How do you calculate federal retirement benefits?

- The employee’s length of service under FERS;

- the employee’s high-three average salary; and

- the FERS annuity calculation formula.

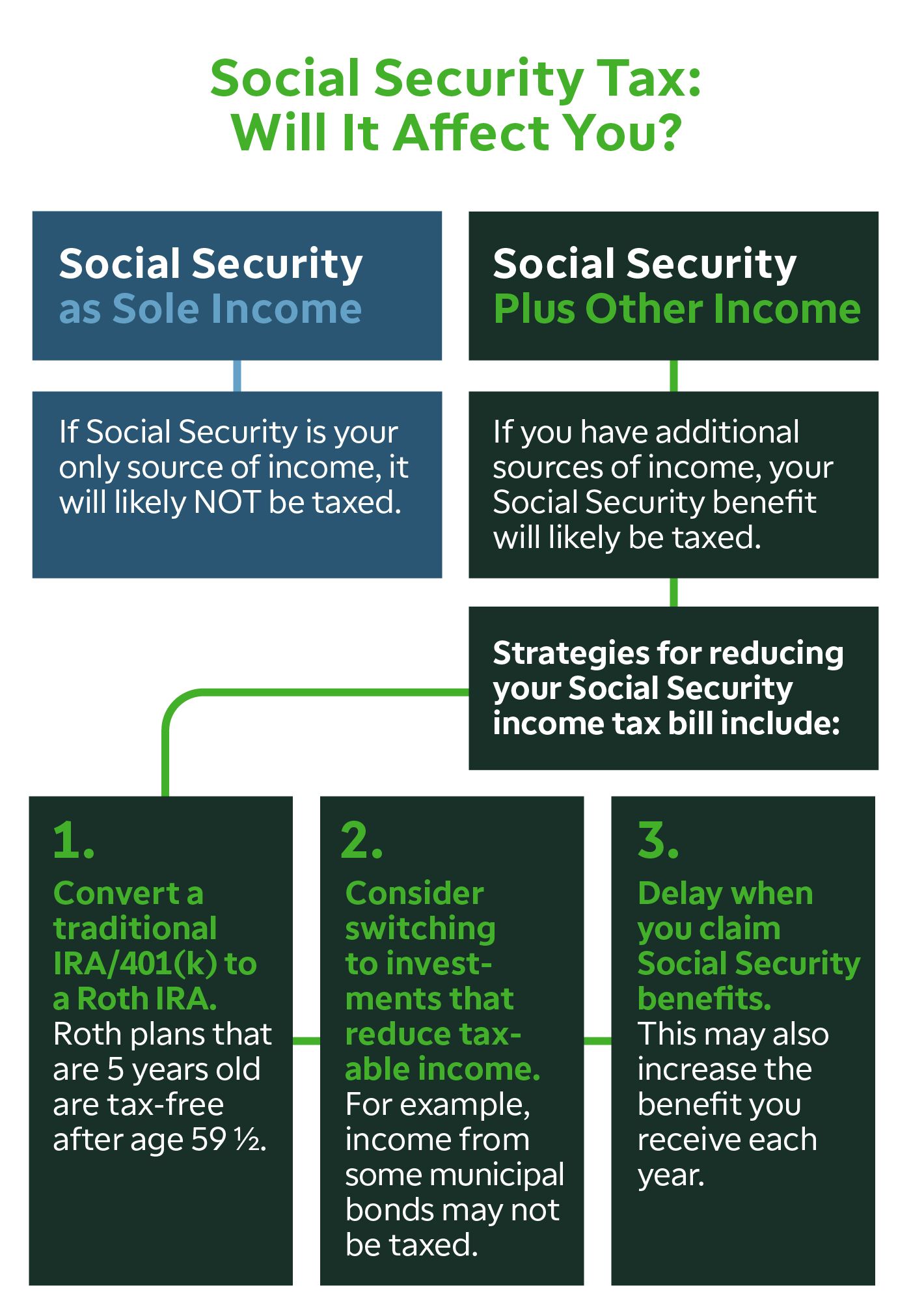

How much of my retirement benefit is taxable?

between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable. between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits.

How to maximize the benefits of your retirement savings?

7 Tips To Maximize Your Retirement Savings

- Start today The best piece of retirement investment advice is to start today. The longer your money has to grow, the more you’ll get out of compounding returns. ...

- Automate your contributions It’s not just about adding to your accounts on occasion. ...

- Use your employer match Do you work for a company that offers an employer match? ...

How much can I earn at full retirement?

