Full Answer

What can affect your Social Security earnings?

- Housing and utilities.

- Food.

- Medical and dental expenses.

- Personal care items.

- Clothing.

- Rehabilitation expenses (if you have a disability).

How much money can you make and still get SSI?

- You were eligible for SSI monthly payments for at least one month.

- You are disabled.

- You meet all non-disability eligibility guidelines for SSI.

- You must have Medicaid coverage to continue working.

- Your gross earnings are insufficient to replace SSI, Medicaid, and publicly-funded care services.

How does income affect SSI benefits?

Key Takeaways

- You can get Social Security and work at the same time, but your monthly benefit may be reduced.

- If you have reached full retirement age, you can receive your entire benefit, no matter how much you earn.

- If you haven't reached full retirement age, Social Security will deduct $1 from your benefits for every $2 or $3 you earn above a certain amount.

Does receiving a pension affect social security?

You, and many other retirees, may collect both Social Security benefits and a monthly pension check. Receiving a pension doesn't automatically reduce your Social Security benefits.

What type of income affects Social Security benefits?

Social Security calculates your benefit amount based on your earnings over the years, whether you were self-employed or worked for an employer. The more money you earned, the more you paid into Social Security—and the higher your future benefits—up to certain limits.

Does income level affect Social Security benefits?

If you are younger than full retirement age and earn more than the yearly earnings limit, we may reduce your benefit amount. If you are under full retirement age for the entire year, we deduct $1 from your benefit payments for every $2 you earn above the annual limit. For 2022, that limit is $19,560.

What amount of income reduces Social Security benefits?

The earnings cap is adjusted for inflation. For 2022, if you're under FRA, it is $19,560 . Once annual earnings reach the cap amount, for every $2 a Social Security recipient under FRA earns, the total annual benefit gets reduced by $1.

Do you get more Social Security if you earned more?

Earn more. Earning a higher salary can set you up for higher Social Security payments in retirement. Increasing your income by asking for a raise or earning income from a side job will increase the amount you receive from Social Security in retirement.

How much can I earn in 2020 and still collect Social Security?

In 2020, the yearly limit is $18,240. During the year in which you reach full retirement age, the SSA will deduct $1 for every $3 you earn above the annual limit. For 2020, the limit is $48,600. The good news is only the earnings before the month in which you reach your full retirement age will be counted.

At what age do your earnings not affect Social Security?

You can earn any amount and not be affected by the Social Security earnings test once you reach full retirement age, or FRA. That's 66 and 2 months if you were born in 1955, 66 and 4 months for people born in 1956, and gradually increasing to 67 for people born in 1960 and later.

What decreases Social Security benefits?

If you recently started receiving Social Security benefits, there are three common reasons why you may be getting less than you expected: an offset due to outstanding debts, taking benefits early, and a high income.

What is the earnings limit for Social Security in 2021?

The maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $147,000. The earnings limit for workers who are younger than "full" retirement age (see Full Retirement Age Chart) will increase to $19,560. (We deduct $1 from benefits for each $2 earned over $19,560.)

What is the SS income limit for 2021?

$18,960How Much Can I Earn? The annual Social Security earnings limit for those starting benefits before reaching full retirement age (FRA) in 2021 is $18,960. In 2022, the limit is $19,560.

