A Formula for Determining Taxable Social Security

- Determine Provisional Income (1/2 of a Social Security benefit, and all other taxable income including dividends, realized interest, realized capital gains, plus non-taxable interest earnings, such as from ...

- Subtract the first threshold and multiply by .5.

- Subtract the second threshold and multiply by .35.

- Add them up.

How much of my social security benefit may be taxed?

If your income is above that but is below $34,000, up to half of your benefits may be taxable. For incomes of over $34,000, up to 85% of your retirement benefits may be taxed. For the purposes of taxation, your combined income is defined as the total of your adjusted gross income plus half of your Social Security benefits plus nontaxable interest.

How much tax on social security calculator?

In October the Social Security Administration announced ... 2021 Beneficiaries can calculate their base rate by taking the gross amount that they receive each month, before deductions such as taxes and Medicare, and multiplying it by 1.059.

Are my SSA benefits taxable?

Your child tax credit payments will not affect your Social Security benefits, the Social Security Administration noted in a blog post. If you receive SSI, any child tax credit you receive, including advance payments received in 2021, won’t count as ...

What is the current Social Security tax rate?

West Virginia has been gradually phasing out its tax on Social Security benefits, and by 2022, those taxes will be history. For 2021, however, taxpayers will still have to pay state income tax on 35% of Social Security benefits.

Are Social Security benefits taxed after age 66?

Are Social Security benefits taxable regardless of age? Yes. The rules for taxing benefits do not change as a person gets older. Whether or not your Social Security payments are taxed is determined by your income level — specifically, what the Internal Revenue Service calls your “provisional income.”

What percentage of your Social Security is taxed?

Nobody pays taxes on more than 85 percent of their Social Security benefits, no matter their income. The Social Security Administration estimates that about 56 percent of Social Security recipients owe income taxes on their benefits.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

Do I pay federal taxes on Social Security?

Some people who get Social Security must pay federal income taxes on their benefits. However, no one pays taxes on more than 85% percent of their Social Security benefits. You must pay taxes on your benefits if you file a federal tax return as an “individual” and your “combined income” exceeds $25,000.

Quick Rule: Is My Social Security Income Taxable?

According to the IRS, the quick way to see if you will pay taxes on your Social Social Security income is to take one half of your Social Security...

Calculating Your Social Security Income Tax

If your Social Security income is taxable, the amount you pay in tax will depend on your total combined retirement income. However, you will never...

How to File Social Security Income on Your Federal Taxes

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this par...

Simplifying Your Social Security Taxes

During your working years, your employer probably withheld payroll taxes from your paycheck. If you make enough in retirement that you need to pay...

State Taxes on Social Security Benefits

Everything we’ve discussed above is about your federal income taxes. Depending on where you live, you may also have to pay state income taxes. As y...

Tips For Saving on Taxes in Retirement

1. What you pay in taxes during your retirement will depend on how retirement friendly your state is. So if you want to decrease tax bite, consider...

How much is the FICA tax withheld?

For the first 20 pay periods, therefore, the total FICA tax withholding is equal to ($6,885 x 6.2%) + ($6,885 x 1.45%), or $526.70. Only the Medicare HI tax is applicable to the remaining four pay periods, so the withholding is reduced to $6,885 x 1.45%, or $99.83. In total, the employee pays $8,537.40 to Social Security and $2,395.98 to Medicare each year. Though it does not affect the employee's take-home pay, the employer must contribute the same amount to both programs. 18

What is the maximum amount of income subject to OASDI tax in 2021?

For 2021, the maximum amount of income subject to the OASDI tax is $142,800, capping the maximum annual employee contribution at $8,853.60. For 2022, the maximum amount of income subject is $147,000, capping the maximum annual employee contribution at $9114. 3 The amount is set by Congress and can change from year to year. 1

How much is Medicare taxed in 2021?

Though Medicare tax is due on the entire salary, only the first $142,800 is subject to the Social Security tax for 2021.

How is Social Security funded?

Because Social Security is a government program aimed at providing a safety net for working citizens, it is funded through a simple withholding tax that deducts a set percentage of pretax income from each paycheck. Workers who contribute for a minimum of 10 years are eligible to collect benefits based on their earnings history once they retire or suffer a disability. 7

What is the Social Security tax rate for 2021?