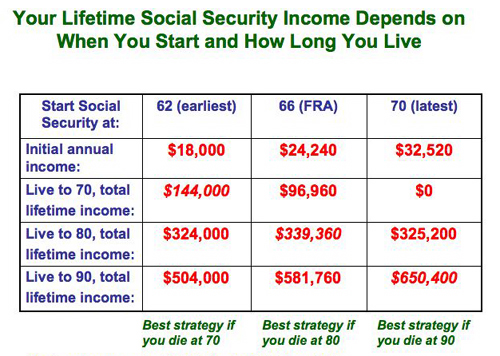

How much money can i earn at full retirement age? If you will reach full retirement age in 2021, you can earn up to $4,210 per month without losing any of your benefits, up until the month you turn 66. But for every $3 you earn over that amount in any month, you will lose $1 in Social Security benefits.

How to save for retirement?

What is the most popular way to save for retirement?

Why do people underestimate how much they need to save for retirement?

How much of a person's income is Social Security?

What is the standard of living after retirement?

What is passive income?

Why do people invest in retirement?

See more

About this website

How much will I get from Social Security when I retire?

Your retirement benefit is based on your lifetime earnings in work in which you paid Social Security taxes. Higher income translates to a bigger benefit (up to a point — more on that below). The amount you are entitled to is modified by other factors, most crucially the age at which you claim benefits.

How many years do you have to work to get maximum Social Security?

35 yearsQualifying for Social Security in the first place requires 40 work credits or approximately 10 years of work. 2 To be eligible to receive the maximum benefit, you need to earn Social Security's maximum taxable income for 35 years.

Is Social Security based on highest 40 quarters?

To even be eligible for retirement benefits, you generally need 10 years (40 quarters) of gainful employment. In 2017, you need to earn at least $1,300 in a quarter for it to count as a credit.

Is Social Security based on the last 5 years of work?

A: Your Social Security payment is based on your best 35 years of work. And, whether we like it or not, if you don't have 35 years of work, the Social Security Administration (SSA) still uses 35 years and posts zeros for the missing years, says Andy Landis, author of Social Security: The Inside Story, 2016 Edition.

How much Social Security will I get if I make 60000 a year?

That adds up to $2,096.48 as a monthly benefit if you retire at full retirement age. Put another way, Social Security will replace about 42% of your past $60,000 salary. That's a lot better than the roughly 26% figure for those making $120,000 per year.

How much Social Security will I get if I make $75000 a year?

about $28,300 annuallyIf you earn $75,000 per year, you can expect to receive $2,358 per month -- or about $28,300 annually -- from Social Security.

How much Social Security will I get if I make $40000 a year?

Those who make $40,000 pay taxes on all of their income into the Social Security system. It takes more than three times that amount to max out your Social Security payroll taxes. The current tax rate is 6.2%, so you can expect to see $2,480 go directly from your paycheck toward Social Security.

How much Social Security will I get if I make $30000 a year?

0:362:31How much your Social Security benefits will be if you make $30,000 ...YouTubeStart of suggested clipEnd of suggested clipThe number of months and 35. Years that gives you 2500. Still with me that number gives you yourMoreThe number of months and 35. Years that gives you 2500. Still with me that number gives you your average index monthly earnings or aim. Simply put it's your monthly pay for the last 35.

IRA Calculator

Free inflation-adjusted IRA calculator to estimate growth, tax savings, total return, and balance at retirement of Traditional, Roth IRA, SIMPLE, and SEP IRAs.

Best Retirement Calculator – Calculate Retirement Savings

Are you saving enough for retirement? This calculator will help you with retirement planning and provide you with an estimate on your future retirement savings.

401K Calculator

401K Calculator. The 401(k) Calculator can estimate a 401(k) balance at retirement as well as distributions in retirement based on income, contribution percentage, age, salary increase, and investment return.

How long will my money last with systematic withdrawals?

You have worked hard to accumulate your savings. Use this calculator to determine how long those funds will last given regular withdrawals.

Quick Calculator - Social Security Administration

Benefit Calculators. Frequently Asked Questions. Benefit estimates depend on your date of birth and on your earnings history. For security, the "Quick Calculator" does not access your earnings record; instead, it will estimate your earnings based on information you provide. So benefit estimates made by the Quick Calculator are rough.

How to save for retirement?

What may seem like the most obvious way to save for retirement is through personal savings such as checking, savings, or money market accounts ; after all, it is the first place where surplus disposable income accumulates for most people before something is done with it. However, it may not exactly be the best method to save for retirement over the long term, mainly due to inflation. In the U.S., personal savings such as cash, checking accounts, savings accounts, or other forms of liquid assets normally offer little or no interest. With income tax accounted for, the returns rarely beat inflation.