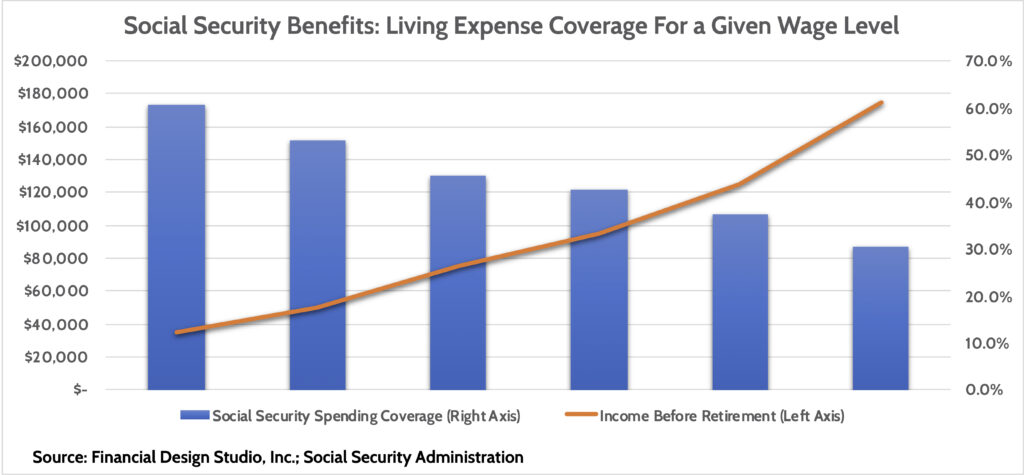

How much Social Security will I get if I make $60000 a year?

That adds up to $2,096.48 as a monthly benefit if you retire at full retirement age. Put another way, Social Security will replace about 42% of your past $60,000 salary. That's a lot better than the roughly 26% figure for those making $120,000 per year.

How much Social Security will I get if I make $75000 a year?

about $28,300 annuallyIf you earn $75,000 per year, you can expect to receive $2,358 per month -- or about $28,300 annually -- from Social Security.

How much Social Security will I get if I make $100000 a year?

Based on our calculation of a $2,790 Social Security benefit, this means that someone who averages a $100,000 salary throughout their career can expect Social Security to provide $33,480 in annual income if they claim at full retirement age.

Why Is Income Important in The SSI Program?

Generally, the more countable income you have, the less your SSI benefit will be. If your countable income is over the allowable limit, you cannot...

What Income Does Not Count For Ssi?

Examples of payments or services we do not count as income for the SSI program include but are not limited to:the first $20 of most income received...

How Does Your Income Affect Your SSI Benefit?

Step 1: We subtract any income that we do not count from your total gross income. The remaining amount is your "countable income".Step 2: We subtra...

Example A – SSI Federal Benefit With only Unearned Income

Total monthly income = $300 (Social Security benefit)1) $300 (Social Security benefit) -20 (Not counted) =$280 (Countable income)2) $750 (SSI Feder...

Example B – SSI Federal Benefit With only Earned Income

Total monthly income = $317 (Gross wages)1) $317 (Gross wages) -20 (Not counted) $297 -65 (Not counted) =$232 divided by 1/2 =$116 (Countable income)

Example C – SSI Federal Benefit and State Supplement With only Unearned Income

The facts are the same as example A, but with federally administered State supplementation.1) $300 (Social Security benefit) -20 (Not counted) =$28...

Example D – SSI Federal Benefit and State Supplement With only Earned Income

Total monthly income = $317 (Gross wages)1) $317 (Gross wages) -20 (Not counted) $297 -65 (Not counted) $232 divided by 1/2 =$116 (Countable income...

How Will Windfall Offset Affect My Benefit?

Windfall offset occurs when we reduce your retroactive Social Security benefits if you are eligible for Social Security and SSI benefits for the sa...

When Does Deemed Income Apply?

When a person who is eligible for SSI benefits lives with a spouse who is not eligible for SSI benefits, we may count some of the spouse's income i...

When Does Deemed Income Not Apply?

When you no longer live with a spouse or parent.When a disabled or blind child attains age 18. When an alien's sponsorship ends.

What happens if you start collecting Social Security benefits earlier?

However, once you reach full retirement age, Social Security will recalculate your benefit to make up for the money it withheld earlier.

What happens to Social Security after you reach full retirement age?

After you reach full retirement age, Social Security will recalculate your benefit and increase it to account for the benefits that it withheld earlier. 7 .

How much can I deduct from my Social Security if I earn more than $50,520?

If you earn more than $50,520, it deducts $1 for every $3 you earn—but only during the months before you reach full retirement age. Once you reach full retirement age, you can earn any amount of money, and it won't reduce your monthly benefits. 3 . Note, however, that this money is not permanently lost. After you reach full retirement age, Social ...