For 2021, the Social Security tax rate for both employees and employers is 6.2% of employee compensation , for a total of 12.4%. Those who are self-employed are liable for the full 12.4%. 3 . The combined taxes withheld for Social Security and Medicare are referred to as the Federal Insurance Contributions Act (FICA).

What happens if you overpay Social Security?

When an overpayment occurs, that amount is applied to the individual’s federal tax bill or is refunded.

What is the maximum amount of Social Security income in 2021?

There is a limit on the amount of annual wages or earned income subject to taxation, called a tax cap; in 2021, the maximum amount of income subject to the Social Security tax is $142,800.

How much to withhold from Social Security?

The only withholding options are 7%, 10%, 12% or 22% of your monthly benefit . After you fill out the form, mail it to your closest Social Security Administration (SSA) office or drop it off in person.

How many lines are there on a W-4V?

To withhold taxes from your Social Security benefits, you will need to fill out Form W-4V(Voluntary Withholding Request). The form only has only seven lines.

How to save on taxes in retirement?

You can also save on your taxes in retirement simply by having a plan. Help yourself get ready for retirement by working with a financial advisorto create a financial plan. It may seem daunting to wade through the options, but a matching tool like SmartAsset’scan help you find a person to work with to meet your needs. Just answer some questions about your financial situation and the tool will match you with up to three advisors in your area.

How to find out if you will pay taxes on Social Security?

According to the IRS, the quick way to see if you will pay taxes on your Social Social Security income is to take one half of your Social Security benefits and add that amount to all your other income , including tax-exempt interest. This number is known as your combined income (combined income = adjusted gross income + nontaxable interest + half of your Social Security benefits).

How much tax do you pay on your income if you live in one of the states?

So if you live in one of those four states then you will pay the state’s regular income tax rates on all of your taxable benefits (that is, up to 85% of your benefits). The other nine states also follow the federal rules but offer deductionsor exemptions based on your age or income.

How to file Social Security income on federal taxes?

Once you calculate the amount of your taxable Social Security income, you will need to enter that amount on your income tax form. Luckily, this part is easy. First, find the total amount of your benefits. This will be in box 3 of your Form SSA-1099.

What to do with a Roth IRA?

If you’re concerned about your income tax burden in retirement, consider saving in a Roth IRA. With a Roth IRA, you save after-tax dollars. Because you pay taxes on the money before contributing it to your Roth IRA, you will not pay any taxes when you withdraw your contributions. You also do not have to withdraw the funds on any specific schedule after you retire. This differs from traditional IRAs and 401 (k) plans, which require you to begin withdrawing money once you reach 72 years old (or 70.5 if you were born before July 1, 1949).

What is the highest portion of Social Security?

