vice versa.

What happens when a company's stock falls?

Companies may also have substantial capital investments in their stock which can lead to problems if the stock falls. For example, companies may hold shares as cash equivalents or use shares as backing for pension funds. In any case, when shares fall, the value decreases, which can lead to funding problems.

High earners

Just around 40% of American households with incomes between $22,000 and $49,000 a year have money invested in the stock market, according to the Center for Retirement Research at Boston College.

Those with a high net worth

More than 90% of American homes with a net worth over $580,000 own stocks, Boston College found.

How do long term investors buy stocks?

Many long-term investors hold on to stocks for years, without frequent buying or selling, and while they see those stocks fluctuate over time, their overall portfolio goes up in value over the long term. These investors often own stocks through mutual funds or index funds, which pool many investments together. You can buy a large section of the stock market — for example, a stake in all of the companies in the S&P 500 — through a mutual fund or index fund.

Why do stocks go down?

But while stocks overall have a history of high returns, they also come with risk: It’s entirely possible that a stock in your portfolio will go down in value instead. Stock prices fluctuate for a variety of reasons, from overall market volatility to company-specific events, like a communications crisis or a product recall.

Why do people buy stocks?

Stocks are an investment in a company and that company's profits. Investors buy stock to earn a return on their investment.

What is common stock?

Most investors own what’s called common stock, which is what is described above. Common stock comes with voting rights, and may pay investors dividends. There are other kinds of stocks, including preferred stocks, which work a bit differently. You can read more about the different types of stocks here.

What is the purpose of investing in stocks?

Simply put, stocks are a way to build wealth. They are an investment that means you own a share in the company that issued the stock .

How do companies issue stock?

Companies typically begin to issue shares in their stock through a process called an initial public offering, or IPO. (You can learn more about IPOs in our guide.) Once a company’s stock is on the market, it can be bought and sold among investors.

Why do companies sell shares?

Companies sell shares in their business to raise money. They then use that money for various initiatives: A company might use money raised from a stock offering to fund new products or product lines, to invest in growth, to expand their operations or to pay off debt.

Financial Health

Financing

- Most companies receive an infusion of capital during their initial public offering (IPO) stages. But down the line, a company may rely on subsequent funding to finance expanded operations, acquire other companies, or pay off debt. This can be achieved with equity financing, which is the process of raising capital through the sale of new shares. However, for this to happen, the comp…

A Performance Indicator of Executive Management

- Investment analysts ritually track a publicly-traded company's stock price in order to gauge a company's fiscal health, market performance, and general viability. A steadily rising share price signals that a company's top brass is steering operations toward profitability. Furthermore, if shareholders are pleased, and the company is tilting towards success, as indicated by a rising s…

Compensation

- Compensation likewise represents a critical rationale for a company's decision-makers to do everything in their power to make sure a corporation's share price thrives. This is because many of those occupying senior management positions derive portions of their overall earnings from stock options. These perks afford management personnel the ability to acquire shares of the corporati…

Risk of Takeover

- The prevention of a takeover is another reason a corporation might be concerned with its stock price. When a company's stock price falls, the likelihood of a takeover increases, mainly due to the fact that the company's market value is cheaper. Shares in publicly traded companies are typically owned by wide swaths of investors. Therefore, bidders who seek to take over a company by obt…

Positive Press

- Companies with high share prices tend to attract positive attention from the media and from equity analysts. The larger a company's market capitalization, the wider the coverage it receives. This has a chain effect of attracting more investors to the company, which infuses it with the cash it relies on to flourish over the long haul.