How much can I deduct from my Social Security?

If you haven't reached full retirement age, Social Security will deduct $1 from your benefits for every $2 or $3 you earn above a certain amount. After you reach full retirement age, Social Security will increase your benefits to account ...

What is the full retirement age?

What Is Full Retirement Age? For Social Security purposes, your full or "normal" retirement age is between age 65 and 67, depending on the year you were born. If, for example, your full retirement age is 67, you can start taking benefits as early as age 62, but your benefit will be 30% less than if you wait until age 67. 4 . ...

How many Social Security credits will I get in 2021?

In 2021, you get one credit for each $1,470 of earnings, up to a maximum of four credits per year. That amount goes up slightly each year as average earnings increase. 3 . Social Security calculates your benefit amount based on your earnings over the years, whether you were self-employed or worked for another employer.

How many hours can I work to reduce my Social Security?

If you are younger than full retirement age, Social Security will reduce your benefits for every month you work more than 45 hours in a job (or self-employment) that's not subject to U.S. Social Security taxes. That applies regardless of how much money you earn.

How to calculate Social Security income?

The first step translates your earnings history into your Average Indexed Monthly Earnings (AIME): 1 Only your Social Security Earnings (the earnings on which you paid Social Security or FICA taxes) count. 2 SSA indexes your Social Security Earnings, attempting to approximate what your earnings would have been if they had all been paid in the year you turned 60 by adjusting for inflation and productivity growth. 3 SSA averages your indexed earnings for the 35 highest years. 4 SSA then calculates the monthly amount for that average.

What is Jane's indexed earnings for 1991?

Multiply your Social Security earnings by the indexing factor (see chart below). Jane’s 1991 indexed earnings are her 1991 Social Security earnings times 2.06. Jane’s indexing factors are over 4 for 1978, over 3 from 1979-1982, and over 2 after that until 1991. Earnings for years after you turn 60 are not indexed.

What is the average indexed earnings?

Average indexed earnings are the average of your highest 35 years’ indexed earnings. If you have fewer than 35 years of Social Security earnings, the average includes only years with positive earnings.

What does higher AIME mean?

Higher AIME means a larger benefit. 2) Translate your AIME into your Primary Insurance Amount (PIA). A larger PIA means a larger benefit. 3) Adjust your benefit based on when you start receiving benefits relative to your Full Retirement Age (FRA). Starting later (up to your age 70) means a larger benefit .

How much did Jane make in 1978?

The chart shows the calculation of Social Security earnings for someone (call her Jane) who started working in 1978 at 25. Jane earned $45,000 in 1978, increasing $2,000 per year until 2007, then decreasing $1,000 per year until retiring in 2018 at 65.

What is the income base for Social Security?

Every year, the (SSA) defines the Social Security Wage Base. If your income is below the Wage Base, you pay Social Security (FICA) tax and get benefits based on your actual income. If your income is above the Wage Base, you pay FICA tax and get benefits on only the amount up to the Wage Base.

Does lifetime earnings affect Social Security?

Your lifetime earnings affect your Social Security benefit , but it's often hard to see how. getty. Social Security retirement benefits are most Americans’ retirement income foundation. Given their importance, you might think that everyone would know exactly how their retirement benefit is calculated.

What are some examples of payments or services that do not count as income for the SSI program?

Examples of payments or services we do not count as income for the SSI program include but are not limited to: the first $20 of most income received in a month; the first $65 of earnings and one–half of earnings over $65 received in a month; the value of Supplemental Nutrition Assistance Program (food stamps) received;

What is considered in-kind income?

In-Kind Income is food, shelter, or both that you get for free or for less than its fair market value. Deemed Income is the part of the income of your spouse with whom you live, your parent (s) with whom you live, or your sponsor (if you are an alien), which we use to compute your SSI benefit amount.

What is unearned income?