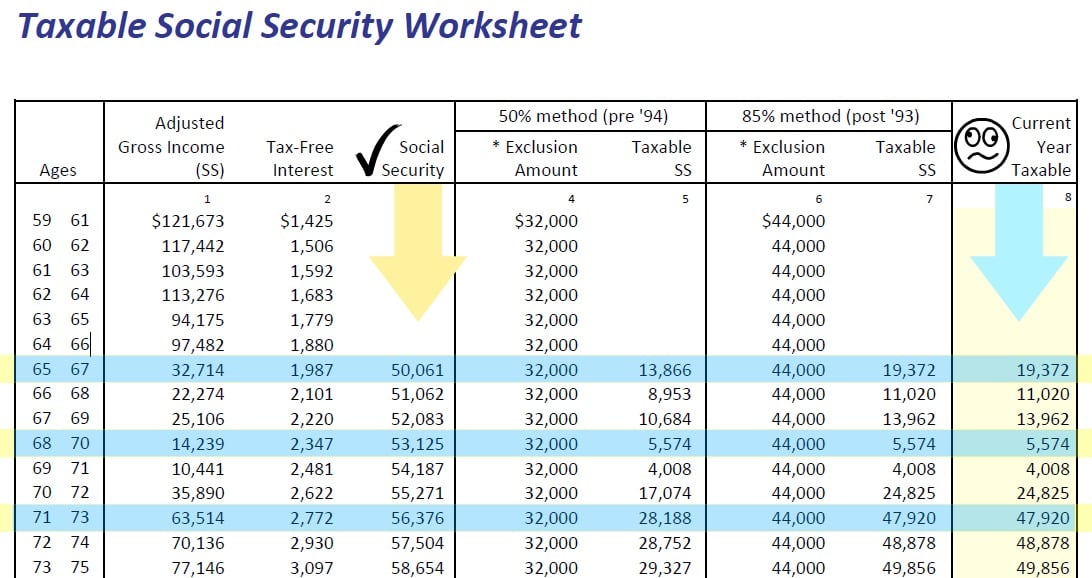

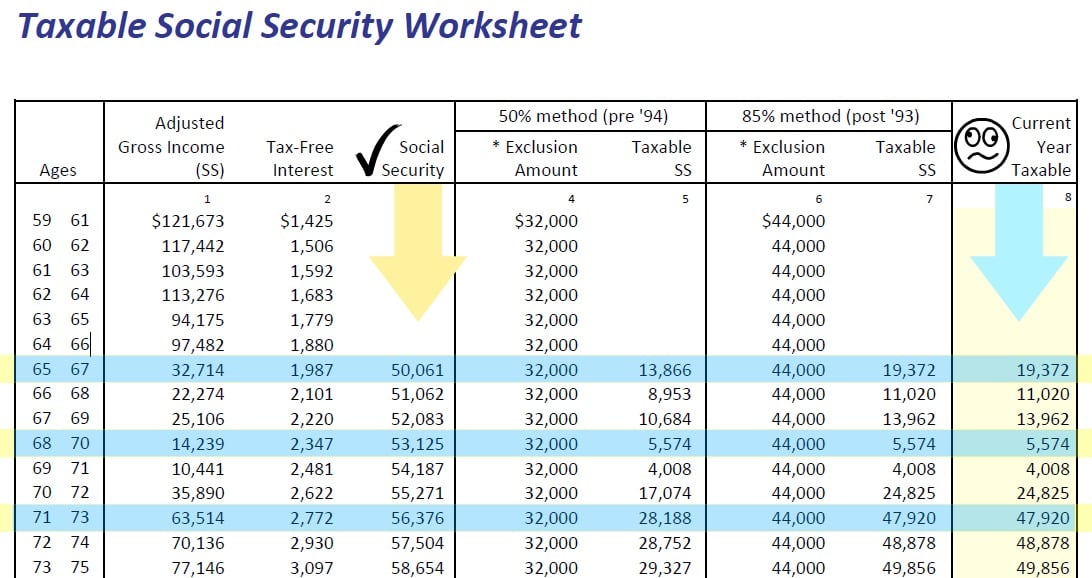

The highest portion of social security benefits subject to taxes is 85%, while 0% is lowest, depending on provisional income. The provisional income is the adjusted gross income, plus tax-free interest, less Social Security benefits, plus one-half of Social Security benefits. The following ranges of provisional income determine the maximum taxable Social Security.

What percentage of Social Security is taxable?

Moneytree Advise always assumes that 85% of the Social Security benefits is taxable to be most conservative (and straightforward). When running Aspire reports in Moneytree Plan, the advisor sets the taxable percentage between 0%, 50% or 85%. Prosper reports determine the taxable Social Security each year, thanks to the detailed tax analysis built into the projections. As a client’s provisional income changes, the amount of Social Security benefits subject to taxes can change too. The taxable amount determined by the projection displays on the Social Security Worksheet (report D16), then carried to the Taxable Income Analysis, column 6 (report D7).

What is the maximum amount of Social Security benefits?

This one is easy – social security benefit times .85 is the maximum amount of taxable benefits.

Is Social Security taxable?

It is typical for Social Security benefits to be 85% taxable, especially for clients with higher income sources in retirement. But the benefit subject to taxation can be lower. Depending on income levels, taxable Social Security can be 0%, 50%, or 85% taxable.

How to get a W-4V form?

You can download the form or call the IRS toll-free at 1-800-829-3676 and ask for Form W-4V, Voluntary Withholding Request. (If you are deaf or hard of hearing, call the IRS TTY number, 1-800-829-4059 .) When you complete the form, you will need to select the percentage of your monthly benefit amount you want withheld.

What is the number to call for W-4V?

If you have questions about your tax liability or want to request a Form W-4V, you can also call the IRS at 1-800-829-3676.

How much of Social Security benefit can be withheld?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

Social Security taxable benefit calculator

Enter the total of any exclusion for U.S. savings bond interest, foreign-earned income, or housing.

The amount of Social Security benefits subject to federal income tax

For advisor use only. This calculator should not be used to provide tax or legal advice. For specific advice, please contact an experienced attorney or CPA.