What is the most popular way to save for retirement?

401 (k), 403 (b), 457 Plan. In the U.S., two of the most popular ways to save for retirement include Employer Matching Programs such as the 401 (k) and their offshoot, the 403 (b) (nonprofit, religious organizations, school districts, governmental organizations). 401 (k)s vary from company to company, but many employers offer a matching ...

Why do people underestimate how much they need to save for retirement?

Inflation is one of the reasons why people tend to underestimate how much they need to save for retirement. Although inflation does have an impact on retirement savings, it is unpredictable and mostly out of a person's control.

How much of a person's income is Social Security?

In the U.S., Social Security was designed to replace approximately 40% of a person's working income. Yet, approximately one-third of the working population and 50% of retirees expect Social Security to be their major source of income after retirement.

What is the standard of living after retirement?

Another popular rule suggests that an income of 70% to 80% of a worker's pre-retirement income can maintain a retiree's standard of living after retirement. For example, if a person made roughly $100,000 a year on average during his working life, this person can have similar standard of living with $70,000 - $80,000 a year of income after retirement. This 70% - 80% figure can vary greatly depending on how people envision their retirements. Some retirees want to sail a yacht around the world, while others want to live in a simple cabin in the woods.

What is passive income?

Passive Income. Just because other investments don't have tax benefits doesn't mean they should automatically be ruled out. Passive income is one of them . During retirement, they can come in forms such as rental income, income from a business, stock dividends, or royalties.

Why do people invest in retirement?

In general, investments are used as a method to grow wealth, but people who have maxed out their tax-advantaged retirement plans and are searching for other places to put retirement funds can also use investments in order to reach their retirement goals.

What is the formula for Social Security benefits?

The Social Security benefits formula is designed to replace a higher proportion of income for low-income earners than for high-income earners. To do this, the formula has what are called “bend points." These bend points are adjusted for inflation each year.

How is Social Security decided?

Your Social Security benefit is decided based on your lifetime earnings and the age you retire and begin taking payments. Your lifetime earnings are converted to a monthly average based on the 35 years in which you earned the most, adjusted for inflation. Those earnings are converted to a monthly insurance payment based on your full retirement age.

What is wage indexing?

Social Security uses a process called wage indexing to determine how to adjust your earnings history for inflation. Each year, Social Security publishes the national average wages for the year. You can see this published list on the National Average Wage Index page. 3 .

Is Social Security higher at age 70?

If you have already had most of your 35 years of earnings, and you are near 62 today, the age 70 benefit amount you see on your Social Security statement will likely be higher due to these cost of living adjustments .

Can you calculate inflation rate at 60?

Until you know the average wages for the year you turn 60, there is no way to do an exact calculation. However, you could attribute an assumed inflation rate to average wages to estimate the average wages going forward and use those to create an estimate.

Benefit Calculators

The best way to start planning for your future is by creating a my Social Security account online. With my Social Security, you can verify your earnings, get your Social Security Statement, and much more – all from the comfort of your home or office.

Online Benefits Calculator

These tools can be accurate but require access to your official earnings record in our database. The simplest way to do that is by creating or logging in to your my Social Security account. The other way is to answer a series of questions to prove your identity.

Additional Online Tools

Find your full retirement age and learn how your monthly benefits may be reduced if you retire before your full retirement age.

How to save for retirement?

Use automatic deductions from your payroll or your checking account. Make saving for retirement a habit. Be realistic about investment returns. If you change jobs, keep your savings in the plan or roll them over to another retirement account. Don’t dip into retirement savings early.

How much of your pre-retirement income should you replace with retirement?

Current savings. The worksheet assumes that you’ll need to replace about 80 percent of your pre-retirement income. Social Security retirement benefits should replace about 40 percent of an average wage earner’s income after retiring. This leaves approximately 40 percent to be replaced by retirement savings.

How does Social Security work?

Social Security is a program run by the federal government. The program works by using taxes paid into a trust fund to provide benefits to people who are eligible. You’ll need a Social Security number when you apply for a job. Find how to apply for a Social Security number or to replace your Social Security card .

How much does Social Security pay?

Social Security pays benefits that are generally equal to about 40 percent of your pre-retirement earnings. The Social Security Administration helps you estimate your benefits. Learn from Investor.gov how you can boost your retirement savings. If you have a financial advisor, talk to them about your plans.

What percentage of your salary should you save for 401(k)?

If, for example, you are in a 401 (k) plan in which you contribute 4 percent of your salary and your employer also contributes 4 percent, your saving rate would be 8 percent of your salary. By using the worksheet, you’ve figured out your target savings rate. It gives you a rough idea –a savings goal.