Unearned Income is all income that is not earned such as Social Security benefits, pensions, State disability payments, unemployment benefits, interest income, dividends and cash from friends and relatives. In-Kind Income is food, shelter, or both that you get for free or for less than its fair market value.

What is income in SSI?

Income is any item an individual receives in cash or in-kind that can be used to meet his or her need for food or shelter. Income includes, for the purposes of SSI, the receipt of any item which can be applied, either directly or by sale or conversion, to meet basic needs of food or shelter. Earned Income is wages, net earnings from ...

What is Supplemental Nutrition Assistance Program?

the value of Supplemental Nutrition Assistance Program (food stamps) received; income tax refunds; home energy assistance; assistance based on need funded by a State or local government, or an Indian tribe; small amounts of income received irregularly or infrequently;

What is a grant, scholarship, fellowship or gift?

grants, scholarships, fellowships or gifts used for tuition and educational expenses; food or shelter based on need provided by nonprofit agencies; loans to you (cash or in–kind) that you have to repay;

Can I get SSI if my income is over the limit?

Generally, the more countable income you have, the less your SSI benefit will be. If your countable income is over the allowable limit, you cannot receive SSI benefits. Some of your income may not count as income for the SSI program.

Are Social Security Benefits Affected by Your Income?

Yes. There are many factors that go into how much your Social Security benefit check is, but how much money you earned over the course of your lifetime has the biggest effect.

How are Social Security Benefits Calculated?

The SSA uses your lifetime earnings to calculate your benefits. They figure out the 35 years when you earned the most money, and apply a formula so that your wages are adjusted for inflation. They use this information to come up with an amount, and that’s how your Social Security benefits are calculated.

Receiving Social Security Income while Working

If you claim Social Security benefits before your full retirement age and continue to work, the SSA will adjust the amount that they pay you based on your income. For 2021, your benefits will be reduced $1 for every $2 you earn over $18,960. Once you reach FRA, you can earn as much as you want and your benefits are unaffected.

Bottom Line

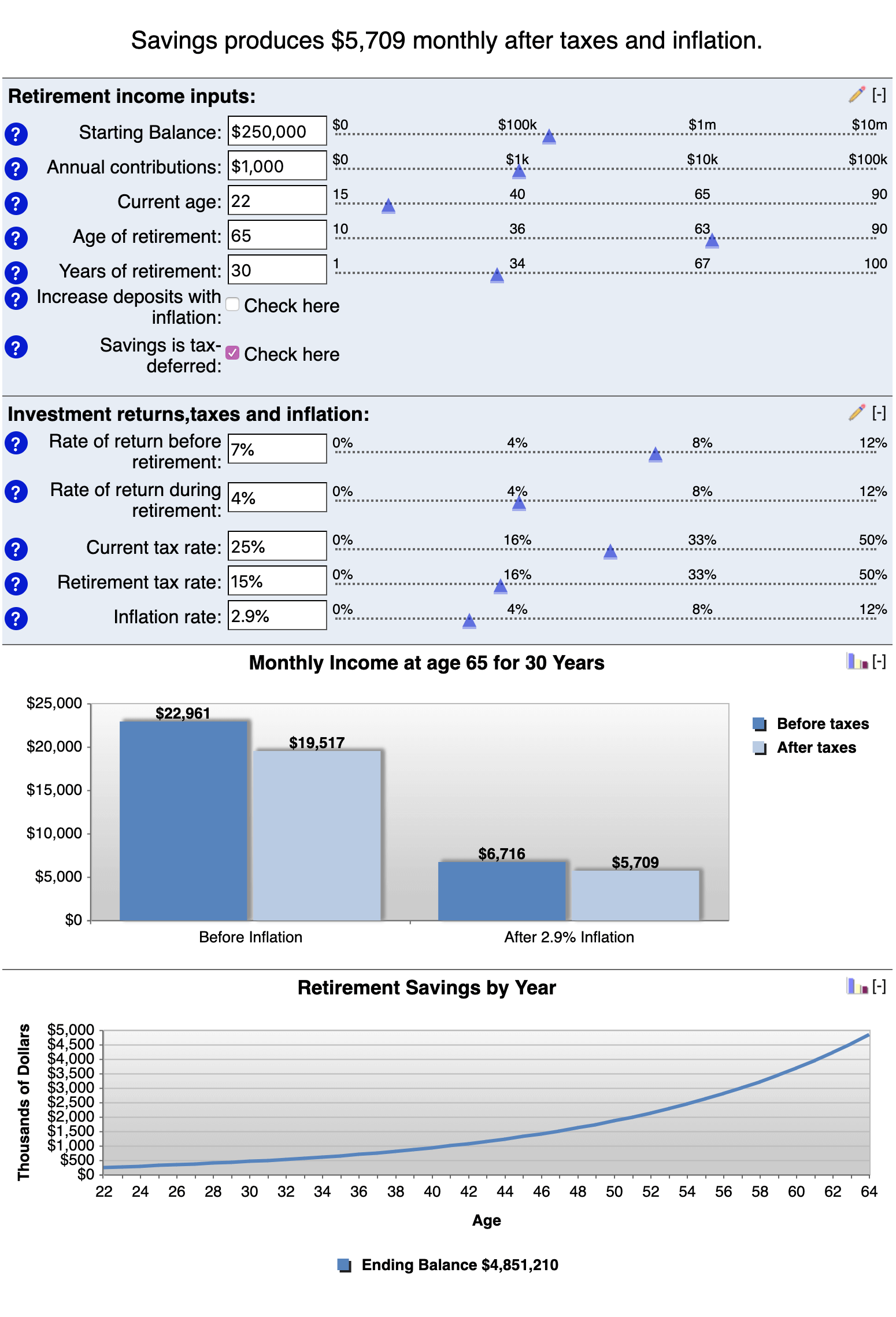

Figuring out how much your Social Security benefits will be can be complex. Sometimes, it helps to have a Certified Financial PlannerⓇ go over things with you, so you can retire with the maximum benefit available.

What is the maximum amount you can earn in 2021?

For 2021 that limit is $18,960. In the year you reach full retirement age, we deduct $1 in benefits for every $3 you earn above a different limit, but we only count earnings before the month you reach your full retirement age. If you will reach full retirement age in 2021, the limit on your earnings for the months before full retirement age is ...

What is the maximum amount you can earn before retirement in 2021?

If you will reach full retirement age in 2021, the limit on your earnings for the months before full retirement age is $50,520. Starting with the month you reach full retirement age, you can get your benefits with no limit on your earnings.

Can you report a change in earnings after retirement?

If you need to report a change in your earnings after you begin receiving benefits: If you receive benefits and are under full retirement age and you think your earnings will be different than what you originally told us, let us know right away. You cannot report a change of earnings online.

How much will Social Security pay in 2021?

Let’s say that you file for Social Security benefits at age 62 in January 2021 and your payment will be $600 per month ($7,200 for the year). During 2021, you plan to work and earn $23,920 ($4,960 above the $18,960 limit). We would withhold $2,480 of your Social Security benefits ($1 for every $2 you earn over the limit). To do this, we would withhold all benefit payments from January 2021 through May 2021. Beginning in June 2021, you would receive your $600 benefit and this amount would be paid to you each month for the remainder of the year. In 2022, we would pay you the additional $520 we withheld in May 2021.

Can I get Social Security if I retire in 2021?

Under this rule, you can get a full Social Security check for any whole month you’re retired, regardless of your yearly earnings.In 2021, a person younger than full retirement age for the entire year is considered retired if monthly earnings are $1,580 or less.

Can I work and get Social Security?

You can get Social Security retirement or survivors benefits and work at the same time. But, if you’re younger than full retirement age, and earn more than certain amounts, your benefits will be reduced. The amount that your benefits are reduced, however, isn’t truly lost. Your benefit will increase at your full retirement age to account for benefits withheld due to earlier earnings. (Spouses and survivors, who receive benefits because they have minor or disabled children in their care, don’t receive increased benefits at full retirement age if benefits were withheld because of work.)