How long can a 65 year old woman live in retirement?

How long will you live in retirement? Based on current estimates, a 65 year old man can expect to live approximately 18 years in retirement, and a 65 year old woman can expect to live about 20 years , but many people live longer. Planning to live well into your 90s can help you avoid outliving your income.

How long do people live after retirement?

Show Description of Infographic. In the United States, people live an average of 20 years after retirement. The three most common options to save for retirement are: Retirement Plans offered by an employer. Savings and Investments. Social Security.

What is the benefit estimate?

Benefit estimates depend on your date of birth and on your earnings history. For security, the "Quick Calculator" does not access your earnings record; instead, it will estimate your earnings based on information you provide. So benefit estimates made by the Quick Calculator are rough. Although the "Quick Calculator" makes an initial assumption ...

What happens if you don't give a retirement date?

If you do not give a retirement date and if you have not reached your normal (or full) retirement age, the Quick Calculator will give benefit estimates for three different retirement ages .

How old do you have to be to use Quick Calculator?

You must be at least age 22 to use the form at right.

How much is the minimum retirement age?

If you have 10 or more years of service and retire at the Minimum Retirement Age (MRA), your benefit will be reduced by 5/12 of 1% for each full month (5% per year) that you were under age 62 on the date your annuity began. However, your annuity will not be reduced if you complete at least 30 years of service, or if you complete at least 20 years of service and your annuity begins when you reach age 60.

How much of your salary is a Social Security annuity?

Description. For the first 12 months. 60% of your high-3 average salary minus 100% of your Social security benefit for any month in which you are entitled to Social Security benefits. However, you are entitled to your “ earned ” annuity, if it is larger than this amount.

How much of your high 3 salary is a disability?

1 percent of your high-3 average salary for each year of service. If your actual service, plus the credit for time as a disability annuitant equals 20 or more years: 1.1 percent of your high-3 average salary for each year of service.

How much of your salary is considered earned annuity?

After the first 12 months. 40% of your high-3 average salary minus 60% of your Social Security benefit for any month in which you are entitled to Social Security disability benefits. However, you are entitled to your “ earned ” annuity, if it is larger than this amount.

What happens to your survivor benefits if you are married?

Survivor Benefits. If you are married, your benefit will be reduced for a survivor benefit, unless your spouse consented to your election of less than a full survivor annuity. If the total of the survivor benefit (s) you elect equals 50% of your benefit, your annuity is reduced by 10%.

How to save for retirement?

What may seem like the most obvious way to save for retirement is through personal savings such as checking, savings, or money market accounts ; after all, it is the first place where surplus disposable income accumulates for most people before something is done with it. However, it may not exactly be the best method to save for retirement over the long term, mainly due to inflation. In the U.S., personal savings such as cash, checking accounts, savings accounts, or other forms of liquid assets normally offer little or no interest. With income tax accounted for, the returns rarely beat inflation.

What is the most popular way to save for retirement?

401 (k), 403 (b), 457 Plan. In the U.S., two of the most popular ways to save for retirement include Employer Matching Programs such as the 401 (k) and their offshoot, the 403 (b) (nonprofit, religious organizations, school districts, governmental organizations). 401 (k)s vary from company to company, but many employers offer a matching ...

Why do people underestimate how much they need to save for retirement?

Inflation is one of the reasons why people tend to underestimate how much they need to save for retirement. Although inflation does have an impact on retirement savings, it is unpredictable and mostly out of a person's control.

How much of a person's income is Social Security?

In the U.S., Social Security was designed to replace approximately 40% of a person's working income. Yet, approximately one-third of the working population and 50% of retirees expect Social Security to be their major source of income after retirement.

What is the standard of living after retirement?

Another popular rule suggests that an income of 70% to 80% of a worker's pre-retirement income can maintain a retiree's standard of living after retirement. For example, if a person made roughly $100,000 a year on average during his working life, this person can have similar standard of living with $70,000 - $80,000 a year of income after retirement. This 70% - 80% figure can vary greatly depending on how people envision their retirements. Some retirees want to sail a yacht around the world, while others want to live in a simple cabin in the woods.

What is passive income?

Passive Income. Just because other investments don't have tax benefits doesn't mean they should automatically be ruled out. Passive income is one of them . During retirement, they can come in forms such as rental income, income from a business, stock dividends, or royalties.

Why do people invest in retirement?

In general, investments are used as a method to grow wealth, but people who have maxed out their tax-advantaged retirement plans and are searching for other places to put retirement funds can also use investments in order to reach their retirement goals.